NYKAA trade ideas

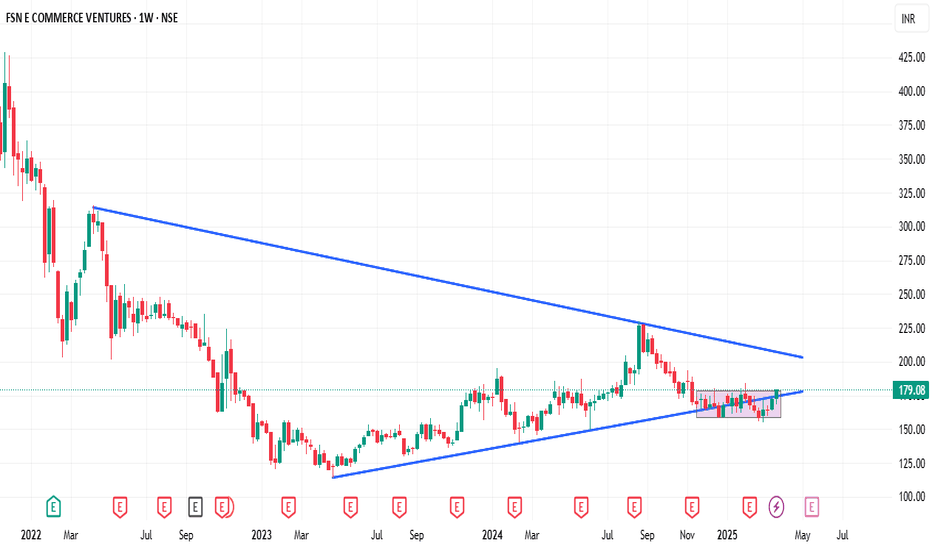

FSN E COMMERCE VENTURES at Best Support Level | NYKAA !!This is the 4 hour Chart of Nykaa.

Nykaa having a good law of polairty near at 195-190 range.

Nykaa is forming ascending boradening wedge pattern with support at 190-195 range .

If this level is sustain , then we may see higher prices in Nykaa .

Thank You !!

NYKAA LONG TRADE SETUP📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

NYKAA LONG TRADE SETUP📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

NYKAAOn this chart, there are lines called "Fibonacci retrenchment levels," which help predict where the price might go up or down.

Here's the simple breakdown:

The chart shows different levels where the price could stop and change direction. These levels are like markers on the chart.

The blue arrow on the chart suggests that the price might go up.

There's also a note saying that the price might increase.

In short, the chart is trying to predict that the price will go up and shows some important points where it might change direction. If you have any specific questions, feel free to ask!

this can be a false breakdown NSE:NYKAA the break is not reflected in the rsi that means there is hesitation for sellers this should be a false break down however 140/150 is next support zone my own strategy is to accumulate on dips for investment as for reasons to do so one can comment and know my reasons

NykaaTrade Setup:

- crossed resistance of 210 INR and sustained on weekly basis (price trading at support levels).

- 20 EMA crossed (or is above) 50 EMA on weekly basis, and the EMA's are steep in upward direction.

- RSI > 50

- RS is positive (>0)

Buy price = CMP (215 INR). Add on drips until near 50 EMA

Stop loss = trendline

Target = 310 INR

Nykka Nykka had created 3 inside and inside candel as you can see it ass we now this is in up trend by seeing ema it 9,20 on the chart .

We will trade for short term on the upper side of the big candel break with good volume and good canel .

As there is more sellers in that area we can see in the volume and target will be upper line and the stop losss will be bellow demand area

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Register adviser, please take advise from your financial adviser before investing in any stocks.

Stock has given break out buy above the High and do not forget to keep stop loss best suitable for swing trading. Keep this stock in watch list.

Target and Stop loss Shown on Chart.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.