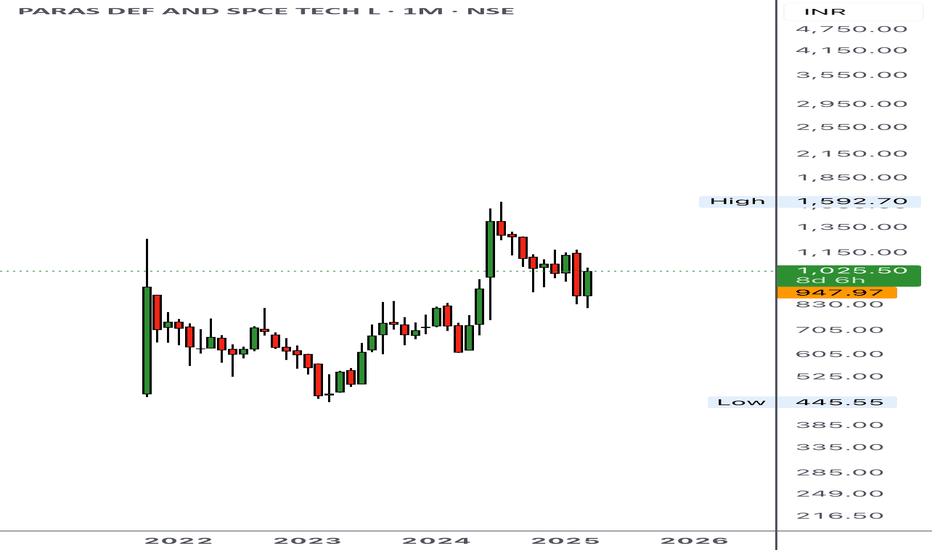

PARAS DEFENSE📈 Trade Setup

Parameter Value

Buy Entry ₹738

Stop Loss (SL) ₹670

Target ₹1,194

Risk ₹68

Reward ₹456

Risk:Reward 6.7 : 1

Last High: ₹797 — Once broken, can trigger fresh momentum.

Last Low: ₹400 — Previous strong base.

⚠️ Key Observations

Strong Weekly & Daily Demand just below current price (678–738) supports the buy zone.

Entry near BUFL zone → suggests breakout continuation.

High reward-to-risk ratio (6.7x) → Attractive setup.

If ₹797 (previous high) breaks with volume, the rally may accelerate toward ₹1,000+.

📌 Strategy

Entry: On price stability above ₹738 or on intraday retest with confirmation.

SL Discipline: Maintain tight SL at ₹670 (just below multiple demand zones).

Partial Booking: Consider at ₹900–950 before full target if volatility spikes.

🔍 Trend Overview

Timeframe Trend Demand Zone Avg Price

HTF (Yearly–Quarterly) UP 302–587 407

MTF (Daily–Monthly) UP 404–738 620

ITF (60M–240M) UP 670–698 686

PARAS trade ideas

LONG PARAS DEFENCE Paras Defence has formed a higher low on the daily chart, in line with Dow Theory. Following this, the stock retraced and entered a consolidation phase on the 15-minute timeframe. A strong volume-backed breakout on the 15-minute chart has confirmed renewed buying interest. With this setup, a favourable risk-reward ratio of 1:5 or higher can be anticipated.

Paras double within a year prediction Will Paras Defence break above the Greenline and sustain its momentum, potentially doubling in value? I remain highly optimistic about the stock. The Indian government’s increasing defence budget—₹6.21 lakh crore in FY25, with a significant allocation toward indigenization and modernization—along with an export-driven policy framework, is expected to drive substantial growth in the defence sector. Paras Defence & Space Technologies stands out due to its strong management team and ambitious goal of becoming a market leader in anti-drone combat systems. Moreover, the company plays a strategic role in India’s space ecosystem by supplying advanced sensors and specialized technologies to ISRO, further reinforcing its growth potential in both defence and space technology segments.

So, we are talking about 5K-6K Cr. Company becoming 10K-12K Cr. Company. Buy, hold and wait patiently.

Equity Research Report – Paras Defence & Space Tech Ltd Technical Summary

Volume Spike: Sharp surge in volume confirms breakout strength.

Resistance Flipped: ₹1,299 now acting as strong support.

Momentum: RSI near 75 (overbought but strong bullish trend), indicating short-term potential with caution.

Moving Averages: 20/50/200 EMA crossover in bullish alignment.

🛒 Trade Setup

Short-Term View (Swing/Positional Trade):

Buy Zone: ₹1,315–₹1,330 (on dip near support ₹1,299)

Target 1: ₹1,435

Target 2: ₹1,475

Stop-Loss: ₹1,255 (below support & 5-day EMA)

Timeframe: 2–3 weeks

Short-Term View (Swing/Positional Trade):

Sell Zone below: ₹1,299

Target 1: ₹1,222

Target 2: ₹1,200

Stop-Loss: ₹1,255

For Education purposes only

PARAS Defence : Another Defence stock on fire PARAS Defence : Another Defence stock on fire like BEL.

Closed above 200 SMA and continuing the momentum .

All Indicators are positive as displayed on the chart .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Equity Research Update – Paras Defence and Space Technologies CMP: ₹1,143 | Upside Potential: High

Paras Defence has broken out of a strong resistance zone (~₹1,120–₹1,160), confirmed by significant volume and bullish momentum. The RSI shows strength above 70, indicating buyer dominance. Historical resistance, marked by previous rejections, may now act as strong support. If sustained, this breakout could lead to a fresh uptrend. Investors may consider accumulating on dips with a medium-term target of ₹1,300–₹1,350, keeping a stop-loss below ₹1,080.

Recommendation: BUY on Breakout Confirmation

For Education Purpose only

Stock Breakout Alert – PARAS - Watch Closely!📊 Stock Breakout Alert – PARAS - Watch Closely!

🚀 Buy Setup Identified:

🔹 Buy Above: 1,036

🔹 Stop Loss (SL): 989.00

🔹 Target 1 (T1): 1,324.12

📈 Pattern Insights:

The stock is moving within a consolidation box and appears ready for a breakout. Once it crosses the buy level, we may see a strong upward momentum towards the target zone.

✅ Action Plan:

Be patient and wait for confirmation above the buy level.

Maintain discipline with the SL to manage risk effectively.

Ride the trend for potential gains of up to 25.36%.

⚡ Remember, discipline is key. Always trade with a plan!

#StockMarketAnalysis #BreakoutStrategy #TradingSignals #InvestSmart

Stock Analysis - Paras Defense & Space Technologies (PARAS)Stock Alert: Paras Defense & Space Technologies (PARAS)

Descending Channel Breakout Potential

Buy Above: ₹1135

Sell Target: ₹1940

Gain Opportunity: ~71% if the pattern completes successfully!

💡 Technical Analysis:

The stock is poised for a bullish breakout from a prolonged descending channel.

Watch for increased volume to confirm the breakout.

📌 Sector: Aerospace & Defense

Stay updated for more actionable insights. Trade wisely!

#StockMarket #ParasDefense #BreakoutTrading #InvestSmart #StockAnalysis #investofino

@investofino

PARAS DEFENCE Getting Support @ Previous ALL Time HighNSE:PARAS

Positive factors – The outlook will be revised to Stable if the company demonstrates a material improvement in its working

capital cycle and liquidity position, along with improvement in earnings and scale of operations.

Healthy order book provides medium-term revenue visibility – The company’s fresh order inflows over the past four fiscals

remained adequate, with orders worth ~Rs. 621 crore added in the last 21 months ending December 31, 2023.

The pending order book of Rs. 526.3 crore as on December 31, 2023 (OB/OI ratio of 2.4 times of the OI in FY2023) provides medium-term

revenue visibility.

Comfortable capital structure and healthy coverage indicators – The company’s capital structure remains comfortable with

TOL/TNW of 0.3 times as on September 30, 2023, supported by equity infusion of Rs. 162.3 crore during FY2021-FY2022 and

low debt levels.

The interest coverage stood at 12.2 times in 9M FY2024 due to the limited dependence on external borrowings

to fund its working capital. Going forward, ICRA expects the coverage indicators to remain comfortable, benefitting from the

scale-up in operations, given the strong order pipeline.

Extensive experience of management team – PDSTL’s promoters have more than three decades of experience in designing,

developing and manufacturing a wide range of engineering products and solutions for the defense and space sector in the

domain of optics, heavy engineering and electronics. Its long presence in the defence and space sector has helped to establish

strong relationships with its customers as well as suppliers. It has developed a strong management and execution team

comprising several ex-employees of BEL and DRDO, among others.

High working capital intensity due to elongated receivables cycle – The business is working capital intensive with NWC/OI of

88.3% and 114.8% in FY2023 and H1 FY2024, respectively, owing to the high inventory holding period and long receivables

cycle.

The inventory levels are high because of additional stocking of critical raw materials to avoid any disruption in the

delivery schedules and high work-in-progress due to elongated manufacturing cycle.

PDSTL has been partly managing its

working capital cycle by stretching its trade payables by more than three months as it has a longstanding relationship with

most of its suppliers and availing mobilisation advance for part orders. Going forward, the company’s ability to alleviate its

working capital intensity while scaling up its revenues and improving its operating margins will be the key rating monitorable.

Moderate scale of operations – Though the company reported a robust YoY revenue growth of 21% and 10% in FY2023 and

9M FY2024, respectively, supported by healthy order book and the timely execution of orders, the scale of operations still

remains moderate. Given the Government’s thrust on ‘Make in India’ in the defence sector, PDSTL has been mainly catering

to domestic demand (~84% of OI contributed by domestic orders in FY2023). Driven by the healthy order book status, ICRA

expects the company to sustain its revenue growth in FY2024 and FY2025.

High customer concentration risk, though largely mitigated by reputed customer base and repeat orders – The company

faces client concentration risk with top three clients contributing 46% to the total order book as on December 31, 2023 and

top five clients accounting for 51% of the revenue in FY2023. The client profile mostly comprises government organisations

with repeat orders received over the years, largely mitigating the counterparty credit risk. A major part of PDSTL’s clientele

included reputed government organisations, namely Laboratory for Electro-Optics Systems (a unit of ISRO), BEL, Instruments

Research and Development Establishment (a unit of DRDO) and private companies like RRP S4E Innovation Private Limited and

Unifab Engineering Project Private Limited. The company has long standing relationships with most of its clientele. PDSTL also

exports to companies based in Israel, Singapore and USA.

PARAS pure jackpot for delivery trade Paras is created rounding bottom reversal pattern take multiple support + multiple small break out but volume and share market capitalization show some thing is big ready to turn our this 630 share price reached 700/800/900/1000 and may more upper side price

only for long term holding trade

Paras Defence and Space Technologies Ltd

Breakout Observed - Target given in chart

Fundamentals

Market Cap

₹ 3,566 Cr.

Current Price

₹ 914

High / Low

₹ 926 / 496

Stock P/E

119

Book Value

₹ 114

Dividend Yield

0.00 %

ROCE

9.80 %

ROE

7.00 %

Face Value

₹ 10.0

Price to book value

8.03

Intrinsic Value

₹ 172

PEG Ratio

12.4

Price to Sales

14.1

Debt

₹ 65.8 Cr.

Debt to equity

0.15

Int Coverage

8.44

Reserves

₹ 406 Cr.

Promoter holding

58.9 %

Pledged percentage

0.00 %

EPS last year

₹ 8.22

Net CF

₹ 14.9 Cr.

Price to Cash Flow

78.0

Free Cash Flow

₹ 22.0 Cr.

OPM last year

20.1 %

Return on assets

5.18 %

Industry PE

68.2

Sales growth

14.0 %

Paras Defence And Space Tech LONG TERM VIEWParas Defence is forming a Symmetrical Triangle On Weekly Timeframe. The Entry and Stoploss would be considered on Candle Closing Basis.

Entry - Above 800

Stoploss- Below 576

Targets - 1001,1260,1550 and 1760 (These Targets would be achieved in 2.5 years max from the date of entry).

NOTE :- This View is purely based on Technical Analysis and is for educational purposes only. Please consult your financial advisor before taking any trade.

Paras decence looks good for 1600++After a huge bull run gone a short down trend

now seems buyers again stepped in

vol average needs to pick up

1600 can be set as a short target

stop loss @nasimrafati_1400

Defence theme!

Paras Defence and Space Technologies (PDST) is an Private sector company primarily engaged in the designing, developing, manufacturing, and testing of a variety of defence and space engineering products and solutions. The company caters to four major segments - Defence & Space Optics, Defence Electronics, Heavy Engineering and Electromagnetic Pulse Protection Solutions

PARAS- AnalysisInvestment Levels

Bullish Levels - Above 765, 838 to 862 (strong level) then 943 to 957 then 1039 to 1052 then 1092 (strong level) to 1104 then 1134 to 1148

Bearish Level - Below 738 , 560 to 546 then 414 to 397 (strong level) below this more bearish.

*Comment or message me if you wish to see my analysis for any stocks.

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

Defence Sector Going Offensive - Paras - Lord Parasuram's WeaponIndia's Defence Minister has said that Domestic Defence Manufacturing will be further strengthened || Defence Exports from India will be taken to an Unprecedented High :)

Amazing news to all Defence Stocks. One such pick is PARAS Defence and Space Technology

On Weekly chart - price has formed an Inverted Head and Shoulders Pattern. Both Breakout and Retest + Bounce - All Done :)

1st Target 1260 (previous ATH). When it breaks-out above 1260, it will initiate a Fresh Rounding Bottom BO for a much larger target of 2070

1st Recommendation was given around 670 levels on Aug 24, 2023. In less than 1 year, price has already reached 42%

When it reaches 1260 - it would be 87%

When it reaches 2070 - it would be 207% (3x) :)

Disclaimer:

3+ Years Teaching Experience in Stock Market - Technical Analysis, Behaviour Analysis, Advanced Patterns, Emotional Management, News based Trading...

We are NOT SEBI Registered and Our focus is NOT providing Buy/Sell Recommendations/calls. Primary Objective is to provide detailed analysis of how to review a chart, explain multi-timeframe views purely for Educational Purposes.

We strongly suggest our followers to "Learn to Ride the Tide irrespective of its Side"

*** Important *** Consult your Financial Advisors before taking any positions

If you like our detailed analysis, please do rate us with your Likes, Boost and share your comments

-Team Stocks-n-Trends

paras 'inverted head and shoulders' pattern, accompanied by significant trading volume.

Paras Defence and Space Technologies are primarily engaged in the designing, developing, manufacturing, and testing of a variety of defence and space engineering products and solutions. The company has five major product category offerings in defence and space optics, defence electronics, heavy engineering, electromagnetic pulse protection solutions and niche technologies.

PARAS DEFENCE Broken & Sustained Above 133 Weeks HighPositive factors – The outlook will be revised to Stable if the company demonstrates a material improvement in its working

capital cycle and liquidity position, along with improvement in earnings and scale of operations.

Healthy order book provides medium-term revenue visibility – The company’s fresh order inflows over the past four fiscals

remained adequate, with orders worth ~Rs. 621 crore added in the last 21 months ending December 31, 2023.

The pending order book of Rs. 526.3 crore as on December 31, 2023 (OB/OI ratio of 2.4 times of the OI in FY2023) provides medium-term

revenue visibility.

Comfortable capital structure and healthy coverage indicators – The company’s capital structure remains comfortable with

TOL/TNW of 0.3 times as on September 30, 2023, supported by equity infusion of Rs. 162.3 crore during FY2021-FY2022 and

low debt levels.

The interest coverage stood at 12.2 times in 9M FY2024 due to the limited dependence on external borrowings

to fund its working capital. Going forward, ICRA expects the coverage indicators to remain comfortable, benefitting from the

scale-up in operations, given the strong order pipeline.

Extensive experience of management team – PDSTL’s promoters have more than three decades of experience in designing,

developing and manufacturing a wide range of engineering products and solutions for the defence and space sector in the

domain of optics, heavy engineering and electronics. Its long presence in the defence and space sector has helped to establish

strong relationships with its customers as well as suppliers. It has developed a strong management and execution team

comprising several ex-employees of BEL and DRDO, among others.

High working capital intensity due to elongated receivables cycle – The business is working capital intensive with NWC/OI of

88.3% and 114.8% in FY2023 and H1 FY2024, respectively, owing to the high inventory holding period and long receivables

cycle.

The inventory levels are high because of additional stocking of critical raw materials to avoid any disruption in the

delivery schedules and high work-in-progress due to elongated manufacturing cycle.

PDSTL has been partly managing its

working capital cycle by stretching its trade payables by more than three months as it has a longstanding relationship with

most of its suppliers and availing mobilisation advance for part orders. Going forward, the company’s ability to alleviate its

working capital intensity while scaling up its revenues and improving its operating margins will be the key rating monitorable.

Moderate scale of operations – Though the company reported a robust YoY revenue growth of 21% and 10% in FY2023 and

9M FY2024, respectively, supported by healthy order book and the timely execution of orders, the scale of operations still

remains moderate. Given the Government’s thrust on ‘Make in India’ in the defence sector, PDSTL has been mainly catering

to domestic demand (~84% of OI contributed by domestic orders in FY2023). Driven by the healthy order book status, ICRA

expects the company to sustain its revenue growth in FY2024 and FY2025.

High customer concentration risk, though largely mitigated by reputed customer base and repeat orders – The company

faces client concentration risk with top three clients contributing 46% to the total order book as on December 31, 2023 and

top five clients accounting for 51% of the revenue in FY2023. The client profile mostly comprises government organisations

with repeat orders received over the years, largely mitigating the counterparty credit risk. A major part of PDSTL’s clientele

included reputed government organisations, namely Laboratory for Electro-Optics Systems (a unit of ISRO), BEL, Instruments

Research and Development Establishment (a unit of DRDO) and private companies like RRP S4E Innovation Private Limited and

Unifab Engineering Project Private Limited. The company has long standing relationships with most of its clientele. PDSTL also

exports to companies based in Israel, Singapore and USA.