PERSISTENT trade ideas

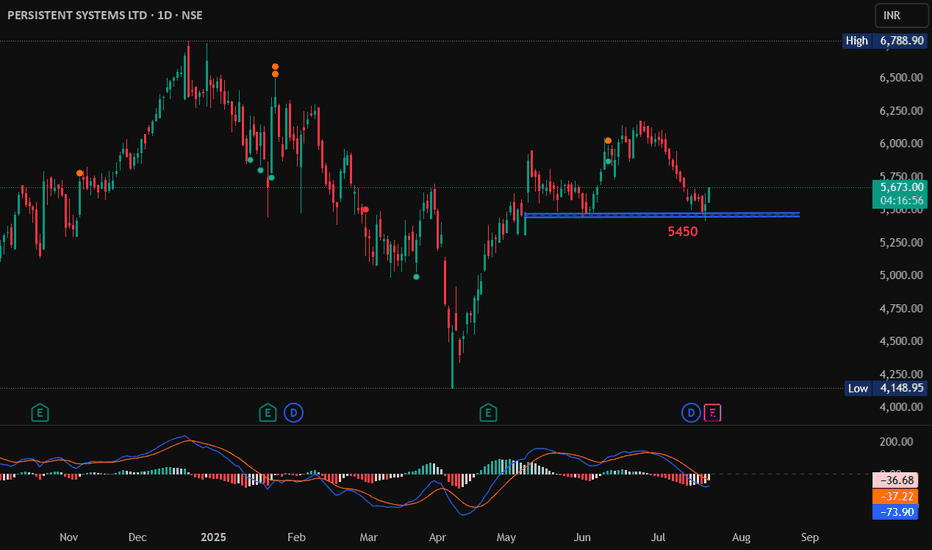

PERSISTENT - Persistent Systems Ltd (45 minutes, NSE) - LongPERSISTENT - Persistent Systems Ltd. (45 minutes chart, NSE) - Long Position; short-term research idea.

Risk assessment: Medium {volume structure integrity risk}

Risk/Reward ratio ~ 2.44

Current Market Price (CMP) ~ 5740

Entry limit ~ 5710 on May 20, 2025

1. Target limit ~ 5900 (+3.33%; +190 points)

2. Target limit ~ 6100 (+6.83%; +390 points)

Stop order limit ~ 5550 (-2.80%; -160 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

Persistent SystemPersistent System

MTF Analysis

Persistent SystemYearly Demand 3,788.0

Persistent System 6 Month Demand 4,450.0

Persistent SystemQtrly Demand BUFL 4,450.0

Persistent SystemMonthly Demand 4,285.0

Persistent SystemWeekly Demand 4,450.0

Persistent SystemDaily Demand DMIP 4,637.0

ENTRY -1 Long 4,637.0

SL 4,400.0

RISK 237.0

Target as per Entry 9,084.0

RR 18.8

Last High 6,767.0

Last Low 4,450.0

#PERSISTENT SYSTEM Demand ZoneIn trading and technical analysis, a demand zone is an area on a price chart where buying interest is significantly strong, causing the price to reverse or bounce upward. For Persistent Systems, a mid-cap IT services company, identifying demand zones can help traders make informed decisions about entry points.

Persistent Systems **Persistent Systems** is a globally recognized Indian IT services company specializing in **software development, digital transformation, and enterprise solutions**. Founded in 1990 and headquartered in Pune, India, the company provides services in **cloud computing, artificial intelligence, big data analytics, cybersecurity, and product engineering**. Persistent Systems partners with leading technology firms such as **IBM, Microsoft, and Salesforce** to deliver cutting-edge solutions across various industries, including healthcare, banking, financial services, and telecommunications. The company has shown consistent growth, driven by its focus on innovation and emerging technologies. With a strong global presence and a commitment to research and development, Persistent Systems continues to be a key player in India's thriving IT sector, offering tailored solutions to help businesses accelerate their digital journeys.

Persistent System Demand Zone**Persistent Systems in Demand Zone**

Persistent Systems, a leading software services company, is currently trading within a **demand zone**, a critical area in technical analysis where buying pressure historically outweighs selling pressure. This zone often acts as a support level, indicating a potential reversal or bounce in the stock's price.

For Persistent Systems, being in a demand zone suggests that the stock may attract buyers at this level, potentially leading to an upward movement. Traders often use this zone to identify strategic entry points, as it reflects a price area where the stock has previously shown strength.

However, it's essential to monitor the stock's behavior closely. A sustained hold above the demand zone could signal a bullish trend, while a breakdown below it might indicate further downside. Additionally, considering Persistent Systems' strong fundamentals, such as consistent revenue growth, robust client relationships, and expertise in emerging technologies, could further support its performance in this zone.

PERSISTENT - Strong MomentumPersistent Systems Ltd. (NSE: PERSISTENT) has recently captured the attention of market analysts and investors, showcasing a powerful bullish trend that is hard to ignore. The stock's recent price movements and volume spikes indicate a robust upward momentum, making it a compelling prospect for traders and investors alike.

Key Highlights:

Bullish Momentum and Strong Bullish Candle

The chart for Persistent Systems Ltd. reveals clear signs of bullish momentum, exemplified by a strong bullish candle that has formed recently. This particular candle stands out due to its significant size compared to preceding ones, indicating substantial upward price movement and strong buying interest. The formation of such a bullish candle is often a precursor to continued upward trends, suggesting that the stock may have more room to grow.

RSI Breakout

Although the chart does not explicitly display the RSI (Relative Strength Index), the overall price action hints at a possible RSI breakout. Typically, an RSI breakout occurs when the index crosses above the 70 mark, signaling overbought conditions and strong bullish sentiment. This potential RSI breakout reinforces the positive outlook for Persistent Systems Ltd., indicating that the stock may continue to attract buyers.

5-Day Volume Breakout

A closer look at the volume bars at the bottom of the chart reveals a significant increase in trading volume over the past five days. This 5-day volume breakout is a bullish signal, as it demonstrates growing market participation and heightened interest in the stock. Higher trading volumes often add credibility to price movements, suggesting that the recent upward trend is supported by strong investor activity.

5X Volume Breakout and Price Change

The chart also highlights a remarkable 5X volume breakout, where the trading volume on the most recent day is five times higher than the average volume. This surge in volume, coupled with a substantial price change, underscores the strong buying interest and bullish sentiment surrounding Persistent Systems Ltd. Such a pronounced increase in both volume and price is indicative of a robust uptrend, suggesting that the stock may continue to perform well in the near term.

Conclusion

Persistent Systems Ltd. is currently riding a wave of bullish momentum, with several key indicators pointing to continued strength in the stock. The strong bullish candle, potential RSI breakout, 5-day volume breakout, and 5X volume breakout with a significant price change all contribute to a positive market outlook for the company.

For traders and investors looking to capitalize on this bullish trend, Persistent Systems Ltd. offers a compelling opportunity. The stock's recent performance, backed by strong technical signals, suggests that it may continue to rise in the coming days. As always, it's important to monitor market conditions and conduct thorough research before making any investment decisions.

Persistent Systems Ltd. is certainly one to watch as it continues to make waves in the market. 📈🚀

Persistent can be persisted withPersistent Systems Ltd. is a technology services company. It engages in delivering digital business acceleration, enterprise modernization, and next generation product engineering services. The firm operates through the following segments: Banking, Financial Services & Insurance, Healthcare & Life Sciences, and Technology Companies & Emerging Verticals.

Persistent Systems Ltd. CMP is 6090.90. The Positive aspects of the company are Company with Low Debt, Company with Zero Promoter Pledge, Stocks Outperforming their Industry Price Change in the Quarter and Company able to generate Net Cash - Improving Net Cash Flow for last 2 years. The Negative aspects of the company are high Valuation (P.E. = 77), Companies with growing costs YoY for long term projects and MFs decreased their shareholding last quarter.

Entry can be taken after closing above 6094 Targets in the stock will be 6241, 6392 and 6547. The long-term target in the stock will be 6704 and 6810. Stop loss in the stock should be maintained at Closing below 5850 or 5566 depending on your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. I or my clients might have positions in the stocks that we mention in our posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

PERSISTENT SYSTEMS LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

PERSISTENT SYSTEMS LIMITEDThis is a stock to hold in portfolio for wealth creation.. and also a traders darling to make short term gains and trading gains as well

Currently standing above 21 EMA and showing strong bullish trend on RSI and pivotal supports

One can enter at the current market price @ 4764 and continue to add in dips up to 4400 levels

Short Term Targets

First Target - 4975 (4.4% up side from CMP)

Second Target - 5326 (11.8% up side from CMP)

Third Target - 5885 (23.5% up side from CMP)

Short term stop-loss is 3986 (on daily closing basis) (16.3% downside risk from CMP)

Long Term Targets

Target - 6790 (42.5% up side from CMP)

stop-loss is 3326 (on daily closing basis) (30% downside risk from CMP)

This idea is only for education purpose and not for real time investment or trading. kindly consider your financial adviser before investing

High Beta Stock... kindly check your risk appetite

Persistent System downside target 4700 to 4600 The stock is trading at its highest level in Persistent System. The stock has touched this level four times in the last one month but has failed to break it, if the stock breaks this level at the top then a big rally can be seen, but there is a greater possibility that the stock will once again fall below 4710. The level may be touched again and after which a new higher level may be seen.

PERSISTENT SYSTEMS S/R for 19/7/24Support and Resistance Levels: In technical analysis, support and resistance levels are significant price levels where buying or selling interest tends to be strong. They are identified based on previous price levels where the price has shown a tendency to reverse or find support.

Support levels are represented by the green line and green shade, indicating areas where buying interest may emerge to prevent further price decline.

Resistance levels are represented by the red line and red shade, indicating areas where selling pressure may arise to prevent further price increases. Traders often consider these levels as potential buying or selling opportunities.

Breakouts: Breakouts occur when the price convincingly moves above a resistance level (red shade) or below a support level (green shade). A bullish breakout above resistance suggests the potential for further price increases, while a bearish breakout below support suggests the potential for further price declines. Traders pay attention to these breakout signals as they may indicate the start of a new trend or significant price movement.

20 EMA: The yellow line denotes 20 EMA, to interpret the 20 EMA, you need to compare it with the prevailing stock price. If the stock price is below the 20 EMA, it signals a possible downtrend. But if the stock price is above the 20 EMA, it signals a possible uptrend.

Disclosure: I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. It is important to consult with a qualified financial advisor before making any investment decisions. Tweets neither advice nor endorsement.

PERSISTENT SYSTEMSStock Resumed its bullish trend since 6-Jun-2024 from 3555 levels

Short term traders can enter from 3,727 levels and small quantities on dips up to 3,678

Targets - 4108 & 4448

Stop-loss - 3555

long term investors can accumulate this stock on every dip and maintain stop-loss at 3235

Target - 5000

Caution is required in this stock while taken positions - since the management commented on lower growth for the next quarters

Kindly consult your financial adviser before investing.. this idea is for educational purpose only