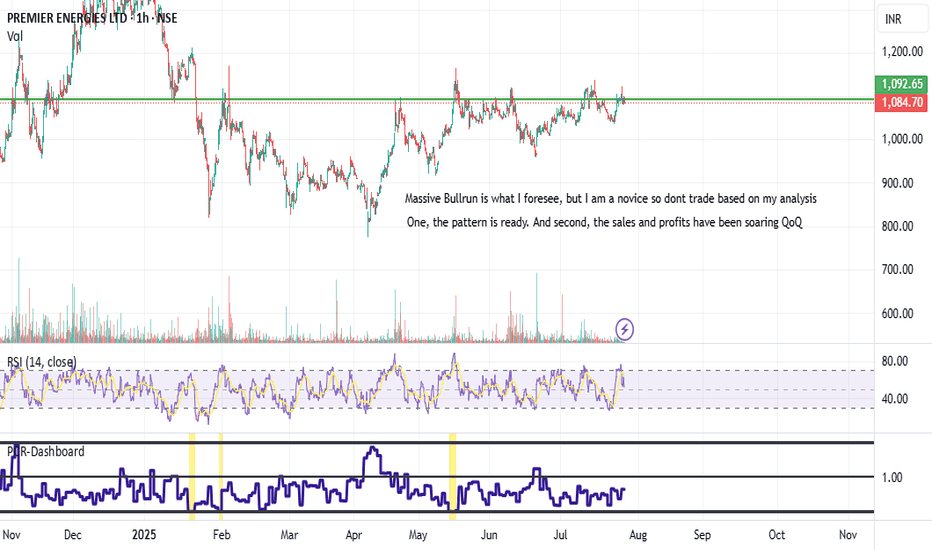

PREMIERENE trade ideas

PREMIERENE CMP 1290.TIMEFRAME- 3 Hour. After a long consolidation range stock breaked 1270 Level and then retest 1260 again trying to bounce from. If it reverce from here then we consider this for a swing trade.Last few days volumes are increasing.So add this to your wachlist and find your Risk Reward area before enter. And see how it perform in coming days.Thanks for support.

PREMIER ENERGIESPremier Energy Stock Momentum Analysis

Current Price Action:

Premier Energy's stock is showing significant momentum, currently trading near 1296. The price action indicates a possible continuation of the ongoing trend based on recent volume and technical patterns. it is crossing its all time high in this current market scenerio.

Key Levels to Watch:

Support Level (SL): Place a stop-loss at 1250 , which aligns with the recent swing low and provides a strong risk management benchmark.

Target Levels:

Target : 1586 .

.

Technical Indicators:

Moving Averages: 20 days moving average in support

RSI: The RSI is currently at 59.08, which suggests. which is supporting the momentum

Volume: The recent spike in volume on buying day supports the breakout potential.

Trading Plan:

Enter near the current price level 1300

Exit partially at Target

Keep a strict SL below 1250

Disclaimer: This is not financial advice. Please conduct your own analysis before making trading decisions.

PREMIER ENERGIES LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Premier Energies Long Term Investment IdeaIntroduction

Premier Energies Ltd. engages in the business of manufacturing and trading of solar modules, solar cells and solar accessories. Its business operations include the manufacturing of solar photovoltaic cells and solar modules including custom made panels for specific applications, execution of EPC projects, independent power production, O&M services with respect to EPC projects and sale of solar-related products.

Observation

As we can see stock breakout after a consolidation on day chart stock trading on good volume. stock trade above 20ema strong RSI with good fundamental.

visit on website for fundamental detail analysis and Latest stock news & updates 👆

Educational content 📖

This stock analysis is designed for educational purposes and should not be taken as financial advice. Please carry out your own research or consult with a financial advisor before investing.

PREMIER ENERGIES STOCK ANALYSIS🚀 Stock Alert: Cup & Handle Formation!

📌 Stock: PREMIER ENERGIES

📊 Sector: Electronic Technology | Semiconductors

💰 Market Cap: ₹50,466 Cr

📈 Key Levels:

✅ Buy Above: ₹1,216

🎯 Target: ₹1,612 (+35.41%)

📉 Support: ₹1,120

🔍 Fundamentals:

EPS Growth: +4% QoQ (Sep '24)

Revenue: ₹1,657 Cr (+19% YoY)

⚠️ Disclaimer: This is not financial advice. DYOR before investing.

#StockMarket #TechnicalAnalysis #Trading #Investing #Nifty

PREMIER ENERGIES LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA(50 EMA): If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

ORDERS BOOST PREMIER ENERGIES' UPSIDE POTENTIALPREMIER ENERGIES is trading within a critical support range of 980 to 1000. Historically, the stock has attempted to break above this level, but those efforts resulted in false breakouts, indicating market volatility. We may anticipate a short-covering rally, which could temporarily increase the stock price as short sellers buy back shares to cover their positions. Additionally, it's worth noting that Premier Energies has recently secured a significant order valued at 632 crore, which could bolster investor confidence and further contribute to a potential rally. The combination of these factors may create an opportunity for investors looking to capitalize on a rebound in the stock.