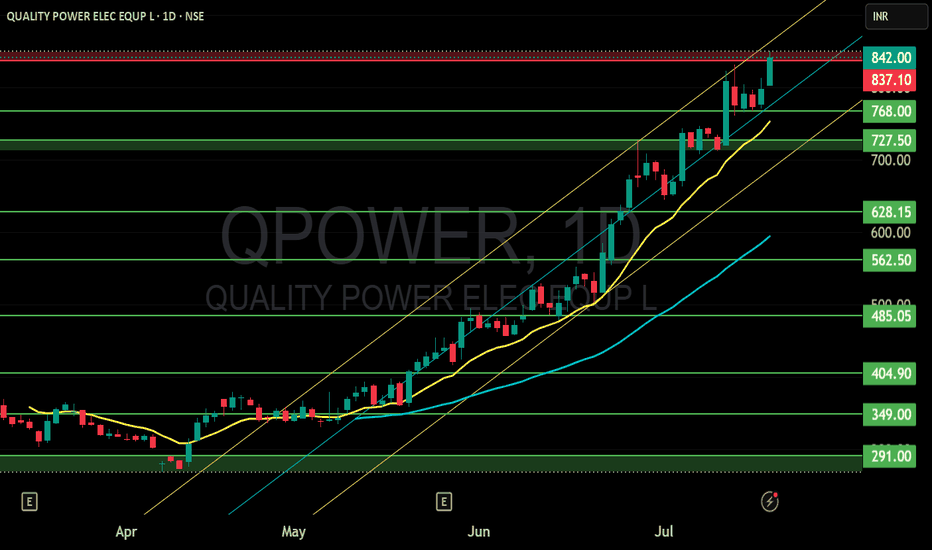

QUALITY POWER ELEC EQUP LTD Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

QPOWER trade ideas

QUALITY POWERThis stock forming a **rounded bottom pattern** with a **bullish breakout**, which can be favorable for a long trade.

---*Technical Analysis**

1. **Rounded Bottom Formation (Cup Shape)**

* The price action shows a smooth transition from a downtrend to an uptrend.

* This is a classic **reversal pattern** signaling a shift from bearish to bullish sentiment.

2. **Breakout Confirmation**

* The last few candles show strong bullish momentum breaking above the recent resistance level (horizontal line).

* This breakout is accompanied by a significant **spike in volume**, validating the move.

3. **Moving Average (Blue Line)**

* Price is consistently trading **above the moving average**, which is sloping upward – a bullish sign.

this is a **20-day moving average**, often used to gauge short- to mid-term trends.

4. **Volume Analysis**

* **Accumulation** is evident in the rising green volume bars leading up to the breakout.

* Strong breakout candle with the **highest volume** in the visible chart — this adds conviction

### 📈 **Trade Setup (Long Bias)**

* **Entry**: On close above the breakout candle or slight pullback to the breakout level (prior resistance acting as support) 400-410

* **Stop Loss**: Just below the breakout level or below the moving average

### ⚠️ Risk

* Avoid chasing the price after a large breakout (above 410) candle unless a retest occurs.

ENTRY 400-410

SL FOR POSITINAL 360

FIRST TARGET -520

RISK REWARD -1:2.2