Review and plan for 28th April 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

RELIANCE trade ideas

RELIANCE SWING TRADE SETUP📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

Reliance Industries Ltd view for Intraday 23rd April #RELIANCE Reliance Industries Ltd view for Intraday 23rd April #RELIANCE

Resistance 1300-1305 Watching above 1280 for upside movement...

Support area 1278 Below 1300 ignoring upside momentum for intraday

Watching below 1278 for downside movement...

Above 1300 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

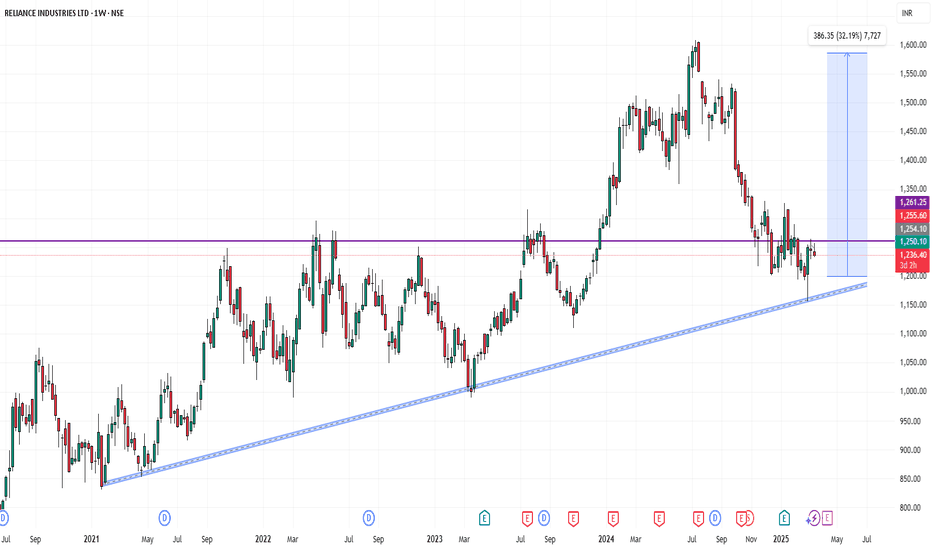

Reliance Industries – Key Weekly Chart Setup | Strong SupportReliance Industries – Key Weekly Chart Setup | Strong Support Zone & Rebound Potential 🚀

Ticker: RELIANCE (NSE)

Timeframe: Weekly

Current Price: ₹1,299.50

Technical Indicators: 200W MA, Fibonacci Retracement, MACD Divergence

🔍 Technical Analysis Insight:

Reliance Industries is currently hovering around its 200-week moving average (MA) (~₹1,220–₹1,225 zone), which has historically acted as a strong long-term support. This confluence with the 61.8% Fibonacci retracement from the previous rally (₹1,608.55 to ₹1,121.55) makes this zone crucial.

Support Zone: ₹1,220–₹1,225

Immediate Resistance: ₹1,362–₹1,380 (near 38.2% retracement & 50W MA)

MACD: Showing bullish crossover on the weekly, along with a positive divergence — signaling potential trend reversal.

📌 If broader markets continue in a rebound phase, Reliance could rally up to 20% in a relatively short span. Targets could be ₹1,460 (23.6% retracement) and ₹1,600 (previous swing high).

🛑 Risk Management Note:

Keep an eye on volume confirmation. A weekly close below ₹1,200 could invalidate the bullish setup and warrant re-evaluation.

Reliance Industries Ltd view for Intraday 23rd April #RELIANCEReliance Industries Ltd view for Intraday 23rd April #RELIANCE

Resistance 1280 Watching above 1285 for upside movement...

Support area 1250 Below 1270 ignoring upside momentum for intraday

Watching below 1245 for downside movement...

Above 1270 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

RELIANCE INDUSTRIES LTD short dayThe stock of Reliance Industries is currently exhibiting a clear bearish tone. Price action continues to show weakness, with repeated failed attempts to recover, signaling that sellers remain in control.

The ongoing downward movement suggests a lack of confidence from market participants, with no strong catalysts visible to shift momentum. Selling pressure dominates, while any bounce attempts struggle to hold.

Unless there's a visible change in price behavior or a shift in sentiment, the overall outlook remains negative. Caution is advised, and buyers may want to wait for clearer signs of stability before considering entry.

Reliance Industries : Already recovered 100 from the support Reliance Industries : Already recovered 100 from the level of 1110 in this week .

Since 2014 it has remained above Supertrend which shows the strength of the script.

It touched 1110 on Oct 2023 and now in April 2025 and recovered in no time.

Next level to watch for is @ 1300

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

How to Use the TradingView Search Bar Efficiently 01. Introduction to the TradingView Search Bar

The TradingView Search Bar is one of the most essential tools in your charting journey. Located at the top-left corner of the interface, this feature allows you to instantly switch between stocks, indices, crypto assets, forex pairs, futures, and more — without leaving your current chart tab.

Whether you're a day trader looking for high-volume movers or an investor monitoring global indices, the search bar makes it effortless to pull up symbols with lightning speed.

One of the best parts? You don’t even need to click anything — just start typing on your keyboard while a chart is open, and the search bar automatically activates.

Pro Tip: The TradingView Search Bar supports symbol auto-suggestions with exchange suffixes (like .NS for NSE stocks), making it ultra-fast for Indian markets too.

02. How to Open the Symbol Search Bar

Opening the symbol search bar in TradingView is incredibly intuitive — and can be done in multiple ways depending on how fast you want to move.

Here are the top 3 ways to launch the search bar:

• 🔘 Click the Symbol: Go to the top-left corner of your chart and click the current symbol (e.g., NIFTY or BTCUSD) to open the search panel.

• ⌨️ Start Typing: When your chart is focused, just begin typing any symbol directly — the search window pops up instantly.

• 📚 Use the Watchlist: Open a saved symbol from your Watchlist using a simple click, and it automatically replaces the current chart.

Shortcut Key:

Just press your keyboard and type RELIANCE or NIFTY without clicking anywhere — TradingView immediately opens the search popup.

Works on both Windows and Mac.

03. Extended: Exploring the Search Interface (Tab-by-Tab Breakdown)

The TradingView Symbol Search Interface is more than just a place to look up stock names. It’s a powerful filtering system designed to help traders and investors access any instrument—globally and across asset classes—in just a few clicks. Let’s break down each tab and filter in detail:

🔍 1. Asset Type Tabs

Located at the top of the search panel, these tabs let you narrow down by instrument type:

• All – View all available instruments.

• Stocks – Equity shares from global exchanges (e.g., NSE, NASDAQ, BSE, etc.).

• Funds – Includes ETFs, mutual funds, and index funds.

• Futures – Derivative contracts across commodities, indices, etc.

• Forex – Currency pairs like USDINR, EURUSD, GBPJPY, etc.

• Crypto – Popular cryptocurrencies like BTC, ETH, and exchange pairs.

• Indices – Market indices like NIFTY50, S&P 500, NASDAQ100.

• Bonds – Government and corporate bond listings.

• Economy – Macro-economic indicators like GDP, unemployment, CPI.

• Options – Derivative instruments based on options chain availability.

💡 Pro Tip: Use these tabs before typing a symbol to narrow down your focus instantly.

🌍 2. All Countries Filter

You can choose to see instruments only from specific countries. Selecting this opens a country-wise list showing all supported exchanges under each country.

• USA: NASDAQ, NYSE, CBOE, OTC

• India: NSE, BSE

• UK: LSE

• Germany: XETRA, FWB

🔎 Use Case: If you only want Indian stocks, choose India to limit the results to NSE/BSE only.

🧾 3. All Types Filter (Only under Stocks Tab)

This filter lets you refine your equity instrument type, such as:

• Common Stock

• Preferred Stock

• Depository Receipt (like ADR/GDR)

• Warrant

🔍 Use Case: Great for global investors looking specifically for ADRs or warrants.

🧭 4. All Sectors Filter (Only under Stocks Tab)

This is one of the most powerful tools for equity screening. You can filter stocks based on their sector like:

• Finance

• Technology Services

• Health Technology

• Consumer Durables

• Electronic Technology

• ... and 20+ more industry segments

💼 Use Case: Perfect for sector-based trading or thematic investing.

⚙️ Power Feature: All filters can be used in combination. Example: You can search only Technology sector stocks from India, of Common Stock type — all in seconds.

05: Using the Flag to Add Symbols to Watchlist

The 🚩 flag icon in TradingView allows you to tag symbols with color-coded labels for easy watchlist management. You can organize your stocks by strategy, sector, volatility, or timeframe using these flags.

🎯 What Does the Flag Icon Do?

• Click the 🚩 icon next to any symbol in the search panel.

• Choose from 7 different colors to group stocks by theme.

• Flagged stocks immediately appear under that color in your Watchlist.

You can create multiple groups — like F&O, Crypto, Sectors, Swing Picks — all visually organized.

🔍 06: Smart Search Tricks (Symbol Syntax, Exchanges, Shortcuts)

The TradingView Symbol Search bar supports intelligent filters, shortcuts, and exchange-based syntax to save time and improve accuracy. Mastering these tricks will allow you to switch charts and find instruments faster than ever.

🧠 1. Use Exchange Prefixes

You can directly use exchange prefixes to narrow your search:

NSE: – National Stock Exchange of India

BSE: – Bombay Stock Exchange

NASDAQ: – U.S. Nasdaq-listed stocks

NYSE: – New York Stock Exchange

👉 Example: NSE:RELIANCE shows Reliance on NSE instantly.

💡 2. Partial Name Works Too

You can type partial symbols after the exchange code and TradingView will auto-suggest:

🔎 Example: Typing NSE:REL shows Reliance Industries and others.

⚡ 3. Avoid Full Company Names

Typing full company names like “Reliance Industries Ltd” might not show accurate results quickly. Instead, use ticker codes or shortcuts with exchange prefixes for better precision.

🎯 4. Type Directly to Open Search

No need to click the 🔍 icon! Just start typing on the chart:

Windows/Mac: Type any symbol (e.g. INFY)

Use Arrows: ⬆️ ⬇️ to move between results

Press Enter: to select symbol instantly

🌐 5. Use Filter Tabs Above Search

TradingView lets you filter across:

Markets: All / India / US / Global

Types: Stocks / Crypto / Forex / Futures

Sectors: Banks / Tech / Pharma / Energy

💡 Pro Tip: Combine NSE: + partial ticker + filters to drill down fast without leaving the chart screen

TIME TO SHOW RELIANCE ON RELIANCE - JUST DO NOT MISS THISEverything is pretty much explained in the picture itself.

I am Abhishek Srivastava | SEBI-Certified Research and Equity Derivative Analyst from Delhi with 4+ years of experience.

I focus on simplifying equity markets through technical analysis. On Trading View, I share easy-to-understand insights to help traders and investors make better decisions.

Kindly check my older shared stock results on my profile to make a firm decision to invest in this.

Kindly dm for further assistance it is for free just for this stock.

Thank you and invest wisely.

RIL S/R Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Reliance Industries📈 Reliance Industries Breakout Alert – ₹1241 Key Level Breached 🚀

Reliance Industries has successfully broken out above a strong resistance zone near ₹1241, indicating a potential bullish move ahead. This level acted as a critical supply zone in the past, and the breakout with volume confirmation adds strength to the trend.

🔍 Technical Highlights:

Breakout Level: ₹1241

Volume: Above average (confirming strength)

Trend: Bullish

Next Resistance Zones: ₹1265 / ₹1290

Support Zones: ₹1220 / ₹1200 (previous resistance now acting as support)

Reliance short term analysis :• Looking at the weekly chart for Reliance, the Stochastic Oscillator (Stoch) is indicating potential strength as it hovers near the oversold zone.

• This suggests that the stock might be nearing a potential buying opportunity from a long-term perspective.

• However, it's crucial to consider the daily chart for a more short-term view. On the daily chart is trading close to the overbought zone, which implies that the stock might be overextended in the short term and due for a price correction.

• This divergence in signals between the weekly and daily charts suggests the possibility of a short-selling opportunity in Reliance.

Reliance Breakout?📈 Reliance Industries Breakout Alert – ₹1241 Key Level Breached 🚀

Reliance Industries has successfully broken out above a strong resistance zone near ₹1241, indicating a potential bullish move ahead. This level acted as a critical supply zone in the past, and the breakout with volume confirmation adds strength to the trend.

🔍 T echnical Highlights:

Breakout Level: ₹1241

Volume: Above average (confirming strength)

Trend: Bullish

Next Resistance Zones: ₹1265 / ₹1290

Support Zones: ₹1220 / ₹1200 (previous resistance now acting as support)

Reliance Industries: Case of Ending DiagonalTheory:

DIAGONAL:

Diagonal are the motive waves like an impulse wave, but diagonals are different from impulse wave in that they do follow the first two Sutras (rules of impulse wave) for wave analysis, but it does not follow the third one i.e. Wave 4 should not intervene the territory of the wave 1. In a diagonal wave 4 always enters into the price territory of the wave 1.

Properties Of Diagonals:

Diagonals can be contracting or expanding type being expanding diagonal a rare one.

In contracting type, wave 3 is shorter than wave 1, wave 5 is shorter than wave 3, and wave 4 is shorter than wave 2.

In expanding type, wave 3 is longer than wave 1, wave 5 is longer than wave 3, and wave 4 is longer than wave 2.

Types Of Diagonals:

LEADING DIAGONAL

ENDING DIAGONAL

LEADING DIAGONAL: In a leading diagonal , waves 1,3, and 5 are all impulsive in nature or all in corrective form of zigzags. Wave 2 and wave 4 are always present in a zigzag form. A leading diagonal suggests the starting of a new wave & that is why it can develop wave 1 of a impulse wave and a first wave of a zigzag pattern.

ENDING DIAGONAL : This is the most common diagonal that can be found out at the ending of a main trend or main correction. It consists of all the waves 1-2-3-4-5 in a single or multiple zigzags. They can be found placed at 5th wave of an impulse wave or can been seen as a wave ‘C’ of a corrective waves zigzags or flat.

After the termination of the diagonal , a swift & a sharp reversal takes place which bring the prices back to the level from where the diagonal has began. (generally it retrace back to the wave-2 of the diagonal structure)

TRADING PLAN:

Stock is likely to hold above 1156 on any weakness and recover towards 1290-1300 in the coming days and weeks ahead.

Above 1200 Reliance can move upward otherwise it will be bearishYt - chartpatern - YT - @chartpatern

As of March 4, 2025, Reliance Industries Ltd. (RIL) shares closed at ₹1,161.70, reflecting a 0.80% decrease from the previous day. This positions the stock approximately 27.80% below its 52-week high of ₹1,608.95, achieved on July 8, 2024.

Your observation that RIL's stock may exhibit bullish behavior above ₹1,200 and bearish tendencies below this threshold aligns with recent performance. The stock's current price is marginally below this pivotal level, suggesting potential bearish momentum.

Analyst sentiment remains optimistic, with a consensus rating of 'Buy' and a median price target of ₹1,559, indicating a potential upside of approximately 24.38% from current levels.

In summary, while RIL's stock is trading below the ₹1,200 mark, indicating possible bearish trends, the prevailing analyst outlook suggests confidence in the company's long-term performance.