ROSSARI trade ideas

ROSSARI BIOTECH LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Rossari Biotech LtdHello,

Trend-Based Analysis. Buy the Dips, Sell The Rallies, Also Following the Trend. Let's see where the Price Action takes us, Riding the wave. Potential trade setups based on trend momentum.

Technical analysis based on trend identification and momentum, Looking for high-probability setups within the prevailing trend.

Analyzing the current market trend and potential future price movement. Focusing on risk management and reward-to-risk ratios.

Details is Mentioned in Chart, Read carefully.. .

Rossari Biotech Formed Reverse Head & shoulder pattern After almost 3 yr long correction ROSSARI BIOTECH formed Reverse H&S pattern on weekly chart. Also given break out of pattern on 29 July ...Target will be arround 1087 with a stoploss of 860.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

ROSSARI BIOTECH Showing Change in Price StructureNSE:ROSSARI

....................................................................................................................

....................................................................................................................

....................................................................................................................

Update on the expansion projects at Dahej Facilities

....................................................................................................................

• In the Q2FY24 the Company had announced an expansion of its facility at Dahej by adding up

20,000 MTPA capacity for products related to HPPC in the specialty chemical space, as well as for producing ingredients for its subsidiary companies.

Also, to cater to the growing

demand in agro chemicals, home and personal care, oil & gas and the pharma sector, the

Company had further announced expansion of the Ethoxylation capacity by 30,000 MTPA at

the Dahej facility of Unitop Chemicals Private Limited.

• Work on both these projects are progressing as planned. Commissioning is expected to

happen, in a phased manner in the current year

....................................................................................................................

....................................................................................................................

....................................................................................................................

• Consistent growth trajectory over the past three years, driven by both organic and inorganic growth strategies

• While near-term investments and strategic initiatives have led to a moderation in ROCE and ROE, the balance sheet position

remains strong.

The Company is confident of reporting improved return metrics in the future as these investments start yielding

results

Rossari Biotech Steady Financial Growth with Strong Market PosRossari Biotech has demonstrated consistent financial growth, with its revenue increasing from ₹516 crores in FY2019 to ₹1,910 crores in the trailing twelve months (TTM) of FY2024. The company has maintained a stable operating profit margin around 13-17% over the years, reflecting its efficient cost management and strong market position. Although the return on equity (ROE) has slightly decreased to 13% in the most recent fiscal year, it remains a solid performer within the specialty chemicals sector. Additionally, Rossari's conservative dividend payout and strategic reinvestment into the business indicate a focus on long-term growth.

I am buying at 900-915 zone with a stop loss at 790 for a target of 1250-1600+

Disclaimer: The information provided here is intended for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any securities. The opinions expressed are those of the author and are subject to change without notice. Past performance is not indicative of future results. Investors should consult their financial advisors before making any investment decisions. Trading and investing in financial markets involve risks, including the loss of principal. Neither the author nor any of their affiliates shall be held liable for any loss or damage resulting from the use of this information.

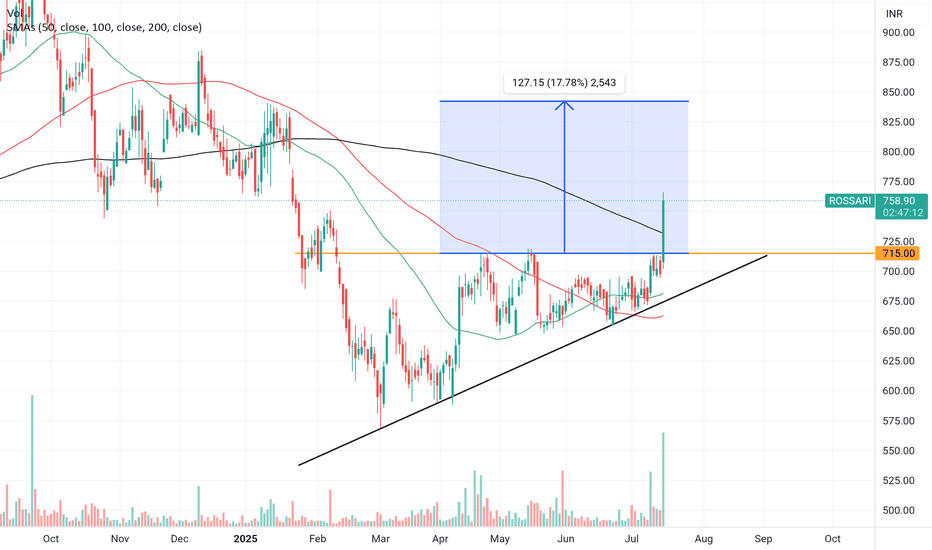

ROSSARI - Bullish SetupStock name - Rossari Biotech Limited.

Weekly chart setup

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Master Score - B

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trade.

SWING IDEA - ROSSARI BIOTECHConsider a compelling swing trade opportunity in Rossari Biotech , a leading specialty chemicals manufacturer in India, renowned for its innovative and sustainable solutions across various industries.

Reasons are listed below :

Price at Support Zone : Rossari Biotech is trading at its support zone, where it was initially listed, indicating potential buying interest and stability at these levels.

Doji Candle Formation : A doji candlestick pattern has formed, confirming the bullish momentum indicated by the preceding marubozu candle. This suggests that the price is holding onto higher levels and may continue to move upward.

0.618 Fibonacci Support : Finding support at the 0.618 Fibonacci level strengthens the bullish case, providing a solid foundation for potential upward movement.

Initiation of Double Bottom Pattern : The beginning of the formation of a double bottom pattern suggests a potential trend reversal and bullish continuation, indicating a shift in market sentiment.

Increase in Volumes : An increase in trading volumes reflects growing market interest and potential accumulation by investors, adding confirmation to the bullish thesis for Rossari Biotech.

Target - 809 // 890

StopLoss - weekly close below 655

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

ROSSARI BIOTECHRossari Biotech was started in 2003. They are among the largest manufacturers of textile specialty chemicals in India

Their 3 main product categories are:

- Home, personal care, and performance chemicals

- Textile specialty chemical

- Animal health and nutrition

The company has two R&D facilities, one at Silvassa manufacturing facility and a research lab at IIT Bombay.

Rossari Biotech LtdTarget given in the chart

SL 690

FUNDAMENTALS

Market Cap

₹ 4,710 Cr.

Current Price

₹ 852

High / Low

₹ 904 / 657

Stock P/E

36.0

Book Value

₹ 190

Dividend Yield

0.06 %

ROCE

18.3 %

ROE

13.3 %

Face Value

₹ 2.00

Price to book value

4.51

Intrinsic Value

₹ 590

PEG Ratio

1.55

Price to Sales

2.57

Debt

₹ 119 Cr.

Debt to equity

0.11

Int Coverage

10.2

Reserves

₹ 1,037 Cr.

Promoter holding

68.3 %

Pledged percentage

0.00 %

EPS last year

₹ 23.7

Net CF

₹ -43.8 Cr.

Price to Cash Flow

109

Free Cash Flow

₹ -82.5 Cr.

OPM last year

13.6 %

Return on assets

8.90 %

Sales growth

10.6 %

Rossari Biotech LTD Trend AnalysisPrice bounced at key support level and RSI showing moderate bullish divergence on daily TF.

Expecting the price to make a leading diagonal pattern as highlighted, will update the chart later if any changes observed.

Good to buy at CMP for the following targets:

Medium term swing target @ 1270 (80% ROI)

Long term positional target @ 1560 (120% ROI)

Strong fundamentals with highest ever Sales & Net Profit.

Do your own due diligence before taking any action.

Peace!!