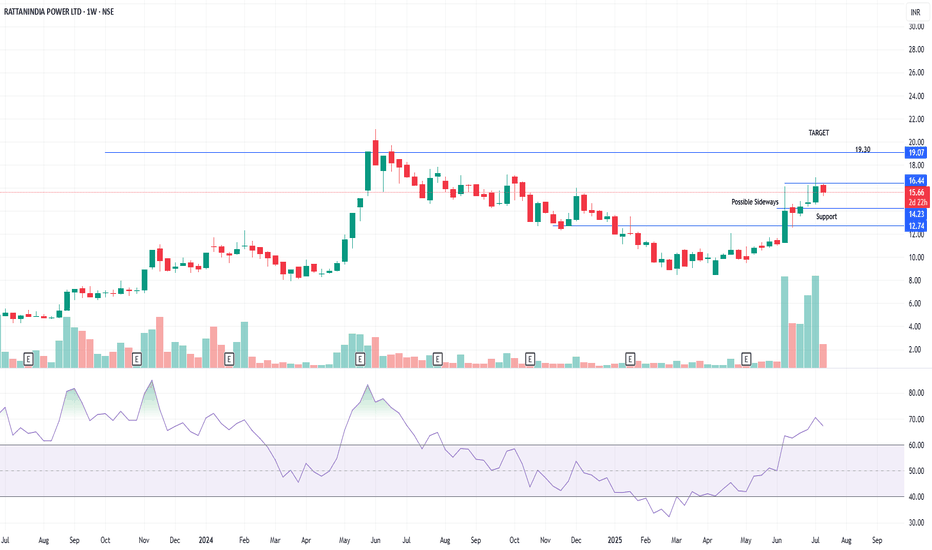

RattanIndia Power Ltd. – Breakout or Pause? A Technical & ShareTimeframe: Weekly | Idea Type: Technical + Smart Money Flow

🧠 Technical Analysis:

=============================================

📈 Stock is currently testing a key resistance zone around ₹16.44, after a strong uptrend.

📉 Possible sideways consolidation around ₹14.23–₹16.44 zone as shown on chart.

🧱

0.21 INR

2.22 B INR

32.84 B INR

2.68 B

About RATTANINDIA POWER LTD

Sector

Industry

Website

Headquarters

New Delhi

Founded

2007

ISIN

INE399K01017

FIGI

BBG000VC5LT5

RattanIndia Power Ltd. engages in the development, operation and maintainance of coal based thermal power projects. It focuses on power generation, distribution, trading, transmission, and other ancillary and incidental activities. The company was founded by Rajiv Rattan on October 8, 2007 and is headquartered in New Delhi, India.

Related stocks

RATTANINDIA POWER LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

rtn power, fully chargedFor the past three financial years, RattanIndia has demonstrated a healthy track record of generation and offtake.

Its plant availability factor (PAF) was 81% in FY 2023 (86% in FY 2022) leading to healthy recovery of fixed cost.

Plant load factor (PLF) for the plant also improved to 77% in FY 202

RTN Power is trading above trendline and forming a good baseRTN Power broke above trendline and form a good base with a reversal signal, good to keep in watch list. Volumes are increasing, very high probability of good upside potential.

Note: Please consult your financial advisor before making any investments.

STOCK TRADING IS INHERENTLY RISKY AND THE USERS

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RTNPOWER is 13.34 INR — it has decreased by −1.33% in the past 24 hours. Watch RATTANINDIA POWER LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange RATTANINDIA POWER LTD stocks are traded under the ticker RTNPOWER.

RTNPOWER stock has fallen by −12.01% compared to the previous week, the month change is a −6.39% fall, over the last year RATTANINDIA POWER LTD has showed a −18.66% decrease.

RTNPOWER reached its all-time high on Oct 30, 2009 with the price of 45.05 INR, and its all-time low was 0.95 INR and was reached on Aug 23, 2019. View more price dynamics on RTNPOWER chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RTNPOWER stock is 2.96% volatile and has beta coefficient of 1.15. Track RATTANINDIA POWER LTD stock price on the chart and check out the list of the most volatile stocks — is RATTANINDIA POWER LTD there?

Today RATTANINDIA POWER LTD has the market capitalization of 71.58 B, it has decreased by −4.99% over the last week.

Yes, you can track RATTANINDIA POWER LTD financials in yearly and quarterly reports right on TradingView.

RTNPOWER net income for the last quarter is −131.10 M INR, while the quarter before that showed 1.26 B INR of net income which accounts for −110.41% change. Track more RATTANINDIA POWER LTD financial stats to get the full picture.

No, RTNPOWER doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. RATTANINDIA POWER LTD EBITDA is 4.93 B INR, and current EBITDA margin is 17.80%. See more stats in RATTANINDIA POWER LTD financial statements.

Like other stocks, RTNPOWER shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade RATTANINDIA POWER LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So RATTANINDIA POWER LTD technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating RATTANINDIA POWER LTD stock shows the buy signal. See more of RATTANINDIA POWER LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.