SBIN trade ideas

SBI short sellI feel it's too much away from the moving averages.

72% lifetime high fail.

There is a negative divergence too.

There is trendline resistance too in daily.

Doji on top is also a selling confirmation according to candlestick patterns.

it is overbought territory too.

The 3 bullish waves are also complete and it's ready for a pullback.

SBI Levels & Strategy for next few daysDear traders, I have identified chart levels based on my analysis, major support & resistance levels. Please note that I am not a SEBI registered member. Information shared by me here for educational purpose only. Please don’t trust me or anyone for trading/investment purpose as it may lead to financial losses. Focus on learning, how to fish, trust on your own trading skills and please do consult your financial advisor before trading.

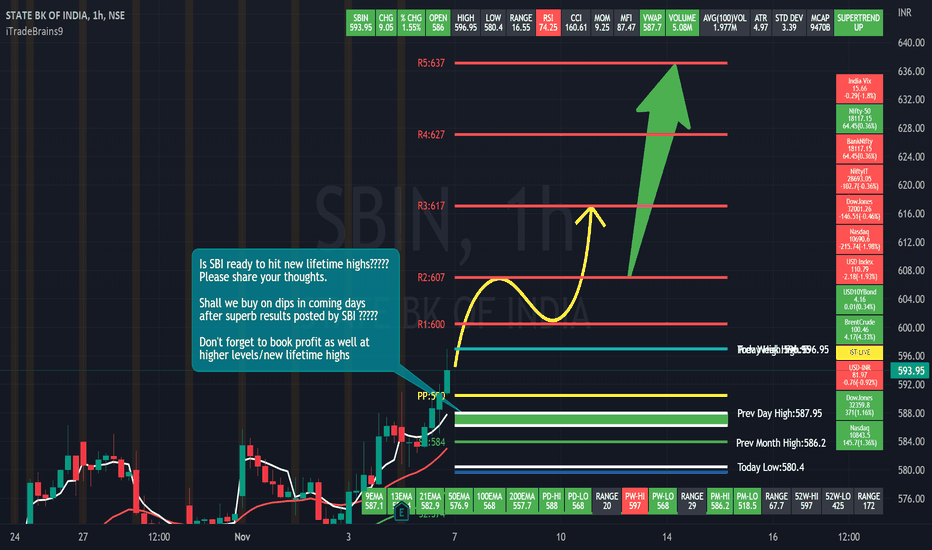

SBI has posted excellent results and clearly beat the market expectations. I am feeling quite happy for long term investors who are consistently getting rewarded. SBI is trend is positive & momentum on buying side is strong. Buy on dips strategy is working well in SBI, however traders must be careful near new lifetime highs and work level by level with strict stoploss and maximize the profit using trailing stop loss.

Shall we wait & look for buy on dips opportunity in SBI in coming days?????

Yes, I think so.

Shall we book profits near major resistance levels/near new lifetime high?????

Yes, I think so.

Shall we short SBI near new lifetime high?????

We should avoid to short.

Is correction in coming days due to imported weakness in Indian market/RBI rate hike to curb inflation, likely to be buying opportunity for traders & long term investors????

Yes, I think so.

Please share your thoughts as well. Good luck to traders & investors for profitable trading in SBI.

SBINNSE:SBIN

> One can enter Now or wait for an Retest !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose!

SBIN - Bullish Price Action Analysis NSE:SBIN has already activated Harmonic PRZ 1.272 level in weekly timeframe of the target price 583.

BUY:

if price sustains above 520-522.

SELL:

if it not sustains above 520. you may get some profit booking up to 475.

Chances are more in favor of buyers to make new All time high so do accordingly.