SHARDAMOTR trade ideas

SHARDA MOTOR INDS LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

H & S setup ready for big from here Company Overview:

Sharda Motor Industries Limited (SMIL) is a leading automotive component manufacturer based in India. The company specializes in producing exhaust systems, seat frames, and other critical components for the automotive industry. With a strong presence in both domestic and international markets, SMIL has demonstrated consistent growth and resilience.

Market Position:

SMIL's position as a key supplier to major automakers provides it with a stable revenue stream. The company's wide product portfolio and established customer relationships make it a trusted partner in the automotive industry. This market position is a significant strength, especially as the auto sector continues to evolve and grow.

Key Investment Themes:

Growing Automotive Industry: The Indian automotive industry is poised for significant growth, driven by factors such as increasing disposable income, urbanization, and a growing middle-class population. SMIL stands to benefit from this growth as a critical component supplier to the industry.

Export Opportunities: SMIL has a strong export presence, with a focus on markets in North America, Europe, and Asia. As global demand for Indian automotive components continues to rise, the company is well-positioned to capitalize on export opportunities.

Diverse Product Portfolio: The company's diverse product portfolio, including exhaust systems, seat frames, and other components, offers stability and reduces dependency on a single product category. This diversification minimizes risks associated with fluctuations in demand for specific components.

Quality and Innovation: SMIL has a reputation for high-quality products and a commitment to innovation. In an industry where quality and compliance are paramount, the company's adherence to international standards and continuous innovation contribute to its competitive advantage.

Operational Efficiency: SMIL has invested in modern manufacturing facilities and processes to enhance efficiency and productivity. This focus on operational excellence enables the company to maintain competitive pricing while ensuring quality.

Risks and Mitigation:

Cyclical Nature of the Auto Industry: The automotive industry is cyclical and can be influenced by economic conditions. SMIL's diversification and export focus help mitigate this risk, as it is less reliant solely on the domestic market.

Competitive Landscape: The automotive component manufacturing sector is competitive. SMIL's emphasis on quality, innovation, and customer relationships can help it withstand competitive pressures.

Currency Exchange Risk: As an exporter, SMIL is exposed to currency exchange rate fluctuations. Risk management strategies such as hedging can help mitigate this risk.

Long-Term Outlook:

Sharda Motor Industries Limited exhibits strong potential for long-term growth, backed by its solid market position, diverse product portfolio, export opportunities, and commitment to quality and innovation. While risks exist, the company's strategic focus on operational efficiency and customer-centricity positions it well to navigate challenges in the automotive industry.

Investors with a long-term perspective and an appetite for exposure to the automotive sector should consider including SMIL in their portfolio. However, it's crucial to conduct comprehensive due diligence, stay informed about industry trends, and regularly reassess the investment thesis to align with changing market conditions.

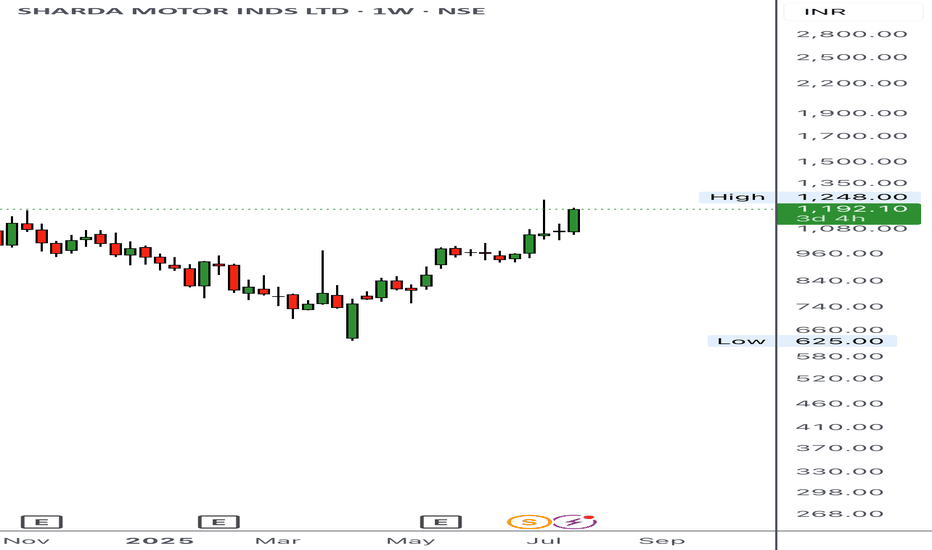

Round Bottom Resistance Breakout - SHARDA MOTORPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose

SHARDAMOTR - Bullish Consolidation with VolumesNSE: SHARDAMOTR is closing with a bullish consolidation candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 8% to 12% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

Sharda MotorsTrade setup:

Weekly: Cup and handle breakout done with huge volumes. After that, consolidation done and another breakout with volumes. One can also consider this as Flag and pole pattern. Also, taking support at trend line.

Entry = CMP ie, 789 INR

Sl = below trend line or swing low ie; 650 INR or 50 EMA

Target = 1079 INR (length of pole)

RR = 2.07

Since there are not many confluences in this trade, keep trailing your SL (very important).