Review and pln for 16th July 2025Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

43.25 INR

109.29 B INR

521.53 B INR

988.99 M

About SUN PHARMACEUTICAL IND L

Sector

Industry

CEO

Dilip Shantilal Shanghvi

Website

Headquarters

Mumbai

Founded

1983

ISIN

INE044A01036

FIGI

BBG000BV5H87

Sun Pharmaceutical Industries Ltd. engages in manufacturing, developing, and marketing of pharmaceuticals products. It offers tablets, capsules, injectable, inhalers, ointments, creams, and liquids. The company was founded by Dilip Shantilal Shanghvi in 1983 and is headquartered in Mumbai, India.

Related stocks

Sunpharma I'm not a SEBI REGISTERED ANYLISIS

just for learning purpose

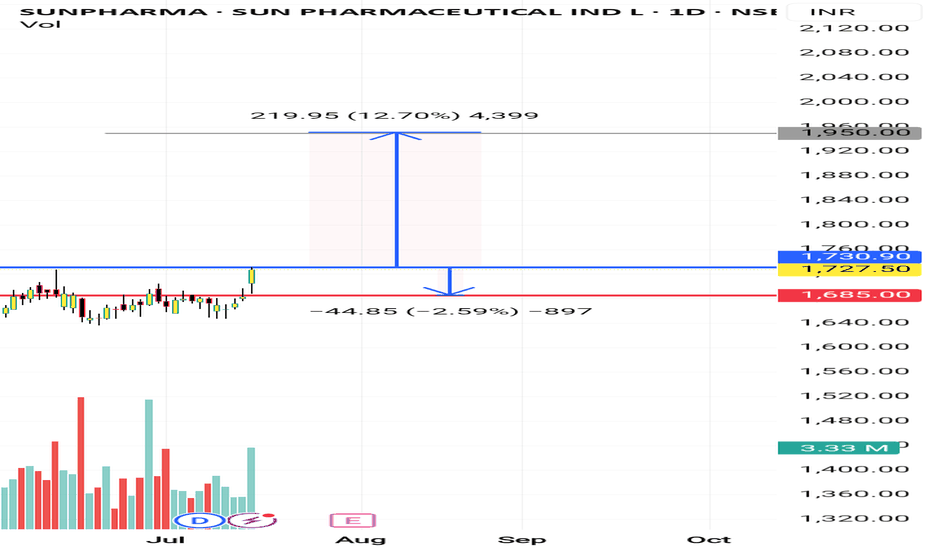

above the blue line close in D chart candle i will buy and put strictly SL to below red line...once candle close below Red line in D chart...i will close the Trade...

Note: 1

Breakout candle should close time 6 or below 6 points I wil

Review and plan for 23rd May 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar

SUN PHARMA | Inverted Head & Shoulders BreakoutSun Pharma has completed an Inverted Head and Shoulders pattern on the daily chart, signaling a potential bullish reversal.

📈 Entry: Buy above ₹1800 (breakout confirmation)

📉 Stop Loss: ₹1722 (below right shoulder support)

🎯 Targets (based on Fibonacci extensions & previous resistance zones):

• ₹1

#SUNPHARMACEUTICAL Supply ZoneShort selling is a trading strategy used by investors to profit from the decline in the price of a stock or other financial asset. Here’s how it works:

Borrowing Shares: An investor borrows shares of a stock they believe will decrease in value, typically from a broker.

Selling the Shares: The borr

SUN PHARMA S/R for 27/1/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

SUN PHARMA S/R for 20/1/25Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

SUNPHARMA | STBT | SHORTSUNPHARMA is clearly unable to sustain above the Monthly Pivot and has gotten rejected strongly.

Weekly Pivot also has not been able to sustain.

The Bulls are clearly trapped and hence, a short STBT type trade can be initiated for a target to 1800 level which is also a long term trend line.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where SUNPHARMA is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of SUNPHARMA is 1,629.70 INR — it has decreased by −4.51% in the past 24 hours. Watch SUN PHARMACEUTICAL IND L stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange SUN PHARMACEUTICAL IND L stocks are traded under the ticker SUNPHARMA.

SUNPHARMA stock has fallen by −3.57% compared to the previous week, the month change is a −1.59% fall, over the last year SUN PHARMACEUTICAL IND L has showed a −5.55% decrease.

We've gathered analysts' opinions on SUN PHARMACEUTICAL IND L future price: according to them, SUNPHARMA price has a max estimate of 2,450.00 INR and a min estimate of 1,525.00 INR. Watch SUNPHARMA chart and read a more detailed SUN PHARMACEUTICAL IND L stock forecast: see what analysts think of SUN PHARMACEUTICAL IND L and suggest that you do with its stocks.

SUNPHARMA reached its all-time high on Sep 30, 2024 with the price of 1,960.35 INR, and its all-time low was 2.25 INR and was reached on Jan 1, 1999. View more price dynamics on SUNPHARMA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SUNPHARMA stock is 6.14% volatile and has beta coefficient of 0.63. Track SUN PHARMACEUTICAL IND L stock price on the chart and check out the list of the most volatile stocks — is SUN PHARMACEUTICAL IND L there?

Today SUN PHARMACEUTICAL IND L has the market capitalization of 3.91 T, it has increased by 2.27% over the last week.

Yes, you can track SUN PHARMACEUTICAL IND L financials in yearly and quarterly reports right on TradingView.

SUN PHARMACEUTICAL IND L is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

SUNPHARMA earnings for the last quarter are 12.20 INR per share, whereas the estimation was 12.52 INR resulting in a −2.52% surprise. The estimated earnings for the next quarter are 12.85 INR per share. See more details about SUN PHARMACEUTICAL IND L earnings.

SUN PHARMACEUTICAL IND L revenue for the last quarter amounts to 138.51 B INR, despite the estimated figure of 137.04 B INR. In the next quarter, revenue is expected to reach 143.24 B INR.

SUNPHARMA net income for the last quarter is 22.79 B INR, while the quarter before that showed 21.50 B INR of net income which accounts for 5.99% change. Track more SUN PHARMACEUTICAL IND L financial stats to get the full picture.

SUN PHARMACEUTICAL IND L dividend yield was 0.92% in 2024, and payout ratio reached 35.13%. The year before the numbers were 0.83% and 33.82% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 25.87 K employees. See our rating of the largest employees — is SUN PHARMACEUTICAL IND L on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SUN PHARMACEUTICAL IND L EBITDA is 155.01 B INR, and current EBITDA margin is 28.80%. See more stats in SUN PHARMACEUTICAL IND L financial statements.

Like other stocks, SUNPHARMA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SUN PHARMACEUTICAL IND L stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SUN PHARMACEUTICAL IND L technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SUN PHARMACEUTICAL IND L stock shows the buy signal. See more of SUN PHARMACEUTICAL IND L technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.