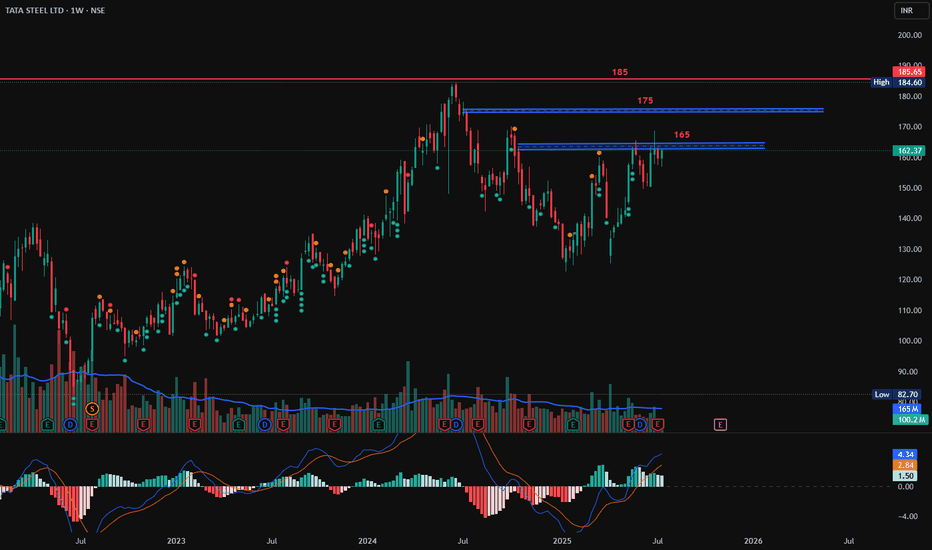

Tata Steel, Weekly, Long PositionTata Steel has tried to break the resistance 165, however it has failed to sustain it.

If it breaks the level of 165, then it may go upwards from here.

Enter on the Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Twe

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.64 INR

34.21 B INR

2.19 T INR

8.26 B

About TATA STEEL LTD

Sector

Industry

CEO

Thachat Viswanath Narendran

Website

Headquarters

Mumbai

Founded

1907

ISIN

INE081A01020

FIGI

BBG000D0ZGF4

Tata Steel Ltd. is a holding company, which engages in the manufacture of iron and steel products. It operates through the following segments: Agriculture, Automotive Steels, Construction, Consumer Goods, Energy and Power, Engineering and Material Handling. Its products include Automotive Steels, Galvano, Tata Agrico, Astrum, Bearings, Pipes, Precision Tubes, Shaktee, Steelium, Tiscon and Wiron. The company was founded on August 26, 1907 and is headquartered in Mumbai, India.

Related stocks

TATA STEEL at Resistance ZoneThis is Daily Chart of TATA STEEL.

Tata steel having good Law of Polarity at 163-168 range.

If this level is sustain , then We may see lower prices in the stock again.

Tata steel is a good support zone at 125-130 range.

Two EMAs are also supporting the stock, with the first EMA positioned at ₹14

Tata Steel Ltd view for Intraday 21st May #TATASTEEL Tata Steel Ltd view for Intraday 21st May #TATASTEEL

Resistance 160 Watching above 161 for upside momentum.

Support area 155 Below 155 ignoring upside momentum for intraday

Watching below 154 for downside movement...

Above 160 ignoring downside move for intraday

Charts for Educational purposes o

TATA Steel Ltd view for Intraday 13th May #TATASTEEL TATA Steel Ltd view for Intraday 13th May #TATASTEEL

Resistance 155 Watching above 155 for upside movement...

Support area 148-150 Below 150 ignoring upside momentum for intraday

Watching below 147 for downside movement...

Above 155 ignoring downside move for intraday

Charts for Educational pur

TATA Steel Ltd view for Intraday 13th May #TATASTEEL TATA Steel Ltd view for Intraday 13th May #TATASTEEL

Resistance 155 Watching above 155 for upside movement...

Support area 148-150 Below 150 ignoring upside momentum for intraday

Watching below 147 for downside movement...

Above 155 ignoring downside move for intraday

Charts for Educational pur

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

A

TAEL4599346

ABJA Investment Co. Pte Ltd. 5.45% 24-JAN-2028Yield to maturity

4.67%

Maturity date

Jan 24, 2028

See all TATASTEEL bonds

Frequently Asked Questions

The current price of TATASTEEL is 158.35 INR — it has decreased by −0.21% in the past 24 hours. Watch TATA STEEL LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange TATA STEEL LTD stocks are traded under the ticker TATASTEEL.

TATASTEEL stock has fallen by −1.48% compared to the previous week, the month change is a −2.28% fall, over the last year TATA STEEL LTD has showed a 4.72% increase.

We've gathered analysts' opinions on TATA STEEL LTD future price: according to them, TATASTEEL price has a max estimate of 200.00 INR and a min estimate of 135.00 INR. Watch TATASTEEL chart and read a more detailed TATA STEEL LTD stock forecast: see what analysts think of TATA STEEL LTD and suggest that you do with its stocks.

TATASTEEL reached its all-time high on Jun 18, 2024 with the price of 184.60 INR, and its all-time low was 3.51 INR and was reached on Sep 27, 2001. View more price dynamics on TATASTEEL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TATASTEEL stock is 0.98% volatile and has beta coefficient of 1.33. Track TATA STEEL LTD stock price on the chart and check out the list of the most volatile stocks — is TATA STEEL LTD there?

Today TATA STEEL LTD has the market capitalization of 1.99 T, it has decreased by −2.09% over the last week.

Yes, you can track TATA STEEL LTD financials in yearly and quarterly reports right on TradingView.

TATA STEEL LTD is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

TATASTEEL earnings for the last quarter are 1.66 INR per share, whereas the estimation was 1.79 INR resulting in a −7.30% surprise. The estimated earnings for the next quarter are 3.04 INR per share. See more details about TATA STEEL LTD earnings.

TATA STEEL LTD revenue for the last quarter amounts to 531.78 B INR, despite the estimated figure of 513.26 B INR. In the next quarter, revenue is expected to reach 535.80 B INR.

TATASTEEL net income for the last quarter is 20.78 B INR, while the quarter before that showed 13.01 B INR of net income which accounts for 59.72% change. Track more TATA STEEL LTD financial stats to get the full picture.

Yes, TATASTEEL dividends are paid annually. The last dividend per share was 3.60 INR. As of today, Dividend Yield (TTM)% is 2.26%. Tracking TATA STEEL LTD dividends might help you take more informed decisions.

As of Aug 6, 2025, the company has 80 K employees. See our rating of the largest employees — is TATA STEEL LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TATA STEEL LTD EBITDA is 262.92 B INR, and current EBITDA margin is 11.38%. See more stats in TATA STEEL LTD financial statements.

Like other stocks, TATASTEEL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TATA STEEL LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TATA STEEL LTD technincal analysis shows the sell today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TATA STEEL LTD stock shows the buy signal. See more of TATA STEEL LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.