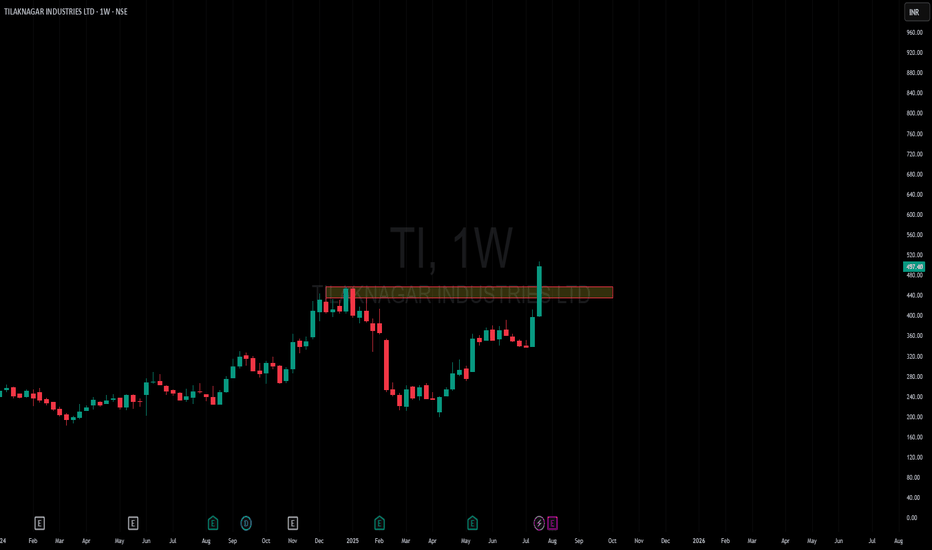

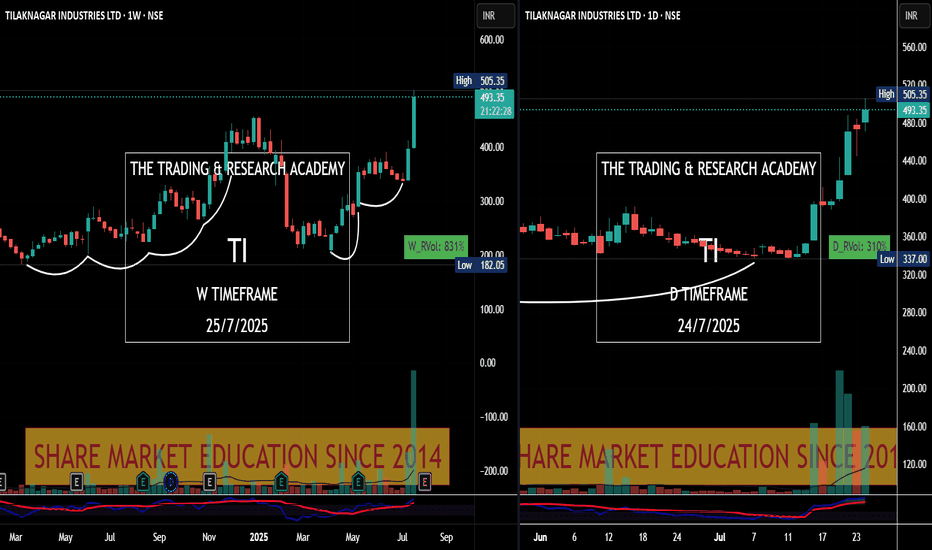

Amazing breakout on WEEKLY Timeframe - TICheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

Check this stock which has made an all time low and high chances that it makes a "V" shaped recovery.

> Taking support at last years support or breakout level

> High chances that it reverses from this point.

> Volume dried up badly in last few months / days.

> Very high suspicion based analysis and not based on chart patterns / candle patterns deeply.

> VALUABLE STOCK AVAILABLE AT A DISCOUNTED PRICE

> OPPURTUNITY TO ACCUMULATE ADEQUATE QUANTITY

> MARKET AFTER A CORRECTION / PANIC FALL TO MAKE GOOD INVESTMENT

DISCLAIMER : This is just for educational purpose. This type of analysis is equivalent to catching a falling knife. If you are a warrior, you throw all the knives back else you will be sorrow if it hits SL. Make sure to do your analysis well. This type of analysis only suits high risks investor and whose is willing to throw all the knives above irrespective of any sectoral rotation. BE VERY CAUTIOUS AS IT IS EXTREME BOTTOM FISHING.

HOWEVER, THIS IS HOW MULTIBAGGERS ARE CAUGHT !

STOCK IS AT RIGHT PE / RIGHT EVALUATION / MORE ROAD TO GROW / CORRECTED IV / EXCELLENT BOOKS / USING MARKET CRASH AS AN OPPURTUNITY / EPS AT SKY.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

TI trade ideas

Tilaknagar Industries Ltd, 1Day, Long, ResistanceTilaknagar Industries Ltd at its resistance of 420, if it breaks it with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then it may go up from here.

Entry: 420

Target: 450

POV: TI - Pole and Pennant BreakoutPOV: TI - Pole and Pennant Breakout

While the Nifty 500 and broader market are underperforming, this stock stands out as an outlier, consistently hitting new all-time highs (ATH). 🚀

Key Observation:

This swing setup delivered a Pole and Pennant Breakout, a classic bullish continuation pattern that reflects strong buying momentum even in a weak market environment.

Why It Matters:

Constant ATHs signal exceptional strength.

The breakout confirms the stock's resilience, making it a key watch for potential opportunities.

Disclaimer:

For educational purposes only, not financial advice.

TILAKNAGAR INDUSTRIES LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

TILAKNAGAR INDUSTRIES LTD IS GETTING PREPARED FOR A FRESH FLYTilaknagar Industries Ltd. crossing the **Pivot R1 level** is a strong technical indicator, often suggesting bullish momentum. Combining this with positive sales and EPS surprises strengthens the case for a further upside. Here’s an analysis:

---

### **1. Fundamental Analysis:**

#### **Positive Sales and EPS Surprise**:

- **Sales Growth**: Indicates strong demand for their products (likely alcoholic beverages given Tilaknagar's sector). Look into whether this growth is seasonal or driven by structural changes like premiumization or market expansion.

- **EPS Growth**: A positive surprise often indicates improved cost management or operating leverage, especially crucial in FMCG sectors like beverages.

#### **Peer Comparison**:

- Compare with other liquor companies like United Spirits or Radico Khaitan. If Tilaknagar's sales or EPS growth outpaces peers, it may indicate gaining market share.

#### **Margins**:

- Improving margins (Gross/EBITDA/Net) can confirm efficiency and scalability. Check if these improvements are sustainable.

---

### **2. Technical Analysis:**

#### **Pivot R1 Breakout**:

- The **Pivot R1** level, when crossed with volume, is a key sign of bullish sentiment.

- Look at the following:

- **Volume Confirmation**: High volume accompanying this breakout strengthens the signal.

- **Next Resistance**: The next target is the **R2 level**. A strong move can signal further momentum.

- **Support Zone**: The R1 level will now act as a support, and the stock must hold above it to maintain bullish momentum.

#### **Indicators to Watch**:

- **RSI**: If RSI is rising but not yet overbought (>70), there could still be room for further upside.

- **MACD**: A bullish crossover or increasing divergence supports the momentum.

- **Moving Averages**: If the stock is trading above key moving averages (e.g., 20, 50, 200-day), it indicates strong trend alignment.

---

### **3. Momentum Catalysts**:

- **Sectoral Trends**: Rising disposable incomes, premiumization, or festive demand can act as tailwinds.

- **Company-Specific Developments**: Any new product launches, distribution network expansions, or debt reduction measures could further strengthen the case.

---

### **4. Risk Management**:

- **Stop Loss**: Place a stop-loss slightly below the R1 level to manage downside risk.

- **Profit Booking**: Consider partial profit booking near the R2 or key resistance levels.

- **Volatility**: Given the nature of the liquor industry, regulatory changes (e.g., state-level policies) or input cost fluctuations can impact profitability.

---

### **5. Investment Strategy**:

- **Short-Term**: If this is a momentum trade, watch for volume and price action near the R2 level to decide whether to hold or exit.

- **Long-Term**: For a fundamental bet, focus on consistent performance, debt management, and broader market share gains.

Would you like specific resistance and support levels or a comparison with peers for a more comprehensive perspective?

Darvas Box Strategy - Break out Stock - Swing TradeDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:1 & 2

Stop loss can be Trail when it make new box / Swing.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

tiTilaknagar Industries share price surged 17 percent on November 5 on strong Q2 results.

Indian-Made Foreign Liquor (IMFL) manufacturer Tilaknagar Industries Ltd on Monday reported a 57 percent rise in its consolidated net profit at Rs 58 crore crore in September 2024 quarter. It had reported a net profit of Rs 37 crore during the July-September period of preceding 2023-24 fiscal,

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss best suitable for swing trading.

Target and Stop loss Shown on Chart. As stop loss is Big Risk to reward Ratio / Target - 1:1.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

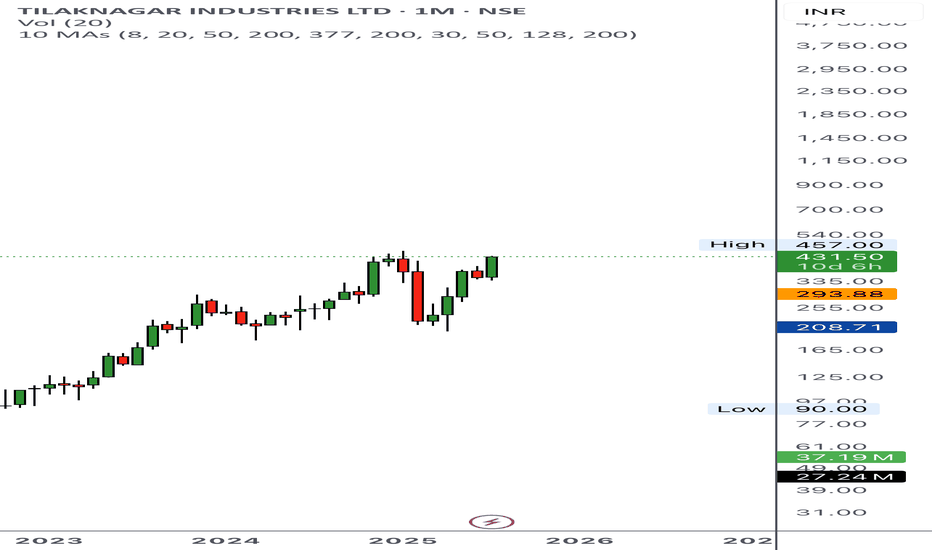

TILAK NAGAR INDUSTRY: Possible breakout candidate for 52 wk highTI Industry:

stocks is above 200 dema

stocks is above 50 dema

Volumes are building which indicates big players are adding up.

Level of 260-262 can act as a next level of resistance.

Can test 288-290 above that.

Fresh leg of rally above 292.

Upto 100 % upside in Tilaknagar IndustriesPrice bounced near key support level and RSI is showing strong bullish divergence on daily & weekly TF.

Good to buy at CMP for positional target of 440 (103% ROI) in medium term.

Short term target should be around 300 (38.5% ROI).

FIIs have increased their shareholdings aggressively and TTM sales & operating profit are highest ever in spite of margin pressure.

Do your own due diligence before taking any action.

Peace!!

Upto 40% upside potential in Tilaknagar Industries (Short Term)Upside break out of the triangle pattern will confirm it's final 5th wave move.

Approx. 40% short term target is based on Pole with Flag pattern.

Good to buy around 250 level for a target of 350+ in short term.

Mandatory SL @ 237

A good 7.2:1 R:R setup.

Fundamentals are good.

Do your own due diligence before taking any action.

Peace!!

TREND LINE BREAKOUT Tilaknagar Industries Ltd

looking for buying entry

buying range - cmp

target for short term - 265-280-290++🚀🚀

stop loss - 220❌❌

fundamentaly company is good

Market Cap ₹4,827Cr.

ABOUT

Tilaknagar Industries Ltd. is primarily involved in manufacturing and sale of Indian Made Foreign Liquor (IMFL).

KEY POINTS

Product Portfolio

The Co. has a strong and diverse portfolio of brands in various liquor categories including brandy, whisky, vodka, gin, and rum.

Brand Portfolio

The Co. has more than 15 brands across brandy, whisky, gin, rum and vodka. These brands cater to different types of customers with a greater focus on premium and high-margin brands. Some of its brands are Mansion House Brandy, Courrier Napoleon Brandy, Madiraa, Mansion House Whisky and Senate Royale Whisky.

Disclaimer:

I am not a SEBI Registered Analyst.

Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any

decision or trade.