TORNTPOWER trade ideas

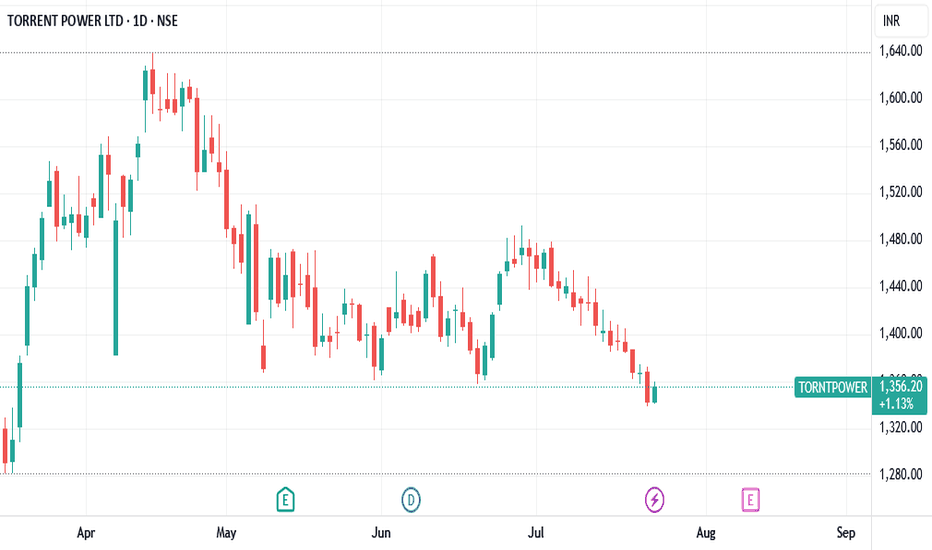

Swing the TORNTPOWER (NSE)🔍 **Technical Analysis Summary:**

✅ **Trendline Support:**

* The weekly chart shows a **well-respected ascending trendline** stretching from early 2023.

* The current price action at ₹1,390 is approaching this **long-term support zone**, which has consistently provided **bullish rebounds** in the past.

* Price action continues to form **higher lows**, confirming a structurally bullish pattern.

📊 **MACD on OBV (Volume Strength Indicator):**

* The **MACD applied on On-Balance Volume (OBV)** is showing early signs of **bullish divergence**.

* This is particularly important as OBV integrates volume with price movement, and **MACD crossover at low levels** typically indicates accumulation and **potential trend reversal**.

* A bounce in OBV would further confirm strength backed by **smart volume participation**.

⚠️ **Caution Point:**

* The recent candles have shown some **indecision and consolidation**, indicating market participants are awaiting a catalyst.

* **Global cues or negative macroeconomic factors** could temporarily break the trend, but unless a strong bearish breakdown with volume occurs, this trendline remains **technically intact and valid**.

---

💡 **Investment Thesis:**

TORNTPOWER is currently trading near a **strong, multi-touch ascending trendline** that has provided reliable support for over 18 months. The **MACD on OBV** is hinting at a **volume-backed trend reversal**, suggesting a **bullish bounce is likely** if macro sentiment remains neutral or positive.

🎯 **Trading Strategy:**

* **Entry Zone:** ₹1,370–₹1,400 (near the trendline support)

* **Stop Loss:** Below ₹1,300 (on weekly closing basis)

* **Upside Targets:**

* ₹1,550 (short-term resistance)

* ₹1,750+ (medium-term target if the trend continues)

🧠 Final Word:

This setup offers an attractive **risk-reward ratio** for swing traders and positional investors. Technicals favor a bounce — **stay cautious on macro cues**, but the **structure favors accumulation on dips** near the trendline.

TORRENT POWER : Bullish due to forming inverted head & shoulder

INVERTED HEAD & SHOULDER PATTERN -

the stock has formed an inverted head & shoulder pattern on daily chart indicating strong upward momentum for the stock

TRENDLINE BREAKOUT -

price has broken out of a strong trendline & has taken support on it indicating strong bullish momentum for the stock

TARGET -

price will go till 1629 level

TORRENT POWER LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

Plan for 13th December 2024 Nifty future and banknifty future analysis and intraday plan.

Swing trading ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Torrent Power Ltd *Torrent Power Ltd.

P&F Formation on Yearly Basis.

Price BO > 1880 Needed & to be watched. If Sustains, then good to go.

Other major Resistance levels before T1/T2.

Downward Price Channel BO on Weekly Basis.

Strong Vol. Consolidation. Continued traction.

RSI: 1H>D=W<M. All in a Bullish Zone.

EMAs: Widening Gaps amongst 20/ 50/ 100/ 200 levels on Monthly Basis.

*Trail SL with Upside*

*Book Profit as per Risk Appetite*

*This is an Opinion. Do your own research as well.

*_Happy Investing_*🤓

SWING IDEA - TORRENT POWERTorrent Power, a major player in the power sector, is showing strong technical signs of a swing trading opportunity.

Reasons are listed below :

1650 Support Zone : The 1650 level has acted as a strong support zone, and the price is holding steady around this level, indicating potential upside.

Bullish Engulfing Candle on Daily Timeframe : A bullish engulfing candle on the daily chart suggests strong buying momentum, indicating that the stock may reverse from its current support zone.

Double Bottom Pattern : The formation of a double bottom pattern is a bullish reversal signal, indicating the stock may have completed its downtrend and is now primed for an upward move.

0.618 Fibonacci Level Support : The stock has bounced back from the golden Fibonacci retracement level, providing additional support to the bullish thesis.

50 EMA Support : The price is holding above the 50-day exponential moving average, adding strength to the current setup and suggesting the trend is intact.

Target - 1908 // 2000

Stoploss - daily close below 1610

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

TORRENT POWER LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

50 SMA Rising - Positional TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

It 50 SMA Rising. Suitable for Positional Trading Initial Stop loss lowest of last 2 candles and keep trailing with 50 days SMA if price close below 50 SMA then Exit or be in the trade some time trade can go for several months.

Be Discipline because discipline is the Key to Success in the STOCK Market.

Trade What you see not what you Think

TORNTPOWER1. Anything can happen.

2. You don't need to know what is going to happen next in order to make money.

3. There is a random distribution between wins and losses for any given set of variables that define an edge. No other thoughts

4. An edge is nothing more than an indication of a higher probability of one thing happening over another.

5. Every moment in the market is unique.

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in TORNTPOWER

BUY TODAY SELL TOMORROW for 5%

TORNTPOWERNSE:TORNTPOWER

One Can Enter Now ! Or Wait for Retest of the Trendline (BO) Or wait For better R:R ratio

There can be a pause or reversal, at all time high.

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose