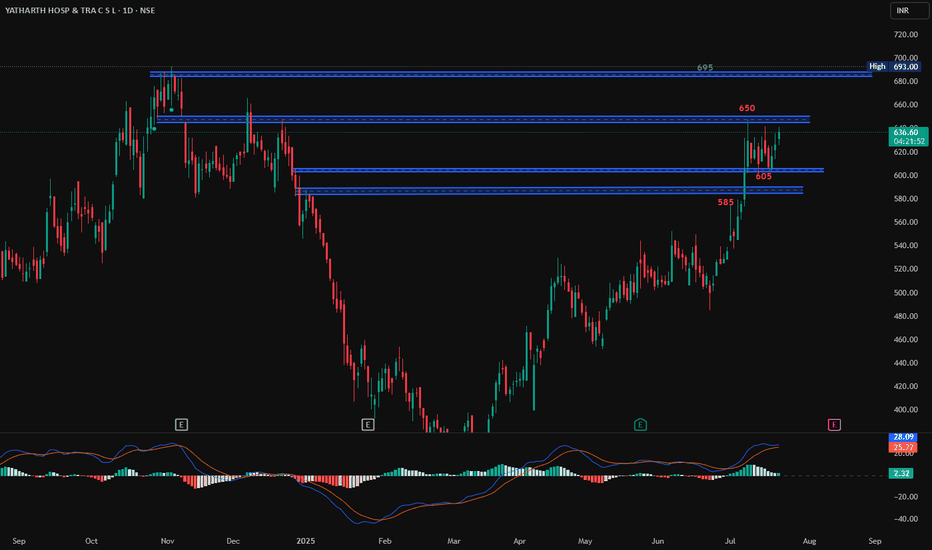

Yatharth, Resistance, 1D, LongYatharth has created a good support at 605, however it has not filled the FVG created between 645 and 650. Once it filled this FVG and crosses 650 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

14.70 INR

1.31 B INR

8.80 B INR

37.16 M

About YATHARTH HOSP & TRA C S L

Sector

Industry

Website

Headquarters

Greater Noida

Founded

2008

ISIN

INE0JO301016

FIGI

BBG01HM7WRQ8

Yatharth Hospital & Trauma Care Services Ltd. is a holding company, which engages in the provision of health care services. It involves in the business of operating hospitals and other allied services. The company was founded on February 28, 2008 and is headquartered at Greater Noida, India.

Related stocks

Yatharth hospital 470-490Yatharth hospital 470-490

Yatharth Hospital & Trauma Care Services Ltd. is a multi-specialty hospital chain operating in North India, with locations in Noida, Greater Noida, Noida Extension, and Jhansi. The hospital has been expanding its bed capacity and revenue at a strong pace, with operational b

YATHARTH - Ichimoku Breakout📈 Stock Name - Yatharth Hospital & Trauma Care Services Ltd

🌐 Ichimoku Cloud Setup:

1️⃣ Today's close is above the Conversion Line.

2️⃣ Future Kumo is Turning Bullish.

3️⃣ Chikou span is slanting upwards.

All these parameters are shouting BULLISH at the Current Market Price and even more bullis

Yatharth Hospital:- Range Breakout (WCB)Expecting a good action here.

Range Breakout with volume support and Price is above Key moving Averages.

Shorterm view is Bullish.

Entry Point:- 496-505

Stoploss:- 463-460

Target:- 25-30% Upside.

Risk-Reward Ratio: 2:1

Disclaimer: This analysis is for educational purposes and does not constit

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks.

Stock has given break out, buy above the High and do not forget to keep stop loss best suitable for swing trading. Keep this stock in watch list.

Target and Stop loss Shown

Attractive Investment Opportunities in Yatharth HospitalYatharth Hospital & Trauma Care Services Ltd, listed on the National Stock Exchange (NSE), presents an attractive investment opportunity for those looking to capitalize on the growing healthcare sector in India. The company's financial performance, technical indicators, and positive reviews all p

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of YATHARTH is 636.55 INR — it has decreased by −1.15% in the past 24 hours. Watch YATHARTH HOSP & TRA C S L stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange YATHARTH HOSP & TRA C S L stocks are traded under the ticker YATHARTH.

YATHARTH stock has risen by 0.07% compared to the previous week, the month change is a 15.40% rise, over the last year YATHARTH HOSP & TRA C S L has showed a 37.22% increase.

We've gathered analysts' opinions on YATHARTH HOSP & TRA C S L future price: according to them, YATHARTH price has a max estimate of 685.00 INR and a min estimate of 510.00 INR. Watch YATHARTH chart and read a more detailed YATHARTH HOSP & TRA C S L stock forecast: see what analysts think of YATHARTH HOSP & TRA C S L and suggest that you do with its stocks.

YATHARTH reached its all-time high on Nov 4, 2024 with the price of 693.00 INR, and its all-time low was 306.10 INR and was reached on Aug 7, 2023. View more price dynamics on YATHARTH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

YATHARTH stock is 2.52% volatile and has beta coefficient of 1.36. Track YATHARTH HOSP & TRA C S L stock price on the chart and check out the list of the most volatile stocks — is YATHARTH HOSP & TRA C S L there?

Today YATHARTH HOSP & TRA C S L has the market capitalization of 61.26 B, it has decreased by −2.28% over the last week.

Yes, you can track YATHARTH HOSP & TRA C S L financials in yearly and quarterly reports right on TradingView.

YATHARTH HOSP & TRA C S L is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

YATHARTH earnings for the last quarter are 4.00 INR per share, whereas the estimation was 3.90 INR resulting in a 2.56% surprise. The estimated earnings for the next quarter are 4.50 INR per share. See more details about YATHARTH HOSP & TRA C S L earnings.

YATHARTH HOSP & TRA C S L revenue for the last quarter amounts to 2.32 B INR, despite the estimated figure of 2.36 B INR. In the next quarter, revenue is expected to reach 2.64 B INR.

YATHARTH net income for the last quarter is 387.18 M INR, while the quarter before that showed 304.91 M INR of net income which accounts for 26.98% change. Track more YATHARTH HOSP & TRA C S L financial stats to get the full picture.

No, YATHARTH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. YATHARTH HOSP & TRA C S L EBITDA is 2.20 B INR, and current EBITDA margin is 25.01%. See more stats in YATHARTH HOSP & TRA C S L financial statements.

Like other stocks, YATHARTH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade YATHARTH HOSP & TRA C S L stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So YATHARTH HOSP & TRA C S L technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating YATHARTH HOSP & TRA C S L stock shows the buy signal. See more of YATHARTH HOSP & TRA C S L technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.