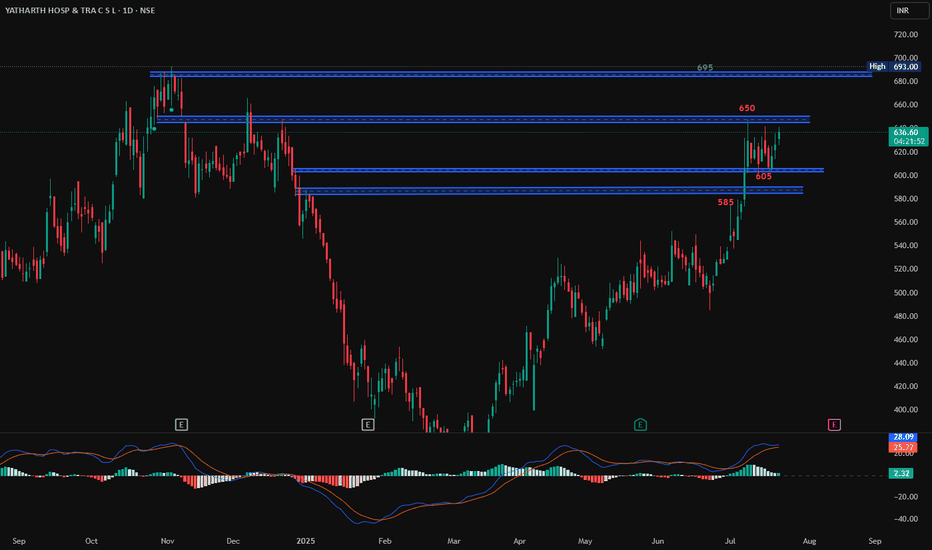

Yatharth, Resistance, 1D, LongYatharth has created a good support at 605, however it has not filled the FVG created between 645 and 650. Once it filled this FVG and crosses 650 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then chances of it moving upward is higher. Enter the stock above 650 for the targets of 680 and 695.

Enter 650

Target 690-695.

YATHARTH trade ideas

Yatharth hospital 470-490Yatharth hospital 470-490

Yatharth Hospital & Trauma Care Services Ltd. is a multi-specialty hospital chain operating in North India, with locations in Noida, Greater Noida, Noida Extension, and Jhansi. The hospital has been expanding its bed capacity and revenue at a strong pace, with operational bed capacity growing at a 25% CAGR and revenue increasing at 50% CAGR

YATHARTH - Ichimoku Breakout📈 Stock Name - Yatharth Hospital & Trauma Care Services Ltd

🌐 Ichimoku Cloud Setup:

1️⃣ Today's close is above the Conversion Line.

2️⃣ Future Kumo is Turning Bullish.

3️⃣ Chikou span is slanting upwards.

All these parameters are shouting BULLISH at the Current Market Price and even more bullishness anticipated AFTER crossing 667.

🚨Disclaimer: This is not a Buy or Sell recommendation. It's for educational purposes and a guiding light to learn trading in the market.

#CloudTrading

#IchimokuCloud

#IchimokuFollowers

#Ichimokuexpert

Excited about this analysis? Share your thoughts in the comments below!

👍 Like, Share, and Subscribe for daily market insights! 🚀

#StockAnalysis #MarketWatch #TradingEducation #ichimoku #midcap #smallcap #largecap #YATHARTH

Yatharth Hospital:- Range Breakout (WCB)Expecting a good action here.

Range Breakout with volume support and Price is above Key moving Averages.

Shorterm view is Bullish.

Entry Point:- 496-505

Stoploss:- 463-460

Target:- 25-30% Upside.

Risk-Reward Ratio: 2:1

Disclaimer: This analysis is for educational purposes and does not constitute financial advice. Always conduct your own research and consider your risk tolerance before making any trades.

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks.

Stock has given break out, buy above the High and do not forget to keep stop loss best suitable for swing trading. Keep this stock in watch list.

Target and Stop loss Shown on Chart. As stop loss is Big we keep Target 1:1.

As it was is the box for last 6 Months, it can reach Target 1 & Target 2 also.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

Attractive Investment Opportunities in Yatharth HospitalYatharth Hospital & Trauma Care Services Ltd, listed on the National Stock Exchange (NSE), presents an attractive investment opportunity for those looking to capitalize on the growing healthcare sector in India. The company's financial performance, technical indicators, and positive reviews all point towards a promising future for investors.

Financial Performance

Yatharth Hospital & Trauma Care Services Ltd has consistently shown growth in its quarterly results. The sales figures have been increasing steadily, with a significant jump from ₹375 crores in March 2022 to ₹671 crores in March 2024. This growth is accompanied by an improvement in operating profit margins, which have remained stable around 27% over the past year. The net profit has also seen a substantial increase, from ₹44 crores in March 2022 to ₹114 crores in March 2024. This indicates the company's ability to maintain profitability while expanding its operations.

The profit and loss statement for the past few years also shows a positive trend. The operating profit has increased from ₹18 crores in March 2017 to ₹180 crores in March 2024, indicating a significant expansion of the business. The net profit has also seen a substantial increase, from ₹3 crores in March 2017 to ₹114 crores in March 2024.

Technical Analysis

From a technical perspective, the Moving Average Convergence Divergence (MACD) on the On Balance Volume (OBV) chart shows a bullish signal. This indicates that the stock is in an accumulation stage, making it a good entry point for investors. The MACD is a widely used indicator that helps identify changes in the strength, momentum, and duration of a trend. The OBV is a measure of the flow of money into and out of a security. When the MACD on OBV is bullish, it suggests that the stock is likely to continue its upward trend.

Positive Reviews

The company has received very positive reviews on Google, indicating a high level of customer satisfaction. This is crucial for a healthcare service provider, as it directly impacts the reputation and trustworthiness of the company. Positive reviews can lead to increased business and a stronger brand image.

Valuation

According to Alpha Spread, the intrinsic value of Yatharth Hospital & Trauma Care Services Ltd under the Base Case scenario is ₹431.63. Compared to the current market price of ₹415.55, the stock is below its intrinsic value. However, this slight overvaluation does not detract from the company's overall attractiveness as an investment opportunity.

Analyst Price Targets

Analysts have set an average 1-year price target of ₹617.1 for Yatharth Hospital & Trauma Care Services Ltd, with a low forecast of ₹611.05 and a high forecast of ₹635.25. This indicates that analysts expect the stock to continue its upward trend in the coming year.

Conclusion

Yatharth Hospital & Trauma Care Services Ltd offers an attractive investment opportunity due to its consistent financial growth, bullish technical indicators, and positive customer reviews. While the stock value is at attractive, the company's strong fundamentals and positive outlook make it a promising investment for those looking to capitalize on the growing healthcare sector in India.

High Probability Swing Idea

=> Swing Idea: NSE: YATHARTH

=> Breakout Retest Trade.

=> Dry Volumes on Selling.

=> Coming to Demand Zone and Retest Zone.

=> High Probability Trade with Double Confluence of Price and Volume Action.

=> Change in Polarity could be Seen.

=> For Educational Purpose Only.

=> Trade at Your Own Risk.