YESBANK trade ideas

Yes Bank 10 RRR shortTrading Methodology:

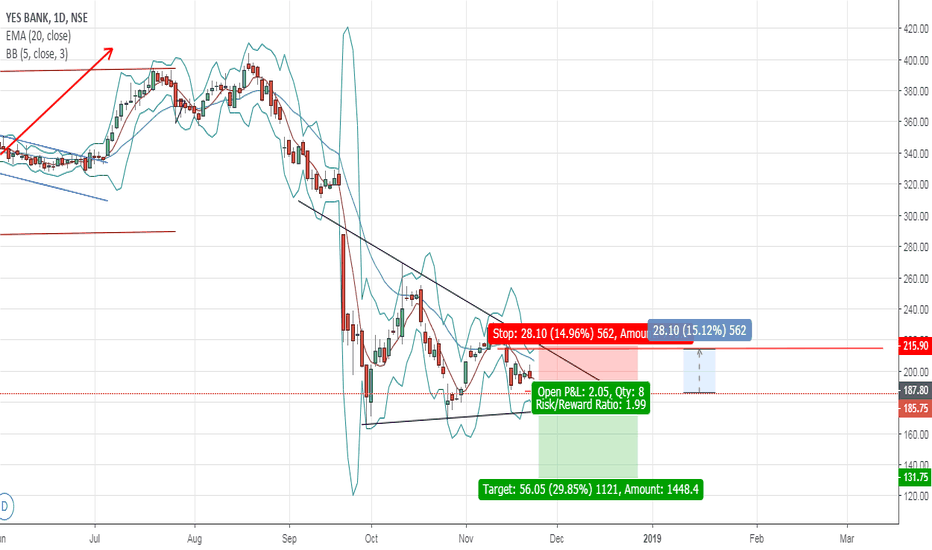

1. An asymmetric bullish/bearish pennant is drawn using ascending and descending curved trend lines with a minimum of three price action touche points per line. The direction is determined by the previous trend.

2. The angle tool is applied from the earliest two trend touch points, beginning at the earliest touch point.

3. A trend-based Fibonacci retracement triangle is drawn starting from the earliest trend touch point and ending at the earliest touch point of the opposite trend line .

4. Based on the degree, of the earlier defined angle, the appropriate (and secret) levels are selected for the fibonacci retracement ; two levels for stop-loss and two levels for take-profit. The closest stop-loss level to the current price level is the top priority stop-loss. Though the secondary stop-loss level is often chosen for some markets such as FX and some equities in order to account for seldom unexpected resistance breaks. The greater target level is the top priority, and where majority of the shares are sold, though some may choose to close part of the position at the first target level or set it to be the stop-loss once price exceeds it. Entries should be laddered in around the levels closest of the yellow line.

This trading strategy can be applied to any market and time frame, and positions most often garner the greatest risk-to-reward ratio with the highest success rate. What more can you ask for? I will only be posting my unique trading strategy until EOY. I work solely with price action to identify pennants and apply unique trend-based fibonacci retracement levels for SL and TP levels. Reach out to me if you have any questions.

Yesbank Broke Key SupportYesbank broke down below key band support.

1600 Crore INR working capital loan to DHFL is an Issue

3000 Crore Essal Group ( Zee Entertainment) for DISH TV share collateral is also a issue.

Looking to re-enter @ 165 level

Looking to short on close below 191

Strong performance by Axisbank and Icicibank also keeps good new money out of YESBANK.

Good luck!

YesBank: Short on Bounce !!Yesbank broke below its trendline support on monthly charts. Clearly Banknifty has made its life high for next 2-3 years. The 2008 bears are back.

Target : Accumulate Yes Bank around 120 in next 1 year !!

Expect 50 - 70 % cut from life highs in all major Nifty 50 stocks barring pharma which is already corrected.

YES BANK - Short term pull back possible Daily charts

cmp 169.80

Long advised above 172.

High probability of Short term pull back towards mean. (195-200 )

Logic -

Strong divergence seen in price Vs pivot based oscillators.

Price forming lower lows + pivot based oscillators forming higher lows with volume supporting.

DOES NOT SIGNIFY A PERMANENT REVERSAL. ONLY A SHORT TERM TRADING OPPORTUNITY.

Stop for this would be 160. Entry should be only above 172 for a target of 195-200.

(India) YES BANK - Long Term Buy (at Rs.185)Recommending YES BANK as a long term buy, at around 180-185 levels.

YES Bank is one of the TOP-5 private sector banks in India, along with others like ICICI Bank, HDFC Bank, KOTAK etc.

Its loan book, NPAs, OPM, PAT numbers etc. are in line with other top private banks (as it should be), but the recent sharp sell-off (due to CEO's resignation & slight IL&FS exposure), might have created a LT buying opportunity.

SCALE: Has a loan book of ~ Rs. 2.1 Lac Cr (deposits & advances each).

PROFITABILITY: Net Profit YE Mar 2018 = Rs. 42Bn (TTM upto Nov2018 ~ Rs. 45B)

MARKET CAP: Rs. 444Bn (@ CMP Rs. 192.5) ... as of Nov2018

P/E Ratio: 10x (444B / 45B) .... which is very low compared to 25-30x of other large Private Banks.

SELL-OFF: There was a sharp sell-off in YES BANK from Aug-Oct 2018, with shares dropping from 393 to 184 (-53%).

RBI asked YES BANK chairman to step down, due to some discrepancy in NPA reporting. Additionally, in the last earnings call they reported Rs.2600Cr exposure to IL&FS (which even if considered zero/written-off), is just 1% of the total deposits (Rs. 2.1LacCr). So, structurally I do not see these things impacting the long term profitability, AND/OR much of it is discounted in the 50% price drop (& valuation / PE contraction from 21x to 10x annual earnings).

So, recommending a buy around 180-185 level (vs. CMP 192). Doubling of the PPS from here (PE doubling 10x to 20x) would roughly put it in line with the remaining Private sector banks. Timeline - long term.

CAVEAT 1:

Technically, if it closes below 185 on a closing basis ... do average out. And, get back in if it recovers. OR,

Average-in more at the next support (around Rs. 132).

CAVEAT2:

Investing in INDIVIDUAL stocks is always tricky, because of the unknown future news, & can be highly VOLATILE.

So be prepared to average in more if a stock drops 50% from your initial purchase, and even more on further drop, etc, before giving up.

Otherwise, vs. individual stocks ... consider investing in the top ETFs (NIFTY 50, or NIFTY NEXT 50) for a well diversified approach to Long Term investing (for a steady growth with the GDP & economy).