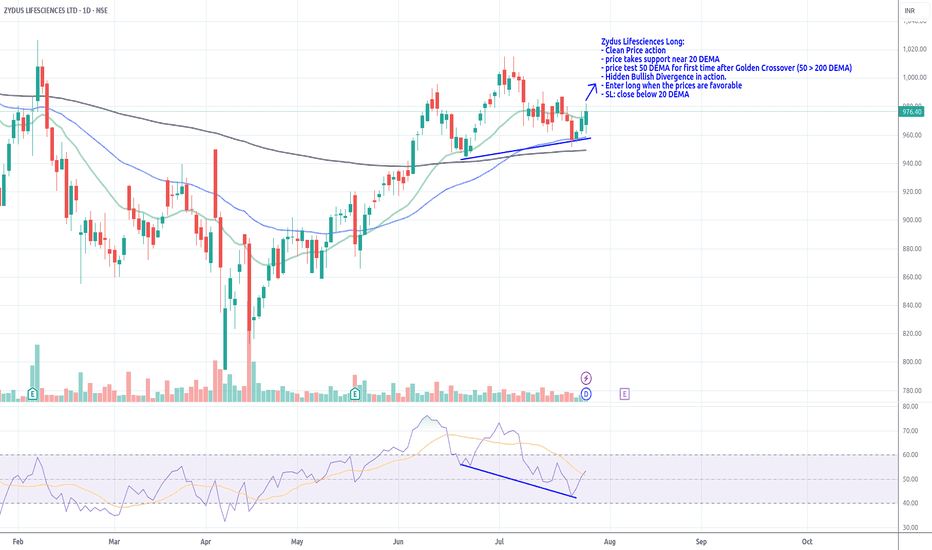

Zydus Lifesciences Long_Support @ 20 DEMAZydus Lifesciences Long:

- Clean Price action

- price takes support near 20 DEMA

- price test 50 DEMA for first time after Golden Crossover (50 > 200 DEMA)

- Hidden Bullish Divergence in action.

- Enter long when the prices are favorable

- SL: close below 20 DEMA

ZYDUSLIFE trade ideas

Zydus Lifesciences Long_Support at 20 Daily EMAZydus Lifesciences Long:

- Clean Price action

- price takes support near 20 DEMA

- price test 20 DEMA for first time after Golden Crossover (50 > 200 DEMA)

- Hidden Bullish Divergence in action.

- Enter long when the prices are favorable

- SL: close below 20 DEMA

ZYDUS LIFESCIENCES AT BEST SUPPORT !!This is the 4 hour Chart of ZYDUSLIFE.

Zydus Lifesciences at good support zone near ₹920–₹930 range.

Zyduslife is moving in a Higher High and Higher Low (HH-HL) formation.

Stock has formed a broadening pattern within the channel.

If this level is sustain, we may see higher prices in ZYDUSLIFE.

THANK YOU !!

ZYDUSLIFE Weekly UpdateZYDUSLIFE seems to be stable on the current 985-990 levels.

Things to watch carefully for Long trades.

Long Trade entry :

Entry Trigger : 1011

Stop Loss for target 1 : 977

First Target : 1044

Second target : 1068

Third target: 1130

Last target: 1211

Note: Consider each target for exit of the hold position and re- enter after 3%(Approx.) drop. this will maximize the re-entry position and the profits.

Exit for sure On last target as 2-3 Month or retracement would possibly come after this point.

Trade Updates would be shared on this on every Friday

Zydus Life Sciences Ltd view for Intraday 21st May #ZYDUSLIFE Zydus Life Sciences Ltd view for Intraday 21st May #ZYDUSLIFE

Resistance 900 Watching above 902 for upside momentum.

Support area 870 Below 890 ignoring upside momentum for intraday

Watching below 868 for downside movement...

Above 875 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Key Support / Resistance Breakout - Swing TradeDisclaimer: I am not a Sebi registered adviser.

This Idea is publish purely for educational purpose only before investing in any stocks please take advise from your financial adviser.

Key Support & Resistance Breakout. Stock has give Breakout of Resistance level. Keep in watch list. Buy above the high. Suitable for Swing Trade. Stop loss & Target Shown on Chart.

Be Discipline because discipline is the Key to Success in the STOCK Market.

Trade What you see not what you Think.

ZYDUS LIFE SWING BOThe stock showing a breakout with strong volumes.

For a successful breakout, we should ideally see a strong 1H candle on our chart—it’s crucial to use that timeframe.

Following the breakout, the ideal entry point would be after a consecutive candle that breaks above the breakout candle

As always, remember to do your own research before making any investment decisions!

ZYDUS LIFESCIENCE LTD swing tradeHello,

Trend-Based Analysis. Buy the Dips, Sell The Rallies, Also Following the Trend. Let's see where the Price Action takes us, Riding the wave. Potential trade setups based on trend momentum.

Technical analysis based on trend identification and momentum, Looking for high-probability setups within the prevailing trend.

Analyzing the current market trend and potential future price movement. Focusing on risk management and reward-to-risk ratios.

Details is Mentioned in Chart, Read carefully.. .

Zydus Lifesciences (NSE:ZYDUSLIFE)Overview: Zydus Lifesciences is currently at an interesting juncture, with signs of a potential reversal from recent lows. The price action suggests a possible recovery towards higher resistance levels, supported by technical indicators and market sentiment. Nomura's revised price target of ₹1,030, while maintaining a Neutral rating, aligns with this view.

Key Levels to Watch:

Current Price: ₹966.65

Immediate Support (SL): ₹902.55

Key Resistance Zones: ₹1,008.35, ₹1,041.45, and ₹1,102.15

Technical Analysis:

Volume Profile: The visible range volume profile shows significant accumulation near ₹1,000, which could act as a strong magnet for the price.

Moving Averages: The stock has started reclaiming its short-term moving averages. A breakout above the 200-day MA would confirm bullish momentum.

RSI (Relative Strength Index): The RSI is trending upwards, indicating improving bullish momentum. Divergence suggests a potential reversal.

Price Action: The formation of higher lows near ₹949 reinforces the possibility of a short-term recovery.

Trading Strategy:

Entry Zone: Between ₹950 and ₹970, as the stock shows stability near support levels.

Stop-Loss: Strict stop-loss at ₹902.55 to limit downside risk.

Targets:

Target 1: ₹1,008.35

Target 2: ₹1,041.45

Extended Target: ₹1,102.15

Risk Management:

Position size will depend on risk tolerance, ensuring a Risk-Reward ratio of at least 1:2.

Avoid chasing the price above ₹970 if momentum wanes.

Final Thoughts: Zydus Lifesciences presents a favorable risk-reward scenario with clear technical signals for a rebound. However, macroeconomic factors and sector performance will play a critical role in sustaining the move. Traders should monitor price action near the resistance zones closely for signs of continuation or rejection.

Zydus LifeSciences Ltd view for Intraday 14th Nov #ZYDUSLIFEZydus LifeSciences Ltd view for Intraday 14th Nov #ZYDUSLIFE

Resistance 970. Watching above 971 for upside movement...

Support area 950. Below 960 ignoring upside momentum for intraday

Support 950 Watching below 948 for downside movement...

Resistance area 970

Above 960-962 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Zudus lifeZudus Life

MTF Analysis

Zudus Life Yearly Demand Breakout 696

Zudus Life 6 Month Demand Breakout 696

Zudus Life Qtrly Demand Breakout 1027

Zudus Life Monthly Demand Breakout avg 972

Zudus Life Weekly BUFL 1000

Zudus Life 240 m dmip 984

ENTRY 984

SL 946

RISK 38

Target 1658

REWARD POINT 674

Last High 1321

RR 17.74

RR 68%

ZYDUX LIFESECIENCES LTD S/R for 10/9/24Support and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

20 EMA (Exponential Moving Average):

Above 20 EMA: If the stock price is above the 20 EMA, it suggests a potential uptrend or bullish momentum.

Below 20 EMA: If the stock price is below the 20 EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

RSI: RSI readings greater than the 70 level are overbought territory, and RSI readings lower than the 30 level are considered oversold territory.

Combining RSI with Support and Resistance:

Support Level: This is a price level where a stock tends to find buying interest, preventing it from falling further. If RSI is showing an oversold condition (below 30) and the price is near or at a strong support level, it could be a good buy signal.

Resistance Level: This is a price level where a stock tends to find selling interest, preventing it from rising further. If RSI is showing an overbought condition (above 70) and the price is near or at a strong resistance level, it could be a signal to sell or short the asset.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.