Crude oil---sell near 63.90, target 60.00-58.00Crude oil market analysis:

The recent crude oil has been delivered. The new contract is relatively strong at present. Yesterday's daily line closed with a positive line. In the short-term bottom shock, we are still bearish on crude oil today. We continue to sell. The large pattern suppresses around 65.30. The daily moving average suppresses around 65.700, which means that buying needs to break this position to reverse. Today's crude oil is suppressed at 63.90.

Operational suggestions:

Crude oil---sell near 63.90, target 60.00-58.00

CL1! trade ideas

Possible upward pullbackCrude oil is on a bearish trend based on higher timeframes but is currently showing bullish pressure as a potential pullback. The potential upward pullback may try to retest the 70.0 barrier. Breaking further and settling above the 70.0, may see a rise towards resistance barriers between 71.00 and 73.00 as potential bearish sell zones.

Crude oil---sell near 62.00, target 60.00-59.00Crude oil market analysis:

The crude oil pattern shows that it is starting to hover at the bottom. Continue to sell when it rebounds. If the 65.30 position is not broken, you can stick to the bearish idea. The recent tariffs and fundamentals of crude oil make it difficult to rise, and the previously announced inventory data has also increased a lot. Crude oil rebounds to 62.00 today and can be sold. If it breaks, the next selling position is around 63.80.

Fundamental analysis:

There are not many data this week, but there are still many fundamentals. Note that the market will rest on Friday this week, which is Good Friday.

Operation suggestions:

Crude oil---sell near 62.00, target 60.00-59.00

Crude oil---sell near 64.00, target 62.00-60.00Crude oil market analysis:

Crude oil has been falling recently. Under the pressure of tariffs, the decline of crude oil is very large. In addition, the previously released crude oil inventory data also shows its weakness. The weekly line closed with a cross star, and the lower shadow is very long. The possibility of a unilateral decline in crude oil this week is small, and the possibility of fluctuations is greater. The position of 65.30 is its suppression. Look for selling opportunities in the Asian session of 63.50-65.30 today. The other 58.00 of crude oil is support.

Operational suggestions:

Crude oil---sell near 64.00, target 62.00-60.00

Go Long: Crude Oil's Undervaluation Signals Potential Upside Nex- Key Insights: Crude Oil is facing bearish pressures, but inventory analysis

reveals significant undervaluation, with an implied fair value of $92.

Seasonal trends and insider confidence in energy stocks further support

potential upside. Watch for geopolitical developments and OPEC actions that

might influence price movement.

- Price Targets:

- T1: $63.50

- T2: $64.94

- S1: $60.50

- S2: $60.00

- Recent Performance: Crude Oil prices closed below key support levels after a

consistent downtrend due to geopolitical tensions and recession fears.

Speculative positions remain at historic lows, reflecting widespread market

pessimism despite valuations and long-term prospects in the energy sector.

- Expert Analysis: Analysts highlight undervaluation driven by commercial

inventory data. Electric vehicle adoption is steadily reducing oil demand,

yet insider buying in Canadian energy stocks reveals confidence in a

recovery. Geopolitical risks, including Iranian sanctions and SPR refill

speculation, might temporarily impact price volatility.

- News Impact: OPEC's surprise production hikes have balanced market pressures

between bullish and bearish forces. Uncertainty in energy policy and delayed

CapEx decisions could limit medium-term production. Canadian elections could

further drive sentiment if pro-oil policies emerge post-election.

COT report showing big players buying oil for the coming weekafter reading the COT report/ and oil hitting heavy lows from last week.

COT report is showing big institutional players are buying oil for the coming week.

as we can see, buyers have already entered the market. we may get a pullback down to

57.0000 area before a push up, looking to take profit around 67 /68.00000 4 hour support

areas.

Crude oil------sell near 63.00, target 60.00-57.00Crude oil market analysis:

The recent daily crude oil line is still not very strong. There was a rebound, but it was just a rebound. Gold rose strongly, but crude oil did not rise strongly. Yesterday's crude oil also ran down slightly. Today's crude oil is still around 63.00 and 65.00, which are opportunities to consider selling. If it continues to decline and stabilizes around 57.00, buy it back. Crude oil does not reflect the fundamentals so strongly.

Fundamental analysis:

The CPI announced yesterday did not have a big impact on the market, but the data difference was still relatively large, and the result was -0.1%. The bulls only rose slightly. The bottoming out and rebound of the US stock market was mainly due to Trump's withdrawal of some tariff policies.

Operational suggestions

Crude oil------sell near 63.00, target 60.00-57.00

Crude oil-----Buy near 65.00, target 62.30-60.00Crude oil market analysis:

Recently, crude oil has also fluctuated greatly due to the influence of fundamentals. It started to rise rapidly yesterday, and the daily line closed with a standard big hammer candle pattern. Today, we rely on the 65.20 position to buy. We can also consider buying when it falls back to a small support. Today's crude oil trend is bearish, and short-term buying and selling are both possible. The current fundamentals have basically not changed the selling of crude oil. In addition, there will be EIA crude oil inventory data tonight. Today's crude oil is expected to fluctuate greatly. Consider selling it when it rebounds to 65.00 in the Asian session.

Fundamental analysis:

Tariffs are the biggest fundamentals in the near future, and the market impact is relatively large. Today we focus on CPI data and crude oil inventory data.

Operation suggestions:

Crude oil-----Buy near 65.00, target 62.30-60.00

Crude oil-----sell near 61.00, target 69.00-67.00Crude oil market analysis:

Tariffs have been increased again, and crude oil continues to fall sharply. It is difficult to change the short-term selling of crude oil. In addition, data and fundamentals all suppress it. Today's crude oil can continue to find selling opportunities. The crude oil pattern shows that the possibility of a big rebound is small. We pay attention to the suppression position of its moving average, which has dropped to around 61.80. This position is also the high point of yesterday's rebound. Today's idea will rely on this position to sell it. The first suppression of crude oil is around 59.30, and the strong pressure is 61.80.

Fundamental analysis:

The tariff war continues to affect the market, and buying and selling have begun a big game. We will pay attention to CPI later, and there will be crude oil inventory data today.

Operation suggestions:

Crude oil-----sell near 61.00, target 69.00-67.00

crude oilPreferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a comment or a personal message..

Enjoy Trading... ;)

Oil Futures Moving into Bear Market?Oil futures recently broke down from a long-term wedge, following a failed breakout at the start of the year, and a recent death cross of its 50/200 weekly EMAs and MAs.

It looks to flip long-term bearish here unless we see a rapid recovery of the wedge, the EMAS/MAs and a subsequent breakout.

It could lose half its value or even 2/3rds if it hits TP 1 and then TP 2 over the next weeks and months to come.

Crude oil-----sell near 63.70, target 62.00-60.00Crude oil market analysis:

We continue to be bearish on crude oil today, and continue to sell on rebounds. The position of 63.80, which was pulled up last night, is today's major suppression position. This position is a selling opportunity. Crude oil has not broken the previous low point, but it will have a big bottom shock and a big repair after the data is over. Today's crude oil will wait for the opportunity to sell. In addition, the recent data on crude oil also suppresses it. Crude oil has not effectively stood on the major pressure before, and the short-term rebound is just a rebound. The weekly trend is still bearish.

Fundamental analysis:

The US tariffs on the world are still brewing, which has also led to a sharp drop in global stock markets, and the market is not optimistic about expectations. Later this week, we will focus on the heavyweight CPI data.

Operation suggestions:

Crude oil-----sell near 63.70, target 62.00-60.00

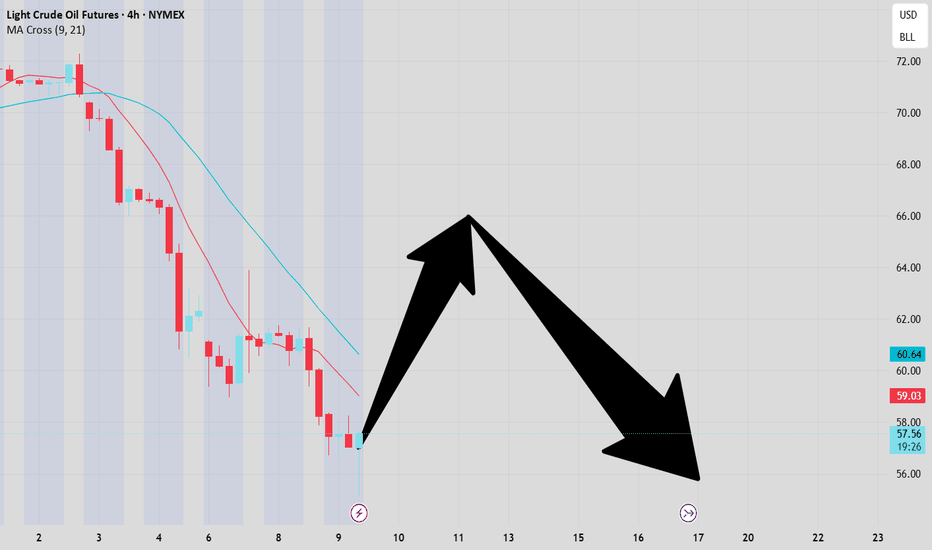

Light Crude Oil (CL) is Targeting Further Declines in the Near TLight Crude Oil (CL) has exhibited a downward trajectory since reaching its high on January 16, 2025, with indications suggesting further declines ahead. The descent follows an incomplete bearish pattern, structured as a double three Elliott Wave formation. The initial decline, termed wave W, concluded at 65.22, followed by a recovery to 72.23, designated as wave X. The price has since resumed its downward movement in wave Y, characterized by a zigzag pattern.

From the wave X peak of 72.23, the price fell to 69.27, marking the end of wave (i), then rose to 70.15 in wave (ii). The decline continued in wave (iii) to 60.45, followed by a recovery in wave (iv) to 63.20. The final segment, wave (v), concluded at 58.95, completing wave ((a)). A subsequent rise in wave ((b)) reached 63.90, after which the price resumed its descent in wave ((c)). For this downward trend to solidify, the price must fall below the 58.95 level established by wave ((a)). Otherwise, a potential stabilization or reversal remains possible.

In the near term, as long as the 72.23 high remains intact, any upward movements are expected to lose momentum—potentially after 3, 7, or 11 incremental rises—leading to further declines.

Crude Oil: Volatility and Key Levels in FocusThe Crude Oil (CL1!) chart shows a recent phase of high volatility, with a sharp decline followed by a recovery attempt. After reaching the recent high around 80.77, the price underwent a significant correction, returning to the key support zone between 60.97 and 62.43. This price range represents an important accumulation level, previously tested multiple times in recent months and defended by buyers.

From a technical perspective, the area between 65.27 and 69.00 represents a dynamic resistance zone, whose breakout could pave the way for a recovery towards the critical 73.00 area. However, the recent bearish impulse has pressured lower levels, and a weekly close below 60.97 could indicate a structural trend change, with potential bearish targets around 57.00.

The RSI is currently in an oversold zone, suggesting a potential consolidation phase or a technical rebound attempt. However, selling pressure remains high, and sentiment is negative, partly driven by global economic uncertainties and concerns about oil demand.

From an operational perspective, a move back above 65.27 could indicate a recovery phase, with targets at 69.00 and subsequently 73.00. Conversely, a break below 60.97 would open negative scenarios with a possible extension towards the lower support at 57.00. Investors remain focused on macroeconomic data and OPEC+ decisions, as potential production cuts could trigger a new rally, while an unfavorable macro environment could increase selling pressure.

Crude oil------sell near 62.20, target 60.00-58.00Crude oil market analysis:

Trump's tariff policy has greatly stimulated crude oil, causing it to plunge all the way. At present, it has fallen to the bottom of the previous plunge again. We estimate that there will be a small counterattack at this position. The rebound is our opportunity to sell again. The idea of crude oil follows the general direction. Pay attention to the suppression near 62.20. The daily line shape shows that it will go down.

Operational suggestions

Crude oil------sell near 62.20, target 60.00-58.00

Consider Long Positions as Crude Oil Tests Lows

-Key Insights: As crude oil tests key support levels around $62, considering

long positions with caution could be advantageous. Understanding OPEC's

increased production impact and broader market sentiment will guide strategic

decision-making. Despite bearish pressures, potential for recovery exists as the

market may stabilize and seek reversals.

-Price Targets: Next week targets: T1 = $65, T2 = $68. Stop levels: S1 = $57, S2

= $52. The target levels and stops are framed to leverage potential bounce from

current lows, allowing room for modest recovery amidst volatility.

-Recent Performance: Crude oil prices experienced a sharp decline from the low

70s to the low 60s, touching $62 for the first time since April 2021. This

decline aligns with general commodity trends reflecting recession fears, with

oil down by approximately 10.6%.

-Expert Analysis: Mixed opinions reign over crude oil's trajectory. Analysts

point to inflation and constraints hinting at long-term bullish potential, while

OPEC's supply increase suggests ongoing downward pressure. Caution is advised as

the market's technical trajectory could shift with emerging conditions.

-News Impact: OPEC's decision to boost production influences current market

sentiment, exacerbating crude oil's selling pressure amid global economic

uncertainties. Bond markets have seen increased interest due to stability

concerns, further affecting commodity price movements including crude oil.

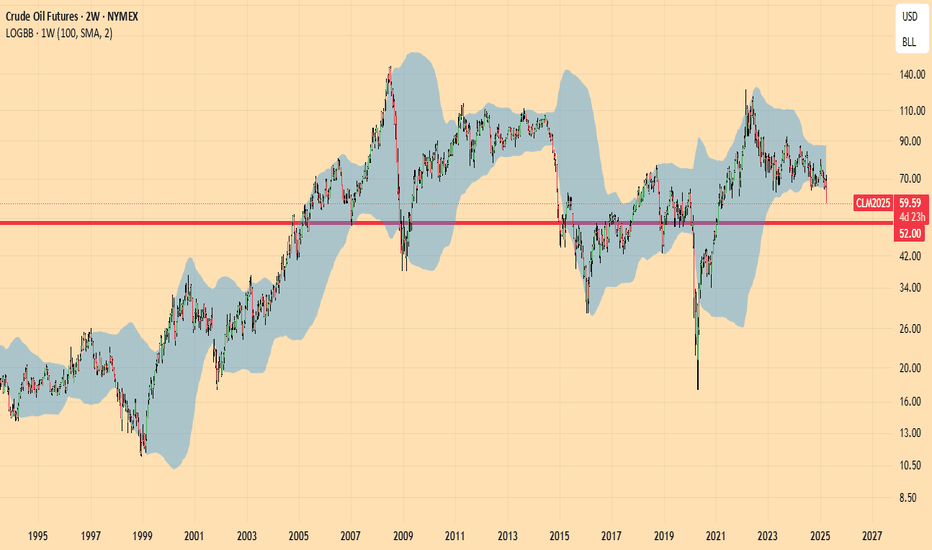

OIL GLUTSTRONG SELL until November 2025

First Target : $52

Second Target : $43

Under the screening of 100 Weeks Bollinger Bands, Oil is in the same situation as in 1986, 1993, 1998, 2014 and 2020

Since there is talk of a glut " Strong production growth expected to increase global oil glut in 2025, 2026" Bloomberg 11/02/2025, the target could be as low as $32 (High 2022 =130 * GannRatio 0.25)

However there will be a heavy test at around $52-55, a support line uniting several key points since 12/2006. Eventually, greater volatility alone would make $43 possible. (130*GannRatio 0.33).

It is noticeable that in all instances exepted 2014, a very sizable rebound was observed from 6 months after the plunge, so that we would be strongly short right now and contemplate to buy from September 2025

We cannot speculate as to whether there will be 2 plunges (2014) or 1 straight plunge (all other instances excepted 1998) or a prolonged plunge (1993). This is why the test in the $50 is crucial. The article suggests for 2025-26, more in line with 1993 and 2014. Therefore we believe that $43 will be reached.