CL1! trade ideas

Crude Oil: Volatility and Key Levels in FocusThe Crude Oil (CL1!) chart shows a recent phase of high volatility, with a sharp decline followed by a recovery attempt. After reaching the recent high around 80.77, the price underwent a significant correction, returning to the key support zone between 60.97 and 62.43. This price range represents an important accumulation level, previously tested multiple times in recent months and defended by buyers.

From a technical perspective, the area between 65.27 and 69.00 represents a dynamic resistance zone, whose breakout could pave the way for a recovery towards the critical 73.00 area. However, the recent bearish impulse has pressured lower levels, and a weekly close below 60.97 could indicate a structural trend change, with potential bearish targets around 57.00.

The RSI is currently in an oversold zone, suggesting a potential consolidation phase or a technical rebound attempt. However, selling pressure remains high, and sentiment is negative, partly driven by global economic uncertainties and concerns about oil demand.

From an operational perspective, a move back above 65.27 could indicate a recovery phase, with targets at 69.00 and subsequently 73.00. Conversely, a break below 60.97 would open negative scenarios with a possible extension towards the lower support at 57.00. Investors remain focused on macroeconomic data and OPEC+ decisions, as potential production cuts could trigger a new rally, while an unfavorable macro environment could increase selling pressure.

Crude oil------sell near 62.20, target 60.00-58.00Crude oil market analysis:

Trump's tariff policy has greatly stimulated crude oil, causing it to plunge all the way. At present, it has fallen to the bottom of the previous plunge again. We estimate that there will be a small counterattack at this position. The rebound is our opportunity to sell again. The idea of crude oil follows the general direction. Pay attention to the suppression near 62.20. The daily line shape shows that it will go down.

Operational suggestions

Crude oil------sell near 62.20, target 60.00-58.00

Consider Long Positions as Crude Oil Tests Lows

-Key Insights: As crude oil tests key support levels around $62, considering

long positions with caution could be advantageous. Understanding OPEC's

increased production impact and broader market sentiment will guide strategic

decision-making. Despite bearish pressures, potential for recovery exists as the

market may stabilize and seek reversals.

-Price Targets: Next week targets: T1 = $65, T2 = $68. Stop levels: S1 = $57, S2

= $52. The target levels and stops are framed to leverage potential bounce from

current lows, allowing room for modest recovery amidst volatility.

-Recent Performance: Crude oil prices experienced a sharp decline from the low

70s to the low 60s, touching $62 for the first time since April 2021. This

decline aligns with general commodity trends reflecting recession fears, with

oil down by approximately 10.6%.

-Expert Analysis: Mixed opinions reign over crude oil's trajectory. Analysts

point to inflation and constraints hinting at long-term bullish potential, while

OPEC's supply increase suggests ongoing downward pressure. Caution is advised as

the market's technical trajectory could shift with emerging conditions.

-News Impact: OPEC's decision to boost production influences current market

sentiment, exacerbating crude oil's selling pressure amid global economic

uncertainties. Bond markets have seen increased interest due to stability

concerns, further affecting commodity price movements including crude oil.

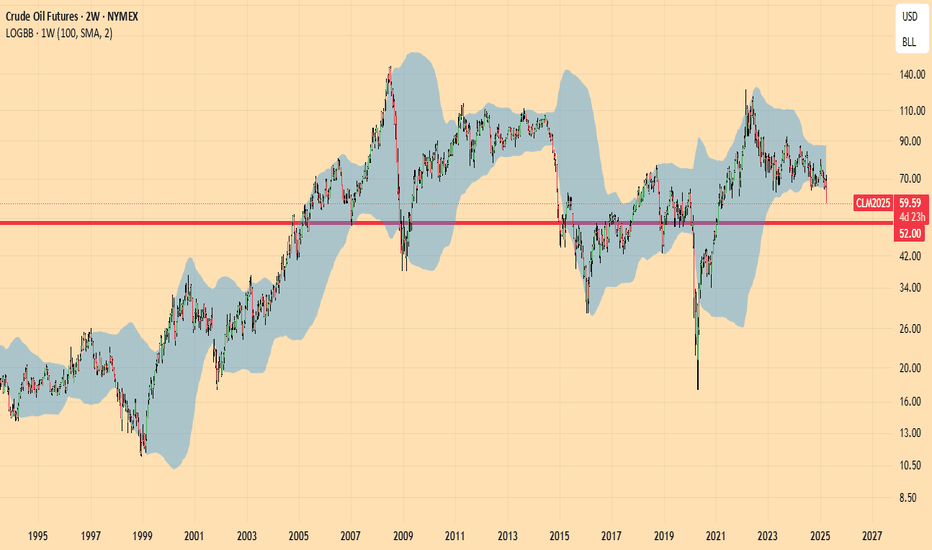

OIL GLUTSTRONG SELL until November 2025

First Target : $52

Second Target : $43

Under the screening of 100 Weeks Bollinger Bands, Oil is in the same situation as in 1986, 1993, 1998, 2014 and 2020

Since there is talk of a glut " Strong production growth expected to increase global oil glut in 2025, 2026" Bloomberg 11/02/2025, the target could be as low as $32 (High 2022 =130 * GannRatio 0.25)

However there will be a heavy test at around $52-55, a support line uniting several key points since 12/2006. Eventually, greater volatility alone would make $43 possible. (130*GannRatio 0.33).

It is noticeable that in all instances exepted 2014, a very sizable rebound was observed from 6 months after the plunge, so that we would be strongly short right now and contemplate to buy from September 2025

We cannot speculate as to whether there will be 2 plunges (2014) or 1 straight plunge (all other instances excepted 1998) or a prolonged plunge (1993). This is why the test in the $50 is crucial. The article suggests for 2025-26, more in line with 1993 and 2014. Therefore we believe that $43 will be reached.

#202514 - priceactiontds - weekly update - wti crude oil futures

Good Evening and I hope you are well.

#mcl1 - wti crude oil futures

comment: Strong momentum for the bears but I have zero interest in selling where all bears for the past 2 years lost money. Not much more to say about this. Wait for strong buying and join but market will likely do some more testing of 60 first and then sideways before we can go higher. Anything above 63 is a bull surprise and could lead to a squeeze.

current market cycle: trading range on the monthly chart

key levels: 59 - 63

bull case: Bulls are at prior big support but right now we are still in the spike down phase. Market likely needs some time sideways before we can try a bounce. Bulls would do good if they stay above the 2023-12 low and keep it a higher low. Targets for bulls are the bull trend line break retest around 63.7 and the next breakout retest 2025-03 low at 65.

Invalidation is below 59.

bear case: Bears had the news crash down and now what? Are they strong enough to make lower lows below 60? I highly doubt it until it happens. Only pattern is an ugly expanding triangle and we are at the very bottom of it. Bears don’t have much reasons to sell down here but technicals only go so far for commodities. I will sit on hands for this.

Invalidation is above 63.

short term: Neutral for now but I will never sell down here since we have not traded this low for 2 years and every time we went below 65 bears lost.

medium-long term - Update from 2025-02-23: Down at support again around 60. Market has not traded below 59 since 2023 and until it happens it’s a bad trade betting on it. It’s a multi-year trading range and below 64 bulls made money, not bears.

current swing trade: None

chart update: Highlighted broken shallow bull trend line and just removed things

Crude bearish after minor retracementCrude has fallen over 14% in the last two trading days; can it go another 5-10% down from here? Many analysts seem to think so. However, a retracement cannot be ruled out as well. It needs to be seen will there be a minor retracement before the next leg of bearishness or direct fall.

CRUDE - WEEKLY SUMMARY 31.3–4.4 / FORECAST🛢 CRUDE – 18th week of the base cycle (28 weeks). We are in the 2nd phase, clearly bearish. On March 23 I wrote:

"The current base cycle cannot yet be called bearish as it hasn’t broken the starting point. The next key extreme forecasts for crude are March 27 and 31."

👉 Now this base cycle can be considered bearish. Even though the short position from March 27 was stopped out with a planned loss, the extreme forecast of March 31 provided an opportunity to open a new short position. This is a rare case of two closely spaced extreme forecasts triggering back-to-back. These forecasts were issued specifically for crude at the beginning of the year as a window from March 28–31.

⚠️ It looks like my bearish forecast is being confirmed, as outlined in the summer 2024 crude post. The Jupiter–Uranus conjunction is working precisely. All of this resembles the 2010–2014 setup. The previous 4-year crude cycle began in spring 2020 and went sideways from fall 2022. It seems a new 4-year cycle has already started, and its beginning is very weak — much like fall 2012. There’s a high probability this will be a bearish 4-year cycle ending closer to 2028. The next universal extreme forecast is on April 7. The next crude-specific extreme forecast is on May 5.

Oil Futures short: Breakdown of descending triangleThis is the breakdown that I had discussed in my earlier idea on the same product. I had used futures this time because this is the product that most professional traders used for trading oil (and really because it's what my friend uses).

The stop is set slightly above the breakdown price.

The take profit is set at 1-1 target from the most recent peak to the breakdown.

What next for WTI ?Although we had a strong up move in oil last week we remain well within last years range. we still a need above $76.50 area to pose a threat on higher prices towards $85/90, otherwise we sink back into the range of the last 14 months, similarly a close below $63.75 will see the deeper move lower.

Crude Oil Broke Strucutre to the DOWN Side!here we have a pretty simple trade, price action on the daily has finally broke structure to the downside.. this week i'll be looking for sells, you can either enter on the open or look for imbalance GAPS for a slightly better entry on any PULL backs... i'll be adding additional entries as we break the next structure... the structures i have drawn up with the blue dotted lines are areas to target and also wait for the break down of that support area!!!!

conclusion - simple trade keep it simple and don't over risk and over trade!

Tactical Setups & Opportunistic Fades

Asset Focus: Crude Oil (WTI)

Setup Type: Bull Trap Reversal with Structural Decompression – Tactical Short Bias

⸻

Setup Overview:

Crude Oil has transitioned from an emotionally driven rally into a reactive phase of structural decompression. The advance was underwritten by geopolitical risk and inflation narratives, but failed to sustain as macro catalysts reversed. The recent U.S. tariff announcement and OPEC+’s unexpected supply adjustment have directly challenged the bullish framework, forcing a revaluation of near-term demand and policy trajectory.

The result: a rejection event that is less about price and more about positioning. The crowd narrative cracked — and the structure followed. What unfolds now is not collapse, but reset.

⸻

COT & Sentiment Snapshot:

• Leveraged funds expanded long exposure aggressively into strength — classic trend-chasing.

• Recent positioning data shows contraction in net longs, signaling early-phase exit behavior.

• Open interest has dropped in parallel with price — a sign of liquidation, not new conviction.

• Commercial activity likely neutral-to-hedging, providing natural resistance into strength.

• Sentiment rotated quickly — from supply fears to demand caution — validating the trap thesis.

⸻

Market Structure & Technical Breakdown:

• Structure confirms a failed continuation — rejection at a known inflection zone undercuts trend integrity.

• Rally occurred without foundational support — gaps beneath price reflect structural imbalance.

• Price has rotated back through key pivots, invalidating prior momentum.

• Thin, untested zones now offer a path of least resistance if pressure continues.

• Current structure suggests rotational or decompressing behavior rather than directional clarity.

⸻

Behavioral Finance Layer:

“When the justification for a trade becomes a headline, the trade is already crowded.”

• Market participants had fully embraced oil as a geopolitical and inflation hedge — a one-dimensional thesis.

• The introduction of U.S. tariffs and the OPEC+ supply shift challenged that belief in real time.

• The rejection was not just technical — it was narrative failure.

• Emotional capital is now unwinding. The next phase will not be fast — it will be unsure.

⸻

Reflexivity Risk Model:

• Phase 1: Risk-driven narratives drive flow into the asset (conflict, inflation, supply tightness).

• Phase 2: Price rise validates the narrative — conviction deepens, flows accelerate.

• Phase 3: Macro catalysts shift (tariffs, supply bump), undermining belief system.

• Phase 4: Narrative fails — positioning begins to unwind, structure decompresses under pressure.

⸻

Strategic Stance:

Hold a tactical short bias grounded in structural rejection and narrative breakdown. No immediate directional call is required — the edge is in recognizing the psychological unwind already underway. Until a new belief structure emerges, the path forward remains governed by residual flow and fading conviction.

Crude oil-----buy near 68.90, target 69.90-72.00Crude oil market analysis:

Yesterday's crude oil daily line showed continuous tombstones, which was suppressed near 72.00. Today's idea is to continue to look at the rebound in the short term and pay attention to the support near 68.70. This position is a buy rebound. We will wait for opportunities in the Asian session. Crude oil has begun to move on a weekly trend. We need to pay attention to this week's closing to determine whether it will start a weekly trend in the future.

Fundamental analysis:

Trump's midnight tariffs caused the market to tremble again. In addition, ADP rose sharply, with a result of 155,000 people, 80,000 people in advance, and 115,000 people expected. The bulls still pulled up under such a big negative situation.

Operation suggestions:

Crude oil-----buy near 68.90, target 69.90-72.00

Crude oil---Buy near 70.60, target 71.90-76.00Crude oil market analysis:

Today's crude oil is still bought at a low price, and short-term bulls have started. Yesterday, gold fell in the US market, but did not fall in the Asian market, but repaired at a high level. The strong support of the daily line has reached 70.00, and the small support is 70.50. Today's idea is to find buying opportunities above 71.50. The daily moving average of crude oil is lined up, and there is still a lot of room for growth.

Fundamental analysis:

This week is a data week. Today, pay attention to the ADP employment data, which is the pre-agricultural data.

Operation suggestions:

Crude oil---Buy near 70.60, target 71.90-76.00