NATGAS Set To Fall! SELL!

My dear friends,

NATGAS looks like it will make a good move, and here are the details:

The market is trading on 2.964 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 2.929

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

HH1! trade ideas

NG1!: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse NG1! together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 2.951 will confirm the new direction upwards with the target being the next key level of 3.042 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

NATGAS: Expecting Bearish Continuation! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current NATGAS chart which, if analyzed properly, clearly points in the downward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NG1! BUYERS WILL DOMINATE THE MARKET|LONG

NG1! SIGNAL

Trade Direction: long

Entry Level: 3.247

Target Level: 3.717

Stop Loss: 2.932

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NG1!: Next Move Is Down! Short!

My dear friends,

Today we will analyse NG1! together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3.241 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

NATGAS Swing Long! Buy!

Hello,Traders!

NATGAS went down after

The support cluster breakout

Just as we predicted in my previous

Analysis but price will soon hit a

Horizontal support level of 3.00$

From where we will be expecting

A local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS SUPPORT AHEAD|LONG|

✅NATGAS is set to retest a

Strong support level below around 3.00$

After trading in a local downtrend from some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above 3.40$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Will there be a 50 percent increase in the price of natural gas?Will there be a 50 percent increase in the price of natural gas?

The imposition of tariffs also has an effect on the price of natural gas, which has fallen dramatically since Trump announced his policy of reciprocal tariffs and the trade war has intensified.

In general, there have been significant declines in natural gas futures, with a drop of about 10 percent in value.

The magnitude of this drop is due to fears that the ongoing global trade war could lead to a reduction in industrial activity and gas demand.

The Trump administration has created many waves of concern and economic instability around the world. The trade tariffs imposed by the president have affected not only finished goods, but also the raw materials used to create them. With the addition of Chinese taxes on U.S. products, the situation has become even more uncertain, with the risk of a global recession increasingly imminent.

The trade war has had a significant impact on the global economy, with increased tariffs leading to higher prices for goods. This in turn has reduced demand and produced a decrease in industrial production and overall growth. Experts also predict a possible reduction in production in energy-intensive sectors, as market uncertainties may lead to lower energy needs in the future.

There are several factors that could affect gas supply and related prices in the coming years. One of these is the increase in oil production starting in May. In addition, changes to storage targets in Europe are expected, which could further increase gas supply. At the same time, more liquefied natural gas shipments to Europe are expected due to lower demand from China. All this could keep gas prices low in both Europe and the United States.

Since the announcement of the duties, many companies have already begun publicly discussing possible shutdowns and production reductions. With the ongoing trade war, these decisions could become a reality.

But it could also be good news for prices. As we all know, the tariff war is likely to end soon. This means that with the closure of the fields-which take at least 3 years to reopen-we could see limited gas supply during the summer, when peak demand is expected and unusual heat is expected, this will be very good for natural gas prices.

From a technical point of view, this asset is one of the few to keep prices above the 200-period moving average. In addition, the rises of the past few months are supported by above-average volumes.

Natural gas supply is currently below average, which is a positive sign for strengthening prices. In such an unstable market, I have decided to invest in natural gas and expect prices to reach $5 in the summer, with a possible 50% growth.

It is important to emphasize the gas futures curve, which is currently backwardation in the long run. When there is strong demand, markets tend to reduce contango and even invert the curve to backwardation. The backwardation curve can be theoretically unlimited, that is, the price differential between near and far maturities can continue to grow indefinitely.

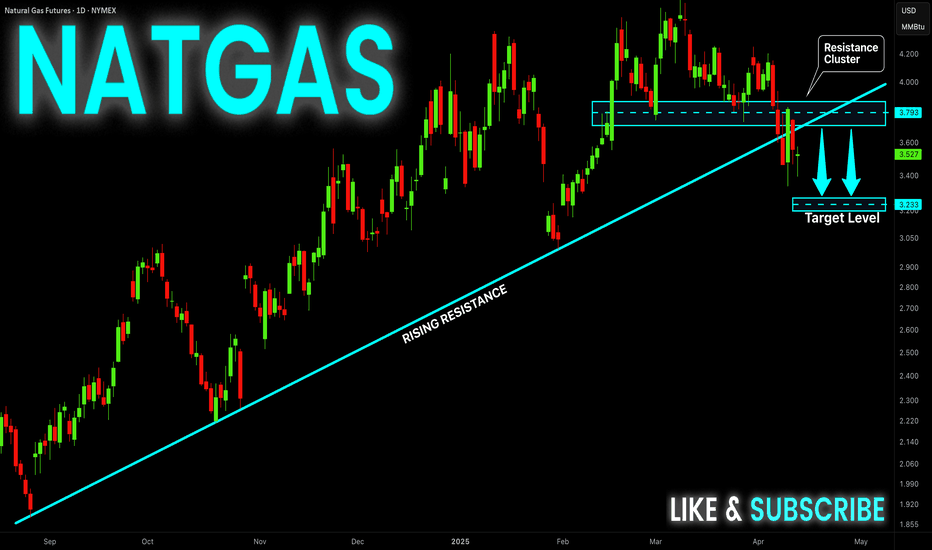

NATGAS Resistance Cluster Above! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the support

Cluster of the rising and

Horizontal support levels

Which is now a resistance

Cluster round 3.717$ then

Went down and made a local

Pullback on Thursday and

Friday but we are bearish

Biased mid-term so we

Will be expecting a further

Bearish move down this week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS: Long Trade Explained

NATGAS

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long NATGAS

Entry - 3.541

Sl - 3.371

Tp - 3.841

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS Expected Growth! BUY!

My dear followers,

This is my opinion on the NATGAS next move:

The asset is approaching an important pivot point 3.541

Bias - Bullish

Safe Stop Loss - 3.373

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 3.834

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NG1!: Will Go Down! Short!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.540 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 3.507..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

Smart Money Trapping RetailThis is a great example of why you trade with the trend and stay away from counter trend moves. I’ve kept the chart basic with only a 50 ema that is pegged to the one hour candle as that is a good short term trend indicator. My question is this. Did smart money pile into this trade to drive the price up to the 50 ema to trap all the retail traders only to create the liquidity they needed to put on large positions and trap retail which is then forced to sell out of their losing positions? I have no idea but this seems to be a repeatable pattern.

NATGAS Local Bearish Pullback Expected! Sell!

Hello,Traders!

NATGAS is about to hit

A strong horizontal resistance

Level of 3.880$ after a sharp

Push upwards by the bulls

So a local correction is needed

From the resistance with the

Expected target being the

Local level below at 3.655$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Bearish Breakout! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the key horizontal

Resistance of 3.626$ and the

Breakout is confirmed so we

Are bearish biased and we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS BEARISH BREAKOUT|SHORT|

✅NATGAS formed a head

And shoulders pattern then

Made a bearish breakout of

The neckline which is now

A resistance of 3.850$

And the breakout is confirmed

So we are bearish biased and

We will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.