DIESEL OIL GOES 'STILL-RUNNING', AND IT IS NOT A MEME AGAINDiesel Oil NY Harbor ULSD December 2025 futures contracts are trading around $2.25/gallon, once again above its 52-week average, with recent technical ratings indicating a strong buy.

The market has shown a 4.50% rise in the past 5-Day time span, reflecting bullish momentum.

Fundamental Perspective

Supply: Distillate inventories are 20% below the five-year seasonal average, the lowest since 2022. Refinery utilization is high at 94.7%, leaving little buffer for disruptions.

Demand: Distillate consumption has risen to 3.794 million barrels per day, up 260,000 b/d year-over-year, driven by robust industrial activity and summer travel.

Geopolitics: A U.S.-brokered ceasefire in the Middle East has reduced immediate supply risks, but the situation remains fragile and could quickly change.

Macroeconomic Risks: While fundamentals are bullish, potential U.S. recession risks and data reporting delays add uncertainty. Monitoring GDP growth and manufacturing PMIs is crucial.

Summary

ULSD futures are technically strong and fundamentally supported by tight inventories and robust demand, but traders should remain vigilant for macroeconomic and geopolitical shifts.

--

Best wishes,

@PandorraResearch Team 😎

MBEJ2027 trade ideas

Daily HO analysisDaily HO analysis

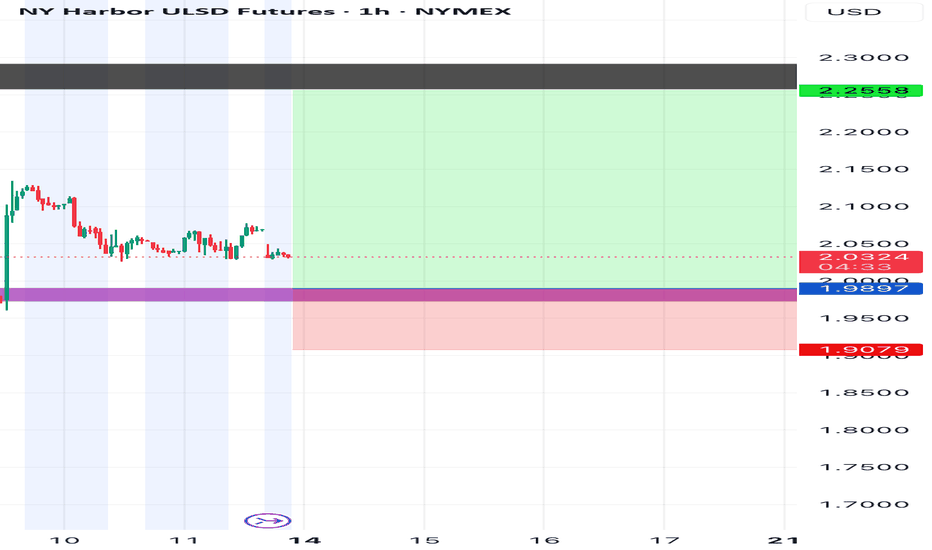

A long position with the target and stop loss as shown in the chart

The trend is up, we may see more upside

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from the strongest areas of entry, special recommendations, with a success rate of 95%, for any inquiry or request for analysis, contact me

HO Time CycleThere’s a 518 day time cycle from the 2 previous major lows to today. There’s also a falling broadening wedge breakout, DMI cross (not shown), and escalating regional conflict in the Middle East. Iran has launched ballistic missiles at Israel. There is a major downtrend but it’s far enough overhead that there’s headroom for upside. The trend seems vulnerable to failure, all things considered. This analysis establishes a bullish daily bias. Intraday long setups may be necessary for a good entry.

Daily HO analysisDaily HO analysis

Sell trade with target and stop loss as shown in the chart

The trend is down and we may see more drop in the coming period in the medium term

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from the strongest areas of entry, special recommendations, with a success rate of 95%, for any inquiry or request for analysis, contact me

Cyclical Analysis - Heating OilIf you follow my channel, you know that I am long Heating Oil, and am looking for more entries long, based on my COT strategy setup.

Today, we look at Heating Oil through the lens of cycles. Do cycles support the COT Buy Setup?

As you will see, there is some compelling cyclical data that is supportive of the idea for Oil to rise to October 10-20, and then decline before putting in a major cyclical low in December.

8/2/24 - VROCKSTAR portfolio snapshot bc mkt is cray craydon't really anticipate doing these so often really.

but so much has happened and i've been maxing out GDLC (as many of you know, then sizing it down), in and out of weird EPS stuff, semi's weren't really even in my portfolio prior, now they are. god knows what happens next. I like a cash buffer, but equally i had gotten pretty cash heavy the last week/s-ish as you know, so i've been deploying hard.

OTC:GDLC - 30%. Still trades at a massive discount. Would size the hell out of it if I didn't think BTC and really general risk didn't look so trashy. Also I like the discounts I'm getting on trad mkts.

NASDAQ:META - 10%. The best beta for mega cap. Great results. Great cash gen. Will obviously "follow the market" but it's the first bid among the mag7 IMO into YE and will be a big outperformer. I'm a big buyer of dips here all else equal. Have a closer look if you haven't already and read my note.

NASDAQ:DLO - 5%. Speculative. I know the company well. Super shorted. LT compounder. But this coming Q could be the kitchen sink. So even 5% is large. But it's trading at lows and positioning is off. NASDAQ:MELI 's solid results help give me confidence and Chinese keep moving hard in LatAm.

NYSE:TSM - 5%. Staple semi. Best risk/reward for volatility. No competition. Sub 20x PE for 20-30% CAGR for as long as eye can see. Eventually this re-rates.

NASDAQ:LULU - 3%. 17x PE still not cheap, but I think it's the marginal winner in a tough discretionary space for apparel. Even those who can't afford it are still buying. Some operational challenges, but have a long roadway ahead. Go read my comments for more deets.

NASDAQ:NXT - 3%. Great results. Bad mkt timing all else equal. I think this gets held hostage for a few weeks, but the risk reward in a YE context is great and 'tis a multi-year compounder. Sizing this thing is key. You've seen my notes. I trade around. But at low $40s you're getting great value.

NASDAQ:CELH - 3%. Expensive, but grows like a weed. Fastest growing beverage brand, a lot to go. Think it gets bid among staples before others. But not without the challenge in terms of the multiple mkt has to pay for it. Was 2% earlier today and took to 3%. A bit of a swing in there, think I'm probably a tad too large, but playing a reversion to the mid-high $40s in the coming week/s.

NASDAQ:AVDX - 3%. WTF how did i get into this position w/ such large size. I kept doubling and today i took it from ~1.25% to 3% on the dippity dip. I think this is a clear candidate for a reversal, but it's not going to be a mainstay in the portfolio. I just think the tape is pressuring this and fundamental buyers will send it up 10-15% and i'm out.

NASDAQ:NVDA - 2%. Also a semi staple. I'm in and out of this alot. Idea is to make this a 5% position. I've been trading it well, earlier today I was actually at 5% but took some off as the semi's ripped and am playing beta thru the more rocket fuel AMEX:SOXL degen below.

About 25% cash.

The rest are calls on some small caps I've written about and smaller positions. AMEX:SOXL weeklies is the most degen thing I have rn b/c i think positioning is off.

Others I like in 50 bps to 1.5% sizes in no particular order: NASDAQ:BLDE , NASDAQ:TEAM , NASDAQ:BTDR , SNAP (swing today only b/c off 30%), NASDAQ:PLYA , NASDAQ:PYCR , $NICE.

Hope it helps. Stay solvent and healthy.

We'll sort thru this mess together.

V

7/11/24 - VROCKSTAR portfolio snapshot for start of 2Husing a rando ticker to do this lol

have been a lot of movements since i started writing maybe 2.5-3 mo at this pt. in out, size up, size down. so i'll need to figure out a rhythm to even give these periodic updates. but bc i enjoy the DMs so far and the comments/ interactions... this is probably the easiest way to show where i stand w a lot of things. mainly to be helpful to the guys who follow me more closely if this helps your process or you want to dig in on any of these topics or sizing thinking etc.

60% :: OTC:GDLC - playing the ETH etf announcement, 30% discount to NAV. i plan to get this closer to 45-50% after the announcement if happens. risky but biggest homerun swing i've found recently. spelling this one out bc it's so large. i've posted on all this stuff (below) so go search it and comment on it and i'm curious where/ what you all own too! two heads r better than one (usually lol).

round #s

3% :: NASDAQ:DLO

2.5% :: AMEX:IWM '26 calls (that = ~20% gross)

2% :: NYSE:YOU

2% :: NYSE:OLO

1.5% :: NASDAQ:NICE

1.5% :: NYSE:BABA

1.5% :: NASDAQ:LULU

1.5% :: BLDE

1% :: NASDAQ:OLPX

~2-3% assorted downside hedges (that = ~20% gross)

the rest cash (~25%)

--

pains me to get rid of NYSE:IOT on this run up (today) but i can't justify high teens sales multiple

want to get back into a bunch of other stuff, but have taken gains (even the most recent stuff!)

want to size up a lot of the above when the time is right (maybe even at a higher level, idk) but i'm re-planting feet and decided to reallocate a lot of capital into the OTC:GDLC trade (obviously), so i'm making room to swing for the fences there (usually i take 2-3 massive swings per year).

so let's see. i could always use more luck. but attempting to stay solvent as the market prepares for some wild moves ahead.

hope this helps.

V

+62% YTD. i won't validate this (for now), but to add perspective for those of you who follow/ msg me and know i'm not likely to BS. let's see how we finish the year. a lot will depend on this OTC:GDLC trade i have on lol.

May we fill up the gas tank of the car?Hello Traders

Jerome Powell has spoken and the economy seems to be not so "overheated" and the labor market seems calm after the "spikes" of 2020-2021. This could suggest that perhaps the much talked about interest rate cuts that have been mentioned may be coming. Powell spoke to the Senate informing them of the risks facing the economy. "risks on both sides" and with a labor market in apparent balance. He also made reference to the fact that if rate increases are implemented it will be based on measurable data, despite an election also coinciding in the same season.

Currently gasoline (Ticker AT: GASOLQ2) is at 2.5132 the current scenario looks like this. If there are no cuts, the price could go down towards 2.2988 and if there are cuts, it would climb towards 2.8500. Currently the Control Point (POC) is at 2.4992, so it is in a high trading zone at the moment. The RSI is at 41.67% slightly oversold.

Theory tells us that lower rates are gasoline for the markets in the short term, but if the Fed were to lower rates it would change the outlook. Especially in a context of oil supply problems.

Do you think rising oil prices will affect the Fed's rate hike plans or threaten the ECB's rate cut plans?

As always, I look forward to your comments.

Ion Jauregui - Analyst ActivTrades

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

Dangerous TradeThis trade has bad idea written all over it. Don’t try this at home. Not investment advice. etc. It has come to my attention that HO i.e.. NY Harbor heating oil which is a proxy petroleum distillate for diesel has gotten more expensive than gasoline in recent years many times and that it has done so in an aggressive manner quite a few of those times. This aggression is easily captured by charting the spread between HO and RB. RB is refinery gasoline. The formula for the spread is HO1! - RB1!. I’ve multiplied it by the contract multiplier of 42000 because each contract represents 42000 gallons and the price of each contract is per gallon. The number on the price axis therefore shows exactly how much money could have been made or lost with this spread. The trade idea is to go long HO and short RB once the spread closes positive twice ie. once diesel contracts start trading higher than gasoline contracts for more than one day within a 2-week period. The alternate trade idea is to just go long HO when the spread turns positive. Opex is on June 25th for both HO and RB July contracts so that’s something to be aware of. July contracts HON 2024 and RBN2024 are the contracts of interest until that options expiration date is reached. You’ll need approximately $20k margin to place this trade, as each contract is currently worth around $100k.

This trade is super dangerous because the spread is highly volatile. Don’t do it.

The reward/risk is 7.15. The “if nothing goes catastrophically wrong” risk is $4200 and the “congratulations, jack**s!” reward is $30,000.

The down trend in heating oil startsWe got sell signals based on cot data from #cotreport in crude oil and gasoline. The heating oil is strong correlated with RB and CL. When the sell cot signal stats to work out, we will see also a down trend in HO. The HO is the weakest one in the energies sector, therefore I expect a down trend in HO. I am waiting for my entry pattern to open a short position in this market.

ULSD Gulf Coast, Technical AnalysisFor PEMEX Mexico's prices:

Throughout the year 2023, there has been a bearish trend in the international reference price. However, in the last weeks of July 2023, there was an increase in international reference prices. The Fibonacci retracement technique was used to assess potential support and resistance levels.

The analysis shows that the next price resistance level is at 2.6413 USD, equivalent to $24.98 MXN. However, it is unlikely to reach this level as the highest recorded price to date is $24.14 MXN, and due to government policies, it is difficult for this price to increase.

Consequently, it is expected that the international reference price will experience increases of up to 50 cents in the month of August. On the other hand, the selling price of TAR will remain within the expected averages for the month of August, at $23.75 MXN.

Change Management: Why not trade Heating Oil?There are clear re-entry long signals for the most bullish market

why are most traders just focused on E-MINIs or bitcoin, when commodities like heating oil provide an easier trading opportunity?

Even better risk reward ration can be archived on the 15 min chart by simply using fair value gaps as re-entry spots...