Nat Gas Report 3/29/25: Can you shoulder the shoulder?

Well, after much fanfare it is finally here! No, not the SSW event, not the Liberation Day (Trump’s April Tariffs), but the shoulder season! That important time of the year for energy traders to watch the price of NG drop faster than Trump’s current approval ratings! The cyclical trade in energy warrants a movement of funds this time of the year to Crude oil, then eventually Gasoline. As discussed, a few weeks ago this constant movement in energy trades keeps the asset allocations inline with seasonal trends in energy usage and the funds fat and happy. But this year we have the ultimate monkey in the works, true market dynamics!

Although with the upcoming Liberation Day tariffs starting this coming Wednesday, 4/2/25, the market once again is on edge with the unknown unknowns! As the broad equity market has sold off this quarter, we have seen a movement into commodities, especially NG (sorry Gold bugs!). The underlying weakness in global oil demand, and the inability for oil producing nations and majors to temper supply has led to a glut in worldwide crude stockpiling. Yesterday’s Crude Oil COT report showed commercials with a net short position of -208,888 (an increase in short positions by 3,580 from the previous week) and non-commercials who are net long +197,061. This is not a common seasonal response in the Oil markets. Normally the December to May timeframe is a season of oil accumulation by major traders and the petro industry. This demand is not without purpose; it marks the onset of preparations for the impending summer driving season. Refiners embark on a strategic accumulation of crude oil inventory for gasoline production, laying the groundwork for oil price increases in the months ahead. But with softness in the overall global markets, downward revisions in GDP, Trump tariff uncertainty, and the big electrification to the transportation sector. There is a bearish undertone to the global oil and gasoline market this year. Remember what was discussed. The global nature of institutional energy traders is to trade crude in the spring (as NG sells off), gasoline in the summer (as oil sells off), NG in the fall (as diesel sells off), and diesel/heating oil in the winter (as gasoline sells off). This round robing of trades allows the savvy trader to expect entry and exit points, or to determine the overall direction of seasonal trends. But throw that out this year! The past few months NG and Oil have been trading inversely with each other, almost to the dollar!

So, that leaves us with a tremendous amount of allocated worldwide capital in the one energy trade left. NG! But, not without merit! Natural Gas has a tremendous amount of underlying fundamental support. Lower than normal storage (currently 6.5% below 5-yer average), increasing power generation demand, increasing exports via pipeline to Mexico, increasing LNG export (currently hit a record at 16.7 BCF/d this week and expected to hit 18 BCF/d next month), and stagnant production (NG rig count down 9% y/y, oil down 4.5% y/y). The producers have finally understood that producing too much NG will probably affect the price in a negative way. Last week’s energy conference in Houston, TX had one general theme from all the energy majors. Supply restraint/discipline and an increase in infrastructure. There must have been some concerted effort, because the catch phrase all week was not “Drill baby Drill” but “Build baby Build” The discussion was that Trump’s lowering of barriers for pipeline construction and LNG export facilities is what is going to give them a reason to drill. But, for the time being they need takeaway capacity. They will continue to keep rigs out of the field until that happens. Imports from Canada are at a 2-year low, due to the increase in heating demand in Canada, due to the SSW event taking hold up north. Increasing demand, stagnant production = higher prices!

Weather related demand has decreased with the unusually warm March. But the SSW event is now affecting Canada. If not for the main Pacific Teleconnection, the EPO, this cold bottled up in Canada would have brought seasonal temperature to the US. But!!!!!!! Now the EPO(negative) Teleconnection is aligning with the SSW event and the models over the past week have been printing colder. I expect the month of April to end up below average. Which could possibly lead to one, maybe to more storage withdrawals, outside the withdrawal season. As of earlier this week, April is now projected to end the storage deficit created during the withdrawal season. But if we can head into the month of May with a continued deficit, we can expect elevated prices for the summer strip. The summer forecasts are currently coming out, which is showing dry and hot conditions from the Rockies west to the Mississippi River. The current storage deficit in the South Central region (-10.5%) and the Midwest (-16.2%), will be the main driver for price appreciation due to weather related issues. Years that had a SSW event in the months of March and April, statistically have very hot May and June months that follow. This kick start to the summer cooling season is another reason for the predicted elevated prices this summer. This is not 2024! Do not expect for historic low process to return, bar a pandemic or a worldwide global recession. There will be price volatility, but not a complete dropping of the floor price.

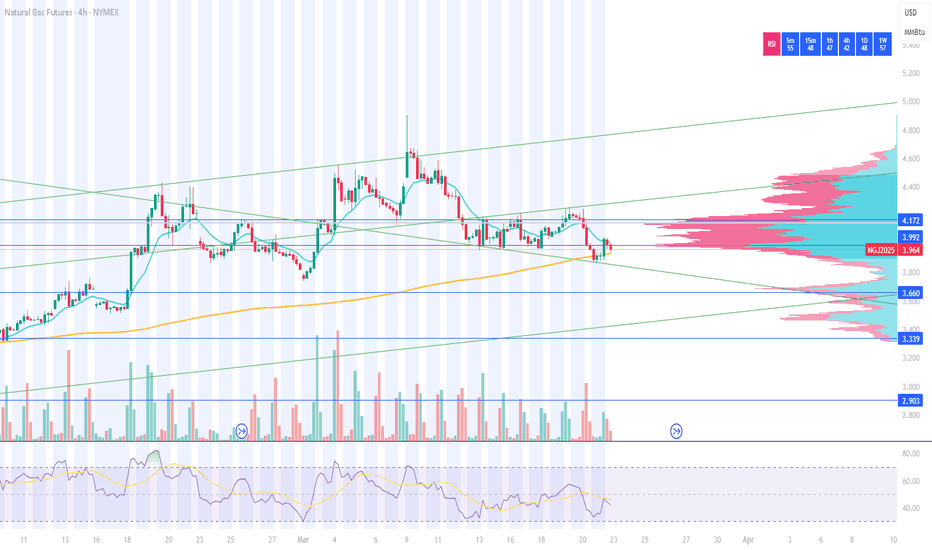

Near term pricing: Ever since moving above the 100D SMA back at the end of December the 50D SMA has held up wonderfully as support during last four months. Since Tuesday the 50D SMA has continued to hold, except for a brief 12 hour period, but the price showed bullish support by retracing, touching and bouncing back off. The weekly low bounced off the lower SD of the BB. This another bullish conformation. The weekly low dropped below the 38.2% fib level and reclaimed upward momentum, another bullish sign, only to move up past the 50% fib level. The psychological 4000 level, another bullish indicator. When technical and fundamentals align, we should pay close attention and listen!

I am watching 4170, 4252, and 4316 for my immediate term resistance levels. If 4316 is broken, the upper BB SD and the 78.6% swing retracement level 4570 is next. For support, 3953, 3854, 3729. If there is a break below the 3729 then the 23.6% swing retracement level at 3560 would be up next. I am of the belief that the market is expected to travel higher. But there are many reasons for continued range bound days. So, I will be setting these levels to range trade until I see an indication for otherwise.

Keep it Burning!

QG1! trade ideas

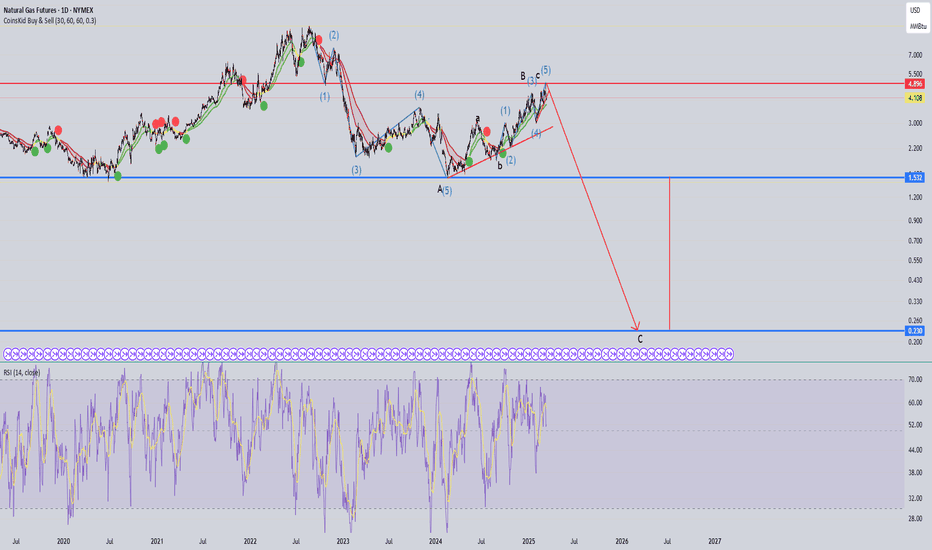

NATGAS: Market of Sellers

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the NATGAS pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS Growth Ahead! Buy!

Hello,Traders!

NATGAS made a retest

Of the horizontal support

Level of 3.720$ and we are

Seeing a nice strong bullish

Rebound so we are bullish

Biased and we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATURAL GAS Channel Up getting ready for the next Leg to 6.600Natural Gas (NG1!) has been trading within a Channel Up since the August 27 2024 Low and right now it is consolidating on its 1D MA50 (blue trend-line).

The last Higher Low was priced on the 1D MA100 (green trend-line), which isn't far of, actually it sits at the bottom of the Channel Up. Given the strong symmetry on the Channel's initial Bullish Legs (+61.23%), we expect the new rally that is about to start to also reach the 1.618 - 1.786 Fibonacci extension Zone as the previous.

As a result, we see NG at a minimum of 6.600 by June - July.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NATGAS: Trading Signal From Our Team

NATGAS

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long NATGAS

Entry - 3.964

Sl - 3.800

Tp - 4.264

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS What Next? BUY!

My dear friends,

Please, find my technical outlook for NATGAS below:

The instrument tests an important psychological level 3.964

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 4.197

Recommended Stop Loss - 3.852

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

#NATURAL GAS Supply ZoneA Natural Gas Supply Zone refers to a designated area or region where natural gas is extracted, processed, and distributed to meet energy demands. These zones are critical hubs in the energy supply chain, encompassing production facilities, pipelines, storage units, and distribution networks. They play a vital role in ensuring a stable and reliable supply of natural gas for residential, commercial, and industrial use.

NG1! NATURAL GAS SHORT TERM TARGETNatural Gas Price Forecast: Rises to Five Day High

Natural gas strengthened on Wednesday and reached a five-day high of $4.25. The high for the day was a successful test of resistance around a trendline

Following a breakdown from the trendline last week natural gas consolidated in a relatively narrow four-day price range, largely below the trendline and the 20-Day MA.

Short term entry and targets

We can chose ,because of volatility and high uncertainty,tariffs,news... between 2 profit targets

If the 1st profit target hits,and NG reverses,possibility 1 to take profit

If it passes through, we take profit at 2nd target.

Entries:

In case to entry currently Buy1

If pullback Buy2

If pullback deep Buy3 level.

Alternatives:

Entry 1 Buy1

Entry2 cover

Entry3 Cover2

Nat Gas Report: 3/16/25 - Pre Summer outlook

(scroll chart for info/data/charts. Info located between 2.200-5.500, 2019-2025. Sorry for the extra work!)

The weekend calls paid off. I closed my 4.50 calls Monday AM, when the price failed to break the 4120 level. When the price popped, I entered a set of 4.50 puts which I closed this morning when the price approached the 4000 level. April has immediate support at the 4000 psychological level followed by the 3955 low of last week, an area tested twice before rallying. So, 4000 is supporting the price structure. This morning as the price struggled at the 4170 level, I entered my short, knowing that support sits at 4000. Once the price bounced around the 4030 level I again enter at block of four calls at 4.50, but on the May contract. The April contract is too dangerous to hold longer than a day due to the Greeks of the option, and the uncertainty of Trump. So, I now have a true strangle with a block of calls at 4500 and a half block of puts at 3300, on the May contract. I am thinking that I may close my puts if the price breaks below the psychological support of 4000/3950 on the April, and there is velocity to the down side. I am expecting that May should make it back to the resistance level 4320-4350 and back up to the 4500-4550 level.

Tomorrow Trump and Putin and speaking and there should be some news about the proposed peace plan. My belief is that Putin is going to stall for more time, but the big test is if Trump will make good on his threats of banking sanctions! That is one of the reasons I am taking the hedge with the strangle. Strangles are great for high volatility. But, again, we will see the price react probably before the news hits! So big spike up rumors of no peace deal, big move down more rumors of peace.

I do believe that we will see price move back to the higher resistance levels in May, due to production not keeping up with demand. There is not much wiggle room in the availability of supply, due to the low number of rigs pulled out of the field last year, and the low number in the field this year (check 3/13 post for info on rig counts).

Supply/Demand

Even with weak demand, storage remains tight compared to historical averages. The latest EIA report showed a larger-than-expected withdrawal of 62 Bcf for the week ending March 7, pushing inventories 11.9% below the five-year average. While this helped stabilize prices briefly, it has not been enough to drive a lasting uptrend.

On the supply side, Wood Mackenzie estimated Lower 48 production at 104.9 Bcf/d Monday, versus a weekend average of about 105.5 Bcf/d. The about 600 MMcf/d drop was attributed mainly to Pennsylvania amid maintenance on Empire Pipeline Inc. Lower-48 dry gas production remains steady, averaging 107.1 Bcf/day, a 4.6% year-over-year increase. Total demand reached 77.0 Bcf/day, up 5.7% from last year. According to Wood Mackenzie data, LNG demand continued to hover around 16.0 Bcf/d on Monday.

Additionally, after an uneventful 2024, LNG export demand has surged to new record highs as the new Plaquemines facility has rapidly ramped up volumes. Feed gas demand has repeatedly topped 16 BCF/day for five days in a row, including yesterday when flows were right at a new record high of 16.53 BCF/day, up +3 BCF/day year-over-year. Today’s feed gas demand was in at 16.38 BCF/d. Importantly, exports will continue to rise this Summer and Fall, potentially reaching 17-18 BCF/day, up to 5 BCF/day higher year-over-year, essentially countering the gain in supply. Along the same lines, while gains in natural gas production are fueling the large gain in year-over-year supply as discussed above, investors speculate that continued diminished drilling activity and less productive wells will ultimately lead to little production growth the rest of the year. As a result, the year-over-year gain in exports could rise while supply gains are narrowing, leading to a quickly tightening imbalance heading into the next withdrawal season. HH Spot was up another 22.5 cents today, signaling the demand for LNG feedgas. Which is helping to keep pressure on HH future contract. Cheniere Energy Inc. said Monday that the first train at its CCL expansion has been completed. It is the first of seven mid-scale liquefaction trains the company is adding at the facility.

Mexico demand has also been solid. Mexico imported 6.679 Bcf/d of natural gas via pipeline from the United States on Thursday. South Texas flows accounted for 4.408 Bcf/d, according to NGI calculations. West Texas flows across the border into Mexico were 1.549 Bcf/d. Wood Mackenzie’s 30-day range for cross-border flows was 6.2 Bcf/d as of Wednesday. Average U.S. pipeline exports to Mexico this month are 6.59 Bcf/d, according to NGI calculations, on track for a record month.

The weather wild card

The models are now seeing the reaction to the atmospheric influence of the SSW event. The AO and the NAO are now predicted to go negative after this coming work week. This is being telegraphed in the models printing colder and adding more HDDs. It is my belief that we will continue to draw from storage up until the second week of April. This is the time of year where storage begins it injection cycle. This week is the official end to the withdrawal season, and when calculations are begun for the upcoming injection season before next winters withdrawal season. We are currently at 1.7 TCF in storage, second only to 2022. The current industry projections currently put us 200 BCF below 2022’s injection season. This is being influenced by the greater overall demand in LNG exports, exports to Mexico, and general power demand. And the lack of new production due to lack of drilling activity the past 12 months and the lack of pipeline infrastructure due to regulatory issues left over from the Biden Administration. The upcoming summer forecasts are predicting a hot summer in the south-central US, where NG storage is at 16.8% the 5-year average and the lowest in the 5-year period! This has a big impact on LNG production, Mexican exports, and most of all the main contributor to the HH spot price! The summer forward price strip reflects this with an average price of 4454. The most recent EIA STEO forecast predicts Henry Hub price will average around $4.20 per million British thermal units (MMBtu) in 2025, 11% more than last month’s forecast. This is price is not reflected by last week’s price spike to 4950, and the expectation is the next report will revise prices even higher!

The current SSW event is happening during a period of the year where the days are longer and warmer. So, there is no expectation of any drastic events that should spike the price, like a Trump press conference on Tariffs! But the expectation is steady pressure on the storage numbers through the shoulder season, and the dry hot weather that is associated with the months that follow such an atmospheric event. From past years, we know that the month of May following SSW events, are very warm in the central part of the US. A very good indicator for increased demand. As such the south-central US is currently under going a serious drought, which should aid in the increase demand for cooling. As the lack of moisture in the ground will aid in daily night time temperatures exceeding historical normal.

Demand on top of demand on top of stagnant production is a good sign for a similar set up to 2022. I am not predicting 2022 types of pricing, just a steady increase of pricing going into the US summer season. 2022 pricing spiked up to 64% of the yearly opening price. 2025 is currently up 29% for the year. 2022’s price highs were during the months of June and late August. I do see such a situation forming now, like 2022. But, again, Trump can Trump the Trump! So, this analysis is based only on my fundamental outlook for the next eight weeks, or two contract cycles. Since I am currently trading the April contract, I am only beginning to develop a strategy for the shoulder season and will trade accordingly, based upon the market fundamentals and the market pricing dynamics.

Key levels I will be watch include support beginning at 3950-4000, 3875, and 3685-3730. My belief is that if the price breaks the 3875 level, it could get very ugly, very fast with all the longs piled into the market. There are many, many long positions that entered the market after the 4000 price was broken and I could foresee numerous margin calls and possibly mass liquidations. But to the upside I am looking at resistance beginning at the 4170-4200 level. From there 4290-4320 and 4430-4460. If there is velocity up to the prior gap, I can see trying to reach the very important level of 4750. Which by the way has a great deal of importance from the double peak form the previous highs of the last great swing. So, good fortunes and happy trading.

Keep it Burning!

NATURAL GAS: One more technical push.Natural Gas is neutral on its 1D technical outlook (RSI = 49.489, MACD = 0.098, ADX = 23.222), which is the ideal buy opportunity inside its 8 month Channel Up, as long as the 1D MA100 holds. The last HH peaked at +97.12% before pulling back to the 1D MA100. The trade is long, TP = 5.800.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

NATGAS Trading Opportunity! BUY!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level - 4.089

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 4.280

Safe Stop Loss - 3.977

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

Nag Gas Midweek Recap: 3/13/25

$5.00 looked so close , but now so far! As predicted the market came to its senses and reverted back to some fundamental pricing this week. Although one tweet from Trump and who knows? I better finish this post and get it posted before he strikes again, or I might be at the drawing board before you know it. For the first time in several months, NG prices were not matching weather trends. However, that changed over the past few days as prices plunged as weather trends and the models printed warmer. NG prices finally reacted sharply lower on fundamental news and lack of Trump-o-nomics. The run up in prices has aided in resetting of fundamental levels of pricing. The upper price for the 2025 NG season has been reset close to the 5000 level, more importantly, the long term double top formation in the 4700-4730 range that has been in place since early in September 2022 held and continues to serve as important resistance for the prompt month. One potential technical implication from the quick price surge late Sunday is it has effectively shifted Fibonacci Retracement levels higher. Key 38.2% retracement now exists at 3984, up from 3875, effectively making $4.00 a bit of a stronger support level. So too does the middle of the current 20 day-Bollinger Band currently sitting at 4128. Yesterday was the first fall below the middle band (20D SMA) since February 7th and there has not been an open and close day below it since January 31st.

As for lower technical levels I am watching, the channel trend at 3908, the swing low at 3742, the 50% retracement level at 3702, and the 50D SMA at 3644. Again, I believe we are in an overall bullish pattern. But I will be looking for these support levels for the turn around in price and the beginning of a move higher. I have been discussing my thoughts for the reasons for the move higher for a bit now. But I suggest caution with the Trump uncertainty in the news. The next round of tariffs come into play the first week of April, and with Ukraine and Russia hammering out a peace deal, I am keeping my investing window close. I am only looking week to week for the time being and suggest you do also. We learned this past weekend that fundamentals will be Trumped by Trump every time. For the remainder of the week, I am playing this market to the short side. I did exit my puts last night when the price dropped below 4000. I waited until the report and entered another block of puts. On a purely, short term fundamental basis, I do not see any reason for the market to react and pressure prices higher. I will not plan on holding any large positions over the weekend, due to the geopolitical and tariff uncertainty. But I will take a small strangle, which I will post before the end of the day tomorrow.

I do see some encouraging signs of the coming colder shift in the pattern. Europe is now forecasting colder weather for the next 10 days. A good telegraph for North America. The SSW is finally beginning to show its signs and I believe by early next week the weather models will begin to see it also. The major long-range teleconnections, the AO/NAO/EPO, are modeling colder day 10-40. It is now just a matter of wait and see. The good thing about the recent run up in price is that we are not going to need bitter cold to start the price to rise. We are just going to need below average temps to keep the shoulder season as short as possible. This will keep the price in a bid mode to refill storage. The other factor about past SSW events in the month of March, is that the tend to have very warm Mays, which will put a jump on the US cooling season.

LNG exports continue to show historic production. This week, in Houston, TX, CERA Energy Week conference was held. Industry majors continue to reinforce the bullish nature of the LNG, data center buildouts, and increase in power generation in the US. The main take away from the conference is the one thing that Trump is doing for the NG industry, is cutting red tape. More that 20 BCF of LNG export capacity was approved by the FERC this week, with expedited permitting. The once dead Continental Pipeline is in talks to restart permitting, and most of the steel needed for the construction of said projects have been pre bid, with pre tariff pricing already in place. The demand is there, and the gas is in the ground. There is other bullish issue such and storage continuing to drop. The shut down of 8 GW of coal plants this summer the now talked about warm summer being forecasted. The U.S. Energy Information Administration researchers calculated U.S. natural gas rigs decreased by 32%, roughly 50 rigs, between 2022 and 2024. The majority of that reduction occurred in the Haynesville Shale and Appalachia Basin, which have helped supply the growing demand for feed gas from Gulf Coast LNG terminals during the same period. Both regions declined by a combined 21 rigs last year as natural gas prices continued to crater amid surging oversupply and the pull of LNG demand from Europe.

So, for the immediate future, keep an eye on those lower support levels. Pricing will begin to move higher sooner rather than later. May is not too far off, and the cooling season is about to begin soon in the southern US.

Keep it Burning!

#NATURAL GAS Demand ZoneA Natural Gas Demand Zone refers to a specific price level or area on a chart where the buying interest in natural gas is significantly strong, leading to a potential reversal or pause in a downtrend. This concept is commonly used in technical analysis by traders to identify key levels where the price of natural gas might find support and reverse upward.