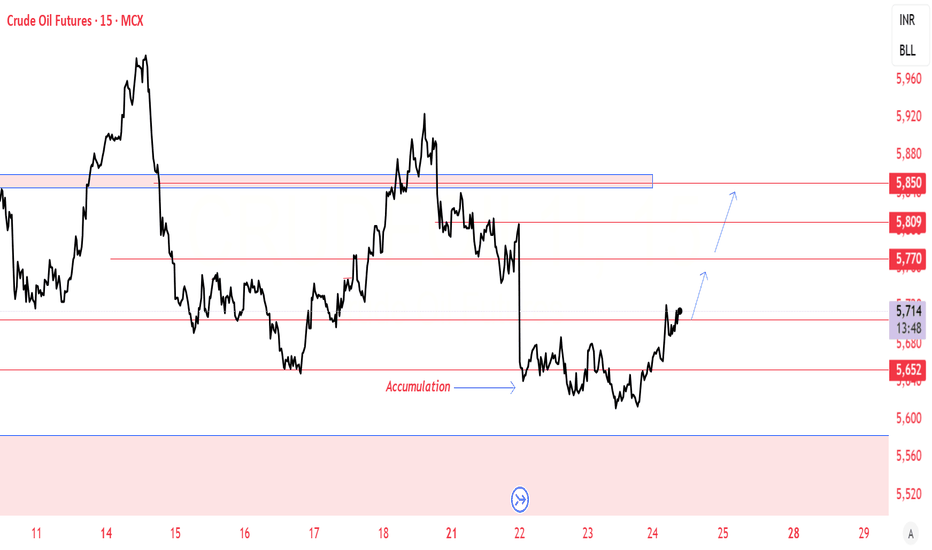

Crude Oil – Retesting Resistance | Possible Pullback Trade Setu

Crude Oil (1H timeframe)

broken out from its short-term downtrend channel and is now retesting key resistance near 5740.

Price is holding above the 5610 support, but upside is likely capped unless bulls sustain momentum.

🔹 Key Levels:

• Resistance: 5740 – 5770

• Support: 5610 → 5513

📊 Technical View & Trade Plan:

• Sell Zone: 5730 – 5770 (near trendline resistance)

• Stop Loss: Above 5800

• Target 1: 5610

• Target 2: 5513

💡 Next Scenario:

• If price breaks & sustains above 5800, bullish momentum could extend toward 5860 – 5900.

• If rejection happens at resistance, expect a pullback toward 5610 and possibly 5513.

Bias: Neutral to Bearish — waiting for price reaction at resistance to confirm the next move.

QMQ2027 trade ideas

Crude Oil: Equilibrium, Key Levels & Trade ScenariosNYMEX:CL1! NYMEX:MCL1!

Market Recap

In our prior crude oil commentary, we identified a bullish flag formation with key support anchored at the Q3 micro composite Value Area Low. Following a measured pullback, prices decisively reclaimed the Q3 micro composite Value Area High, subsequently advancing toward the $70 level. However, this upward momentum proved unsustainable, with prices unable to maintain higher ground. We have since retraced to the yearly open, where the market is now consolidating.

Current Market Structure

Crude oil is presently exhibiting a balanced profile. Notably, the composite Volume Points of Control (VPOC) for both the yearly and quarterly profiles are overlapping — a technical signal indicative of equilibrium in positioning.

Market Performance Assessment

Price action in recent sessions has been heavily influenced by shifts in the global demand outlook, which in turn remain sensitive to macroeconomic expectations, geopolitical events, and OPEC+ V8 members’ gradual unwinding of voluntary production cuts. Despite the prevailing headwinds — including tariff disputes, Russian sanctions, and broader trade tensions — crude oil has demonstrated resilience, consistently trading above the $65 threshold.

Forward Outlook

Attention will turn to today’s EIA release at 9:30 a.m. CT, which may serve as the primary catalyst for near-term directional bias.

Key Technical Levels

• Q3 mCVAH: 67.28

• Neutral Zone: 66.45 – 66.30

• Yearly Open: 66.34

• Intermediate Support: 65.80

• CVPOC / mCVPOC: 65.54

• Q3 mCVAL: 64.95

• Support Zone: 65.00 – 64.80

Trading Scenarios

• Scenario 1 — Yearly Open Rejection

Monitor the Yearly Open (66.34) as an initial resistance level. A rejection here could prompt a tactical pullback toward the Line in the Sand (LIS), offering long entry opportunities with a target above the yearly open.

• Scenario 2 — DOE-Driven Flush & Recovery

Should the DOE data trigger a downside push, watch for a swing failure at recent lows. A close back above prior levels would present a potential long setup, with conviction increasing on sustained price action above 65.80.

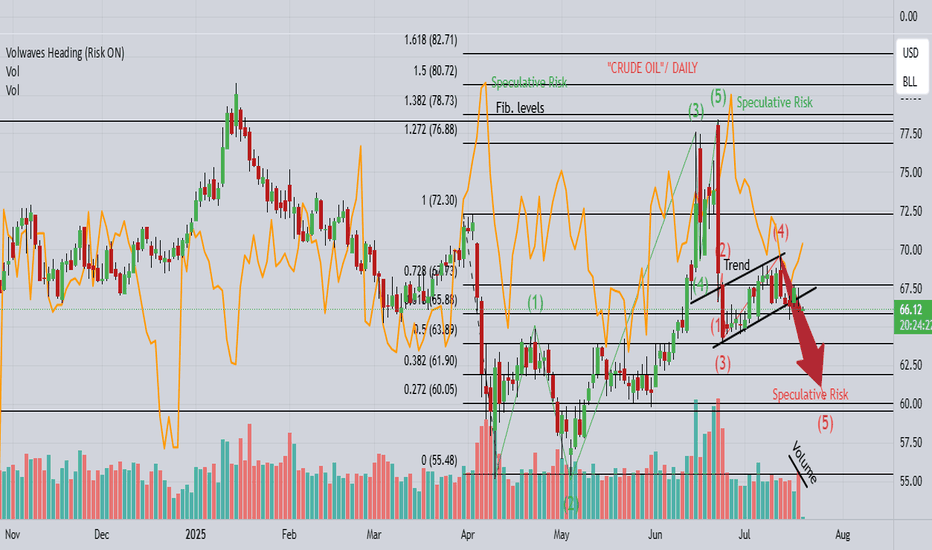

Crude Oil Resumes Its WeaknessCrude oil rised and then fell sharply from above 78 dollars back in June, after tensions in the Middle East. The drop unfolded as an impulse into wave A, so even if this is just a counter-trend move down from 78, it still appears incomplete. After we recently spotted a corrective rally in wave B that nicely stopped at projected $70 resistance near 61,8% Fibo. retracement, we can now see it resuming lower within projected wave C towards 60-59 area at least, if not even lower.

A look at multiple markets Eight six 25 that I looked at about 4 or 5 markets today including gold and a few other markets. I focused on 1.272 extensions which are very effective and getting you out of the market before you lose your profits. I talked a little bit about a stop in reverse approach to the market which can be very profitable. I also talked about taking profits when you're long on the market because you know there's going to be a correction..... And then getting back into the market to trade it higher..... This is a little bit different than stop in reverse. Years ago I tried to trade stop and reverse Trading but I did not do well at all with it and I didn't understand why this was until years later.

CRUDE OILPreferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a comment or a personal message.

Enjoy Trading ;)

Oil Trap Activated – Limit Orders Set for the Big Score💥🛢️Crude Oil Vault Breach Plan – DCA Heist Begins!🧨💰

🚨Asset: CL1!

📈Bias: BULLISH RAID MODE ON

🎯Target: $74.50

🛡️Stop Loss: $67.50

🔑Entry: ANY LEVEL – Thief stacking limit orders like layers of gold bars 💼⚖️ (DCA Mode Activated)

🕵️♂️Thief Trader is not chasing, we're ambushing 🧠 — scaling in smart with multiple limit traps. The crew never FOMOs, we trap the market 🎯.

💣This is a layered loot plan, not for weak hands. Watch how we load up quietly while market sleeps 😴, then hit hard when the vault cracks open 🔐.

Support this heist by smashing that ❤️LIKE button

💬 Comment your plans below & join the real thief squad

🤝 Together we rob the market — LEGALLY & LOGICALLY

#ThiefTrader #OilHeist #CL1 #BullishTrap #DCA #CrudeOilStrategy #SmartMoneyPlay #MarketRobbery #TeamLoot #NoRetailPanic

Crude oil: Sell around 66.50, targeting 63.00-60.00Crude Oil Market Analysis:

We've stated this dozens of times before: the overall trend of crude oil is bearish. As long as crude oil doesn't break above 70.00, we can maintain our bearish outlook. Today, we maintain our bearish outlook and continue to sell on any rebounds. Crude oil fundamentals don't support buying. The previous easing of tensions in the Middle East has also been suppressing crude oil prices for a long time, and the ever-changing tariff war is also suppressing crude oil. However, crude oil hasn't broken through 63.00 yet. Today, we're focused on selling if it breaks through. If it doesn't, we'll wait for a small rebound to sell. Focus on selling at 66.50.

Fundamental Analysis:

The tariff war has been the most influential fundamental factor affecting gold recently, and in the long term, it supports gold. This surge in gold prices is driven by Trump's renewed turmoil. Furthermore, the Federal Reserve's future monetary policy remains a key focus.

Trading Strategy:

Crude oil: Sell around 66.50, targeting 63.00-60.00.

MCL About to Take the Express Elevator DownOn the 15-min chart, MCL has completed a clean double top at 64.50, with neckline support broken at 63.00. This pattern is forming within a broader descending channel, adding higher-timeframe confluence for further downside.

Bearish Scenario (Primary Bias – 70% Probability)

- Entry Zone: 63.80–64.00 retest of broken neckline

- Stop Loss: 64.20 (above retest high)

- Target 1: 62.50 (recent swing low / intraday liquidity pocket)

- Target 2: 61.50 (lower channel boundary)

- Target 3: 60.80 (HTF measured move from double top)

Technical confluence:

Pattern completion, retest rejection, descending channel structure, macro trend alignment.

Bullish Invalidator (30% Probability)

A sustained reclaim of 64.20 with volume would invalidate the breakdown, likely triggering a short squeeze back into 64.50–64.70. This scenario is less likely without a macro catalyst during Tokyo liquidity, but remains a risk consideration.

The Tokyo open often sees thin liquidity in oil futures, meaning stop hunts above retest zones are common. Patience is key wait for rejection confirmation before entering short.

Bearish unless we see a confirmed reclaim and hold above 64.20. Short from 63.80–64.00 offers a high R:R toward the 62.50–60.80 range.

WTI(20250808)Today's AnalysisMarket News:

① Trump nominated Stephen Milan, Chairman of the White House Council of Economic Advisers, to serve on the Federal Reserve Board, with a term ending January 31, 2026.

② Waller is reportedly a leading candidate for the next Fed Chair.

③ U.S. Treasury Secretary Bensont stated that the interview process for the Fed Chair has begun.

④ Bostic stated that the July jobs report did change the Fed's outlook on its employment goals.

Technical Analysis:

Today's Buy/Sell Levels:

63.55

Support and Resistance Levels:

64.86

64.37

64.06

63.05

62.73

62.24

Trading Strategy:

If the price breaks above 63.55, consider entering a buy position, with the first target price being 64.06.

If the price breaks below 63.05, consider entering a sell position, with the first target price being 62.73.

Crude Oil setting up for a Long Trade to $78.40In the long term, Crude Oil is in a short position.

We can see this from the red pendulum fork, which projects the price movement downward.

However, in the short- to medium-term, we're long, as clearly illustrated by the white fork. Supporting the case for higher prices is the Hagopian signal that occurred on June 24, 2025.

This essentially means that the market is expected to rise beyond the point it came from—specifically, the C-point of the red fork. The target would therefore be around $78.40 in the coming weeks or months, which does seem quite ambitious.

But as long as price remains within the boundaries of the white fork, we're in an upward mode, and the potential profit target of $78.40 remains valid.

Also, the fact that Crude Oil is finding support exactly at the L-MLH (Lower Median Line Parallel) of the white fork gives me further confidence in a long trade.

Crude: Long and: Don't forget to watch the follow-up Video.

Wave 2 Completed for CLI am back after taking some time off. I'm renewing my interest in Elliot Wave counts but am looking only to use for validation of past price action and possible movement going forward but will not rely on the counts as a primary means for set ups along with fib extensions. I'll be focusing more on trend channels as it relates to Wyckoff principles in consolidation areas to utilize for trade set ups.

On the weekly chart for CL, I believe we have finished up Wave 2 coming down from the previous high at 130. I think there was a massive B wave triangle that dominated the length of the wave and finished with a ABCDE wave contracting triangle. Wave C looks to have finished off with a 5 wave ending diagonal for the low at 55. It's quite possible the B wave added two more waves for wave E & F and the current leg down is the 5th wave of C. If that's the case, then expect a new low below 55.

From a Wyckoff perspective, I'm struggling to identify structures give the massive B wave that I have in this count. So that probably means the count is wrong and will need to assess an alternative count.

I am no longer subscribing to Pure Elliot Wave so I don't know what they have for a current count in oil.

Good luck.

Crude Awakening. This Double Bottom’s Built DifferentCrude oil is sitting at a critical technical level. Zooming out to the daily chart, we’re seeing a textbook double bottom forming at $64.70 a level that’s already been defended twice this summer. Each time price tagged that zone, buyers stepped in with conviction, and last month we saw a strong rally pushing up toward the mid-70s before stalling.

That rally has since pulled back, but here’s the key: the pullback isn’t impulsive it’s corrective. Price is now compressing just above the POC (Point of Control) at $65.88, and right at the golden neckline zone of the double bottom. As long as we hold above $65.50–65.80 on a daily close, the bullish thesis remains valid.

Market Structure Summary

- Double bottom anchored at $64.71

- POC: $65.88 acting as support

- 50% retracement: $71.86 key target if bulls take control

- 100% measured move: $79.01 potential swing target

- Short-term price action still bearish, but macro structure is shifting

Quant Bias

Right now, the data shows a strong confluence zone between $65.50–$66.00. We’re seeing prior demand, volume clustering, and macro structure all stacking here. That’s high-probability territory for mean reversion or trend continuation not collapse.

While short-term charts may still look weak, this is exactly the type of spot where weak hands get flushed before a strong trend resumes. If bulls reclaim $67.60 and close above $68.00 early this week, that’s your first sign this thing is loading.

Trade Setup Plan

- Swing Long (Primary Setup)

- Entry Zone: $65.50–66.00

- TP1: $68.33 (short-term fib & volume shelf)

- TP2: $71.86 (50% retracement of range)

- TP3: $79.00 (full double bottom target)

- Stop: Daily close below $64.50 = structure breaks

Scalp Short (Only if Monday Fakes Out)

- Entry: $67.60 (into fake out zone)

- TP: $66.80 / $66.50

- SL: Above $67.85

Treat as short-term only don’t overstay

Monday Game plan

Watch for a flush into $65.80, ideally with some wicks and basing on the 30m chart. If that happens and we see buyers defending the low with volume, that’s the cue to get long. The safer long comes on a reclaim of $67.60 with strong follow-through. If we open and trap above $67.50 but fail to hold it, classic short-term fade opportunity down to $66.50.

Crude oil: Sell around 70.20, target 65.00-64.00Crude Oil Market Analysis:

Yesterday's crude oil market was very strong, with buying driving the market higher. The daily chart ultimately closed with a clear bullish candlestick. Buying on the daily chart is testing the resistance level between 70.00 and 70.60. After two consecutive days of bullish closes, and with clear bullish candlesticks, I predict another surge today. Let's look at the daily chart. The daily chart shows a significant rebound after a significant drop. Today, focus on selling opportunities between 70.00 and 70.60. A break of this level will change the overall selling trend. The strategy remains to sell high and be bearish.

Fundamental Analysis:

Today, focus on the ADP employment data and the EIA crude oil inventory data. The key news will be the interest rate results during the US trading session, along with speeches.

Trading Recommendations:

Crude oil: Sell around 70.20, target 65.00-64.00

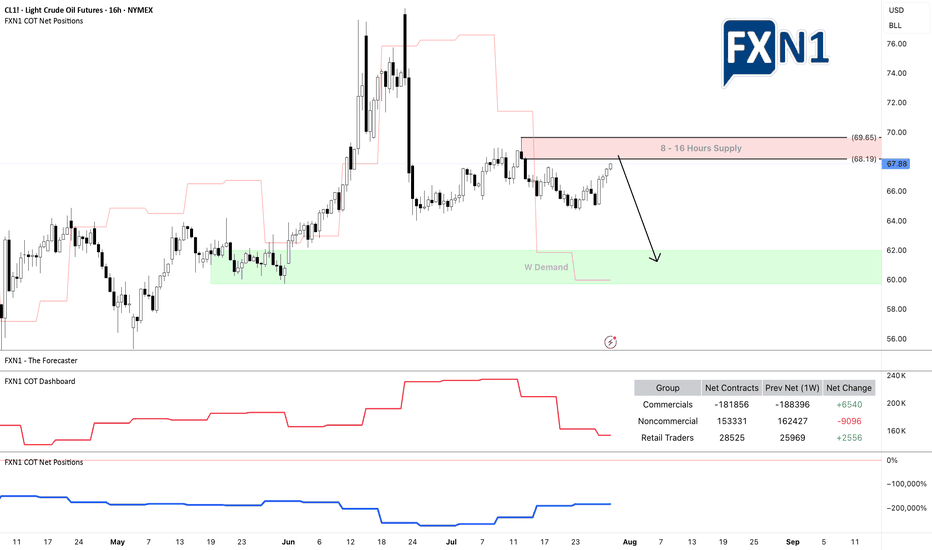

Oil Market Sentiment Shifts After Trump’s Urgent Warning, but...On June 23, 2025, at 9:35 AM, President Donald J. Trump issued a stark warning via social media:

"EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!"

Since his post, oil prices experienced a notable bullish impulse. From both fundamental and technical perspectives, the market is now approaching a 16-hour supply zone, which could serve as a potential resistance area.

Additionally, I’ve observed a divergence in trader positioning: non-commercial traders increased their short positions significantly last week, while retail traders remain long. This divergence between price action and non-commercial positions suggests a possible shift in momentum, and I am currently eyeing a short setup.

As always, I encourage traders to conduct their own analysis. The trader featured below operates on the D1 timeframe and focuses on scalping, which can be useful for short-term entries.

Stay cautious and keep an eye on how the market reacts near the identified supply zone.

✅ Please share your thoughts about CL1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Oil Price Pulls Back to Keep RSI Out of Overbought ZoneThe recent rally in oil appears to have stalled as it struggles to extend the bullish price series from earlier this week, with the Relative Strength Index (RSI) pulling back ahead of overbought territory.

Lack of momentum to hold above the $67.60 (61.8% Fibonacci retracement) to $69.10 (38.2% Fibonacci retracement) zone may push the price of oil toward $65.30 (38.2% Fibonacci retracement), with a breach of the monthly low ($63.36) bringing $61.50 (61.8% Fibonacci retracement) on the radar.

At the same time, the price of oil may defend the advance from earlier this week should it hold above the $67.60 (61.8% Fibonacci retracement) to $69.10 (38.2% Fibonacci retracement) zone, with a move/close above the $73.90 (23.6% Fibonacci retracement) to $74.50 (50% Fibonacci retracement) region bringing the June high ($77.09) on the radar.

--- Written by David Song, Senior Strategist at FOREX.com

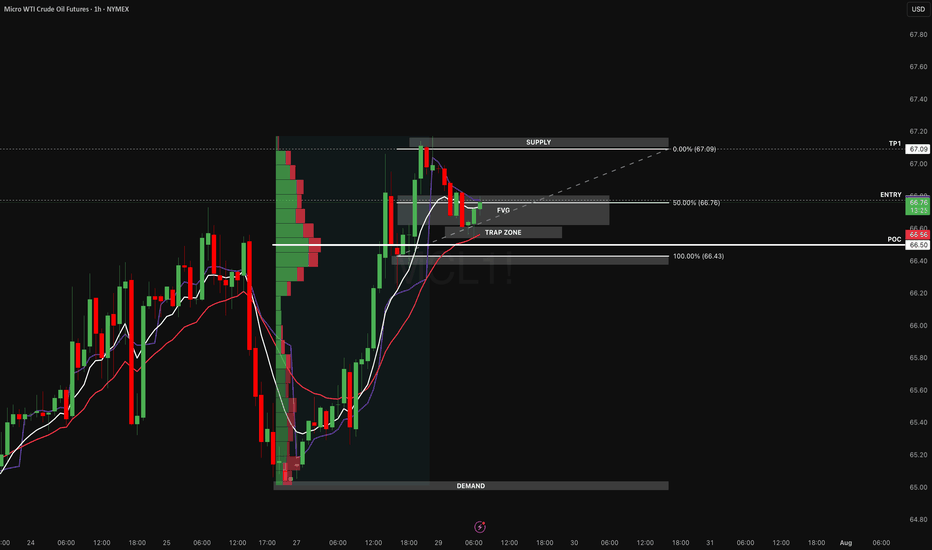

Oil’s Next Bullet: Locked, Loaded, Waiting at ValueOil made a clean move from 66.43 to 67.09 no noise, no hesitation and now it’s consolidating right where we want it: above the most important value zone of the leg. We’re not chasing green candles here. We're setting up for a measured, high-confluence re-entry at the point of balance.

This is the kind of setup we like to take at Staakd value-based, built off structure, supported by data, and always defined by risk.

Why We Like This Long

1. Fair Value Gap (FVG)

There’s a clear imbalance from 66.70–66.76 this is where price moved aggressively and left inefficiency behind. When price pulls back into an FVG with structure still bullish, we treat it like a reload zone not weakness.

2. POC (Point of Control) from Volume Profile

We anchored a Fixed Range Volume Profile from the impulse low to recent high, and the POC sits at 66.56, just under the FVG. That’s where most volume traded meaning institutions likely built their position there. If price reclaims this area after a dip, it’s a strong signal buyers are still in control.

3. Fib 50% Retracement

The 50% level of the impulse move (66.76) aligns with the FVG midpoint. That’s a psychological retracement level where trend traders and mean reversion players often meet.

4. Structure & Momentum Still Intact

- EMAs are stacked bullish: 9 > 21 > 50

- No lower low has formed

- Volume dropped on the pullback (typical in bull flags or controlled consolidations)

Plan of Attack

- Entry Zone: Anywhere from 66.56–66.76 (FVG, POC, fib confluence)

- Trigger: Look for a wick below and reclaim of FVG engulfing candle, ORB break, or VWAP reclaim

- TP1: 67.09 (supply + liquidity sweep)

- SL: Below 66.43 (demand origin + invalidation of trend)

What Invalidates This Trade

A clean break and hold below 66.43 means the structure has flipped. At that point:

- The FVG is fully filled and disrespected

- Demand is broken

- We’d likely reassess for a reversal setup, not continuation

- No egos, no praying. If we’re wrong, we’re out.

Why This Matters

We don’t trade predictions, we trade probabilities based on imbalances, value zones, and participation. When price returns to where the real business was done (the POC), we wait for confirmation and execute without emotion.

This setup aligns with our model:

- Value-based entry

- Tight, clearly defined invalidation

- Measured upside to recent high

- Multiple technical confluences

All that’s left now is patience the setup is built, the levels are mapped, and the edge is clear.