AA trade ideas

When Are We Shorting Metals?Afternoon!

Just combing through charts, and I saw this one in Alcoa. Kinda insane.

Now, I know Metals are in vogue right now from both a narrative & flows perspective (positive and improving):

***

Financials 4

Energy 4

Consumer Cyclical 4

Consumer Defensive 2

Industrials 1

---- Materials 1----

Utilities 0

Technology 0

Real Estate -2

Communications -3

Healthcare -4

***

But seriously?? This chart is insane, and the temporary increase in profits from all of the shortages might last for the next two years, if we're lucky. Buying this at 12x FWD cash flows when that leading number is liable to drop seems like a LOT. I'm steering clear of stuff like this at these prices. With the rate situation, banks seem like a much better "value" play. KRE is something I'm actually considering.

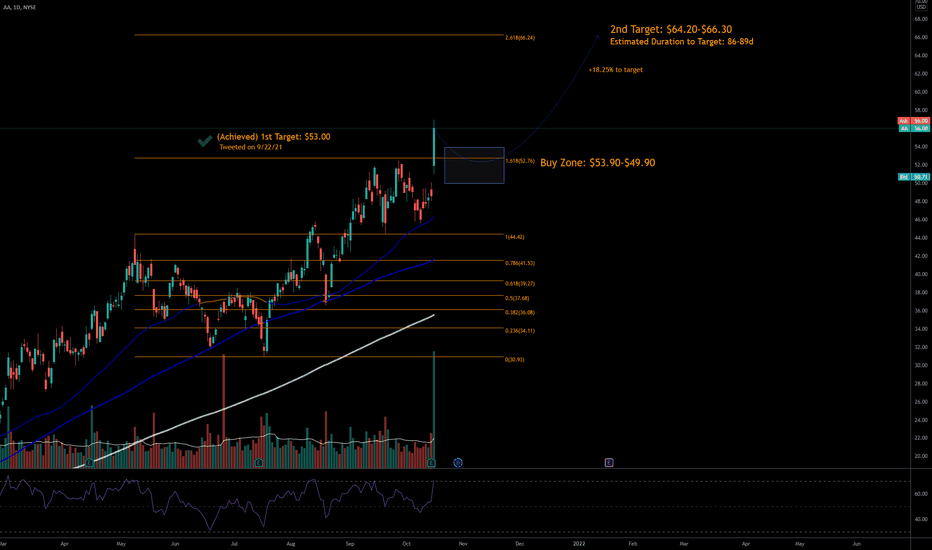

10/17/21 AAAlcoa Corporation ( NYSE:AA )

Sector: Non-Energy Minerals (Aluminum)

Current Price: $56.00

Breakout price trigger: $52.50 (hold above)

Buy Zone (Top/Bottom Range): $53.90-$49.90

Price Target: $53.00 (1st, achieved) $64.20-$66.30 (2nd)

Estimated Duration to Target: 86-89d (2nd)

Contract of Interest: $AA 12/17/21 55c, $AA 1/21/22 60c

Trade price as of publish date: $5.00/cnt, $4.20/cnt

$AA Alcoa Jumps with new Buybacks + Dividend $55 PT

Hopefully you find the chart helpful in terms of Supports & Resistance etc.

we refrain from adding commentary on the chart as that is reserved for our members and we are very conscious of not giving financial or trading advice.

Thank you for taking time to consult our chart and we would really appreciate a like, follow or comment.

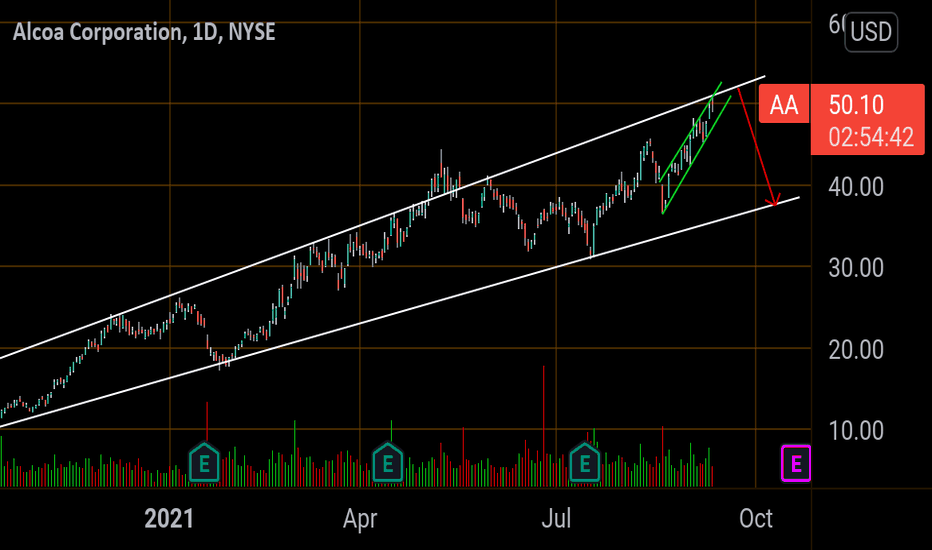

Short AA Alcoa Follows Aluminium prices pretty closely..

Alcoa is at the top of its channel and MFI says a pullback is imminent. Also Fib resistance at 51 was touched and rejected

Aluminum futures are way over bought since sept 3 rally after Guinea military coupe (Long story)

Short term target is 48$ (Minor channel support)

After that 45.79

finally channel bottom around 40$

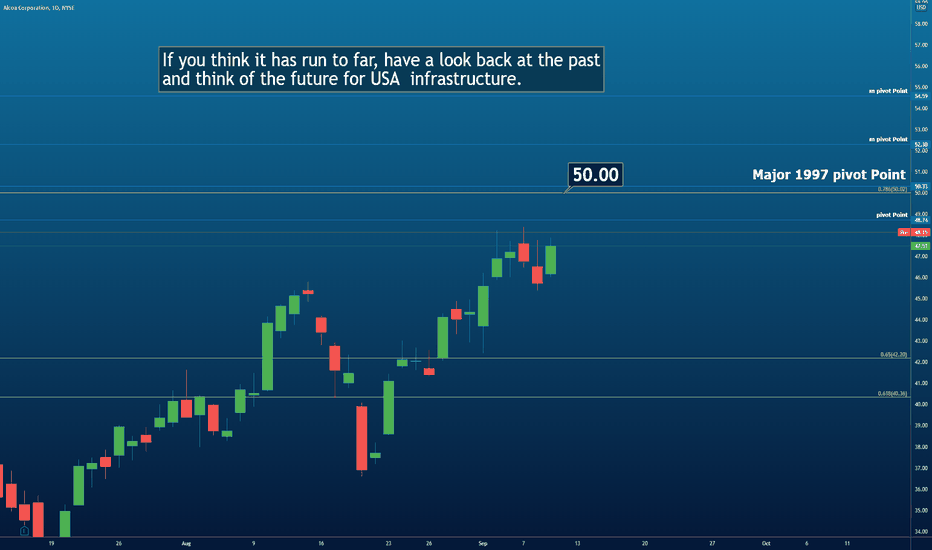

$AA Is Alcoa still a buy at 1997 Prices. 😲😲😲

Hopefully you find the chart helpful in terms of Supports & Resistance etc.

we refrain from adding commentary on the chart as that is reserved for our members and we are very conscious of not giving financial or trading advice.

Thank you for taking time to consult our chart and we would really appreciate a like, follow or comment.

AA 200 MA and Resistance Break to Continue Bull Trend.AA is in a long term bullish trend. Currently it is on a pullback and I believe it is about to break out of that pullback and continue bullish creating a great swing opportunity. A few days ago AA released its earnings for the quarter and beat estimates by 15.95%. Just a few days later AA has now broken back above the 200MA and on top of that is broke through a resistance trendline. I believe that it is going to continue its bullish trend off this news.

🟢 $AA Target 39.86 for 20.57% 🟢 $AA Target 39.86 for 20.57%

Or double position at 26.26

This one's trying...

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

I finally added my YouTube Training Video to my profile tagline since I’m not allowed to on here. It’s a quick 15 minute training video on how to set up your chart and how to spot opportunities. So check here first but If you have questions just message me.

NEW POSITION $AA Target 39.86 for 20.57% $AA Target 39.86 for 20.57%

Or double position at 26.26

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.