Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−2.23 USD

−288.70 M USD

389.06 M USD

120.86 M

About C3.ai, Inc.

Sector

Industry

CEO

Thomas M. Siebel

Website

Headquarters

Redwood City

Founded

2009

FIGI

BBG00Y6G6X31

C3.ai, Inc. engages in the provision of enterprise artificial intelligence software for digital transformation. It delivers the C3 AI suite for developing, deploying, and operating large-scale AI, predictive analytics, and Internet of Things applications in addition to a portfolio of turn-key AI applications. It operates through the following geographical segments: North America, Europe, The Middle East, and Africa, Asia Pacific, and Rest of World. The company was founded by Thomas M. Siebel, Patricia A. House and Stephen Maurice Ward, Jr. on January 8, 2009 and is headquartered in Redwood City, CA.

Related stocks

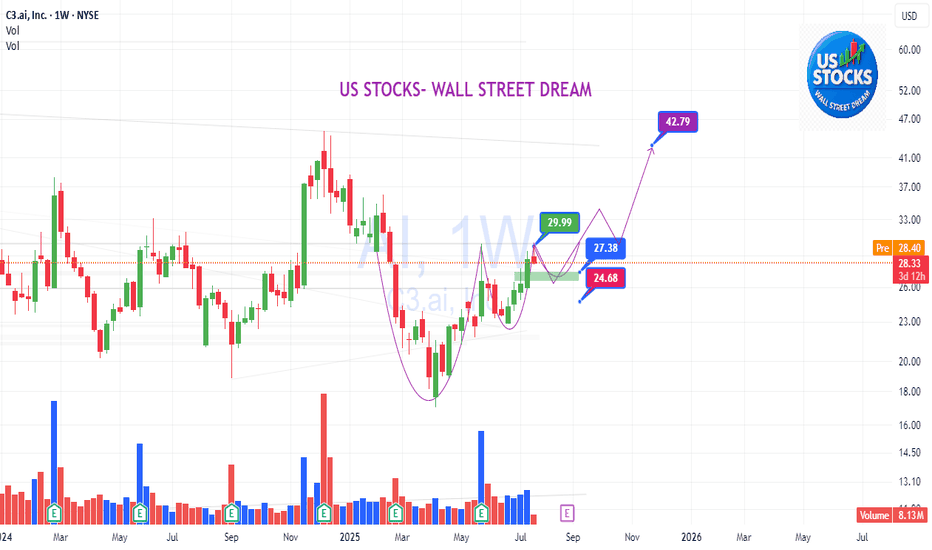

C3.ai (AI) Shows Signs of Wyckoff AccumulationAI Stock (C3.ai)

C3.ai (Ticker: AI) is currently trading just above key long-term support levels, exhibiting behavior that closely aligns with the Wyckoff Accumulation model. The stock has shown resilience after a prolonged downtrend and is now forming a potential accumulation base near its recent l

Is C3.ai the Quiet Giant of Enterprise AI?C3.ai (AI), an enterprise artificial intelligence software provider, has operated somewhat under the radar despite its foundational role in delivering advanced AI solutions to large organizations. While the broader AI market has seen significant attention on hardware innovators, C3.ai has steadily s

SPY, SPX, IWM, Natural Gas, NVDA, XYZ, AI - Analysis- Markets sold off into the NVDA rally this morning.

- Small afternoon rally turned indices back green

- Major pre market high levels up ahead likely allow us to push higher in coming days.

- NVDA should retest its premarket high levels.

- Profits secured on AI calls!

- Structurally indices are

AI C3ai Options Ahead of EarningsIf you haven`t bought AI before the previous earnings:

Now analyzing the options chain and the chart patterns of AI C3ai prior to the earnings report this week,

I would consider purchasing the 23.5usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $1.31.

If

C3.AI has bottomed and is targeting $39.00C3.ai (AI) has been trading within a Channel Down pattern since the June 16 2023 High and right now is testing its 1D MA50 (blue trend-line) as Support, following a bottom (Lower Lows) rebound on April 08 2025.

This is technically the start of its new Bullish Leg, even though based on May - August

AI (C3.ai) – Bullish Reversal Setup on 30-min Chart!

📊 Trade Setup Summary

Pattern: Falling wedge breakout → Potential bullish reversal

Entry: Around $21.87 (breakout area, marked with yellow circle)

Stop-Loss (SL): $21.28 (below key support zone in white)

Target 1 (TP1): $22.92 (red resistance line)

Target 2 (TP2): $24.22 (green resistance zone)

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where AI is featured.

Frequently Asked Questions

The current price of AI is 26.01 USD — it has increased by 0.04% in the past 24 hours. Watch C3.ai, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange C3.ai, Inc. stocks are traded under the ticker AI.

AI stock has fallen by −11.14% compared to the previous week, the month change is a 7.13% rise, over the last year C3.ai, Inc. has showed a −0.80% decrease.

We've gathered analysts' opinions on C3.ai, Inc. future price: according to them, AI price has a max estimate of 50.00 USD and a min estimate of 15.00 USD. Watch AI chart and read a more detailed C3.ai, Inc. stock forecast: see what analysts think of C3.ai, Inc. and suggest that you do with its stocks.

AI stock is 2.49% volatile and has beta coefficient of 2.01. Track C3.ai, Inc. stock price on the chart and check out the list of the most volatile stocks — is C3.ai, Inc. there?

Today C3.ai, Inc. has the market capitalization of 3.50 B, it has increased by 1.57% over the last week.

Yes, you can track C3.ai, Inc. financials in yearly and quarterly reports right on TradingView.

C3.ai, Inc. is going to release the next earnings report on Aug 27, 2025. Keep track of upcoming events with our Earnings Calendar.

AI earnings for the last quarter are −0.16 USD per share, whereas the estimation was −0.20 USD resulting in a 20.39% surprise. The estimated earnings for the next quarter are −0.13 USD per share. See more details about C3.ai, Inc. earnings.

C3.ai, Inc. revenue for the last quarter amounts to 108.72 M USD, despite the estimated figure of 107.76 M USD. In the next quarter, revenue is expected to reach 104.02 M USD.

AI net income for the last quarter is −79.70 M USD, while the quarter before that showed −80.20 M USD of net income which accounts for 0.62% change. Track more C3.ai, Inc. financial stats to get the full picture.

No, AI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 1.18 K employees. See our rating of the largest employees — is C3.ai, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. C3.ai, Inc. EBITDA is −311.82 M USD, and current EBITDA margin is −80.15%. See more stats in C3.ai, Inc. financial statements.

Like other stocks, AI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade C3.ai, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So C3.ai, Inc. technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating C3.ai, Inc. stock shows the sell signal. See more of C3.ai, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.