VZ: Verizon stock update after earningsVerizon jumped on positive results, which aligned with my bullish view on it.

Tomorrow will have its competitors T-Mobile & AT&T earnings result, this will update us on the industry as well. Most probably that I will go long on it in the next 24Hr.

Disclaimer: This content is NOT a financial advise,

Key facts today

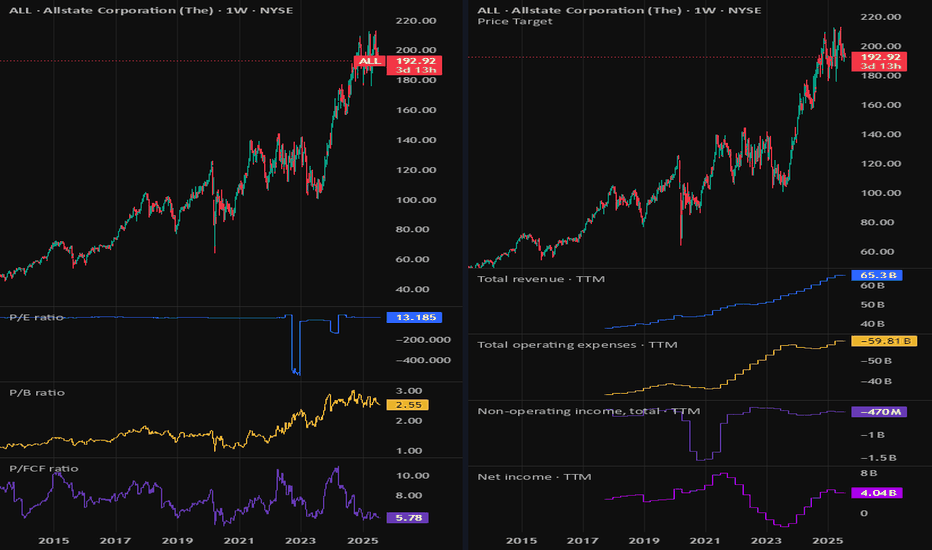

Allstate Corporation (ALL) expects a 6.7% revenue rise to $15.239 billion for Q2 2025, with an EPS estimate of $3.29, following a previous quarter's revenue of $16.45 billion.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

14.82 USD

4.67 B USD

64.11 B USD

263.40 M

About Allstate Corporation (The)

Sector

Industry

CEO

Thomas Joseph Wilson

Website

Headquarters

Northbrook

Founded

1931

FIGI

BBG000BVMGF2

The Allstate Corp. engages in the property and casualty insurance business and the provision of protection solutions. It operates through the following segments: Allstate Protection, Protection Services, Allstate Health and Benefits, Run-off Property-Liability, and Corporate and Other. The Allstate Protection segment offers private passenger auto, homeowners, other personal lines, and commercial insurance marketed under the Allstate, National General, and Answer Financial brand names. The Protection Services segment provides a range of solutions and services that expand and enhance customer value propositions including Allstate Protection Plans, Allstate Dealer Services, Allstate Roadside, Arity, and Allstate Identity Protection. The Allstate Health and Benefits segment focuses on voluntary benefits and individual life and health products, including life, accident, critical illness, short term disability, and other health insurance products sold through independent agents, benefit brokers, and Allstate exclusive agencies. The Run-off Property-Liability segment relates to property and casualty insurance policies with exposure to asbestos, environmental, and other claims in run-off. The Corporate and Other segment is involved in debt service, holding company activities, and certain non-insurance operations. The company was founded on April 17, 1931 and is headquartered in Northbrook, IL.

Related stocks

ALL AnalysisALL has shown a strong support around 103-106 range. Neckline is around the 116-119 consolidation range. RSI showing a consistent patter also for these levels on the weekly chart. Past RSI oversold 7 times in 7 years almost once every year except 2022.

Anticipating a retest to the 103 area if we fal

Allstate Corporation - 25% Shorting Opportunity?Following the crash in 2008 Allstate has enjoyed explosive rally with circa 800% gains.

Is is over and are we observing a global correction?

Fundamental indicators:

Revenue and Profits - demonstrated consistent long-term earnings growth over the past 10 years

Profit margin - quite low wi

Not So Fast..Allstate Corp. has been on a tear over the past month breaking out of the $127 level and taking the express lane up 15% for the month of March. However the next road block will require alot more strength to move throgh as this will be the 3rd time in a little over a year that we attempt to break thr

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ALL4037296

Allstate Corporation 7.52481% 15-AUG-2053Yield to maturity

7.47%

Maturity date

Aug 15, 2053

ALL4843255

Allstate Corporation 3.85% 10-AUG-2049Yield to maturity

6.53%

Maturity date

Aug 10, 2049

US20002AU5

ALLSTATE 2067 FLRYield to maturity

6.47%

Maturity date

May 15, 2057

US20002BC4

ALLSTATE 2046Yield to maturity

6.33%

Maturity date

Dec 15, 2046

ALL.AA

Allstate Corporation 5.2% 15-JAN-2042Yield to maturity

6.25%

Maturity date

Jan 15, 2042

ALL4015209

Allstate Corporation 4.5% 15-JUN-2043Yield to maturity

6.09%

Maturity date

Jun 15, 2043

ALL.GD

Allstate Corporation 6.9% 15-MAY-2038Yield to maturity

5.30%

Maturity date

May 15, 2038

ALL.IF

Allstate Corporation 5.95% 01-APR-2036Yield to maturity

5.19%

Maturity date

Apr 1, 2036

ALL.HX

Allstate Corporation 5.55% 09-MAY-2035Yield to maturity

5.10%

Maturity date

May 9, 2035

ALL5083324

Allstate Corporation 1.45% 15-DEC-2030Yield to maturity

5.02%

Maturity date

Dec 15, 2030

ALL5564982

Allstate Corporation 5.25% 30-MAR-2033Yield to maturity

4.91%

Maturity date

Mar 30, 2033

See all ALL bonds

Curated watchlists where ALL is featured.

Frequently Asked Questions

The current price of ALL is 193.89 USD — it has decreased by −1.89% in the past 24 hours. Watch Allstate Corporation (The) stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Allstate Corporation (The) stocks are traded under the ticker ALL.

ALL stock has fallen by −0.75% compared to the previous week, the month change is a −1.17% fall, over the last year Allstate Corporation (The) has showed a 14.40% increase.

We've gathered analysts' opinions on Allstate Corporation (The) future price: according to them, ALL price has a max estimate of 286.00 USD and a min estimate of 188.00 USD. Watch ALL chart and read a more detailed Allstate Corporation (The) stock forecast: see what analysts think of Allstate Corporation (The) and suggest that you do with its stocks.

ALL stock is 1.25% volatile and has beta coefficient of 0.16. Track Allstate Corporation (The) stock price on the chart and check out the list of the most volatile stocks — is Allstate Corporation (The) there?

Today Allstate Corporation (The) has the market capitalization of 50.84 B, it has increased by 0.48% over the last week.

Yes, you can track Allstate Corporation (The) financials in yearly and quarterly reports right on TradingView.

Allstate Corporation (The) is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

ALL earnings for the last quarter are 3.53 USD per share, whereas the estimation was 2.52 USD resulting in a 39.98% surprise. The estimated earnings for the next quarter are 3.25 USD per share. See more details about Allstate Corporation (The) earnings.

Allstate Corporation (The) revenue for the last quarter amounts to 14.30 B USD, despite the estimated figure of 14.05 B USD. In the next quarter, revenue is expected to reach 15.21 B USD.

ALL net income for the last quarter is 595.00 M USD, while the quarter before that showed 1.93 B USD of net income which accounts for −69.14% change. Track more Allstate Corporation (The) financial stats to get the full picture.

Yes, ALL dividends are paid quarterly. The last dividend per share was 1.00 USD. As of today, Dividend Yield (TTM)% is 2.00%. Tracking Allstate Corporation (The) dividends might help you take more informed decisions.

As of Jul 29, 2025, the company has 55.4 K employees. See our rating of the largest employees — is Allstate Corporation (The) on this list?

Like other stocks, ALL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Allstate Corporation (The) stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Allstate Corporation (The) technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Allstate Corporation (The) stock shows the buy signal. See more of Allstate Corporation (The) technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.