ALLY trade ideas

Time to BUY. Time to become an $ALLYKey Stats:

Market Cap: $12.18B

P/E Ratio (FWD): 15.81

Dividend Yield: 3%

Next Earnings Date: Jan 17, 2025

Technical Reasons for Upside:

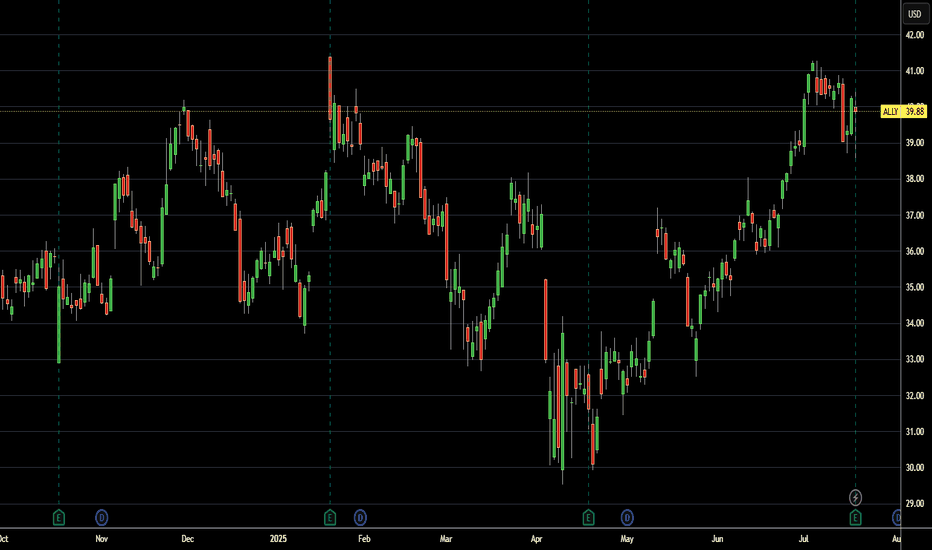

Breakout Potential: ALLY recently tested resistance around $40, with increasing volume indicating a potential breakout towards higher highs. A move past $42 could accelerate bullish momentum.

Bullish Divergence: RSI indicates higher lows despite recent price consolidation, signalling underlying strength. MACD is also crossing bullish territory.

Golden Cross Forming: The 50-day moving average is nearing a crossover above the 200-day MA, a classic long-term buy signal.

Fundamental Reasons for Upside:

Valuation Discount: Trading 28.9% below fair value (per Simply Wall St.), ALLY offers an attractive entry for long-term investors.

Earnings Growth: Analysts project a robust EPS growth of 40% for FY 2024 as auto loan performance stabilizes and digital banking services expand.

Strong Buy Ratings: Recent analyst upgrades (e.g., Citigroup raised its target to $55) reflect confidence in Ally’s recovery and growth strategy.

Potential Paths to Profit:

Option 1 (Low Risk): Buy shares outright and target $55. Collect a steady 3% dividend while holding.

Option 2 (Medium Risk): Sell cash-secured puts at a $38 strike to earn premium while positioning for a cheaper entry.

Option 3 (Higher Risk): Buy long-dated call options (e.g., June 2025, $45 strike) to leverage the expected upside without committing significant capital.

Disclaimer: We are not a brokerage or investment firm. We do not offer financial advice or investment advice and/or signals. This is not certified financial education. We offer access to the daily thought process of an individual and his experiences. We do not offer refunds. All sales are final.

ALLY Ally Financial Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ALLY Ally Financial prior to the earnings report this week,

I would consider purchasing the 36usd strike price Calls with

an expiration date of 2024-10-25,

for a premium of approximately $1.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ALLY FINANCIAL LONGAlly Financial

MTF Analysis

Aly Financial Yearly Demand Breakout 20.6

Aly Financial 6 Month Demand BUFL 28.18

Aly Financial Qtrly Demand BUFL 35.56

Aly Financial Monthly Demand 30.05

Aly Financial Weekly Demand BUFL 31.71

Aly Financial DAILY DEMAND 32.28

ENTRY 31.71

SL 25

RISK 6.71

Target 58.29

REWARD POINT 26.58

Last High 45

RR 3.96

Ally Financial's Credit Woes Deepen: Rising DelinquenciesAlly Financial (NYSE: ALLY) faced a steep decline as its Chief Financial Officer, Russ Hutchinson, highlighted worsening conditions within its auto loan portfolio. Rising delinquencies, heightened net charge-offs, and the ongoing struggles of its typical borrower amid a challenging economic environment have weighed heavily on investor sentiment, leading to a significant drop in the company’s stock.

Auto Loan Portfolio Challenges

Ally Financial's core business, particularly its auto loan segment, is under pressure as consumers grapple with inflation, high living costs, and a softening job market. Hutchinson pointed out that delinquencies in July and August were about 20 basis points higher than expected, while net charge-offs — loans deemed uncollectible — were 10 basis points above projections. These metrics reflect a broader trend of deteriorating consumer credit quality, signaling that many borrowers are struggling to keep up with their payments.

Hutchinson further noted that the issue isn't just a short-term hiccup; Ally anticipates net charge-offs to continue rising in the months ahead. The company’s analysis indicates a growing pool of borrowers with payments more than two months past due, underscoring the persistent nature of the credit issues.

Broader Economic Pressures

The struggles of Ally’s borrowers mirror larger economic pressures. The typical Ally borrower is increasingly burdened by inflation, elevated costs of living, and recent signs of a weakening employment landscape. This scenario has prompted Ally to adjust its expectations, raising concerns that these challenges could persist longer than initially anticipated.

Strategic Response: Reducing Exposure

In response to its mounting credit challenges, Ally has taken steps to reduce exposure. Earlier this year, the company sold its Ally Lending arm to Synchrony Financial (SYF), including loan receivables worth $2.2 billion. While this move was designed to bolster its balance sheet, the persistent issues within its core auto loan portfolio suggest that Ally’s financial health remains a concern.

Net Interest Margin Under Pressure

Adding to the pressure, Ally expects its net interest margin — a key indicator of profitability for lenders — to contract in the third quarter. With interest rates expected to remain elevated, the squeeze on net interest income presents another headwind for the bank. This shift marks a notable deviation from the expansionary trends observed in previous quarters, reflecting the increasingly tough lending environment.

Technical Analysis

Ally's stock plunged 17.67% on Tuesday, hitting its lowest level since January, reflecting investor anxiety over the company's credit outlook. However, the stock saw a slight recovery in premarket trading on Wednesday, up 0.12%, hinting at a potential short-term bounce. Despite this, the technical indicators suggest that the overall outlook remains bearish.

RSI and Oversold Conditions

The Relative Strength Index (RSI) currently stands at 35, indicating that Ally is in oversold territory. An RSI below 30 often signals that a stock is undervalued, and a reversal could be on the horizon. While Ally’s RSI isn’t quite there yet, it does point to increased selling pressure, which has pushed the stock to near critical support levels.

Bullish Flag Pattern Falters

On the chart, Ally recently formed a bullish flag pattern — typically a continuation signal for an upward trend. However, the pattern failed to materialize fully, with the stock unable to break above key resistance levels, indicating a lack of buying momentum. The failed breakout suggests that investors remain cautious, waiting for more concrete signs of improvement in the company’s fundamentals.

Key Support and Resistance Levels

Ally's stock is approaching critical support near the $25 mark, a level that has historically provided a floor for the price. A breach below this point could trigger further downside, with the next major support at around $22. Conversely, resistance lies at the $30 level, and a sustained move above this point would be needed to shift the technical outlook back to neutral.

Conclusion

Ally Financial ( NYSE:ALLY ) faces a challenging road ahead as it grapples with rising delinquencies, tightening credit conditions, and macroeconomic pressures weighing on its borrowers. While technical indicators show that the stock is oversold, signaling potential for a short-term bounce, the broader fundamentals suggest a cautious approach. Investors will be closely monitoring how the company navigates its credit challenges in the coming quarters, particularly as the Federal Reserve’s rate policy continues to evolve.

For now, Ally ( NYSE:ALLY ) remains under pressure, and while strategic steps like selling its lending arm provide some relief, the path to recovery will depend on broader economic improvements and a stabilization in consumer credit quality.

Synchrony's Strategic Move to Acquire Ally's Point-of-Sale

In a significant development in the financial sector, Synchrony (NYSE: NYSE:SYF ) and Ally Financial Inc. (NYSE: NYSE:ALLY ) have recently inked a definitive agreement for Synchrony to acquire NYSE:ALLY 's point-of-sale financing business, encompassing $2.2 billion in loan receivables. The move is poised to reshape the landscape of home improvement and healthcare financing, creating a powerhouse in the industry. This article delves into the intricacies of the deal, exploring its strategic implications, potential benefits, and the market's response.

Strategic Fit and Industry Differentiation:

The acquisition marks a strategic fit for Synchrony, propelling it into a position of strength by offering both revolving credit and installment loans at the point-of-sale in the home improvement vertical. This innovative approach sets Synchrony apart, providing a comprehensive suite of financing solutions for nearly 2,500 NYSE:ALLY Lending merchant locations. The deal also extends Synchrony's reach into high-growth specialty areas, including roofing, HVAC, and windows, further solidifying its position as a key player in these markets.

Economic Efficiency and Diversification:

Synchrony President and CEO Brian Doubles emphasizes the acquisition's potential to unlock value and operational efficiency by integrating products and teams. The expansion into Ally Lending's merchant base is expected to achieve attractive economies of scale, diversifying Synchrony's merchant portfolio. This move positions Synchrony to capitalize on growth opportunities in the home improvement and healthcare sectors, broadening its scope and bolstering its position as a financial services leader.

Financial Impact and Investor Sentiment:

Both Synchrony and Ally Financial executives express confidence in the financial impact of the deal. NYSE:ALLY anticipates an increase in its Common Equity Tier 1 (CET1) ratio by approximately 15 basis points upon closing, while Synchrony expects the acquisition to be accretive to full-year 2024 earnings per share. The positive outlook is reflected in the market, with NYSE:ALLY stock trading near the top of its 52-week range and above its 200-day simple moving average. Investors' enthusiasm and the stock's upward momentum signal confidence in the potential for value creation and enhanced returns.

Smooth Transition and Future Prospects:

Synchrony and NYSE:ALLY commit to working collaboratively to ensure a seamless transition for merchants, customers, and employees. The transaction is set to close in the first quarter of 2024, subject to customary closing conditions. As the financial landscape evolves, Synchrony's acquisition of Ally's point-of-sale financing business positions the company for sustained growth, establishing a strong foundation for success in the dynamic and competitive market.

Conclusion:

Synchrony's strategic move to acquire Ally's point-of-sale financing business represents a bold step towards industry leadership and innovation. The comprehensive suite of financing solutions, coupled with the anticipated economic efficiency and diversification, underscores the potential for long-term value creation. As the financial sector witnesses transformative changes, Synchrony's strategic foresight positions the company as a frontrunner in shaping the future of home improvement and healthcare financing. Investors, industry stakeholders, and market observers eagerly await further details during Synchrony's fourth-quarter 2023 earnings conference call on January 23, 2024, where additional insights into the acquisition's nuances are expected to be unveiled.

ALLY Ally Financial Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ALLY Ally Financial prior to the earnings report this week,

I would consider purchasing the 31usd strike price Puts with

an expiration date of 2024-2-16,

for a premium of approximately $0.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

💳💹 Ally Financial (ALLY): Financial Outlook 📈📊 Fed's Influence:

Ally Financial (ALLY) positioned to benefit from the Federal Reserve's indication of multiple interest rate cuts in the latter half of 2024. This shift is expected to drive higher loan demand and boost net interest income.

💵 Interest Rate Dynamics:

Lower rates to depositors anticipated, stimulating increased borrowing.

🔍 Strategic Moves:

ALLY's focus on share buybacks in the last five years, reducing outstanding shares significantly.

Positive impact on earnings per share.

📈 Market Projections:

Bullish outlook suggests support levels above $30.00-$31.00.

Anticipated upside target in the range of $48.00-$50.00.

Exciting prospects for ALLY in the evolving financial landscape! 💻🌐

#AllyFinancial #FinancialOutlook #StockMarket 📰📊

ALLY FINANCIAL Stock Chart Fibonacci Analysis 070423 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 26.5/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

$ALLY flatline gap needed 28 soon. AMEX:XLF sector showing strength looking at potention gap fill here to 28. Based on past events and my technical analysis I see it filling gap some time this week if not next. Thanks this is just my thought process on the setup I keep things simple and not overly complicated it. Don’t use this as investment advice!

Buffett went big on $ALLY- Here's whyWhy has Buffett invested in ALLY?

Having invested $1.7B since 2012 in the industry giant, General Motors, you could say Buffet is an expert on the auto industry. Which helps explain why Buffett took an interest in Ally.

This fintech company offers multiple services but specializes in the auto loan industry since it once was a financing division of GM, originally known as GMAC. After GM sold the rest of its 8.5% stake in Ally for $900M in 2013, Ally has expanded its market by offering mortgages, credit cards, wealth management, & other services.

Another reason Buffett is investing in ALLY could be its history of share buybacks. Buffett is a big believer in stock buybacks and has said they can be the best use of corporate capital. ALLY also offers quarterly dividends to shareholders, which is a sign of the company’s fundamental strength.

How does ALLY compare to SoFi?

The main difference is the source of Ally’s revenue. 65.6% of Ally’s total revenue in 2022 came from the auto finance industry, while SoFi’s edge is student loan refinancing. In 2019, SoFi generated 59.7% of its revenue from student loans. But it’s worth noting that it can be quite difficult to qualify for student loan refinancing if you have a bad credit score whereas it’s a bit easier for people to get auto loans.

How are Ally & SoFi similar?

Ally & SoFi both offer commission free stock trading for investors with a high APY as well. Ally’s savings account offers 3.60% APY and SoFi offers 3.75% APY with a direct deposit. This means that with a direct deposit, you’ll earn a higher APY with SoFi, but without one, you’d earn a higher APY with Ally.

Both companies offer multiple services such as mortgage loans, credit cards, insurance, etc. and are online banks with no physical locations. Given their different niches, it makes sense that Ally’s customers tend to be millennials while SoFi’s customers tend to be students or fresh graduates.

Conclusion:

So in conclusion, I think SOFI is in a fairly safe spot as long as the Supreme Court gives a favorable ruling. Since Nu Holdings operates in Latin America it won’t compete with SoFi for market share. Ally & SoFi also have different specializations but Ally is a more established FinTech company which could take customers from SoFi. Still, SOFI’s goal is to become a one stop shop for all financial services and it has diversified its services extensively over the years which could give it an edge in this industry.

Personally, I believe SOFI will be able to grow its customer base better than ALLY because it appeals directly to young adults heading into college. If these customers have a good experience, then SOFI can become their go-to financial service provider for the rest of their life.

On this note, the FinTech industry is on track for major growth especially since Covid-19 acted as a catalyst for the industry - leading to wider adoption at a time when contactless payments were becoming essential.

Besides this, the FinTech industry will likely continue to grow just out of sheer practicality. For one thing, Fintech cuts down servicing costs like maintaining physical branches while still providing a very high value service. As more and more transactions move online, the digital revolution continues to work in the industry’s favor and the widespread adoption of smartphones means that our phones will increasingly act as wallets. So it's not surprising that the use of Fintech companies increased 88% from 2020 to 2021.

$ALLY Technical Analysis:

ALLY was in a downward channel all of 2022 but it broke out at the start of 2023 - testing the $34 resistance after earnings. Since then the trend has reversed and is now bearish. The stock touched its $21.91 support mostly due to market turmoil rather than fundamentals.

I’m expecting ALLY to break out of this channel like it did at the start of this year when it approached the $34 support. The stock recently tested what was once the upper trendline and bounced off of it which is a bullish sign.

Personally, I think that these banking fears will dissipate now that the government has stepped in - as illustrated by the XLF closing green on Monday. Looking at the daily timeframe, ALLY is oversold with the RSI at 30 so I am expecting a bounce over the next few weeks.

Long-term, I think ALLY will trade in a sideways channel between the $23.80 support and $34 resistance until a strong catalyst is able to break it out.

But for now, I’ll take a swing here with a stop loss at $23 and my take profits at $27.05 and the 50MA.

ALLY Financial Options Ahead of EarningsLooking at the ALLY Financial options chain ahead of earnings , I would buy the $27 strike price at the money Puts with

2023-1-20 expiration date for about

$1.00 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

An undervalued stock favoured by WBOne follower asked for a chart on this stock. Here it is !

Putting the fundamentals aside, looking at the chart, we can see that it has now reached a resistance turned support level at 30.10. If within the next few weeks, we do not see a rally from this level, then we can expect the price to continue head south towards 23.67.

Despite the increasing interest rates hike by FED, the legendary investor , Warren Buffett must have lots of confidence on the US economy in order to increase his stake on this digital bank.

From Price to earning or price to book value, this stock is undervalued plus the rising interest rates will help it to collect more money from its loan businesses. Of course, in times like this, the default rates can also goes up as well.

Please DYODD

Ally Financial (A HAPPY NEW YEAR :) )Ally Financial Inc, a digital financial services company, offers various digital financial products and services to individual, commercial and corporate customers primarily in the United States and Canada. It operates through four segments: auto finance transactions, insurance transactions, mortgage finance transactions and corporate finance transactions.

Technical: Looking at the 1M chart, we observe a very common oversold pattern.

Fundamental: 26% growth over the last 5 years, with free cash flow of $2B.

Obviously due to economic uncertainty many companies are undervalued, intrinsic value is $60 with a 100%+ margin of safety.

obviously if the fed raises the interest rate and inflation is not controlled the stock may stagnate a little, it is advisable to leave this stock at least until January next year where we will see the results and the best thing is that the company pays a dividend of 4% per share which is not bad at all.

I WILL GIVE MORE DETAILS IN A FEW WEEKS, I HAVE NOT YET FINISHED READING THE LAST ANNUAL REPORT.