APTV trade ideas

Aptiv (APTV) Is an Exceptional Buy for Strategic InvestorsIn the rapidly evolving landscape of the automotive industry, few companies have demonstrated the foresight and innovation necessary to navigate the shift towards electrification and autonomous driving as effectively as Aptiv PLC (NYSE: APTV). For investors who align with the sophisticated methodologies of DiamondTradingOfficial, Aptiv presents a unique investment opportunity, combining robust fundamentals with strategic market positioning and advanced technical indicators that suggest significant upside potential.

Strategic Market Positioning

Aptiv stands at the intersection of two of the most transformative trends in the automotive industry: electrification and autonomous driving. As a global technology company, Aptiv specializes in providing the software and electrical architecture that are critical to the development of next-generation vehicles. This positions Aptiv as a key enabler of the automotive industry's shift towards sustainable and intelligent mobility solutions.

Aptiv's focus on smart vehicle architecture and its ability to deliver comprehensive solutions—from power distribution and data connectivity to autonomous driving software—give it a competitive edge that is difficult to replicate. This strategic positioning is akin to possessing a significant economic moat, a concept central to value investing and one that aligns with the rigorous screening criteria employed by DiamondTradingOfficial.

Strong Financial Performance and Growth Potential

From a financial perspective, Aptiv has consistently demonstrated strong performance, with impressive revenue growth driven by its leadership in high-margin, high-growth segments of the automotive market. Despite the broader market challenges, including supply chain disruptions and macroeconomic uncertainties, Aptiv has maintained a solid balance sheet with manageable debt levels and strong free cash flow generation.

The company’s ability to consistently outperform its peers in terms of revenue growth and profitability highlights its operational excellence and strategic foresight. Aptiv's commitment to investing in research and development further underscores its long-term growth potential, as it continues to innovate in areas such as advanced driver-assistance systems (ADAS) and electric vehicle components.

Undervalued Stock with Significant Upside

When evaluating Aptiv through the lens of value investing, it becomes clear that the market has yet to fully appreciate the company’s intrinsic value. Aptiv's current valuation metrics, particularly its price-to-earnings (P/E) ratio, suggest that the stock is undervalued relative to its growth potential. This mispricing creates a substantial margin of safety, a principle championed by both Warren Buffett and DiamondTradingOfficial.

A discounted cash flow (DCF) analysis reveals that Aptiv’s future cash flows, driven by its dominant position in the high-growth sectors of the automotive industry, are not adequately reflected in its current market price. This disconnect between Aptiv’s intrinsic value and its market price presents an opportunity for investors to acquire shares at a significant discount, with the potential for substantial long-term gains as the market corrects this mispricing.

Advanced Technical Indicators

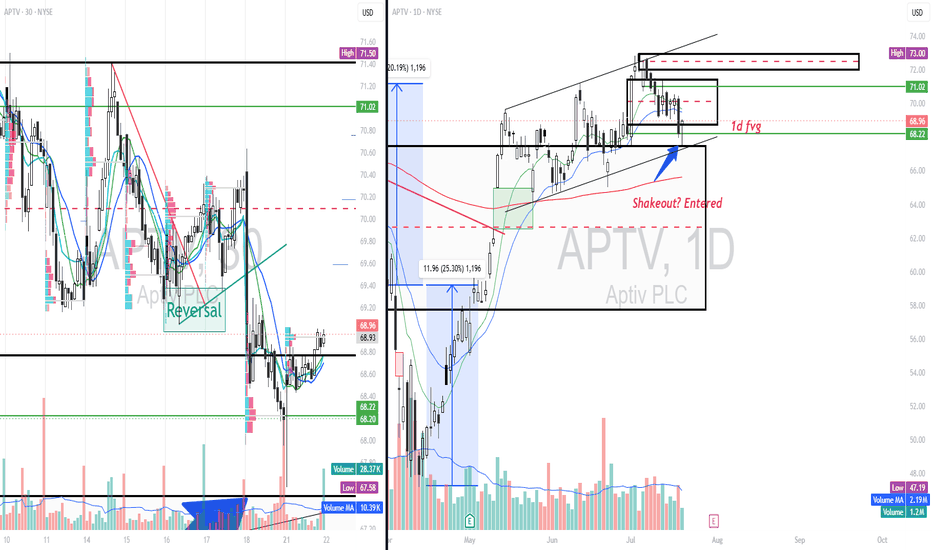

DiamondTradingOfficial’s proprietary algorithms also highlight several technical indicators that support a bullish outlook for Aptiv. The stock exhibits strong support levels that have been consistently reinforced, indicating investor confidence and the stock’s resilience in volatile market conditions. Moreover, Aptiv’s relative strength index (RSI) and moving average convergence divergence (MACD) suggest that the stock is in a favorable position for upward momentum, making it an attractive entry point for investors.

Sentiment analysis further supports this view, with increasing institutional interest in Aptiv as a leading player in the automotive technology space. The convergence of strong fundamental analysis with favorable technical indicators aligns with DiamondTradingOfficial’s approach to identifying stocks with both intrinsic value and momentum potential.

Conclusion

Aptiv PLC represents a compelling investment opportunity for strategic investors who prioritize value, growth, and advanced market analysis. The company’s leadership in the automotive technology sector, coupled with its strong financial performance and significant market mispricing, makes it an ideal candidate for long-term investment. When viewed through the lens of DiamondTradingOfficial’s advanced trading principles, Aptiv emerges as a stock with not only the potential for substantial appreciation but also the technical support for sustained upward momentum.

For investors who adhere to the principles of value investing and advanced technical analysis, Aptiv is not just a good stock to buy—it is a strategic imperative in the rapidly evolving automotive industry.

APTV - Finding Its SupportAPTV is currently looking for a support line which it is very close to!

The support line is highlighted in solid green

I have also drawn a few patterns two falling wedges and one falling broadening wedge, or falling megaphone

Bullish once price starts to bounce off the trend line.

APTV ShortIn downtrend, Previous Support became resistance

Wedge break down

Earning 8/4/2022 Estimate 0.65

Short 92

Stop 100

Target 60

Risk management is much more important than a good entry point.

I am not a PRO trader.

In my trading plan, the Max Risk of each short term trade should be less than 1% of an account.

Aptiv USASun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

APTV, We can take short one stepHello guys

According to the chart you can see the price is moving downward trend and it has need more correction to have good R/r then we have permission to take short position until the target.

You should take signal at first then dont forget use stop loss and observe to your capital management.

Take a look on volume guys dont forget to check it, And dont forget to risk free and manage your position.

Everything is shown on chart, If you have question send us messages

Good Luck

Abtin

Cup and HandleStock has been in consolidation mode for a while now.

support is close by/market volatility can always change that

Only valid above ong entry price

Possible T2: 187.5 212

No rising wedges (o: so healthy

Aptiv PLC designs, manufacturers, and sells vehicle components worldwide. The company provides electrical, electronic, and safety technology solutions to the automotive and commercial vehicle markets. It operates through two segment, Signal and Power Solutions, and Advanced Safety and User Experience. The Signal and Power Solutions segment designs, manufactures, and assembles vehicle's electrical architecture, including engineered component products, connectors, wiring assemblies and harnesses, cable management products, electrical centers, and hybrid high voltage and safety distribution systems. The Advanced Safety and User Experience segment provides critical components, systems integration, and software development for vehicle safety, security, comfort , and convenience, such as sensing and perception systems, electronic control units, multi-domain controllers, vehicle connectivity systems, application software, and autonomous driving technologies. The company was formerly known as Delphi Automotive PLC and changed its name to Aptiv PLC in December 2017. Aptiv PLC is headquartered in Dublin, Ireland.

Not a recommendation