BAH trade ideas

BAH Gaining Momentum With New DOD ContractsBAH recently fell after missing earning expectations, though the results were quite decent. It is currently sitting at 57% of 52 Weeks high. Seems oversold. Its AI products are going to contribute significantly to future revenues. Recently on June 16th, it won a DoD contract worth $96.07 million. Plus, the SMA (10) is finally crossing above SMA (50).

First target (A) seems to be $115 ish. If it breaks that resistance, 2nd target (B) seems to be about $122+.

NFA, just sharing my learning. :)

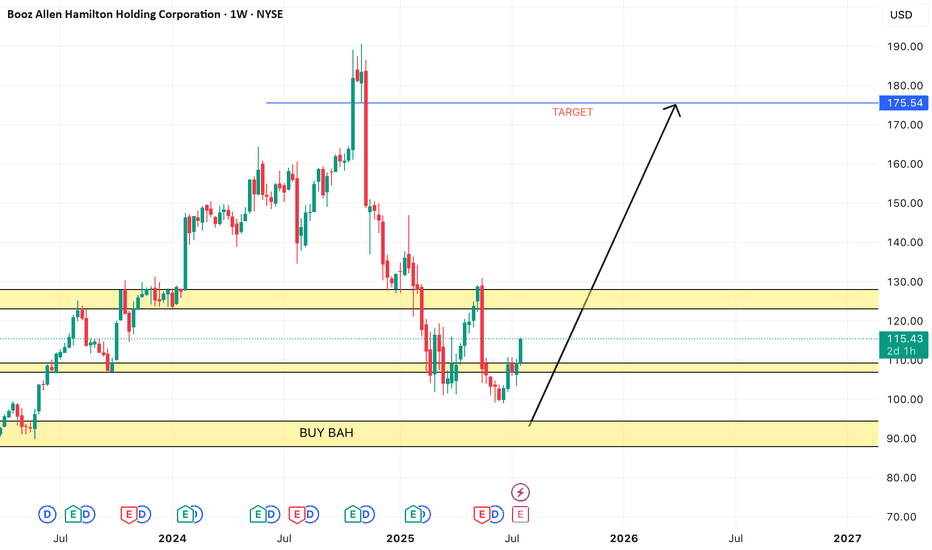

BAH hitting bouncing off long-term support levelNYSE:BAH has been in a steep downtrend since the election. Finally hit a long-term support level ~$107 last week and bounced nicely. BAH has gained ~7% since hitting that level in the face of broadly negative market sentiment and declines in the major indexes. Starting long position in the $110-$115 range.

Aggressive buying scenario: price drifts to < $108 and political headline risk shifts away from DOD, military.

If NYSE:BAH can sustain price >$107, look for next move toward $130.

Booz Allen Hamilton Announces Q4 and Fiscal Year 2024 ResultsBooz Allen Hamilton ( NYSE:BAH ) delivered strong fiscal fourth-quarter results for 2024, with earnings per share (EPS) growing by 32% to $1.33 and revenue increasing by 14% to $2.77 billion. The company also raised its outlook for fiscal 2025, forecasting adjusted EPS of $5.80 to $6.05 and revenue growth of 8% to 11%.

This performance is driven by increased government spending on defense and AI projects, as well as strong demand for IT modernization.

Technical Outlook

NYSE:BAH is up 5.40% as of the time of writing riding high with the Relative Strength Index (RSI) and the Moving Average Convergence Divergence index (MACD) all indicating bullish trend.

Booz Allen Hamilton Surges 13% After Impressive Earnings Beat

Booz Allen Hamilton (NYSE: NYSE:BAH ), the renowned Defense IT company and a key player in the realm of government technology services, is making headlines after delivering quarterly earnings that far exceeded expectations. The company's robust performance has not only propelled its stock up by an impressive 13% but has also fueled optimism among investors, positioning Booz Allen Hamilton ( NYSE:BAH ) for a promising 2024. Let's delve into the key factors behind this surge and explore whether now is the opportune moment for investors to consider Booz Allen Hamilton ( NYSE:BAH ).

Earnings Triumph:

Booz Allen Hamilton ( NYSE:BAH ) closed out 2023 on a high note, reporting fiscal third-quarter adjusted earnings of $1.41 per share on revenue of $2.57 billion. The figures represent a substantial year-over-year increase, with earnings and revenue up by 32% and 12.8%, respectively. Importantly, the per-share earnings easily surpassed Wall Street estimates, underscoring the company's strong operational performance.

Strategic Focus and Leadership Insight:

As a key player in the category of "Beltway Bandit" defense contractors, Booz Allen Hamilton ( NYSE:BAH ) distinguishes itself by concentrating on providing technology services rather than armaments to government agencies. CEO Horacio Rozanski attributed the company's success to "strong demand and growing headcount," emphasizing the momentum generated as the company scales and evolves its technology positions. Rozanski further expressed confidence in delivering exceptional value for clients and investors.

Dividend Boost and Upgraded Guidance:

In a move signaling confidence in future growth, Booz Allen Hamilton ( NYSE:BAH ) raised its quarterly dividend by 8% to $0.51 per share. Moreover, the company revised its full-year fiscal 2024 guidance, expecting earnings per share to range between $5.25 and $5.40, up from the previous guidance of $4.95 to $5.10. The upward adjustment reflects management's optimistic outlook and anticipation of sustained positive momentum.

Robust Book-to-Bill Ratio:

One of the noteworthy metrics supporting Booz Allen Hamilton's ( NYSE:BAH ) strong performance is its book-to-bill ratio, standing at an impressive 1.42 over the past 12 months. This ratio, comparing current-quarter business to the new business acquired during the period, suggests a healthy demand for the company's services and a positive outlook for future revenue generation.

Market Differentiation and Growth Potential:

While larger defense contractors like Northrop Grumman and Lockheed Martin have reported more modest results, Booz Allen Hamilton's ( NYSE:BAH ) success is attributed not only to company-specific factors but also to the government's increasing focus on enhancing its technology capabilities. As a historical top vendor to the intelligence community, Booz Allen Hamilton ( NYSE:BAH ) remains well-positioned to benefit from ongoing investments in technology, making it an attractive prospect for long-term investors.

Technical Outlook:

From a technical standpoint, Booz Allen Hamilton ( NYSE:BAH ) exhibits strong development within a rising trend channel, indicating positive growth and increasing buy interest among investors.

Conclusion:

Booz Allen Hamilton's ( NYSE:BAH ) recent earnings report, dividend increase, and upgraded guidance have positioned the company as a standout performer in the defense IT sector. With a solid foundation, strong market differentiation, and favorable technical indicators, Booz Allen Hamilton ( NYSE:BAH ) appears to be a compelling choice for investors seeking growth potential in the evolving landscape of government technology services. As the company continues to deliver ahead of pace on its investment thesis, the current surge in its stock may only be the beginning of a sustained upward trajectory.

BAH: Reasons to Invest Medium-TermFundamentals:

Increasing earnings and growing sales on a q/q bases.

Return on equity is about 58%. So, for each $1 of shareholders' equity it has, the company made $0.58 in profit.

On October 4, 2023, the company received a contract from US Space Force to support systems engineering and integration of next generation space-based missile warning, environmental monitoring, and surveillance, reconnaissance, and tracking.

Earnings comes out on Friday, October 24, 2023. Looking forward to a positive outlook on its forward guidance.

Technicals:

Monthly HHHL since 2013:

Weekly base has developed in March 2023 that broke out and recently prices retraced and produced a shallow pb trade opportunity.

The weekly chart also produced a bullish cup pattern, which volume in October is greater than the high's volume in July of 2023. The price is currently retracing to 38%-50% fib support.

On the daily chart, there is 3d3 volume as the price retraces and investors negotiate a discount level for support.

uHd developing on the MACD histogram, which with any bullish day will be a favorable environment for the bulls.

Daily decreasing volume as the price falls toward kijun support+50% fib retracement+50 kyan and cloud confluence.

BAH MAR95/FEB17 DIAGONAL PUTBear Rally Set Up:

I've had BAH on my watchlist since the swing low it made on January the 20th. So I set an alert at 96.84 which was around the area of where it closed on January 9th. I wanted to see if this would run back up with lower or equal volume to test at least the 20-day again. With yesterday's candle and it trading below yesterday's low, it triggered me to get in. I also wanted to wait for earnings.

I drew a downward trendline from the high on November 10th down to Feb 17th. From the high of November 28th, to today, this stock touched that trend line multiple times which lead me to select the 90 strike expiring the 17th of February. This only had monthly expirations so if it doesn't make it to 90 by the 17th, I'll have that 95 strike until March.

Position management strategies when the stock goes lower

I've set an alert once this gets to 90. Once it reaches my target, I'll close out the combo.

Position management strategies when the stock goes sideways

If this goes sideways I'll let my 90 strike expire worthless and hang on to the 95 until March.

Position management strategies when the stock goes higher

If this climbs higher, Im set up for max loss risking less than 2% AUM.

Position management strategy at expiration

At expiration, if this is not trading at or below 90, I'll let my 90 expire worthless and hang on to my 95 strike until it hits my 90 target.

$BAH is breaking out of a ~21 month long base! Can it go higher?Notes:

* Strong up trend on the higher time frames

* Great earnings track record

* Broke out of a ~21 month long base

* Higher than average weekly volume and coming off from its 10 week line

* Also breaking out of a smaller consolidation of ~12 weeks

* Gaped up a couple of days ago and is now coiling

* Broke historical resistance around the $97 area

Technicals:

Sector: Industrials - Consulting Services

Relative Strength vs. Sector: 3.15

Relative Strength vs. SP500: 2.07

U/D Ratio: 1.37

Base Depth: 7.78%

Distance from breakout buy point: 0.23%

Volume 55.27% above its 15 day avg.

Trade Idea:

* Now's a great time to buy since the price is just breaking out and is close to the break point

* If you're looking for a better entry you may look for one around the ~97.85 area as that should hold as support

BAH looking for a swing bottomWe have a buy pattern alert on this name at a reference price of $95.66, yesterday's close. This may be best played using a slightly out of the money call option. Perhaps the Sept. 16th expiration in order to give this pattern a bit more time to develop. For a confirmation, we will wait and enter on the first trading day when it is clear that the close will be above the open. One does not need to wait until the final hour if the situation is clear. Published price targets (link below) support our view.

Great stock/Bad PatternThis is a stock that is steady and not volatile as a rule.

I have owned it on several occasions and have owned it again until I wimped out on Friday.

And everything looks great, still.

BAH does not usually live up here, but things do change.

BAH is very close to it's all time high.

The stock looks great, the pattern does not.

This looks like a Deep Crab that is bearish as it is a crooked W.

The 2nd leg pulled to the .886. The current leg is gnawing at the 1.618.

You may see this differently and short interest is low at just over 1%.

No recommendation.

Booz Allen Hamilton Holding Corporation provides management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber services to governments, corporations, and not-for-profit organizations in the United States and internationally. The company offers consulting solutions for various domains, business strategies, human capital, and operations. It also provides analytics services, which focuses on delivering transformational solutions in the areas of artificial intelligence, such as machine learning and deep learning; data science, such as data engineering and predictive modeling; automation and decision analytics; and quantum computing. In addition, the company designs, develops, and implements solutions built on contemporary methodologies and modern architectures; delivers engineering services and solutions to define, develop, implement, sustain, and modernize complex physical systems; and provides cyber risk management solutions, such as prevention, detection, and cost effectiveness. Booz Allen Hamilton Holding Corporation was founded in 1914 and is headquartered in McLean, Virginia.

EPS (FWD)

4.38

PE (FWD)

22.58

Div Rate (FWD)

$1.72

Yield (FWD)

1.68%

Short Interest

1.19%

Market Cap

$13.10B

BAH buying opportunityBuying opportunity

Why?

1. Relative strength to the markets SPY/QQQ and XLY

2. Higher Time frame alignment / Weekly chart is ok

3. Moving averages : 20/50/200 MA are pointing higher near and under the price

Price > 20Ma > 50Ma > 200Ma

4. Chart pattern breakout forming near the minor support area - Cup with handle/W with handle

Entry : 93.55

Stop : 90.25

Target 1 : 100.25

Target 2 : 105

BAH might just soarSo I spotted BAH a couple months back in a scan. It was a strictly technical play. I've been keeping an eye on it and today I pulled up the (D) and noticed that earnings is in May. I spy an inverted head & shoulders. Do you see it too? I'm sensing it's gonna soar upwards 90. May not be a perfect straight line up, but up it will go. What are you thinking?

BAH a tailwind into a Cup and Handle With recent cyber security hacks plaguing the US online infrastructure, a company like $BAH will have no problem meeting expectation. Given this bullish tailwind, I went looking for a pattern formation I could trade on. I opened up an old favorite book The Encyclopedia of Charts and looked up the parameters of a Cup and Handle (a tradition favorite). What I read was primarily that a good Cup and Handle starts with a 30% "Bump and run" as seen in the blue highlighted box. The book stated a U shape cup with a 5-30% rounded bottom is ideal, like that in the highlighted red box. For a proper Cup and Handle (40% potential rise after the handle) I would need to see the right lip get near (lower is better) the price of the left lip. Followed by a rather dramatic handle formation during the following two weeks.