KE Holdings (BEKE) – Transforming China’s Real Estate MarketCompany Overview:

KE Holdings NYSE:BEKE is revolutionizing real estate with its hybrid digital-physical platform, leveraging strategic backing from Tencent (8% voting power).

Key Catalysts:

Strong Financial & Earnings Growth 💰

Analysts project 20.9% annual earnings growth and 26.7% EPS increase

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.54 USD

564.82 M USD

12.99 B USD

1.12 B

About KE HOLDINGS INC

Sector

Industry

CEO

Yongdong Peng

Website

Headquarters

Beijing

Founded

2018

FIGI

BBG00W9L9LX1

KE Holdings, Inc. engages in the provision of an integrated online and offline platform for housing transactions and services through its subsidiaries. It operates under the following segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services. The Existing Home Transaction Services segment provides services in existing home market. The New Home Transaction Services segment consists of new home transaction services in new home market. The Home Renovation and Furnishing segment provides a one-stop solution to give housing customers access to a comprehensive range of home renovation and furnishing, ranging from interior design, renovation, re-modeling, furnishing, supplies, to after-sales maintenance and repair. The Emerging and Other Services segment includes rental property management service business, financial service business, and other newly developed businesses. The company was founded by Hui Zou, Yongdong Peng, and Shan Yi Gang on July 6, 2018 and is headquartered in Beijing, China.

Related stocks

$BEKE Inverse head and shouldersKE Holdings Inc. is a publicly traded Chinese real estate holding firm that offers a comprehensive online and offline platform for housing transactions and related services through its subsidiaries. It stands as the largest online real estate transaction platform in China.

Investors commonly refer

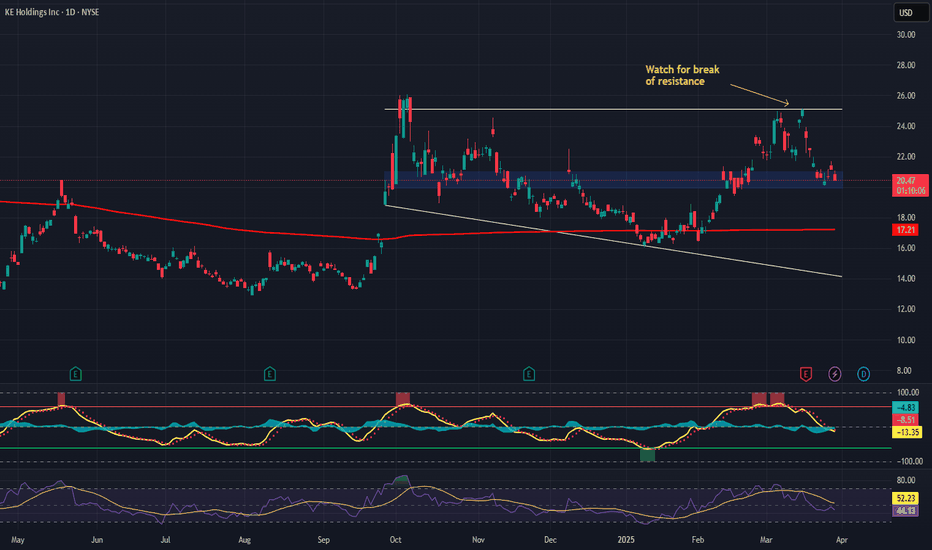

My Watchlist: BEKEBEKE: I have a green setup signal (dot Indictor). It has an excellent risk-to-reward ratio(RR:). I'm looking to enter long near the close of the day if the stock can manage to CLOSE above the last candle highs(white line). If triggered, I will then place a stop-loss below(red line) and a price targe

Chinese Real Estate looks healthyIn recent years we saw stresses in the Chinese real estate market related to their debt. The Chinese government has been handling it early for years by slowly deflating its real estate bubble. Despite the media narrative, on a financial and technical aspect, the Chinese real estate market is looking

Bullish BEKEI have a bullish outlook on NYSE:BEKE as it recently crossed both the 20 and 50 Moving Averages. Last Friday, it successfully defended these levels and closed near a crucial support level. With the current price around $17, I anticipate that the stock has the potential to reach approximately $18-1

BEKE KE Holdings Options Ahead of EarningsIf you haven`t sold BEKE here:

And bought it back here:

Now Analyzing the options chain of BEKE KE Holdings prior to the earnings report this week,

I would consider purchasing the 17.50usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $3.20

If these optio

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.