KEEP TRADING SIMPLE - BYONGood Morning,

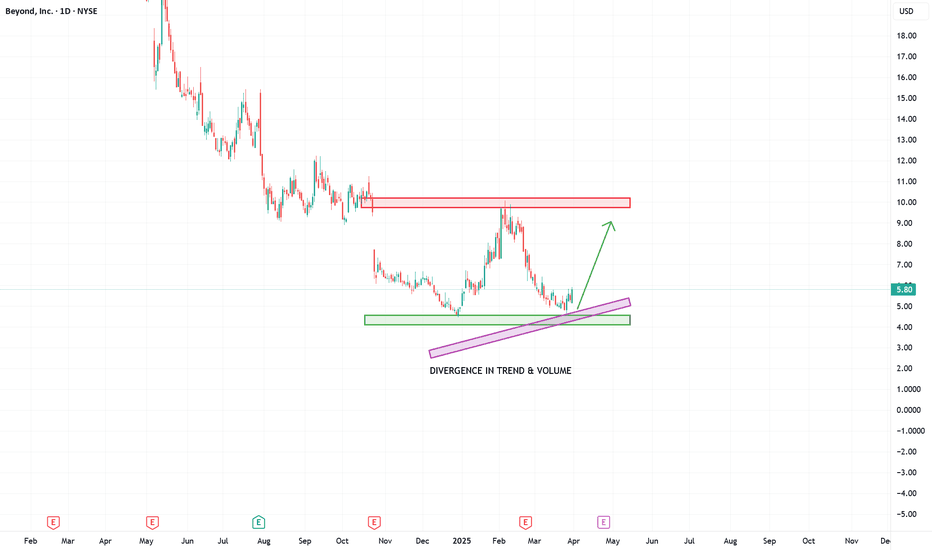

Here we have BYON. Currently we can see a distinct double bottom. This is signalling a change in trend. We have some divergence associate in the volume with BYON which would also signal the same.

Because the indexes will be trending in a bullish manor the next few days, I would buy

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−4.07 USD

−258.80 M USD

1.39 B USD

56.47 M

About Beyond, Inc.

Sector

Industry

CEO

Marcus Anthony Lemonis

Website

Headquarters

Murray

Founded

1997

FIGI

BBG000BF7BV7

Beyond, Inc. engages in the provision of an e-commerce platform. It offers furniture and home furnishing products and services. The company was founded on May 5, 1997 and is headquartered in Murray, UT.

Related stocks

A meme stock, at value prices?It’s not often that you see a meme tier stock trading at deep enough value to attract the attention of highly successful long term investors. This is a classic euthanasia coaster stock from well before Covid, with massive pump & dump patterns all the way back to 2002 that continue to echo in the pri

BYON/USD – 30-Min Long Trade Setup!📉 🚀

🔹 Asset: BYON (Beyond, Inc.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Wedge Breakout

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $6.50 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $5.97 (Break of Support)

🎯 Take Profit Targets:

📌 TP1: $6.90 (First Resistance Level)

📌 TP2: $7.46

Trade Review - BYONWhen SAGE showed up in screener there was a bullish continuation pattern on the daily timeframe and a potential exhaustion on the higher timeframe.

The higher timeframe is in a downtrend, have made a measured move down (volatility projection) and is extended from the mean, thus we observe for pot

BYON Long Trade Setup (30-Min Chart)!### **🚀) 📈🔥**

🔍 **Stock:** BYON (NYSE)

⏳ **Timeframe:** 30-Min Chart

📈 **Setup Type:** Bullish Continuation

---

### **📍 Trade Plan:**

✅ **Entry:** **$8.12** (Breakout Retest Confirmation)

❌ **Stop-Loss (SL):** **$7.54** (Below key support for risk management)

🎯 **Target 1:** **$8.55

Beyond | BYND | Long at $6.00Beyond NYSE:BYON .

The bad:

Highly speculative play.

Currently unprofitable and not forecast to become profitable over the next 3 years.

Has less than 1 year of cash runway.

The good:

Insider buying below $10 (especially in the $6-$7 range) is outweighing insider selling. The last

To infinity & BYON - $375-$660

BYON is replicating the same fractal from 2012-2018 but on a grander scale

It has reached the end of its downtrend (B) and will soon resume Wave C - of equal length to A.

In the short-term BYON is about to cross above a steep downtrend line (yellow), just like it did in May 2012 and April 20

BEYOND INC POISED FOR A SURGE ON THE BACK OF POSITIVE EARNINGSSince October 2023, NYSE:BYON has consistently traded within an ascending trendline indicating a bullish pattern where the stock consistently experienced higher lows reflecting investor confidence and positive market sentiment.

Following the last earnings report, Beyond INC witnessed a remarkable

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BYON is 8.16 USD — it has decreased by −8.83% in the past 24 hours. Watch Beyond, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Beyond, Inc. stocks are traded under the ticker BYON.

BYON stock has fallen by −25.48% compared to the previous week, the month change is a 14.13% rise, over the last year Beyond, Inc. has showed a −27.08% decrease.

We've gathered analysts' opinions on Beyond, Inc. future price: according to them, BYON price has a max estimate of 17.00 USD and a min estimate of 5.00 USD. Watch BYON chart and read a more detailed Beyond, Inc. stock forecast: see what analysts think of Beyond, Inc. and suggest that you do with its stocks.

BYON reached its all-time high on Aug 19, 2020 with the price of 128.50 USD, and its all-time low was 2.53 USD and was reached on Mar 18, 2020. View more price dynamics on BYON chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BYON stock is 13.65% volatile and has beta coefficient of 2.68. Track Beyond, Inc. stock price on the chart and check out the list of the most volatile stocks — is Beyond, Inc. there?

Today Beyond, Inc. has the market capitalization of 468.43 M, it has decreased by −9.05% over the last week.

Yes, you can track Beyond, Inc. financials in yearly and quarterly reports right on TradingView.

Beyond, Inc. is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

BYON earnings for the last quarter are −0.34 USD per share, whereas the estimation was −0.36 USD resulting in a 4.56% surprise. The estimated earnings for the next quarter are −0.38 USD per share. See more details about Beyond, Inc. earnings.

Beyond, Inc. revenue for the last quarter amounts to 282.25 M USD, despite the estimated figure of 250.29 M USD. In the next quarter, revenue is expected to reach 260.31 M USD.

BYON net income for the last quarter is −19.31 M USD, while the quarter before that showed −39.91 M USD of net income which accounts for 51.61% change. Track more Beyond, Inc. financial stats to get the full picture.

No, BYON doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 3, 2025, the company has 610 employees. See our rating of the largest employees — is Beyond, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Beyond, Inc. EBITDA is −108.24 M USD, and current EBITDA margin is −12.32%. See more stats in Beyond, Inc. financial statements.

Like other stocks, BYON shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Beyond, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Beyond, Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Beyond, Inc. stock shows the sell signal. See more of Beyond, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.