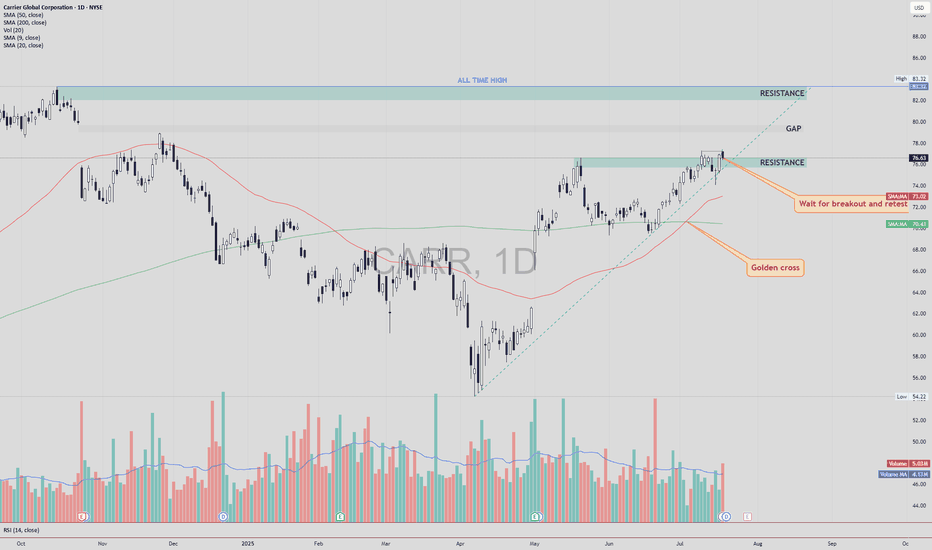

CARR – Bullish Breakout Toward Gap and ATHCarrier Global NYSE:CARR has closed above a key resistance zone near $76.50–$77.00 , indicating a possible breakout setup in progress. This move comes after a Golden Cross , where the 50 SMA crossed above the 200 SMA — a long-term bullish signal.

🔍 Technical Highlights:

✅ Golden Cross: Bull

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.42 USD

428.00 M USD

22.49 B USD

806.34 M

About Carrier Global Corporation

Sector

Industry

CEO

David L. Gitlin

Website

Headquarters

Palm Beach Gardens

Founded

1915

FIGI

BBG00RP5HYS8

Carrier Global Corp. engages in the provision of climate and energy solutions with a focus on providing differentiated, digitally-enabled lifecycle solutions to its customers. Its portfolio includes brands such as Carrier, Viessmann, Toshiba, Automated Logic and Carrier Transicold that offer innovative heating, ventilating, air conditioning (HVAC) and cold chain transportation solutions. It also provides a broad array of related building services, including audit, design, installation, system integration, repair, maintenance and monitoring. The firm operates through the following segments: Climate Solutions Americas (CSA), Climate Solutions Europe (CSE), Climate Solutions Asia Pacific, Middle East & Africa (CSAME) and Climate Solutions Transportation (CST). The CSA segment provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in North and South America. The CSE segment provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in Europe. The CSAME segment provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of residential and commercial customers in Asia Pacific, the Middle East and Africa. The CST segment includes global transport refrigeration and monitoring products, services and digital solutions for trucks, trailers, shipping containers, intermodal and rail. The company was founded by Willis Haviland Carrier on June 26, 1915 and is headquartered in Palm Beach Gardens, FL.

Related stocks

CARR potential Buy setupReasons for bullish bias:

- Strong resistance breakout

- Price has broken all-time high

- Accumulation phase breakout

Here are the recommended trading levels:

Entry Level(CMP): 62.18

Stop Loss Level: 52.73

Take Profit Level 1: 65.33

Take Profit Level 2: 68.78

Take Profit Level 3: Open

🏢 Bullish Outlook on Carrier Global Corporation (CARR) 📈🔍 Analysis:

Strategic Focus: Carrier Global Corporation (CARR) is concentrating on its core operations by divesting its Commercial Refrigeration and Fire & Security businesses after acquiring Viessmann. This move aims to expand its presence in food retail refrigeration.

Asset Optimization: Carrier

Cross-Checking News Trading with Technicals on CARR-USDDear Esteemed Investors,

Everyone asked me to write an analytics on CARR. Although my forecasts achieved some success with this stock, let me remind you it's only a very small percentage of my portfolio. I can measure my exposure in hundreds of thousands, which is relatively small compared to my g

Carrier Global - Starter?Carrier Global purchases the Viessmann Heat pumps unit. The market reacts very negative due to the high price but nevertheless the deal provides big business potential for the future. A opportunity to enter? The technical situation is not 100% supportive a seems more bearish than bullisch. Neverthel

Carrier is a no brainer, if it makes a new ATH soon The impulse wave structure is pretty obvious here. Should get a big run on a breakout ATH confirmation with a lot of accumulation already. On a 10yr span I see a possible 1600%+ gain.

Why Carrier? They are the biggest worldwide HVAC company on the NYSE and Europe is in desperate need for A/C units

CARR Entry, Volume, Target, StopEntry: with price above 60.04

Volume: with volume greater than 4.1M

Target: 72.18 area (this is an area, no guarantee it reaches this price, but you should be selling on the way up)

Stop: Depending on your risk tolerance; Based on an entry of 60.05 & target of 72.18, a stop at 58.54 gets you

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UTX5077957

Carrier Global Corporation 3.577% 05-APR-2050Yield to maturity

6.43%

Maturity date

Apr 5, 2050

UTX5077958

Carrier Global Corporation 3.377% 05-APR-2040Yield to maturity

6.10%

Maturity date

Apr 5, 2040

UTX5742149

Carrier Global Corporation 6.2% 15-MAR-2054Yield to maturity

5.64%

Maturity date

Mar 15, 2054

UTX5704471

Carrier Global Corporation 6.2% 15-MAR-2054Yield to maturity

5.31%

Maturity date

Mar 15, 2054

UTX5704273

Carrier Global Corporation 5.9% 15-MAR-2034Yield to maturity

5.04%

Maturity date

Mar 15, 2034

UTX5742151

Carrier Global Corporation 5.9% 15-MAR-2034Yield to maturity

4.93%

Maturity date

Mar 15, 2034

UTX5077963

Carrier Global Corporation 2.7% 15-FEB-2031Yield to maturity

4.76%

Maturity date

Feb 15, 2031

UTX5077959

Carrier Global Corporation 2.722% 15-FEB-2030Yield to maturity

4.62%

Maturity date

Feb 15, 2030

UTX5077960

Carrier Global Corporation 2.493% 15-FEB-2027Yield to maturity

4.42%

Maturity date

Feb 15, 2027

XS272357714

CARRIER GLOB 23/32 REGSYield to maturity

3.99%

Maturity date

Nov 29, 2032

XS293134421

CARRIER GLOB 24/37 REGSYield to maturity

3.87%

Maturity date

Jan 15, 2037

See all CARR bonds

Frequently Asked Questions

The current price of CARR is 80.73 USD — it has increased by 1.62% in the past 24 hours. Watch Carrier Global Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Carrier Global Corporation stocks are traded under the ticker CARR.

CARR stock has risen by 4.59% compared to the previous week, the month change is a 11.43% rise, over the last year Carrier Global Corporation has showed a 25.09% increase.

We've gathered analysts' opinions on Carrier Global Corporation future price: according to them, CARR price has a max estimate of 100.00 USD and a min estimate of 73.00 USD. Watch CARR chart and read a more detailed Carrier Global Corporation stock forecast: see what analysts think of Carrier Global Corporation and suggest that you do with its stocks.

CARR reached its all-time high on Oct 15, 2024 with the price of 83.32 USD, and its all-time low was 11.50 USD and was reached on Mar 23, 2020. View more price dynamics on CARR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CARR stock is 1.72% volatile and has beta coefficient of 1.24. Track Carrier Global Corporation stock price on the chart and check out the list of the most volatile stocks — is Carrier Global Corporation there?

Today Carrier Global Corporation has the market capitalization of 69.21 B, it has decreased by −1.75% over the last week.

Yes, you can track Carrier Global Corporation financials in yearly and quarterly reports right on TradingView.

Carrier Global Corporation is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

CARR earnings for the last quarter are 0.65 USD per share, whereas the estimation was 0.58 USD resulting in a 11.27% surprise. The estimated earnings for the next quarter are 0.91 USD per share. See more details about Carrier Global Corporation earnings.

Carrier Global Corporation revenue for the last quarter amounts to 5.22 B USD, despite the estimated figure of 5.19 B USD. In the next quarter, revenue is expected to reach 6.11 B USD.

CARR net income for the last quarter is 412.00 M USD, while the quarter before that showed 765.00 M USD of net income which accounts for −46.14% change. Track more Carrier Global Corporation financial stats to get the full picture.

Yes, CARR dividends are paid quarterly. The last dividend per share was 0.22 USD. As of today, Dividend Yield (TTM)% is 1.03%. Tracking Carrier Global Corporation dividends might help you take more informed decisions.

Carrier Global Corporation dividend yield was 1.16% in 2024, and payout ratio reached 169.37%. The year before the numbers were 1.30% and 38.61% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 48 K employees. See our rating of the largest employees — is Carrier Global Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Carrier Global Corporation EBITDA is 4.04 B USD, and current EBITDA margin is 15.46%. See more stats in Carrier Global Corporation financial statements.

Like other stocks, CARR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Carrier Global Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Carrier Global Corporation technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Carrier Global Corporation stock shows the buy signal. See more of Carrier Global Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.