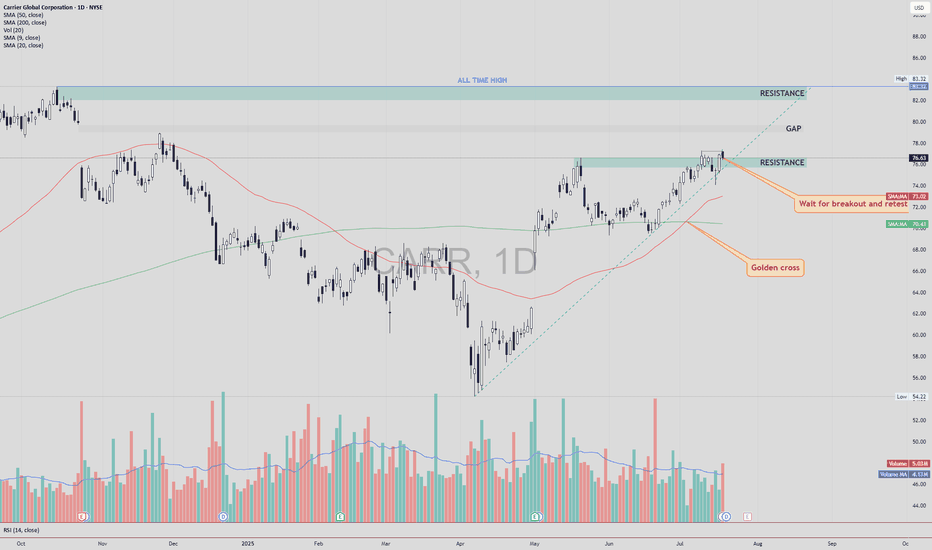

CARR – Bullish Breakout Toward Gap and ATHCarrier Global NYSE:CARR has closed above a key resistance zone near $76.50–$77.00 , indicating a possible breakout setup in progress. This move comes after a Golden Cross , where the 50 SMA crossed above the 200 SMA — a long-term bullish signal.

🔍 Technical Highlights:

✅ Golden Cross: Bullish momentum building.

✅ Breakout level: Price broke above horizontal resistance zone.

🔄 Next step: Wait for a potential retest of the breakout zone.

🔊 High volume on the breakout and retest would increase the strength and reliability of the setup.

🎯 Target Levels:

First Target (TP1): ~$80.00 — near the top of the existing gap.

Second Target (TP2): ~$83.32 — the current All-Time High (ATH).

🛡 Trade Plan:

Entry idea: After a clean retest of the breakout level with supportive volume.

Stop-loss: Below the retest zone or under 50 SMA (~$72-74 area).

Invalidation: If price falls back below resistance on high volume.

Conclusion:

CARR shows a strong breakout setup after a Golden Cross. A confirmed retest with volume could open the door toward the gap fill and new all-time highs.

DYOR – This is not financial advice.

CARR trade ideas

CARR potential Buy setupReasons for bullish bias:

- Strong resistance breakout

- Price has broken all-time high

- Accumulation phase breakout

Here are the recommended trading levels:

Entry Level(CMP): 62.18

Stop Loss Level: 52.73

Take Profit Level 1: 65.33

Take Profit Level 2: 68.78

Take Profit Level 3: Open

🏢 Bullish Outlook on Carrier Global Corporation (CARR) 📈🔍 Analysis:

Strategic Focus: Carrier Global Corporation (CARR) is concentrating on its core operations by divesting its Commercial Refrigeration and Fire & Security businesses after acquiring Viessmann. This move aims to expand its presence in food retail refrigeration.

Asset Optimization: Carrier sold its Industrial Fire division to Sentinel Capital Partners for $1.43 billion, enabling it to focus on its core heating and cooling equipment businesses and strengthen its balance sheet capacity.

Funding for Growth: Recent private offerings of USD and euro-denominated notes, totaling $3 billion and €2.35 billion respectively, provide funding for future growth initiatives, enhancing CARR's financial flexibility.

💼 Trade Plan:

Entry: Consider entry above the $50.00-$51.00 range, signaling bullish sentiment and potential for growth driven by strategic optimization.

Upside Target: Aim for profits in the range of $74.00-$76.00, reflecting confidence in Carrier's strategic moves and growth potential.

Risk Management: Implement stop-loss measures to manage downside risk and protect profits in case of adverse market movements.

📊 Note: Stay updated on Carrier's divestiture and acquisition activities, as well as industry trends impacting its core operations, for informed trading decisions. #CARR #Bullish 📈🏢

Cross-Checking News Trading with Technicals on CARR-USDDear Esteemed Investors,

Everyone asked me to write an analytics on CARR. Although my forecasts achieved some success with this stock, let me remind you it's only a very small percentage of my portfolio. I can measure my exposure in hundreds of thousands, which is relatively small compared to my gold exposure, which I measure in millions. With that, I care about every one of my investments, and I hear your expectation to read analytics about this stock. Here you go.

Chart and Technical Indicators

CARR hit the target level of the last bullish forecast ($59.21 resistance), and technical indicators like MACD and RSI turned bearish. Under the chart, MACD shows bearish progress. Both MACD and RSI have a bearish cross on them. These are typical confirmations of resistance, and CARR hasn't defeated it yet. However, RSI still moves on the more bullish side of its chart, and MACD shows only a slight bearishness. It's not too late for CARR investors to continue the rally. Signs of continuation would be if RSI made a bullish cross again and MACD turned bullish. If they can break the mentioned resistance, a target of $61.12 is possible. With that said, the risk-reward ratio of a long isn't excellent here. So, I've taken profit of my long position from the last forecast. I estimate to open a new long if the price confirms support again around the $51.74 level. Breaking this support would suggest a downward trend rather than a healthy retracement. Downwards, the price can fall to lower trendlines below $48. If I open a new long, I'll use a tight stop loss setting.

News Trading: AI Natural Language Processing

Carrier Global has consistently delivered strong revenue growth in recent quarters, driven by higher demand for HVAC and refrigeration products. The company's recent acquisitions of Viessmann Climate Solutions and Honeywell's Global Access Solutions business expand its market reach and product portfolio. Carrier Global has a healthy balance sheet with a solid financial position. The company has the flexibility to invest in growth initiatives. The global HVAC and refrigeration markets can steadily in the coming years, driven by population growth, urbanization, and rising environmental concerns.

On the other hand, the ongoing supply chain disruptions have impacted Carrier Global's production and delivery of products, potentially affecting sales and profitability. Escalating inflation could put downward pressure on consumer spending on discretionary items such as HVAC and refrigeration products. The HVAC and refrigeration industry is highly competitive, with several players vying for market share. The ongoing geopolitical tensions and potential for global recession could dampen demand for Carrier Global's products.

Despite the potential headwinds, Carrier Global remains a well-positioned company with a strong track record of growth. The company's focus on innovation, strategic acquisitions, and expanding market reach should support its long-term growth prospects. However, investors should carefully monitor the company's ability to manage supply chain disruptions, inflation, and competitive pressures.

Disclaimer:

The success of my historic forecasts don't guarantee your future results. It's not an investment advice. Do your esearch. I wrote the analytics for entertainment purposes.

Kind regards,

Ely

Carrier Global - Starter?Carrier Global purchases the Viessmann Heat pumps unit. The market reacts very negative due to the high price but nevertheless the deal provides big business potential for the future. A opportunity to enter? The technical situation is not 100% supportive a seems more bearish than bullisch. Nevertheless, the price meets some important trend lines and supports, thus it may rebounce or even start a bottom for a future run. But there are also much rooms below if this zone/lines are broken.

Carrier is a no brainer, if it makes a new ATH soon The impulse wave structure is pretty obvious here. Should get a big run on a breakout ATH confirmation with a lot of accumulation already. On a 10yr span I see a possible 1600%+ gain.

Why Carrier? They are the biggest worldwide HVAC company on the NYSE and Europe is in desperate need for A/C units after suffering heatwave summers with less than 10% of homes having A/C.

www.washingtonpost.com

Academics date the invention of air conditioning to the Florida Panhandle in the 1850s. Now, roughly 90 percent of U.S. homes have some form of air conditioning, according to U.S. Census data.

For decades in Europe, leaders and scholars scoffed at U.S. reliance on air conditioning as another example of American excess. In 1992, Cambridge economist Gwyn Prins warned that “physical addiction to air-conditioned air is the most pervasive and least noticed epidemic in modern America.”

Air-conditioned offices are commonplace in Europe, but it is exceedingly rare to find AC units in homes. According to one industry estimate, just 3 percent of homes in Germany and less than 5 percent of homes in France have air conditioning. In Britain, government estimates suggest that less than 5 percent of homes in England have AC units installed.

So the Us market is pretty much saturated, but they still make a killing here. Meanwhile a whole new untapped market is opening up with our closest trade partners. Hrmmm

I think worst case, it starts a wave c down here in a larger impulse wave up. then buy 35ish

CARR Entry, Volume, Target, StopEntry: with price above 60.04

Volume: with volume greater than 4.1M

Target: 72.18 area (this is an area, no guarantee it reaches this price, but you should be selling on the way up)

Stop: Depending on your risk tolerance; Based on an entry of 60.05 & target of 72.18, a stop at 58.54 gets you 8/1 Reward to Risk Ratio.

This LONG swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

CARR - Consolidating after move higherAfter earnings report price is still in a uptrend with little sellers after the follow through. Stock is still extended form KMA and would like the 23EMA to catch up and have the price hold the MA. Volume shows buyers are in control of this name and it wants to continue the path of least resistance which is currently up.

No good R/R entry at the current prices. Need to be patient and let this rest before a move higher. IMO a good entry would be for the price to test the 23EMA then would like to see a move past the previous high of 57.18 on higher volume.

CARR SWINGCarrier Global Corporation is an American multinational home appliances corporation based in Palm Beach Gardens, Florida. Carrier was founded in 1915 as an independent company manufacturing and distributing heating, ventilating and air conditioning systems, and has since expanded to include manufacturing commercial refrigeration and foodservice equipment, and fire and security technologies.

CARR , LongI skimmed their financial statements and I feel they outperformed the covid environment 2019 to 2020. Gross revenue was down but still near 2019 levels, which is 6.19% lower than 2019 . Also, although operating income was down, they were able to significantly increase their in "investment income" (by about 5X) to make up for lower cash from operating activities , which I think hints at a savvy management.

Net issuance of debt for 2020 was up significantly but so is their cash which is over 3X as much as 2019 .

Forward analyst EPS estimates look great, general consensus among analysts for the full year of 2021 is $1.96 which is expected to grow consistently going forward to 2024 to $2.76.

They do have quite a bit of debt but all of it is long term and their cash is more than enough to meet requirements at this time with a current ratio of 1.7.

I have put a swing target on the chart but I think this would also be a good candidate for trend following . Noted on the chart is their eps reports, as you can see, the trend is to beat and earnings are consistently growing. Hopefully they can continue to raise their eps in this fashion, definitely starting to become a bullish trend.

Good luck ~