CBT trade ideas

Strong outlook for materials science companiesChemical and materials science companies like Cabot are going to be key players over the next decade in providing core resources to manufacturing, infrastructure, food supply chain, and energy independence for the US and other western countries.

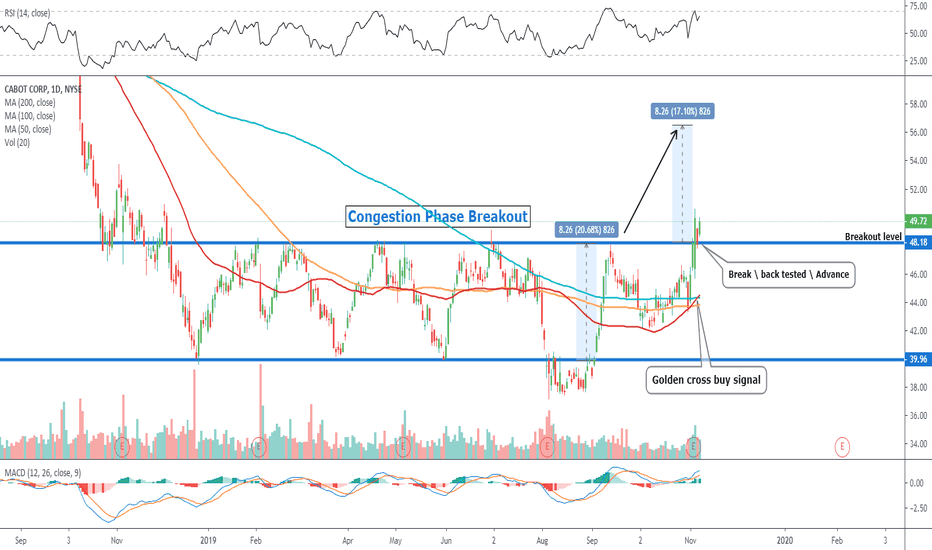

Additionally, Cabot looks ripe for a technical breakout at current levels - MACD bull crossover, RSI bull crossover, and a bounce off the mean in the SD channel which is also a key resistance level.

ForecastNotes:

Awaiting an earnings Surprise.

About CBT:

"Cabot Corp. is a global specialty chemicals and performance materials company. Its products are rubber and specialty grade carbon blacks, specialty compounds, fumed metal oxides, activated carbons, inkjet colorants, and aerogel. The company operates through the following segments: Reinforcement Materials, Performance Chemicals, and Purification Solutions. The Reinforcement Materials segment involves the rubber blacks and elastomer composites product lines. The Performance Chemicals segment combines the specialty carbons and compounds and inkjet colorants product lines into the specialty carbons and formulations business. The Purification Solutions segment refers to the activated carbon business and the specialty fluids segment. The company was founded by Godfrey Lowell Cabot in 1882 and is headquartered in Boston, MA."

Graphene technologyCabot is the leader in carbon black and graphene products development with a significant presence in China where Cabot's characteristics might make it an attractive takeover target. ATHLOS™ carbon nanostructures (CNS) are a unique network of crosslinked carbon nanotubes produced using a proprietary roll-to-roll chemical vapor deposition (CVD) process. ATHLOS 100, 200 and SR1200 CNS enable an optimal balance of conductivity, EMI shielding, mechanical strength and processability which makes them an excellent choice for applications requiring premium performance next-generation materials. Their next generation advanced carbons are enabling customers to develop lighter, thinner and smaller solutions. These materials are typically in the form of few-layered platelets and maintain some of the properties of pristine graphene such as two-dimensional platelet shape, aspect ratio and graphitic bonding. In energy storage applications such as lead batteries, the morphology of their graphene-based additive allows customers to: Improve battery cycle life in deep discharge applications, Maintain high discharge rates at low temperatures, Reduce negative plate sulfation, Improve negative electrode conductivity. In elastomers, the use of even small amounts of graphenes can: Increase modulus at a fraction of the loading of carbon black, Help eliminate performance trade-offs, offering their customers breakthrough product improvements. Do your own due diligence, your risk is 100% your responsibility. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Small incremental steps work : If you double a penny a day for a month it = $5,368,709. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, risk management

Beware of analysts motives

Emotions & Opinions

FOMO : bad timing

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

www.tradingview.com

$CBT with a neutral outlook projected The PEAD projected a neutral outlook for $CBT after a positive under reaction following its earnings release placing the stock in Drift A

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

$CBT Golden cross signal in Cabot CorpEntry level $50 = Target price $56

The fundamentals may not be particularly strong but the technical set up is.

The golden cross is a much sought after buy indicator, added to that the stock is breaking out of a 1 year congestion phase, technically the next step higher such replicate that range.

Company earnings

Cabot Corporation CBT reported profits of $33 million or 55 cents per share in the fourth quarter of fiscal 2019 (ended Sep 30, 2019), down from $94 million or $1.51 per share in the year-ago quarter.

Barring one-time items, adjusted earnings per share were $1.05, up from $1.00 in the year-ago quarter. However, earnings per share missed the Zacks Consensus Estimate of $1.10.

Net sales fell around 2.7% year over year to $827 million in the quarter. It lagged the Zacks Consensus Estimate of $847.8 million.

Growth in new business sales, strong commercial execution and cost-reduction actions helped the company to reduce the impact of continued weakness in the China business and global automobile production.

CBT, Cabot Corp. - Rectangle ready to BreakoutNYSE:CBT

What would I do when the price comes close on these two clear levels?

I will be on the side where the statistic gives favorable results.

If you are curious soon you will receive information that you can use to learn how to trade in the financial markets.

Trading is not particularly difficult or unusual.

A company also trades: on products, on services, on employees.

If you do not trade (of any kind), someone else will do it on your time...

So Stay Tuned and soon there will be news.

CBT Hits Long-Term Trendline Not Touched Since 2015, 15% upsideThis graphene maker has the potential for a 15% upside to the nearest resistance point as a minimum after touching it's long-term uptrend support last touched in 2015. Currently it has a 3.3% dividend yield and could surpass first resistance in the long-term.

CBT- possible Rising wedge formation Short trade potential. CBT is forming a huge rising wedge. Moneyflow is also running within a triangle formation. We would consider a short position if it breaks below & keeping it in watch list for now.

You can check detailed analysis on CBT in the trading room/ Executive summary link here-

www.youtube.com

Time Span- 12:40"

Trade Status: Pending

CBT- Long upward channel breakdown potential CBT is in weak speciality Chemical sector, and now running in a big upward channel. It has huge down side potential if the channel breaks down. We think it can decline to 36 area.

You can check our detailed analysis on CBT in the trading room/ Executive summary link here-

www.youtube.com

Time Span: 7:50"

Trade Status: Pending

OBV volume break + bullish candle sticks + MACD crossingDue to several days of strong positive volume the OBV has broken its downtrend and moves to the upside, indicating that there are accumulators at the current level. The prior days candlesticks are testimony to this as they both have elongated high wicks. The weak ADX shows us that the current downtrend is not that serious and thus it is possible to trade against the current downward move. Finally the MACD is crossing which may be an early indicator of a change of trend.