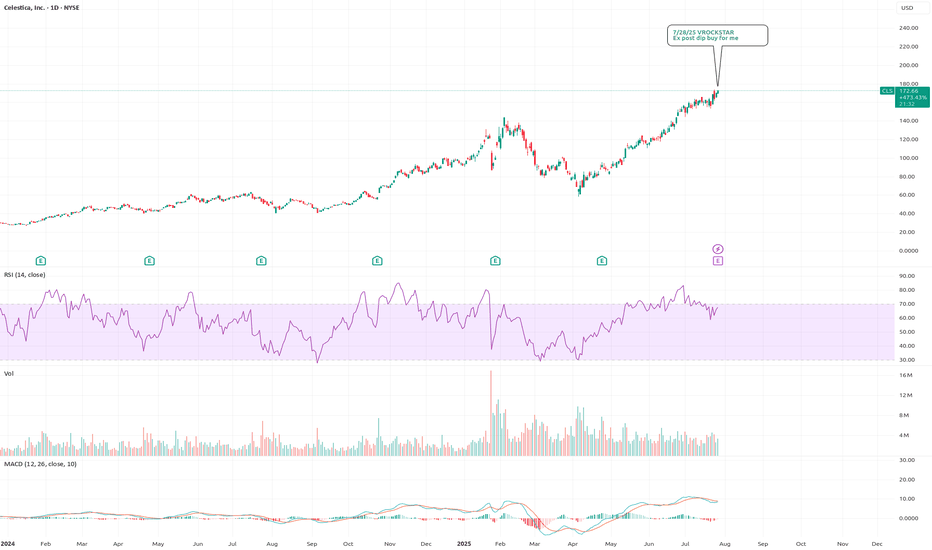

7/28/25 - $cls - Ex post dip buy for me7/28/25 :: VROCKSTAR :: NYSE:CLS

Ex post dip buy for me

- reminds of NYSE:GEV , great product, backlog, growth etc. etc.

- valuation at 2.5% fcf yield, low leverage and mid teens EBITDA for teens EBITDA growth++ is v reasonable

- don't really have an edge here, except to say.. i think any "miss"

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.75 USD

407.45 M USD

9.18 B USD

114.43 M

About CELESTICA INC

Sector

Industry

CEO

Robert A. Mionis

Website

Headquarters

Toronto

Founded

1994

FIGI

BBG000BPS2C3

Celestica, Inc. engages in the provision of supply chain solutions globally to equipment manufacturers and service providers. It operates through the following segments: Advanced Technology Solutions (ATS), and Connectivity and Cloud Solutions (CCS). The Advanced Technology Solutions (ATS) segment includes aerospace and defense, industrial, smart energy, health tech, and capital equipment businesses. The Connectivity and Cloud Solutions (CCS) segment consists of enterprise communications, telecommunications, servers, and storage businesses. The company was founded in 1994 and is headquartered in Toronto, Canada.

Related stocks

CLS Earnings Play - Bullish Setup (07/28)

📈 **CLS Earnings Play - Bullish Setup (07/28)** 💥

💡 *Earnings Confidence: 75% | Sector: Tech/AI Hardware*

🚀 **THESIS**:

* 🔋 19.9% TTM revenue growth

* ✅ 8-quarter beat streak (avg. +11.5%)

* 📈 RSI > 50D/200D MA → Strong momentum

* 🧠 Sector tailwinds from AI/data infra

* 💬 Analysts lagging price →

How Ride the AI Wave in 2025 | Top AI Stocks The AI boom is still making waves on Wall Street

Over the past 15 months, investors have injected more than $ 5 billion into tech sector funds. This surge was fueled by three consecutive interest rate cuts by the Federal Reserve in 2024, coupled with Donald Trump's presidential victory, which led

New Setup: CLSCLS: I have a swing trade setup. I'm looking to enter long if the stock can manage to CLOSE above the 5SMA. If triggered, I will then place a stop-loss below (SL) and a price target above it(TP-50%,move SL to breakeven), then using the close below the 10SMA as a trailing stop loss.

********

Note: Th

New Setup: CLSCLS: I have a green setup signal(dot Indictor). It has an good risk-to-reward ratio(RR:). I'm looking to enter long near the close of the day if the stock can manage to CLOSE above the last candle highs(white line). If triggered, I will then place a stop-loss below(SL) and a price target above it(TP

MY WATCHLIST: CLSCLS, an IBD50 stock now has a setup signal. Has an excellent risk-to-reward ratio. I'm looking to enter long near the close of the day if the stock can manage to CLOSE above the last candle highs(1). If triggered, I will then place a stop-loss below(2) and a price target above it(3).

CLS Holding at the 50 Fib Pivot Bullish CLS has shown rapid expansion and was well extended past a cup with handle formation and is now forming a base right at the 50 fib pivot level. We saw a pretty healthy retracement and now it is back on track to hit 60’s within the next few weeks. Strong fundamentals and earnings support the idea. Ec

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of CLS is 194.74 USD — it has decreased by −2.56% in the past 24 hours. Watch Celestica, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Celestica, Inc. stocks are traded under the ticker CLS.

CLS stock has risen by 17.41% compared to the previous week, the month change is a 30.38% rise, over the last year Celestica, Inc. has showed a 277.55% increase.

We've gathered analysts' opinions on Celestica, Inc. future price: according to them, CLS price has a max estimate of 243.77 USD and a min estimate of 206.96 USD. Watch CLS chart and read a more detailed Celestica, Inc. stock forecast: see what analysts think of Celestica, Inc. and suggest that you do with its stocks.

CLS stock is 5.87% volatile and has beta coefficient of 3.16. Track Celestica, Inc. stock price on the chart and check out the list of the most volatile stocks — is Celestica, Inc. there?

Today Celestica, Inc. has the market capitalization of 22.32 B, it has increased by 0.71% over the last week.

Yes, you can track Celestica, Inc. financials in yearly and quarterly reports right on TradingView.

Celestica, Inc. is going to release the next earnings report on Oct 27, 2025. Keep track of upcoming events with our Earnings Calendar.

CLS earnings for the last quarter are 1.41 USD per share, whereas the estimation was 1.25 USD resulting in a 12.29% surprise. The estimated earnings for the next quarter are 1.46 USD per share. See more details about Celestica, Inc. earnings.

Celestica, Inc. revenue for the last quarter amounts to 2.93 B USD, despite the estimated figure of 2.71 B USD. In the next quarter, revenue is expected to reach 3.00 B USD.

CLS net income for the last quarter is 214.48 M USD, while the quarter before that showed 85.94 M USD of net income which accounts for 149.57% change. Track more Celestica, Inc. financial stats to get the full picture.

No, CLS doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 3, 2025, the company has 26.86 K employees. See our rating of the largest employees — is Celestica, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Celestica, Inc. EBITDA is 1.07 B USD, and current EBITDA margin is 7.99%. See more stats in Celestica, Inc. financial statements.

Like other stocks, CLS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Celestica, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Celestica, Inc. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Celestica, Inc. stock shows the buy signal. See more of Celestica, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.