CMG trade ideas

Your Chipotle Burrito is about to go sour - $CMG Shorting this baby because:

1. Hammer candlestick on daily

2. Triangle forming with two red candles already

3. Price touching upper Bollinger Band

4. TD Sequential is at count #9. One of the next two candles will be a TD count #1

This is like a ripe avocado about to fall and get smashed into a nice little side of guac. I say "little" because the reward on the short side is not great considering the current strength of the stock. I would set the stop loss on the high of the TD #7 candle of Jan 3. I would take 50% profit at 9EMA, and close out the rest at 20MA. I would also play this with puts considering the price of the stock.

CMG, Chipotle Mexican Grill - Trailing StopNYSE:CMG

The head and shoulders is one of the most powerful trend reversal patterns.

If you add that it happens in companies that respect our parameters to enter and in which we like to further invest, and in this case also eat ;) then the only thing to do is to enter Long and ride the trend until the price action tells us to get out and wait for a new signal.

Technical Analysis + Money Management are the keys.

Good Trading to All!

$CMG Chipotle Could Reach $985Stock has reached its average analysts price target so re-rating could very well boost the stock.

P/E ratio 77 which is high but no one seems to cares.

Chipotle Mexican Grill, Inc. engages in the development and operation of fast-casual, fresh Mexican food restaurants throughout the U.S. It offers focused menu of burritos, tacos, burrito bowls and salads prepared using classic cooking methods. The company was founded by Steve Ells in 1993 and is headquartered in Newport Beach, CA.

$CMG Reversal trade in Chipotle Mexican GrillEntry level $745 = $target price $800 = Stop loss $723

Limited risk long entry with the rising 200MA acting as your stop loss.

CMG has had a massive gain in 2019 but has recently suffered from rotation back into tech, MCD had a impact on dragging the sector down also.

Its very difficult to defend the valuation and fundamentals of the company but analysts and investors seem to love it, the recent pullback seemingly presents a good trading opportunity,

Average analysts price target $843

P/E ratio is very high at 67.

Company profile

Chipotle Mexican Grill, Inc. engages in the development and operation of fast-casual, fresh Mexican food restaurants throughout the U.S. It offers focused menu of burritos, tacos, burrito bowls and salads prepared using classic cooking methods. The company was founded by Steve Ells in 1993 and is headquartered in Newport Beach, CA.

Strat 9: CMG 725-727PT, 737.5 Put(1) SL at Strike price

(2) Price Action breaking down toward the green MA, similar to SHOP

(3) Risk Reward: 1:10

(4) The main reason for the naked puts are because the VIX is up, SPY staggering, and strong down trend, plus quick retest to prev swing low ever 2-4 days

CMG playing hard to getI haven't given up on CMG but a daily close below $760.50 would mean a gap fill to $746 likely. Waiting for a close above $782 and then I think we are in for 20-30+ point run in short order with longer term view that we head to the upper end of the balance area.. 2 ways I like to play this... L common or 2 weeks out $800 calls while in the current price range of $765-$770 with stop below $757, targeting a move $790-$810+. The other way to play is wait for a solid move back into balance and either L upon that occurring or wait for a move up, then retest of the $782/$784 area for an anticipated move higher up. Look at the weekly/monthly chart too, to see we broken out and retesting the breakout area.

Start 7: CMG 770-760 Debit Put, Morning Star play(1) Low volume gap up Open, Initial trend down, Rising Vix

(2) Tuesday $20 move down, looking to repeat today or tomorrow.

(3) Consolidating at low of day as of the past 3 hours

(4) Break of Short term uptrend with consolidation

(5) 780 was a critical level, 1 HR wicks rejecting move above 780

(6) Drop may happen at break of 1HR 14MA(New Addition to help confirm my strat)

PT 760: calculated with ATR and prev drop range.

1.86 /c

9.30 PT

1:5 RR

CMG - Trade setupThe break of yesterdays hammer candle is pretty significant. If we can break my entry line I'll be playing this to the 200MA on the daily chart. Lets let it break this gap from July 24th to make sure we get no bounce. This could also be a good buying or bullish swing trade if we bounce off of this entry line..

CMGSo earnings were sold. Stock dropped 70 pts to bottom of recent 3 month range. Do we break down from here and continue run lower? I dont think that is the most likely scenario. IMO we bounce, or we drop below balance, stop some longs then move higher. I just dont think we liquidate much lower. I think this is an area where value seekers buy/add.

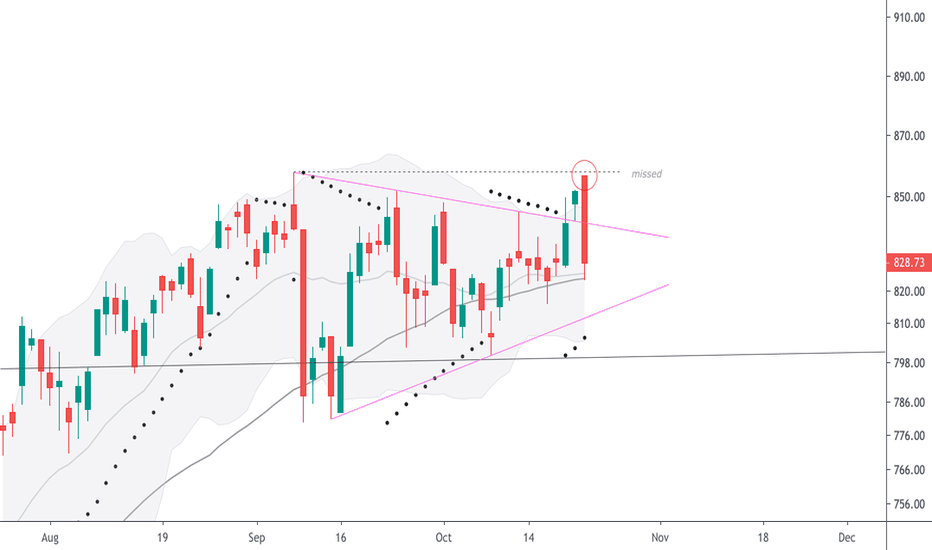

CMG Update (Important)CMG stock took a bad turn with its last-minute reversal, which unfortunately went below the critical level of 842 it took the edge off the bullish sentiment. It's now difficult to say if it'll break out above, as it missed the previous high of September 9th. The Heikin Ashi candle on the 'weekly' is still bullish and so are many other indicators, so I would personally rate this neutral into Earnings. Get out before close, or balance your trade.