COMP trade ideas

Hello BullishHello Again, entered long for Compass Inc. with shown entry, SL and TP1 and TP2 points.

I see daily candle confirmation. along with expected incoming interest rate variation, I expect booming. Let's us. Compare my analysis to yours and take it on your own responsibility.

As usual, this is not a financial advice.

Give me your thoughts!

COMP/USD – 30-Min Breakout Trade Setup!📌

🔹 Asset: Compass, Inc. (COMP/USD)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Symmetrical Triangle Breakout

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $9.10 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $8.60 (Break of Support & Triangle)

🎯 Take Profit Targets

📌 TP1: $9.61 (First Resistance Level)

📌 TP2: $10.28 (Final Target – Extended Move)

📊 Risk-Reward Ratio Calculation

📈 Risk (SL Distance): $9.10 - $8.60 = $0.50 risk per share

📈 Reward to TP1: $9.61 - $9.10 = $0.51 (1:1.02 R/R)

📈 Reward to TP2: $10.28 - $9.10 = $1.18 (1:2.36 R/R)

🔍 Technical Analysis & Strategy

📌 Symmetrical Triangle Breakout: COMP is forming a consolidation pattern with a breakout above $9.10 signaling bullish momentum.

📌 Trendline & Support Bounce: Price is testing key trendline resistance, with a breakout likely to push it toward higher resistance levels.

📌 Breakout Confirmation: A strong bullish candle closing above $9.10 with increasing volume confirms the trade.

📌 Momentum Shift Expected: Holding above $9.10 could trigger a rally toward TP1 ($9.61) and TP2 ($10.28).

📊 Key Support & Resistance Levels

🟢 $8.60 – Strong Support / Stop-Loss Level

🟡 $9.10 – Entry / Breakout Level

🔴 $9.61 – First Resistance / TP1

🟢 $10.28 – Final Target / TP2

🚀 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $9.10 before entering.

📈 Trailing Stop Strategy: Move SL to entry ($9.10) after TP1 ($9.61) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $9.61, let the rest run to $10.28.

✔ Adjust Stop-Loss to Break-even ($9.10) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If price fails to hold above $9.10 and falls back, it could indicate a false breakout—exit early.

❌ Wait for a strong candle close above $9.10 for confirmation before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Holding above $9.10 could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.02 to TP1, 1:2.36 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #COMP #BreakoutTrade #TechnicalAnalysis #MomentumStocks #ProfittoPath #TradingView #StockMarket #SwingTrading #RiskManagement #ChartAnalysis 🚀📈

COMP/USD – 30-Min Long Trade Setup!📊 🚀

🔹 Asset: COMP/USD

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Wedge Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: Above 10.23 USD (Breakout Confirmation)

✅ Stop-Loss (SL): Below 9.60 USD (Breakout Invalidated)

🎯 Take Profit Targets:

📌 TP1: 11.08 USD (First Resistance Level)

📌 TP2: 12.06 USD (Extended Bullish Target)

📊 Risk-Reward Ratio Calculation:

📈 Risk (SL Distance): Below 9.60 USD

📈 Reward to TP1: 11.08 USD

📈 Reward to TP2: 12.06 USD

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: A strong push above 10.23 USD signals bullish momentum.

📌 Pattern Formation: Bullish Wedge Breakout, indicating a potential upside continuation.

📊 Key Support & Resistance Levels:

🟢 9.60 USD – Strong Support / Stop-Loss Level

🟡 10.23 USD – Breakout Zone / Entry Level

🔴 11.08 USD – First Profit Target / Resistance

🟢 12.06 USD – Final Target for Momentum Extension

🚀 Momentum Shift Expected:

📌 If price stays above 10.23 USD, it could rally towards 11.08 USD and 12.06 USD.

📌 A high-volume breakout would strengthen the trend continuation.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure strong buying volume above 10.23 USD before entering.

📈 Trailing Stop Strategy: Move SL to entry (10.23 USD) after TP1 (11.08 USD) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at 11.08 USD, let the rest run to 12.06 USD.

✔ Adjust Stop-Loss to Break-even (10.23 USD) after TP1 is reached.

⚠️ Fake Breakout Risk:

If price falls below 10.23 USD, wait for a retest before considering re-entry.

🚀 Final Thoughts:

✔ Bullish Setup – Holding above 10.23 USD could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.13 to TP1, 1:2.46 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #COMPUSD #BreakoutTrade #TechnicalAnalysis #MarketTrends #ProfittoPath #DayTrading #MomentumStocks #SwingTrading #TradingView #LongTrade #TradeSmart #RiskManagement #StockBreakout #Investing #StockAlerts #ChartAnalysis 🚀📈

Symmetrical triangle on $COMP. Low Volatility ahead of earningsTechnical Setup: NYSE:COMP has shown lower highs and higher lows, forming a classic symmetrical triangle, suggesting potential for either a continuation of the current trend or a reversal.

Key Levels to Watch: Watch for a breakout above the upper trendline for a potential bullish move or a breakdown below the lower trendline for a bearish scenario.

Volatility Note: Low volatility is typical in symmetrical triangles; expect an increase in volume and price movement around earnings. Earnings reports are coming up on Wednesday, October 30th.

$compCan compass finally make a move after IPO? Was beat down during covid highs, beat down on interest rates, stock is down 90% since its public offering. Looks like it made a 100% move recently after hitting its 1.84 low... Stock looks like it is neutralizing- not sure how much longer the shorts can grab off a 90% sell off- looks like there is some opportunity opening up for bulls.

COMP long

Price is down 85% from the top at $22

They have been dumping equity stakes onto their own agents for 2 years as a voluntary alternative to paying out commission. Many people have been burned leading to a class action suit (several over their history)

They have 3 quarters of cash left

They are doing mass layoffs of 450 employees

I'm not giving away my price targets this time.

Get good.

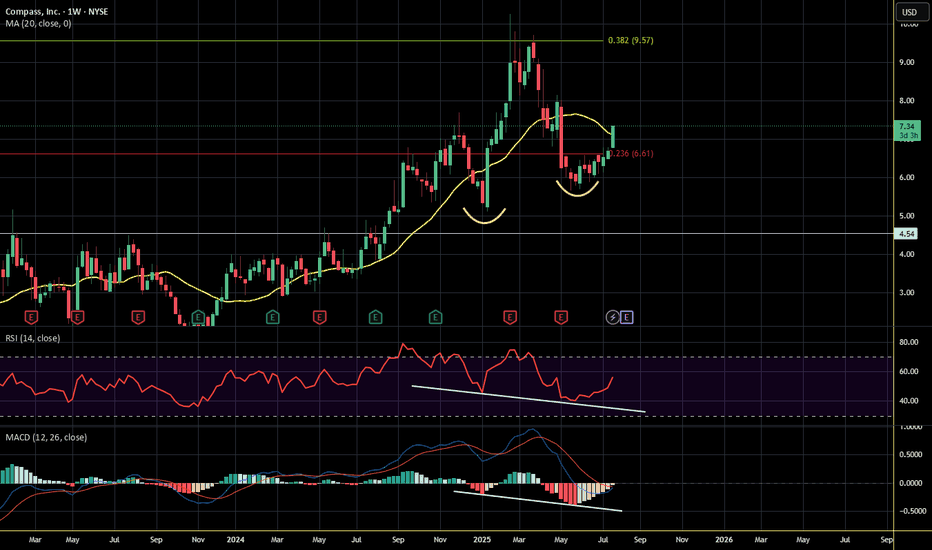

$COMP: Double Bottom with Bullish Divergence Channel BreakoutCOMP is Double Bottoming after showing 3 Instances of Bullish Divergence on the RSI and is now trading above an Assumed Channel which if it hold could signal a Break Hook and Go that could take it up to as high as a 1.618 Fibonacci Extension.

COMP Trade zones Taking a look at this stock because of a screener alert.

Here's a chart with zones marked. It looks like in the really long term you might see upwards of $13, but I wouldn't expect it to be higher than $18.

I think currently, $9 seems to be where this stock is heading.

A Monday morning dip could definitely be a buy opportunity to $9.

I also, am noticing a lot of trends in the market leading to march 17th through the 23rd which are showing a possible big movement (crash maybe). I'll keep watching, but just be careful around those dates.