Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.32 USD

−79.53 M USD

694.67 M USD

134.77 M

About Coursera, Inc.

Sector

Industry

CEO

Greg M. Hart

Website

Headquarters

Mountain View

Founded

2011

FIGI

BBG002WLDMW5

Coursera, Inc. is an online learning platform, which engages in the provision of online courses and degrees from universities and companies. It offers arts, chemistry, engineering, food, and nutrition, health, humanities, law, medicine, and music. The firm operates through the following segments: Consumer and Enterprise. The Consumer segment targets individual learners seeking to obtain hands-on learning, gain valuable job skills, receive professional-level certifications, and otherwise increase their knowledge to start or advance their careers. The Enterprise segment consists of serving businesses, governmental organizations, and academic institutions by providing an intuitive online platform with access to job-relevant educational content enabling them to train, upskill, and reskill their employees, citizens, and students, faculty, and staff, respectively. Coursera was founded by Daphne Koller and Andrew Y. Ng in 2011 and is headquartered in Mountain View, CA.

Related stocks

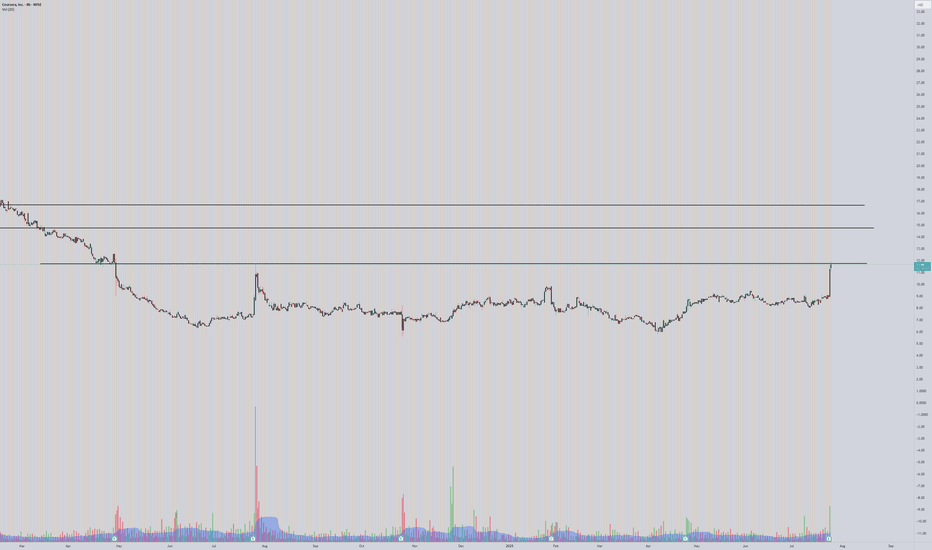

COURSERA Forming Bullish Continuation Patterns 🚨 $COURSERA Forming Bullish Continuation Patterns 🚨

$COURSERA is forming bullish continuation patterns and is approaching a key red resistance zone. A breakout above this level could signal a strong bullish move, with the first target at the green line level.

📈 Technical Overview:

Pattern: Bulli

Another 10 bagger potentialComparing the market cap of DUOL and COUR, I think this is very likely to happen!

vs

Show me a ticker with the potential to disrupt the educational system more than COUR!

Go to the platform and try it you will figure it out!

This platform democratized learning, I got my first certificate 9

$COUR long at $5.80?Coursera has been correcting ever since it IPOed. It hit a high of $60 and now it's declined nearly 90%.

Based on the chart, it looks like the downtrend should be ending soon. I'd like to see backtest of that trend line break at around $5.80 and a push higher to start the new bull trend.

Think we'

Navigating the Crossroads: Coursera's Market ChallengeCoursera (NYSE: NYSE:COUR ) has found itself at a crossroads in the ever-evolving landscape of the education technology industry. A significant market decline ensued after Goldman Sachs analyst Eric Sheridan downgraded the company, expressing concerns about the potential impact of generative AI tec

(NYSE: COUR) Why Coursera Inc's Stock SkyrocketedFundamentals

Coursera Inc (COUR, Financial), a leading player in the education industry, has seen a significant surge in its stock price over the past three months. With a current market cap of $2.8 billion and a stock price of $18.35, the company's stock price has seen a gain of 11.47% over the pa

Coursera Inc. Bullish Trend Price Momentum

COUR is trading near the top of its 52-week range and above its 200-day simple moving average.

Price change

The price of COUR shares has increased $0.74 since the market last closed. This is a 4.30% rise.

Opened at $17.47.

The stock opened $0.27 higher than its previous close.

Inves

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where COUR is featured.

Frequently Asked Questions

The current price of COUR is 12.05 USD — it has increased by 0.08% in the past 24 hours. Watch Coursera, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Coursera, Inc. stocks are traded under the ticker COUR.

COUR stock has risen by 41.16% compared to the previous week, the month change is a 43.45% rise, over the last year Coursera, Inc. has showed a 13.52% increase.

We've gathered analysts' opinions on Coursera, Inc. future price: according to them, COUR price has a max estimate of 15.00 USD and a min estimate of 9.00 USD. Watch COUR chart and read a more detailed Coursera, Inc. stock forecast: see what analysts think of Coursera, Inc. and suggest that you do with its stocks.

COUR reached its all-time high on Apr 7, 2021 with the price of 62.53 USD, and its all-time low was 5.76 USD and was reached on Apr 7, 2025. View more price dynamics on COUR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

COUR stock is 3.86% volatile and has beta coefficient of 1.78. Track Coursera, Inc. stock price on the chart and check out the list of the most volatile stocks — is Coursera, Inc. there?

Today Coursera, Inc. has the market capitalization of 2.02 B, it has increased by 3.35% over the last week.

Yes, you can track Coursera, Inc. financials in yearly and quarterly reports right on TradingView.

Coursera, Inc. is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

COUR earnings for the last quarter are 0.12 USD per share, whereas the estimation was 0.09 USD resulting in a 38.63% surprise. The estimated earnings for the next quarter are 0.08 USD per share. See more details about Coursera, Inc. earnings.

Coursera, Inc. revenue for the last quarter amounts to 187.10 M USD, despite the estimated figure of 180.52 M USD. In the next quarter, revenue is expected to reach 190.32 M USD.

COUR net income for the last quarter is −7.80 M USD, while the quarter before that showed −7.80 M USD of net income which accounts for 0.00% change. Track more Coursera, Inc. financial stats to get the full picture.

No, COUR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 29, 2025, the company has 1.26 K employees. See our rating of the largest employees — is Coursera, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Coursera, Inc. EBITDA is −47.26 M USD, and current EBITDA margin is −9.90%. See more stats in Coursera, Inc. financial statements.

Like other stocks, COUR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Coursera, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Coursera, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Coursera, Inc. stock shows the buy signal. See more of Coursera, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.