COUR trade ideas

COURSERA Forming Bullish Continuation Patterns 🚨 $COURSERA Forming Bullish Continuation Patterns 🚨

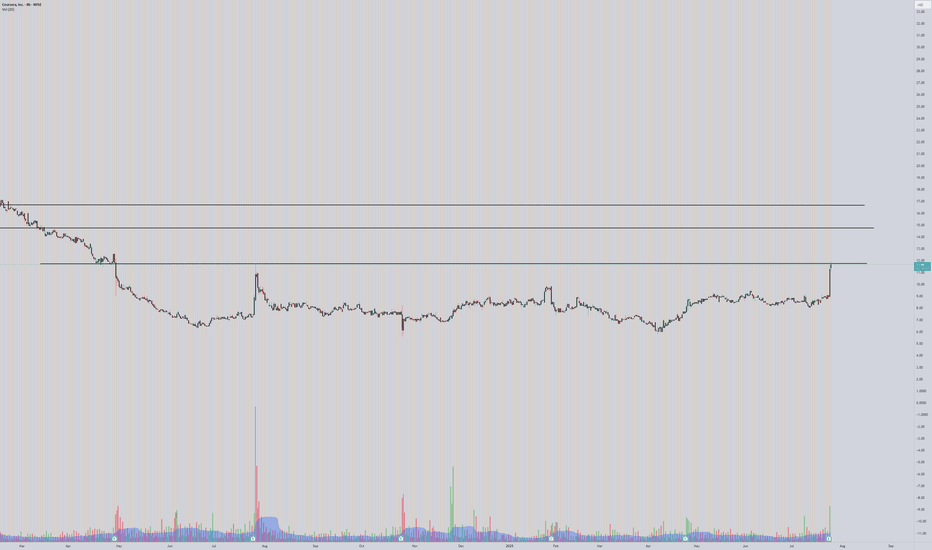

$COURSERA is forming bullish continuation patterns and is approaching a key red resistance zone. A breakout above this level could signal a strong bullish move, with the first target at the green line level.

📈 Technical Overview:

Pattern: Bullish Continuation

Resistance Zone: Red area currently being tested.

🎯 Breakout Target: Green line level upon confirmation.

Another 10 bagger potentialComparing the market cap of DUOL and COUR, I think this is very likely to happen!

vs

Show me a ticker with the potential to disrupt the educational system more than COUR!

Go to the platform and try it you will figure it out!

This platform democratized learning, I got my first certificate 9 years ago!

$COUR long at $5.80?Coursera has been correcting ever since it IPOed. It hit a high of $60 and now it's declined nearly 90%.

Based on the chart, it looks like the downtrend should be ending soon. I'd like to see backtest of that trend line break at around $5.80 and a push higher to start the new bull trend.

Think we'll likely see that $19 resistance get tagged after this chart bottoms so roughly 3x upside from the bottom.

Navigating the Crossroads: Coursera's Market ChallengeCoursera (NYSE: NYSE:COUR ) has found itself at a crossroads in the ever-evolving landscape of the education technology industry. A significant market decline ensued after Goldman Sachs analyst Eric Sheridan downgraded the company, expressing concerns about the potential impact of generative AI technologies on the education sector. This downgrade, coupled with the broader implications for the industry, has prompted investors to scrutinize Coursera's performance and future prospects.

Market Challenges and Downgrades:

Goldman Sachs' decision to downgrade Coursera's rating from Neutral to Sell, accompanied by a lowered price target from $18 to $14, was driven by apprehensions about the influence of generative AI technologies on traditional education offerings. Sheridan highlighted segments such as homework services, language learning, and virtual tutoring as particularly vulnerable to competitive product risks within the education technology industry.

The immediate market reaction saw Coursera's stock prices decline, with NYSE:COUR closing at $17.56 on January 20, 2024, reflecting a 10.32% decrease. The concerns raised by the downgrade and the subsequent drop in stock prices have left investors grappling with uncertainty.

Financial Analysis:

A closer look at Coursera's financials on January 20, 2024, reveals a complex picture. Despite experiencing a robust growth rate of 26.12% in total revenue, reaching $523.76 million for the past year, the company reported a net loss of -$175.36 million, indicating a decrease of 20.76% compared to the previous year. This contradiction between revenue growth and net losses underscores the challenges Coursera faces in turning its revenue into sustainable profits.

On a positive note, Coursera has managed to reduce its net losses since the last quarter, with a reported net loss of -$32.09 million. Additionally, the earnings per share (EPS) increased by 5.57% compared to the previous year, reaching -$1.21, and improved by 0.71% since the last quarter, reaching -$0.21. These metrics suggest that while Coursera is not immune to challenges, it is actively working towards mitigating losses and making progress on the path to profitability.

Navigating the Future:

Coursera's response to the challenges posed by generative AI technologies and the evolving landscape of online education will be crucial in determining its future trajectory. The company's commitment to adapting to market dynamics, reducing losses, and improving EPS reflects a strategic approach to sustainability.

Investors are advised to monitor developments surrounding Coursera, taking into account company news, industry trends, economic indicators, and market sentiment. While the recent downgrades and market decline may raise concerns, the mixed financial results suggest that Coursera is navigating challenges with a resilient spirit. Thorough research and consultation with financial professionals remain essential for making informed investment decisions in this dynamic and competitive sector.

(NYSE: COUR) Why Coursera Inc's Stock SkyrocketedFundamentals

Coursera Inc (COUR, Financial), a leading player in the education industry, has seen a significant surge in its stock price over the past three months. With a current market cap of $2.8 billion and a stock price of $18.35, the company's stock price has seen a gain of 11.47% over the past three months as of November 7, 2023. However, over the past week, the stock price has seen a slight loss of 0.11%.

Understanding Coursera Inc

Coursera Inc is an online learning platform that connects learners, educators, and institutions with the goal of providing world-class educational content that is affordable, accessible, and relevant. It combines content, data, and technology into a single, unified platform that is customizable and extensible to both individual learners and institutions. The platform contains a catalog of high-quality content and credentials, content developed by university and industry partners, data and machine learning drive personalized Learning, effective marketing, and skills Benchmarking among others.

The company operates through three reporting segments: Consumer, Enterprise, and Degrees, with the majority of revenue generated from the Consumer segment.

Profitability Analysis

Despite its impressive stock performance, Coursera Inc's profitability rank stands at a low 1/10 as of September 30, 2023, suggesting that the company's financial health could be better. The company's operating margin is -27.70%, which is better than 12.02% of 258 companies in the same industry. Its ROE is -22.25%, better than 13.36% of 247 companies, while its ROA is -15.73%, better than 10.38% of 260 companies. The company's ROIC is -73.33%, which is better than 2.69% of 260 companies.

Growth Prospects

Despite its low profitability rank, Coursera Inc's growth prospects appear promising. The company's 3-year revenue growth rate per share is -6.90%, which is better than 22.69% of 238 companies in the same industry. Its total revenue growth rate (Future 3Y To 5Y Est) is 19.28%, which is better than 82.35% of 34 companies. The company's 3-year EPS without NRI growth rate is -0.60%, which is better than 37.36% of 174 companies.

Top Holders of Coursera Inc's Stock

The top three holders of Coursera Inc's stock are Baillie Gifford (Trades, Portfolio), Jim Simons (Trades, Portfolio), and Ray Dalio (Trades, Portfolio). Baillie Gifford (Trades, Portfolio) holds the largest share with 18,053,679 shares, accounting for 11.98% of the total shares. Jim Simons (Trades, Portfolio) holds 869,900 shares, accounting for 0.58% of the total shares, while Ray Dalio (Trades, Portfolio) holds 246,392 shares, accounting for 0.16% of the total shares.

Technical Analysis

Price Momentum

COUR is trading near the top of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors have been pushing the share price higher, and the stock still appears to have upward momentum. This is a positive sign for the stock's future value.

Coursera Inc. Bullish Trend Price Momentum

COUR is trading near the top of its 52-week range and above its 200-day simple moving average.

Price change

The price of COUR shares has increased $0.74 since the market last closed. This is a 4.30% rise.

Opened at $17.47.

The stock opened $0.27 higher than its previous close.

Investors have been pushing the share price higher, and the stock still appears to have upward momentum. This is a positive sign for the stock's future value.

COUR (Long) - Impressive relative strength in a choppy marketFundamentals

I do not wish to dwell on fundamentals too much; I am more impressed by price performance and I am always guided by the price as I consider the collective wisdom of the market the best indicator

However, the growth of the company has still been strong, with sales consistently rising by 20% and above

Mainly though, Coursera has future - education does need to undergo a digital revolution and in this sense, the firm has a strong competitive edge . Hence, I would not discourage anyone from taking a longer-term position in the company

But this trade is focused on a more of a 6-month outlook

Technicals

As I tend to, I have been watching the price of NYSE:COUR for over a month; the price has done a decent climb and has been orderly consolidating for the past month.

Despite the turmoil in the broader markets, the price has never substantially decreased

Over the past year, it has formed a robust base built on top of an immaculate double top pattern

I am also big fan of the impressive relative strength against the S&P500 which can be seen at the bottom of the chart

Trade

I have not entered the trade myself as I am still waiting for a confirmation that the trend is going to continue upwards

One could enter now at a better price, but the probability that the trade works out is lower ; a clear breakout would give the idea more validity

The bottom of the consolidation range represents a clear stop-loss option

My main caveat is that I am pretty bearish on the overall market in the next 6-month window. So although the stock does not have to necessarily plummet down with the market, it will certainly complicate its upward trajectory. Hence, I would advice for some patience if you decide to go with the trade.

Follow me for more analysis & Feel free to ask any questions you have, I am happy to help

If you like my content, Please leave a like, comment or a donation , it motivates me to keep producing ideas, thank you :)

more upside in the long termPersonally I see A lot more upside from this stock, although there has been significant insider selling. The current valuation has stayed within the range of 17.75-18.75 during the recent bearish month of September. As we see a slight recovery in the markets today on friday sept 29 23 there is signs of volume entering and green within the equity market.

This stock being in the same category as Google has an will gain more traction in due time.

$COUR showing Relative Strength Keep an eye on this one as it's showing a lot of Relative Strength and Accumulation.

It recently broke into its stage 2 up trend and it's resisting the general market moves and showing signs of institutional demand.

Given the current market conditions, this may continue to range between 17.5 to 18.5.

We might see a flush of late buyers and might see a dip to the ~16.5/3 area.

Double bottom close to be confirmed, $COUR Coursera develops online education and learning platform designed to offer online courses, certifications and degrees.

It stands as 2nd in the IBD Industry Group Rank with a 93 relative strength rating, this means leadership.

Is also good to see that the ratio against NASDAQ:EDUT ; the industry bechmark, already broke out to new highs.

If it can breakout above $16.20 my target sell would be above $20, that is a +30% profit.