CRCL trade ideas

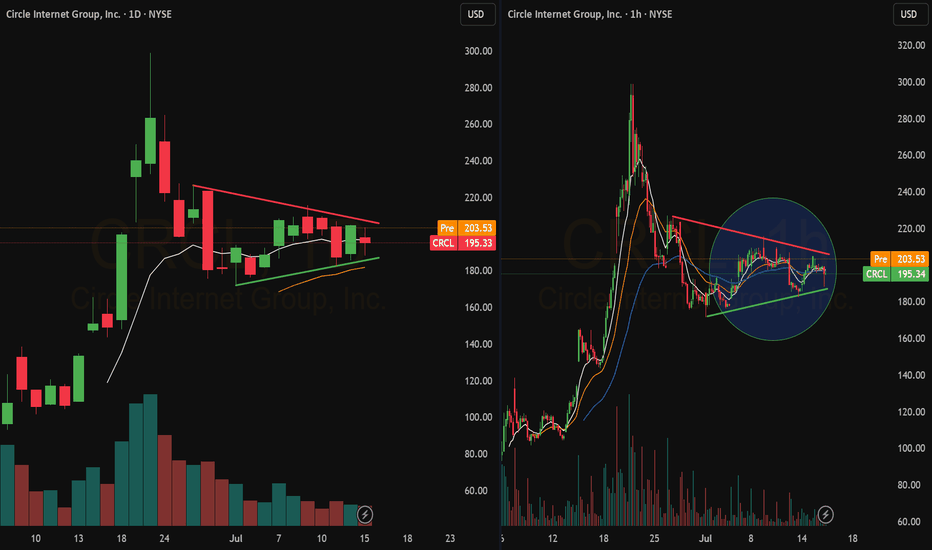

CRCL good pull back and prepare for a new Higher high1. Strong bullish momentum from $104 to $298

2. good pull back to 0.618 lv and the appear with a consolidation

3. a bullish breakout

4. after the breakout retest to middle lv of the range

5. another strong bullish momentum appear from $189 to $262

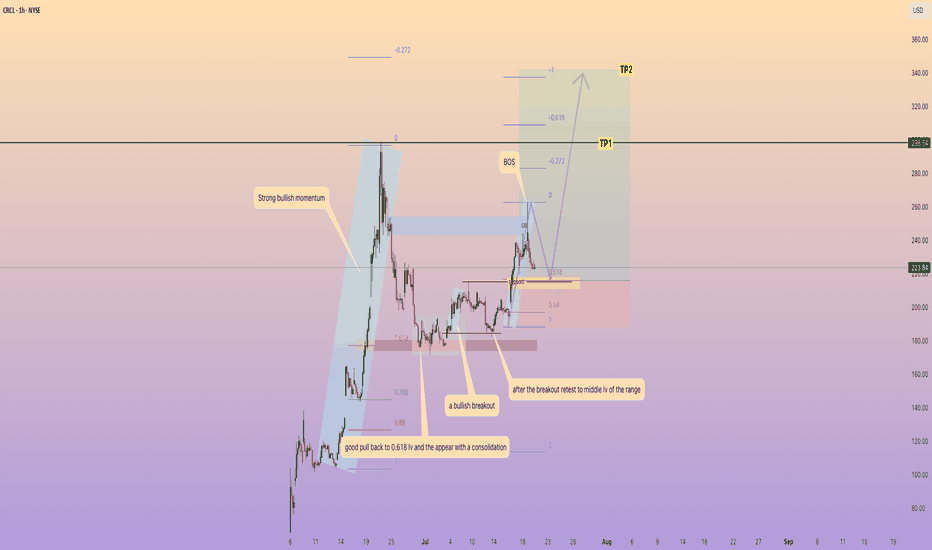

good setup at $216 is the lv of resistance-support + 0.618 pull back

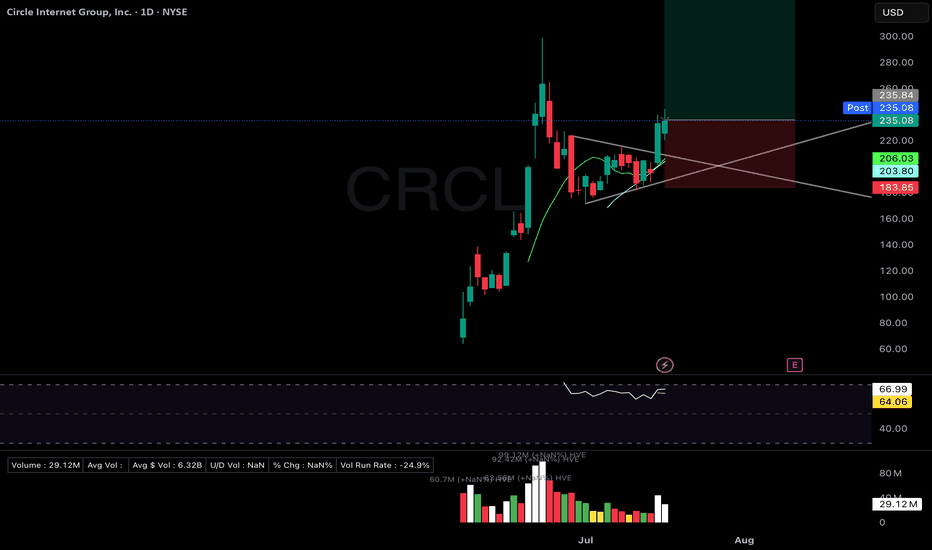

CRCL Right-side base forming post-IPO. Volume supporting accumCRCL – Circle Internet Financial (IPO)

Setup Grade: A

• Entry: $235.84 (7/17)

• Status: Active

• Trailing Stop: $183.85 (2x ATR)

• Setup: Right-side base forming post-IPO. Volume supporting right-side structure. Higher high after higher low. Sector: blockchain/stablecoins.

• Plan: Add on breakout over ATH $98.99. Hold with strict trailing stop discipline.

Why Circle Internet Group (CRCL) Could Reverse Course and Target

After a period of extreme volatility and sharp corrections, Circle Internet Group (NYSE: CRCL) is showing technical and fundamental signs that a reversal toward $240 is plausible. Here’s why investors and traders should watch for a potential rebound:

1. Strong Underlying Growth Drivers Remain Intact

Despite recent profit-taking, the core business fundamentals that fueled CRCL’s parabolic rise remain robust. Circle operates the world’s second-largest stablecoin (USDC), with over $60 billion in circulation and a dominant position in blockchain-based financial infrastructure. Its revenue model—primarily interest income from USDC reserves—remains highly lucrative in the current high-rate environment, and the company continues to expand its enterprise API and non-stablecoin revenue streams.

2. Technical Support and High-Volume Reversal Zone

The latest chart action shows that after a steep sell-off from highs near $299, CRCL found strong support in the $175–$185 range, coinciding with key moving averages and previous breakout levels. The stock has since stabilized and begun consolidating above these supports, with buyers stepping in on high volume—often a precursor to a reversal, especially after such a rapid drawdown.

3. Analyst Sentiment and Price Targets

Despite recent volatility, analyst consensus remains bullish. The average 12-month price target is in the $183–$230 range, with several analysts highlighting the potential for further upside if Circle continues to scale USDC and diversify revenue. The recent correction may have reset overbought technicals, giving the stock room to run if sentiment improves.

4. IPO Volatility and Mean Reversion

CRCL’s post-IPO performance has been extraordinary, with the stock surging nearly 750% since its debut at $31 per share. Such explosive moves are often followed by sharp corrections as early investors take profits. However, historical IPO data suggests that high-growth tech stocks frequently experience a mean-reverting bounce after initial corrections, especially when underlying fundamentals remain strong and speculative excess is flushed out.

5. Macro and Industry Tailwinds

Circle’s leadership in the stablecoin market positions it at the heart of the rapidly growing digital finance sector. As regulatory clarity improves and institutional adoption of blockchain accelerates, Circle stands to benefit from increased transaction volumes and new use cases, supporting a higher valuation over time.

Conclusion: The Path to $240

With technical support established, bullish analyst sentiment, and powerful industry tailwinds, CRCL is well-positioned for a reversal. If the stock can maintain support above the $180 level and regain momentum, a move back to the $240 zone—a key psychological and technical level from its recent trading history—is well within reach. Investors should watch for confirmation via increased volume and a break above short-term resistance to validate the reversal thesis.

Stablecoins, a huge piece of cake to be distributedThe core of stablecoins lies in payment and opening up channels for sovereign currencies to communicate with the US dollar. In other words, whoever can gain an advantage in the field of payment and exchange in the future will be the biggest winner.

CIRCLE has the advantage of first-mover speculation, which is why NYSE:CRCL can soar 300%+ in the secondary market, but the current profit model of USDC is basically only the US dollar interest. In the future, the income will shrink significantly after the Fed cuts interest rates. The market will start to think after calming down.

Market transactions are always based on expectations, not the present. Can USDC dominate the world in the future? I don’t think so. The first obstacle is USDT, which goes without saying. Second, as the entrance to traffic, Binance and TRX have already stood on the side of Trump’s family’s USD1. Grabbing the market through political power is at least very effective during Trump’s term. Third, many sovereign countries around the world are also issuing stablecoins anchored to the US dollar. It is unknown who will win.

If it is short-term speculation, then any target can be traded. For value investment, CRCL faces many challenges and needs to take one step at a time. Heavy gambling is not my trading style.

I will add more views on stablecoins later.

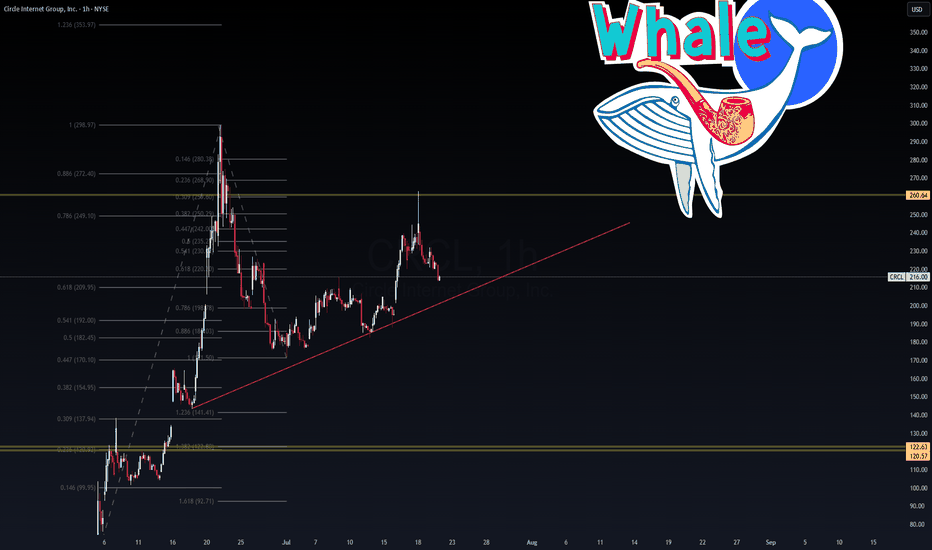

CRCL – Whale Watching Zone Activated🐋 CRCL – Whale Watching Zone Activated

Timeframe: 1H

Posted by: WaverVanir International LLC | VolanX Protocol

Status: Trendline Support Test

🎯 Key Fibonacci Zones Mapped

Circle Internet Group (CRCL) is holding a major ascending trendline, anchored from the July 8 pivot low. We’re monitoring the consolidation above $209–216 as whales defend key volume zones.

🔹 Upside Confluence:

0.786 fib = $249.10

Major liquidity level = $260.64

Extended target = 1.236 = $353.97 (high risk-reward whale zone)

🔻 Downside Triggers:

Trendline failure opens downside flush to $170.10 then $122.63

Strong defense expected at Fib golden pocket (0.618 at $209.95)

📊 VolanX Signal:

Market structure remains intact unless we break below $208 with volume. Any sweep of trendline + reclaim would activate a VolanX Bull Trap Reversal Play with whale targeting in the $260s.

🧠 Strategic Insight:

This chart screams accumulation to reprice, but a sudden liquidation flush is not off the table. Scaling into volatility with defined risk is key.

Analysis on circle using tpo and regular chart longs and shortMust watch video giving 2 really nice Risk reward entries on the Newley listed stock Circle

In this video I highlight a region using limited data of where to get filled if you missed the IPO and want to buy some circle .

We are currently in a no trade zone for buyers as I anticipate that price will gravitate down to the .786/.886 level over time .

In this video I also use the TPO chart "Time price opportunity" and demonstrate what i am looking for from using this type of chart to add to my confluences for a high probability trade .

Also identified in the chart is a short trade off of the weekly pivots and the value area high of the range .

Thankyou for watching and i welcome any questions

CIRCLE Stablecoin Revolution Circle is more than a crypto firm—it’s building infrastructure for a regulated digital dollar economy. With transparent reserves, global licenses, deep financial integrations, and robust blockchain functionality, USDC is rapidly positioning itself as a cornerstone of future finance.

I see a longer term potential for a great investment opportunity given the coming banking revolution involving stable coins.

For a lower risk entry, after a nearly 40% decrease in less than a week, the stock price is currently supported at the VWAP from the original IPO release.

Should the trend continue higher, I would prefer to see a bounce here on the stock.

CRCL | Long | Strong Institutional | (June 30, 2025)CRCL | Long | Strong Institutional & Regulatory Tailwinds | (June 30, 2025)

1️⃣ Insight Summary:

Circle (CRCL) recently pulled back after a massive IPO surge but is showing a strong bounce from key technical levels. With new stablecoin regulations coming and big partnerships, this could be setting up for another move higher.

2️⃣ Trade Parameters:

Bias: Long

Entry: Around $180 (supported by value area low, VWAP, and Fibonacci levels)

Stop Loss: $148 (Golden Fibonacci zone and recent key support)

TP1: $225

TP2: $265

Final Target: $378

3️⃣ Key Notes:

✅ CRCL was listed at $31 on June 5 and exploded nearly 700% to highs around $248 before pulling back ~24% on profit-taking and macro rate pressures.

✅ Major fundamental drivers include the GENIUS Act for stablecoin clarity, and big institutional partnerships (Fiserv, PayPal, Mastercard, Shopify, Ripple).

✅ Technical dynamics also show heavy short interest (~45% of volume) and high borrowing costs, which could lead to a strong short squeeze.

❌ Main risks: High valuation concerns (Compass Point targets $205), heavy exposure to interest rate changes, and rising competition in the stablecoin space (USDT, Diem, etc.).

4️⃣ Follow-up Note:

I’ll continue monitoring price action near $225 and $265 for partial exits and updates if momentum accelerates or structure changes.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

Circle - Buy the dip or short the hype?The ideal short was way above, as I discussed in my prior post, at $300. Using my Fibonacci analysis I was able to determine what was a good entry (around $100) and a good exit ($300). I'd prefer not to short now. We are sitting on support but we need a meaningful bounce above $180 - I remain doubtful for now.

At this stage I would prefer to look for another long, although I am not looking to catch a falling knife right here. What looks most probable to me is a failed pump and then a gap fill around $135, this could present a more compelling long. So far the golden pocket is holding up as support at $178. Monitoring this one closely and happy to go long if the volume supports the trade idea.

Keep an eye on this, the volatility is great, it's a trader's dream!

Circle - A Story of VolatilityThis stock is a traders dream. Huge volatility, good volume and respect of the technicals. I’m analysing this chart on the shorter term time frame. If you went long at the last golden pocket retracement, you made almost 350% gains in a short space of time. We have now pulled back approximately 40% from the highs of $300.22. Using Fibonacci analysis, it was an epic short at a key psychological level.

If we see a bounce here in the golden pocket, around $178, we could have another solid run up.

Watching this closely and trading it according to technicals, with stop losses. Not an investment or investment advice!

Technical Analysis of CRCL (4H Timeframe): A Test of Key SupThis 4-hour chart for CRCL illustrates a classic "impulse and correction" pattern within a powerful uptrend. After a parabolic surge to a peak near $300, the asset is now in a healthy pullback, seeking to establish a new level of support before its next potential move. The key question for traders is whether this correction is a pause or a reversal, and the chart provides critical levels to watch.

The Bullish Thesis:

A Confluence of Support

The primary area of interest is the $160 to $170 zone. This is not just a random level; it represents a powerful confluence of four distinct technical indicators, making it the most critical support zone to watch:

1. Previous Breakout Level: This zone was a clear area of prior resistance. Following the principle of "resistance becomes support," the price is now retesting this level from above, which is a classic bullish confirmation pattern.

2. Fibonacci Golden Pocket: The retracement from the recent high finds the 0.618 Fibonacci level—often called the "golden pocket" and a prime target for buying in an uptrend—located at approximately $153. The 160−170 zone sits just above this, making it the logical area for buyers to step in.

3. Ascending Trend Channel: The price action is contained within a well-defined ascending channel. The lower boundary of this channel, which has provided support throughout the uptrend, is currently intersecting with this key price zone.

4. Anchored VWAP: The light blue line, an Anchored Volume Weighted Average Price (AVWAP) starting from the beginning of the rally, is also trending directly into this support zone. Price holding above the AVWAP signifies that the average buyer from the start of the move is still in profit, which is a strong sign of underlying trend health.

The "Last Stand" Support

Should the primary support fail, the chart highlights a secondary, more significant demand zone at $110 to $120. This is identified as the Point of Control (POC) from the volume profile on the left. The POC represents the price level where the most trading volume has occurred, signifying it as an area of "fair value" and a magnet for price. A drop to this level would represent a much deeper correction but would likely be met with significant buying pressure.

Conclusion and Key Scenarios

Bullish Scenario : The most immediate bullish outcome is for the price to find a bottom within the 160−170 support zone. A strong bounce from this area, confirmed by bullish candlestick patterns and increasing volume, would signal the end of the correction and a likely continuation of the primary uptrend, with the previous high near $300 as the next logical target.

Bearish Scenario : A decisive break and close below the $160 level on the 4-hour chart would be a significant warning sign. This would invalidate the immediate bullish structure and open the door for a deeper retrace towards the Point of Control at 110−120.

In summary, CRCL is at a critical juncture. The chart is constructively poised for a continuation of its uptrend, but traders should watch the 160−170 confluence zone as the definitive line in the sand.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

6/23/25 - $crcl - Sizing up the short6/23/25 :: VROCKSTAR :: NYSE:CRCL

Sizing up the short

- mkt cap of this stonk is now greater than USDC mkt cap

- remember, as rates go lower... so do their "profits"

- competition in stables space is going to be insane, given it's such a simple product to offer

- i've never seen an IPO go 10x in like 2 weeks...

- so yeah. bubble. who knows what happens next.

- but i'm sizing this one up. not my first rodeo. size manage properly, always.

V

a lil simple math

let's say stable cap is 100 bn (it's not, it's 60 bn)

and they get 0.035 LT rate into perpetuity with 0.05 discount rate (i'm oversimplifying here and the way i justify this is let's just assume tons of adoption on the USDC mkt cap e.g. 50% higher and just put that at steady state - assume no competition)

- that's 3.5 bn divided by 5% = $70 bn. or equal to today's mkt cap. anything that we see in the stock here going fwd is just going to retrace, fundamentally... idk when. but we're already at FULL AF valuation, fundamentally. chart bros won't do that math for you. but i will :)

How We're Earning A 14%+ Yield Selling Puts On CircleWe’ve long been eager to invest in Circle Internet Group (CRCL), the issuer of USDC, due to its vital role in the crypto ecosystem and straightforward revenue model. After years as a private company, CRCL recently went public, and its stock has rocketed—from an IPO range of $27–28 to over $240—yielding a ~780 % return for early investors in just weeks.

🏦 Why CRCL Matters

Stablecoins at the core: CRCL issues USDC (USD-backed) and EURC (euro-backed), enabling fast, low-cost transfers, lending, and payments across crypto platforms and institutions.

Infrastructure built for compliance: With a transparent, regulatory‐friendly setup, CRCL is poised to benefit from institutional adoption and improved global financial inclusion.

Favorable regulation incoming: A pro-stablecoin bill passed the U.S. Senate last week, potentially streamlining fragmented rules—a huge win for CRCL’s legitimacy and future growth.

📈 Revenue & Scalability

Interest income engine: CRCL earns revenue by investing reserves (from issued stablecoins) in treasuries and cash securities.

Low incremental costs: Issuing more stablecoins doesn’t significantly raise costs, giving the business strong operating leverage.

Cyclical dependence on interest rates: As the Fed signals rate cuts, CRCL’s margins and profits may experience pressure despite growing stablecoin usage.

💰 Valuation Concerns

Stratospheric multiples: With a market cap of ~$52 billion against ~$1.8 billion in annual revenue, CRCL trades at ~29× sales and ~305× earnings—levels we find tough to justify given the interest-rate dependency.

Short- to medium-term softness: With expected rate cuts, we believe near-term margins could contract, likely keeping multiples high or valuations pressured.

🔧 Our Preferred Strategy: Selling Puts

Rather than buying CRCL outright at these levels, we’re selling put options—specifically the October 17th $80 strike puts, currently priced around $3.80:

Attractive yield: Generates about 4.5 % over 117 days, annualized to ~14.3 %.

Flexibility: If CRCL stays above $80 by October, we pocket the premium; if it falls below, we buy at an effective cost basis near $76.20—a steep discount (66 %) to today’s stock price ($240).

Risk‑reward balance: We get income now, plus optionality to own CRCL at a safer valuation if assigned—potentially capturing long-term upside without front-loading risk.

⚠ Risks to Watch

Assignment downside: If CRCL collapses to zero, we’ll still owe $80/share—mirroring stock-ownership risk.

Interest-rate sensitivity: Profits remain tied to rate levels; moves down could crimp margins even if adoption grows.

Systemic risks: Any regulatory, technical, or confidence failure around stablecoins or USDC could materially impact CRCL.

🧭 Our Conclusion

We see CRCL as a high-potential yet pricey bet today. However, selling deep out-of-the-money puts allows us to capture compelling yield while preserving upside optionality to own shares at a discount. It blends income generation with strategic positioning in a high-conviction long-term theme.

Rating: Hold — we prefer income and optionality over full exposure at the current valuation.

CRCL LOOKS OVERBOUGHTAs you can see after a good ride from 102 to 234 now the stock looks overbought. and on shorter time frames the price action shows a classic pattern of double top and breaking the previous support. simply if the stock closes 15 m candle below the support you might see a short retest to the support from downside that is a good point to short.

CRCL (“Circle”) | Long | Stablecoin | (June 17, 2025)CRCL (“Circle”) | Long | Stablecoin & Institutional Crypto Infrastructure | (June 17, 2025)

1️⃣ Short Insight Summary:

Circle, known for its USDC stablecoin and institutional crypto infrastructure, displays a financially solid foundation with healthy free cash flow and an evolving product footprint, making it a compelling long-term play.

2️⃣ Trade Parameters:

Bias: Long

Entry: Blue-chip levels in the $100–$120 zone (assumed range near current $160)

Stop Loss: ~$90 (well beneath key support zones)

Take Profit 1 (TP1): $200 (psychological & projected 5‑year mid-target)

Take Profit 2 (TP2): $250 (upper end of 5‑year expectation)

3️⃣ Key Notes:

✅ Latest revenue: ~$1.6 B with net income around $155 M; ~82–87 M floating shares, market cap ~$3 B.

✅ Free cash flow is ~6x less debt and matches cash levels—pointing to strong liquidity and balance sheet health.

✅ CEO Jeremy Allaire (since 2013) leads Circle’s path from peer payments to global crypto-financial infrastructure.

✅ Core stablecoin USDC, built on numerous chains (Ethereum, Solana, Polygon, Optimism…), fuels 24/7 trading and reserves—~98% of income comes from net interest on reserves.

✅ Major partnerships include Visa, Shopify, Walmart, Ripple, Ledger, Coinbase, plus backing from Goldman Sachs—highlighting institutional trust.

✅ Regulatory-first design and transparency position Circle favorably amid evolving global crypto frameworks.

4️⃣ Optional Follow‑up Note:

Will track key industry catalysts: regulatory clarifications (e.g. EU’s MiCA), stablecoin adoption rates, yield curve shifts impacting interest income, and enterprise integration announcements.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you find value in this idea! Also share your thoughts and charts in the comments section below! This supports keeping content free and reaching more people.

6/16/25 - $crcl - I'm short6/16/25 :: VROCKSTAR :: NYSE:CRCL

I'm short

- it's much easier to find shorts in this tape than the converse

- NYSE:CRCL is the chitstablecoin that broke a few yrs ago and nobody serious in "crypto" (when i mention "serious" i mean bitcoiners) uses

- they basically hold deposits and give you a USD-style token and earn the spread

- but if you look at financials... they don't make nearly as much $ as they should on these deposits

- ofc they'll tell you they're doing a lot of other silly things

- "yes" stables and the stables economy r red hot (hence the stonk price reaction). also kudos to them for IPO'ing in this window. it was really a great time to do it. so hats off.

- but what is an inferior stable (USDT/ tether is the only legit product on the market) worth?

- multiple hundreds of times PE?

- 10x book?

- guys... this is basically a one-trick-pony-bank, they aren't reinventing the wheel, and most products built around USDC won't likely be launched by circle b/c the org is slow/ expensive and will be highly regulated to doing such things in a reasonable window of time

- so will it go higher? idk. idc. i'm looking for shorts.

- this one is a bit OTM for oct. it's a helluva expensive short, probably for good reason

- but i don't think this valuation holds

- and it's great offset/ hedge to my monster OTC:OBTC stack, which i expect a convert in the next 2-3m to ETF, which means 15% upside on this holding. so i need an offset here, hence i'm looking for some beta-adjacent hedges.

V

CRCL Weekly Bearish Setup (Week of 2025-06-09)📉 CRCL Weekly Bearish Setup (Week of 2025-06-09)

🔍 Ticker: NYSE:CRCL

Multi-model AI consensus indicates a bearish short-term outlook for CRCL this week, driven by weak technicals, downside pressure from max pain, and poor option liquidity.

🧠 Model Summaries:

🔹 Grok/xAI

• 📉 Bearish: Price below 10EMA, negative MACD, RSI near 41

• 🧊 Support: $115.20 | Resistance: $116.34

• ⚠️ Max Pain: $100 → downside bias

• 💡 Trade: Buy $115 Put (Jun 20) → PT: +50%, SL: –50%

🔹 Claude/Anthropic

• 📉 Bearish intraday: below EMAs, negative MACD, RSI ~41

• ⚠️ Max pain at $100, light OI → downside risk

• 💡 Trade: Buy $115 Put @ ~$12.95 → Target 30–50%, SL: 25%

🔹 Llama/Meta

• ⚖️ Mixed: Slight short-term bearish tilt, but warns against poor liquidity

• 💸 Trade: No Trade due to spread/premium inefficiency

🔹 Gemini/Google

• 📊 Daily trend bullish, but intraday showing exhaustion

• ⚠️ Extreme spreads, no open interest

• 💸 Trade: No Trade recommended

🔹 DeepSeek

• 🚨 Strong Bearish: Breakdown of $115.20 w/ volume, negative MACD, RSI ~41

• ⚠️ Sentiment: Max pain at $100 + bid-side put action

• 💡 Trade: Buy $115 Put @ $12.70 → PT: $18.90 (+50%), SL: $8.82 (–30%)

• 🔥 Confidence: 80%

✅ Market Consensus:

📉 Outlook: Bearish Bias

– Short-term momentum is weak (price < EMAs, MACD negative)

– RSI ~41 suggests downside room

– Max pain at $100 = gravity effect

– VIX falling = no panic relief for bulls

– Key Level to Watch: Breakdown below $115 = confirmation

📌 Suggested Trade Setup

🎯 Symbol: NYSE:CRCL

🟢 Strike: 115 PUT

📅 Expiry: 2025-06-20

💵 Entry: $13.30 (ask)

🎯 Profit Target: $19.95 (+50%)

🛑 Stop Loss: $9.31 (–30%)

📈 Confidence: 75%

⏰ Entry Timing: At open

⚠️ Risk Watch:

• ☠️ High premium & wide bid-ask spreads = slippage risk

• ⛔ Low open interest = exit uncertainty

• 🕒 Theta decay accelerates late in the week

• 📈 Invalidated if price breaks above $116.34

• 📰 Unexpected crypto/news rallies = trend reversal risk

📊 TRADE JSON

💬 Are you trading this NYSE:CRCL bearish setup? Share your thoughts below.

📉📈 Follow for daily AI-powered trade breakdowns.

Buying CRCL after IPO — expecting a strong move like SEZLCRCL just hit the market after its IPO and is already showing signs of strength. This setup reminds me a lot of SEZL — after it went public, we saw a strong consolidation phase followed by a confident rally.

Right now, CRCL looks like it’s building a solid base. I'm starting to buy around current levels, expecting demand to grow. As long as the structure holds and buyers stay active, I see a good chance for continuation to the upside.

New IPOs like this often attract attention, and I’m treating it as an early opportunity. Same playbook as SEZL — patience and positioning.