DurchfallWe have been broken through the low of October/November 2023. In January we did not succeed yet but now we have managed to. Hopefully we can remain under this support until the end of February. But anyway the break is a short signal and the present attempt to retrace upward may be seen as healthy profit taking of weak hands.

CRL trade ideas

CRL: bullish megaphone patternA bullish trend is applicable above 206.00

Further bullish confirmation for a break above 216.00

The target price is set at 224.00.

The stop-loss price is set at 202.00.

An incomplete bullish megaphone pattern is busy developing.

Furthermore testing its 200-day simple moving average as well as its 23.6% Fibonacci retracement level.

Charles River Labs is Leaking and now Sinking. CRLWe are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

CRL offering an early entry with a pocket pivot?* Exceptional earnings

* Very strong up trend

* High RS in the Healthcare industry

* Pocket pivot occurring on the right side of a rounded constructive basing pattern

Trade Idea:

* You can get in now as indicated

* Or if you're looking for a slight discount you can look for an entry near the $423.63 area

CRL Short PredictionA very short prediction for CRL............................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

Charles River Laboratories Q2 Profit, Revenue RiseStock suggested by my dad as one to watch. Nice strong upward trend with financials also headed in the right way.

Might be a bit expensive at the moment looking at the RSI, so on the watch list waiting for a bit of a pullback prior to any entry decisions.

Worth a look.

Swing trade entry using hammer candlestickEntry above the hammer as indicated by the

arrow. The price will probably come down for

the next several days before reversing(I am

anticipating a bear trap at around $164). If bulls

begin appearing then it should rise to the order

entry. At this point it will make another

attempt to break all time highs. I will take some

profit here and expect a small rest before

breaking ATH, and eventually reaching target 2.

CRL: Long opportunityAn intraday high potential, Back Tested Long Analysis.

We ll try to enter into the correction of the uptrend movement.

DETAILS ON THE CHART

NOTE: Entry range area above the entry point, is calculated upon 80% of the recorded pullback back tested past performances

DISCLAIMER: This is a technical analysis study, not an advice or recommendation to invest money on.

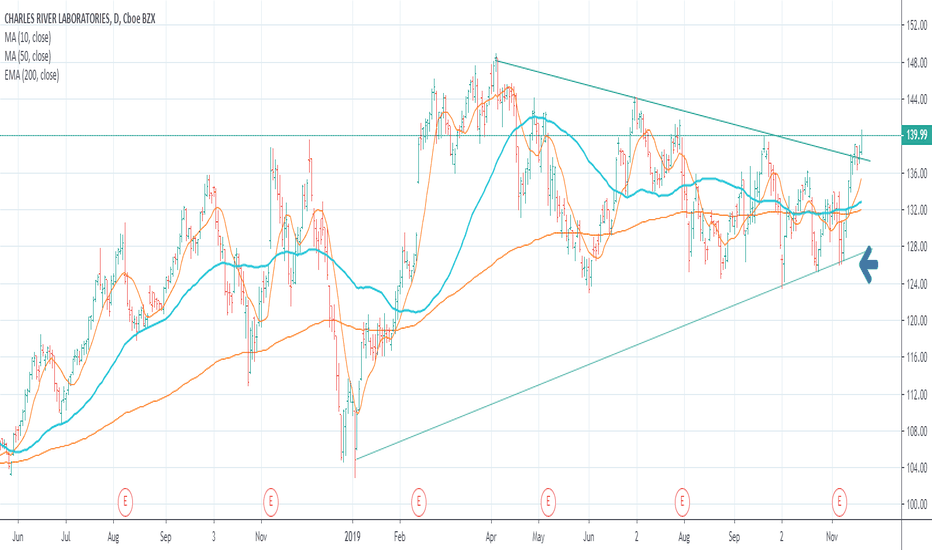

CRL breaks out on higher volumeCRL is a stock which has recently appeared on my watchlist after comfortably clearing the double top formation from 2008. It had begun to trend well prior to this (since the golden cross in September 2014 - although price did retrace to retest the 200ma a few weeks later).

The gap up on 11th February saw price convincingly clear the $70 round number and recent pivot high but, due to this being a major resistance zone, we wanted to wait for further confirmation of the trend. There was no retest of the $70 zone but we have had two bull flags since then, so yesterday's breakout bar (a very bullish bar on higher volume) gives a very good entry.

The one downside of this stock is the lowish volume. Plus there are several other opportunities today which may provide higher probability set ups.