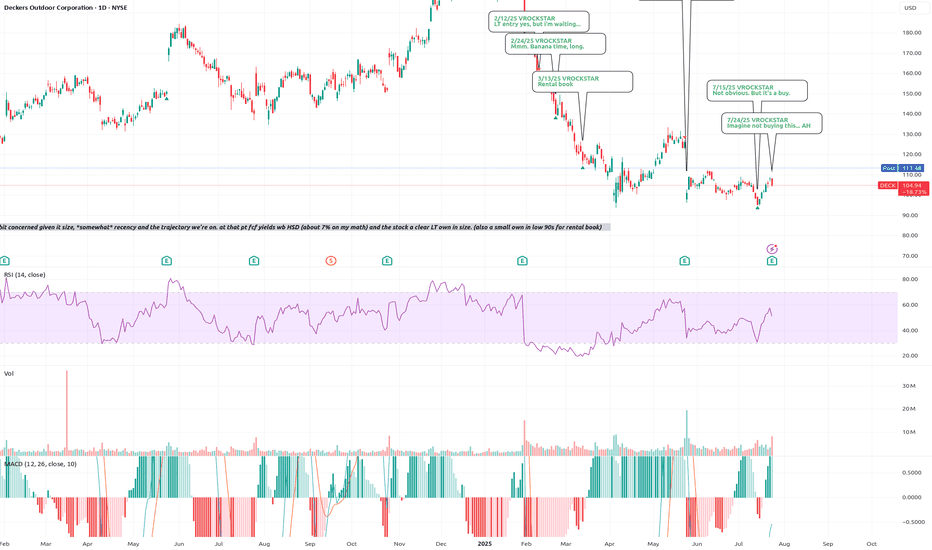

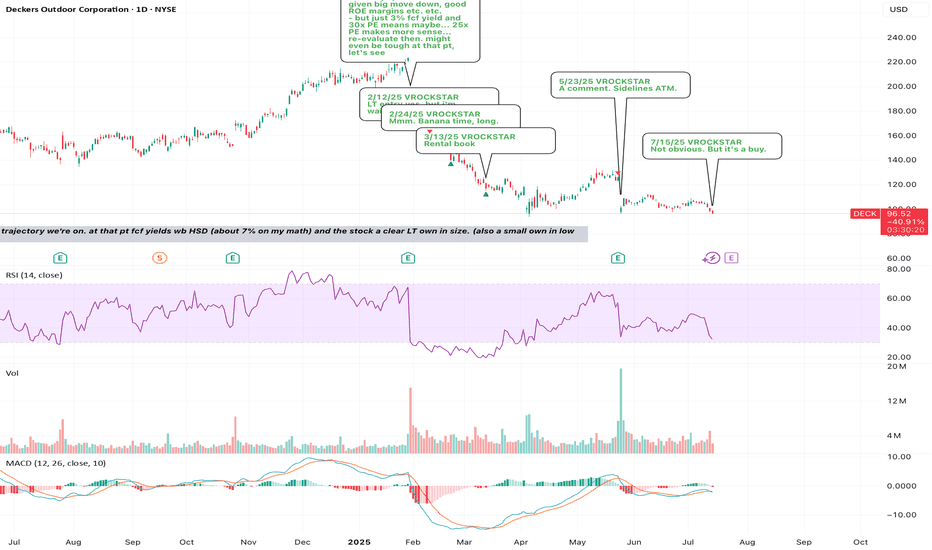

8/1/25 - $deck - 50% position8/1/25 :: VROCKSTAR :: NYSE:DECK

50% position

- if you have followed long enough, you know that when i write this sort of thing, it's maybe 5-10x a year, at most

- i still think anything can happen here in the mkt, so there are a lot of arrangements i've made in my portfolio to account for further drawdowns

- with that being said, conservatively DECK is 6% fcf money, and on my #s probably closer to 7%. when you're growing minimally MSD (nevermind HSD+) eventually this gets revalued

- so my preference is to barbell exposure

- i have a LT exposure w ITM leaps (jan '27 expire) and then i have my jet fuel that i'm burning in the last few sessions to get exposure higher

- think about it like this

- if 1 unit of risk costs me $1 today and $10-15 in 2027, if in this type of tape we leg down... if i say had 1 unit of risk on both of those exposures, i'd lose 1 on the first (zero) and then maybe 2...3...4 on the other.

- which is to say, as we go lower here, i eventually find myself growing that LEAP exposure quite large. rn it's about 25% of my effective book on about 5x leverage. and the other 25% is spread between 10-1 and 20-1 leverage.

if you look at ANF post results a month or so ago, this looks VERY similar and there are a lot of similarities in terms of how shorted/ positioning was into the event (same with NASDAQ:LULU btw, yet to report). by the 6th day... we ripped back to the first fib band.

- that would put next week at 107/108 and if mkt is bid, we hit 110 again. so that's why i'm using the 10-1 and 20-1. it's actually in part a trading call as well backed by my own view/ conviction on fundamentals. i think the flows today took us now far below fair value and we've filled the pre-earnings gap, which was important to point out.

- still doesn't rule out the mkt continues to puke, this is weak beta etc. etc. but from a 12-18 mo POV... this is money good in my estimation no matter what strike, unless you're degen'ing 10 delta BS (not recommended but also not my $, u do u)

be well

remember in this tape we all lose money

it's just important to lose less and find spots that will get bid back first, i think deck is one of those *for me

V

DECK trade ideas

7/30/25 - $deck - Degen time.7/30/25 :: VROCKSTAR :: NYSE:DECK

Degen time.

- look at the last NYSE:ANF report... and tell me you're not noticing the exact same pattern. massive rip. massive gap fill retrace.

- do we re-test pre-report levels mid to low $100s?

- that's what keeps me buying ITM leaps here, but going quite large

- i'm trying to figure out w/ $V report, consumer spending... all consistent w my views, why this doesn't become just the most obvious winner into 2H and '26

- so i'm buying myself some time w/ these expires and ITM

- but it's degen time.

V

7/28/25 - $deck - De risked, a few ways to play7/28/25 :: VROCKSTAR :: NYSE:DECK

De risked, a few ways to play

- mid teens PE

- 2 brands hitting on all strides (pun intended)

- great result, everyone offsides

- the action you're seeing here is MM re-adjusting post pop

- can buy spot/ sell covered calls for healthy mid 40s IV and roll

- my sense is sub $110 you are getting almost a simple play into YE and anything lower is increasing value (mid singles FCF yield growing DD, "yes please")

- so yeah, i like NASDAQ:LULU b/c of the google trends and valuation etc. etc. (go check that one out before tradingview removes it a third time)

- but this one back in the sub $115 zone is comfy like an (h)ugg

V

7/24/25 - $deck - Imagine not buying this... AH7/24/25 :: VROCKSTAR :: NYSE:DECK

Imagine not buying this... AH

- amazing to listen to the mental degradation of "sell side analysts".

- the quarterly ritual when real shareholders must endure management answering the room temperature IQ questions from these "research" providers is a circus

- right now there's a sell side "analyst" demanding an explanation for how 1 + 1 = 2. "put some meat on the bone" he says

- then he interrupts

- it's really amazing the way Elon handles these retards, i wish more mgmt teams would simply tell these folks the truth

- but alas

results is a smash. forget the minutia

- big revenue beat

- key brands growing (lol NYSE:NKE is not even growing and trades 2x multiples)

- buying back shares

- DTC is a tailwind

so weird AH action to see +15-20% then retrace to +2%

i'll be sizing this up and will respond tmr/ what i'm deciding. will be taking the 6x leverage on 1% 6mo ITM leverage to probably 2-3x leverage on 18 mo (jan '27) expires and targeting a gross of ~10%.

be well. enjoy.

V

Long $DECK - NYSE:DECK is the only growth story I'm comfortable buying. This was wall street darling for many years. I believe sell off was overdone.

- It has lot of room to run. It is getting traction and NYSE:NKE because of law of large number is not growing much in %age.

- However, NYSE:DECK has lot of road ahead and it can grow for many years to come. Global expansion is also not out of the question.

- I strongly believe NYSE:DECK will make an all time high when this tariff narrative takes a backseat.

- Another bullish thing for NYSE:DECK is that Trump doesn't plan to bring back shoes or clothing manufacturing back in US.

7/15/25 - $deck - Not obvious. But it's a buy.7/15/25 :: VROCKSTAR :: NYSE:DECK

Not obvious. But it's a buy.

- will reiterate that i'm not on tape so closely this week, but will revert w any comment replies by next week; nevertheless i'm checking in here on the tape

- see what T did today on NVDA/ China?

- you think it's easier or harder to resolve some of these discretionary names in the meanwhile vs. nvda H20s to China?

- exactly.

- even NKE put up pretty barfy numbers and the stock was like well... who cares

- i think we're reaching that point with NYSE:DECK here after seeing NYSE:NKE , then reading between the lines on NASDAQ:NVDA ->consumer/discretionary tariffs etc. etc.

- rates will come down, the consumer is tapped out, new fed chair on deck etc. etc.

so the way I'm playing this:

i've bought some ITM calls for aug 15 expiry. why? because it allows me to get proper MSD size (3-4%) but pay only 30-40 bps (10x leverage). the thinking is this... if stock pukes on this result, i'm high conviction that 80% scenario i'd want to load TF up. and if it rips/ or if T has a favorable bowel movement in the meantime... this will rip and off the *extreme* (remember - extreme positioning always gets you the best rewards... but TA doesn't tell you where the bottoms are as much as fundamentals IMVVVHO)... then you get a double whammy and stock is back in the $110s+. so the R/R is v good. but i don't want to get crushed if the stock/ macro work against me and need some wiggle room.

eye'ing LULU too.. but i like valuation and R/R on NYSE:DECK better esp given the NYSE:NKE print and their multiple-brand-multiple-disty strategy vs. say lulu's own-disty strategy.

V

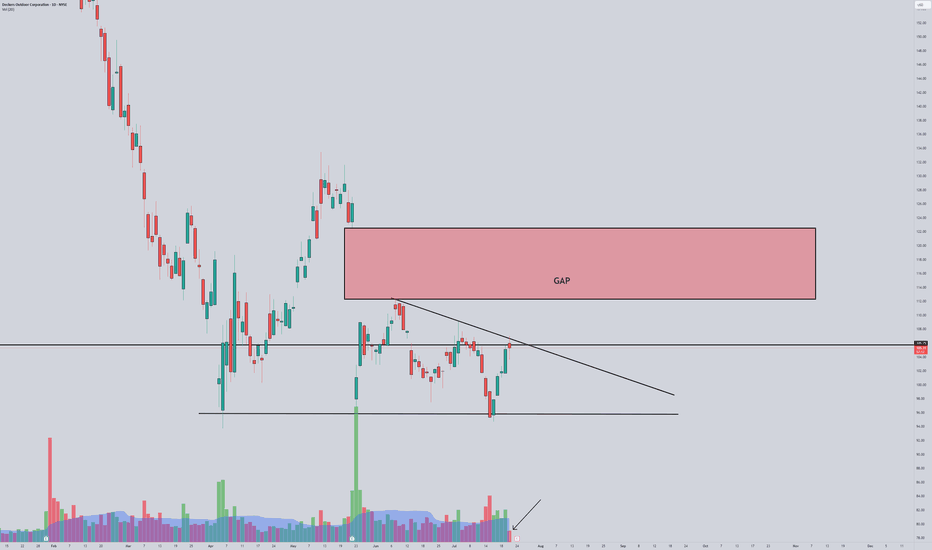

DECK - Is the GAP fill inevitable?📰 Deckers Outdoor (DECK) — Technical & Macro Update

Ticker: DECK | Chart Timeframe: 30‑minute | Current Price: ~$117

Sector: Footwear & Apparel

Date: July 26, 2025

⚡ Market Recap

Deckers made waves this week with a strong mix of earnings momentum and analyst reactions:

👟 Blowout Q1 Earnings: Revenue came in at $965M, up ~17% year-over-year. Hoka grew 20% and UGG grew 19%, with international sales surging nearly 50%. EPS of $0.93 smashed expectations. Management issued strong guidance: $1.38–$1.42B revenue for FY and EPS between $1.50–$1.55.

📈 Stock Surge Followed by Pullback: Shares spiked over 12% intraday after the earnings release, but cooled off shortly after, reflecting some hesitation or profit-taking. Volume doubled the 50-day average, showing strong investor attention.

⚠️ Price Target Downgrade from Goldman Sachs: Goldman Sachs cut its target from $90 to $87, maintaining a Sell rating. Their concern lies in margin pressure from tariff exposure in Deckers' overseas production chain.

🧾 Divergent Analyst Views: TD Cowen raised its target to $154, while other analysts remain neutral to bearish with targets ranging between $100 and $137. The Street’s average 12-month target hovers around $123, though the lowest target now sits at $87.

🔍 Technical Breakdown (Chart Overview)

Price Structure:

Price rallied into a key resistance zone after earnings and is currently consolidating just below $118.

A broad consolidation range has formed between ~$105 support and ~$132 resistance.

Chart suggests the formation of a potential double-bottom reversal pattern, anchored by the $95–$105 zone.

✅ Bullish Case

Trigger: Break and close above $132–134

Target Zones: $150 → $160 → $182

Supporting Factors:

Hoka and UGG continue to post record growth

International expansion is offsetting soft U.S. sales

Solid earnings guidance and positive revisions from bulls like TD Cowen

❌ Bearish Case

Trigger: Breakdown below $105

Target Zones: $95 → $87

Risks:

Exposure to tariffs and global supply chain constraints

Sluggish domestic sales and brand saturation

Goldman’s downgrade reflecting downside institutional risk

🧠 Strategic Takeaway

Deckers is at a technical inflection point. The recent earnings beat lends credibility to the bullish case, but macro headwinds and analyst skepticism inject caution. Price is trapped below resistance, and traders should await confirmation of breakout or breakdown.

Watch for a clean breakout above $132 or breakdown below $105 before committing to directional bias. Volatility and volume are elevated — trade setups could trigger fast.

📊 Summary Table

Outlook Key Price Trigger Potential Targets Key Drivers

Bullish Break above $132–134 $150 → $160 → $182 Hoka/UGG momentum, strong earnings, analyst upgrades

Bearish Fall below $105 $95 → $87 Tariff exposure, U.S. softness, Goldman’s $87 price target

BUY Deck!!!This is a good opportunity to look out for. We can see that market structure is clearly inducing early buyers to perhaps wipe them out with another bearish leg down to our major demand level.

Looking to set some buy orders at our next major zone to ride this stock up to previous all time highs.

Good luck

Double bottomDespite the strong quarterly results, the stock was penalized due to a lower outlook for Q2, a consequence of uncertainties surrounding tariffs, leading to a 20% decline.

The price is reaching the weekly 200-day simple moving average (blue line) for the second time, coinciding with a long-term support level (also marked in blue), initiating the formation of a double bottom pattern.

The first target is the light blue resistance area around $130 (+30%), where a potential confirmation of the double bottom could occur with a breakout of the neckline, followed by a further 25–30% increase

5/23/25 - $deck - A comment. Sidelines ATM.5/23/25 :: VROCKSTAR :: NYSE:DECK

A comment. Sidelines ATM.

- mgmt not providing FY guide is a problem in this environment because (serious) investors that don't own this thing will need to do more work to own it, those who own it might be forced to cut exposure (even if it's down here) and there's a general "what does mgmt know that we don't" overhang until, essentially, next quarter, maybe

- trump lobbing in a pre-market EU tariff threat doesn't help the tape and those that r already going low bid like this and that are discretionary. remember... economy is not "improving"... discretionary gets cut first (consider TGT's recent report... more discretionary vs. say WMT) and a brand that's not kicking butt (like NYSE:ONON ) will get cut/ resized in portfolios and weightings.

- is the stock objectively a buy here in the low $100s. yes.

- but now if the mkt rolls over, will this thing see low 90s or even attempt to fill the somewhat-recent oct 2023 gap in the low 80s? also I'd give that a 50-ish probability. and it's at that point, it's almost a no-brainer. so i'd not necessarily "wait" for that moment, but i'm not going to neck out here on a discretionary name that just reported disappointing results as the mkt has rallied and might give some back (and this would be a weak link/ low bid name)

- i'd look to bit in the low 90s and stack bags more aggressively w/ a 8-handle. otherwise i just let it pass. i like my concentrated exposure here. OTC:OBTC , NASDAQ:GAMB , NASDAQ:NXT , tsm and about 30% cash (and i have a reasonable amt of quantum shorts w longer dated expiry but not really worth mentioning in this post).

hope everyone has a nice long weekend. i guess this is "liberation" (from your money) round deux.

V

Deck pivot Deck has already had a nice pivot from the low and earnings are next week. After a quick analysis it looks like a buy to me. The stock has a strong history of revenue growth and decent operating cash flows. The balance sheet is very healthy as well. Deckers owns Hoka, Ugg, Teva and more popular brands. For a retail company, a 20% net margin is huge, this hows they have pricing power, and a brand moat. Net income has grown at a CAGR of 42% since 2017 which is insane.

My target is 234

DECKERS Death Cross As they say, the trend is your friend. We are witnessing a very strong move down on Deckers, despite it's excellent growth in UGG and Hoka, sales are slowing as inventory has failed to meet demands. This a good problem as the company can fix their supply and demand equilibrium, the management are known for under promising and over delivering. I see Deckers as one of the best run trainer companies out there. They have no debt, a massive cash pile and one of the best management teams in the industry.

From a technical perspective, we have a confirmed death cross as the price has fallen below key daily moving averages. I am expecting a bounce to occur between $100-115, so I will not be entering until I see the reaction to key support areas. I expect support at the 200 week moving average and the golden pocket fib retracement. Historically this has proven to be a good time to enter the stock. As long Hoka and UGG continue to remain popular with consumers, and as long as we don't have a recession, this makes it a compelling story.

As tech continues to show weakness, I think Deckers offers a very attractive buy over the coming weeks. Keep an eye on this, especially if you're a long term investor looking to diversify your portfolio.

Not financial advice, do what's best for you.

3/13/25 - $deck - Rental book3/13/25 :: VROCKSTAR :: NYSE:DECK

Rental book

- ppl ditch their shoes and go homeless chic in a recession, right?

- look. of all the shoe names, this is the only one w the best growth, economics etc. etc.

- but what's probably SHTF 20% case low? 7-handle. instead of high $5s EPS, you probably end up near $5 and so instead of 20x PE you're at 15x (remember the mkt looks fwd, so you have higher EPS and multiple should re-rate). at that pt we're at $75.

- do i think we get there? no. i don't.

- is $100 possible? test of high $90s? sure.

- is the stock a buy here? yes

- do tariffs matter? yes

- so i've added it as a 3% size to my rental book. i am comfortable w these products. it's not an AI-risk issue. mgns and ROIC is solid.

- so Bot decent size here and am in the process of selling the $115C for june this yr at about 15 bucks. this allows me to breakeven if my $100 call is right. and i would love to own the stock there or below and re-rent or keep. and if we just run... that's about 11% yield for 3 mo of what i consider to be a fairly defensible biz and superior to cash and allows me to sit tight and lock away some likely low vol gains as the market chops on any whim of someone sneezing.

so. welcome to the rental book NYSE:DECK :)

V

2/24/25 - $deck - Mmm. Banana time, long.2/24/25 :: VROCKSTAR :: NYSE:DECK

Mmm. Banana time, long.

- first. let's give a thank you to mr. analyst at jefferies who's done his best and he decided "NKE was an upgrade to buy". this is what happens when you cover the elephant in the room, and your institutional bag holders keep forcing you to take a look. eventually you throw up your hands and say "it's a buy... hold it for a few years and you'll make $"

- FIRST OF ALL. we're in the business of making money today, tmr and ALSO in a few years.

- the name of the game is own the best horse.

- in shoes, that's $deck.

- and guess what, they're having a *laughs* going out of business sale today.

- so here i am. playing contrarian after taking the opposite side of what feels like everyone's bags in the last number of days. honestly. it's a bit tiring. but also, it's intellectually challenging. and that's what keeps me going.

- So i'm long this thing as a ST trade, even tho it's objectively a LT buy here at sub 24x PE and 4% fcf yield for a great mgmt team, best mgns in town and growth that spits at some of the best meme tech.

- long.

enjoy

V

2/12/25 - $deck - LT entry yes, but i'm waiting...2/12/25 :: VROCKSTAR :: NYSE:DECK

LT entry yes, but i'm waiting...

- i've been thru the "shoes" names, obviously the 800 lb gorilla NYSE:NKE which remains way too expensive nearly 30x PE for negative growth in this environment, down to NASDAQ:BIRD (which i no longer own bc it's just too nuanced/ complicated and not the right tape to clog up PnL w names) to everything in between.

- the in between we have stuff like NYSE:SKX , which probably does okay in a value driven world, but just pours and pours NYSE:S in marketing (b/c the brand, frankly is just not too exciting and needs that push), we have $onon... which is crushing things... and honestly continues to... but i can't do valuation anymore (i've been long this over the last years into prints)... to $birk... again wrong tape and not cheap... $crox... "cheap", throwing of tons of FCF, but brand and these partnerships are getting exhausted so growth is *maybe* +ve... but could even be -ve this year which the mkt doesn't forecast and would substantiate another leg lower if/when and i don't want to play that game.

- so there's $deck.

- the reasonably priced (mid 20x PE, 3.5% fcf yield, high teens growing) name that is well managed group of cool brands.

- i'd consider this one, the top of the "I'd buy it first, bid comes in first" shoe stock.

- but again, we are facing industry headwinds where we pulled forward a ton of demand in 4Q (industry-wide), perhaps #s need to be re-adjusted ST for '25, and where valuation isn't "screaming cheap".

- i'd guess an entry here in the $150s is probably a great LT own. if i managed profession money again, my risk committee required position sizing, industry diversification stuff (you know - the things that keep you from making real coin if you're actually good and show up on time and do the work)... then yes, this would be actually, a place to build a position (maybe sell some C's in the 1H to generate yield on what might ultimately be an upside-capped stock.

- but tape is tough. i've written in a comment on NASDAQ:NXT today extensively about how i'm sizing, thinking about current environment, notably how i think lower inflation ST is actually risk -ve, not the opposite, how the mkt doesn't seem to care/ hold the same view (and ST anything's possible)... which just leads me to higher cash. more patience and let's see. i don't need another line on my PnL unless it competes on some orthogonal basis for better alpha vs. CRYPTOCAP:BTC (thru OTC:OBTC which is 10% discounted), NASDAQ:NXT (energy), NYSE:UBER (platform/ not tariff exposed), NYSE:TSM (best "semi" growth/ mgns)... frankly we're just "not there" with NYSE:DECK in the $150s.

- i'm allowed to have a greedy entry given the above, so i have an alert at the $150 gap fill (from the previous results gap up in late Oct '24), to look again to see if tape/ context has changed on thinking but realistically i'd like to see a $130s before i can get excited. if/ when we do get a risk dump, i think this gets bid first. i don't think there's much downside from that level and perhaps can leverage it up a bit.

but to each his or her :) own... just spelling it out for if/when i have the docs to support a quick decision and don't need to remember my thoughts. that's why i'm doing this all... documenting thinking for myself. if you find it useful, great. but this is just for me, ultimately :)

be well. stay solvent. stay patient. oppties every day.

V

DECK to $200My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price in channel zones at bottom of channels (period 100 52 & 26)

Stochastic Momentum Index (SMI) at oversold level

VBSM is spiked negative and under at bottom of Bollinger Band

Price at or near Fibonacci level

Entry at $171

Target is $200 or channel top

$DECK: Earnings Beat with Bullish Breakout on DeckDeckers Outdoor ( NYSE:DECK ) just closed at its 200-day moving average, forming a classic falling wedge ahead of its strong earnings beat and raised guidance. With massive short interest ready to cover, this stock is primed for an explosive breakout next week. My price targets are $177.67 and $184.48. Watch for momentum as shorts scramble to exit. Solid fundamentals and technicals aligning—time to pay attention.