DPZ trade ideas

DPZ: Sort opportunityAn intraday high potential, Back Tested Sort Analysis.

We ll try to enter into the correction of the uptrend movement.

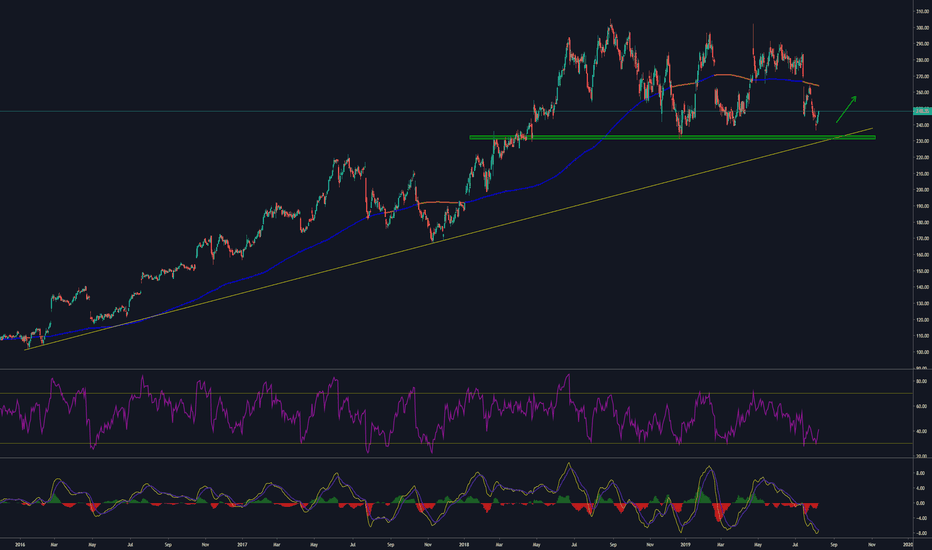

DETAILS ON THE CHART

NOTE: Entry range area above the entry point, is calculated upon 80% of the recorded pullback back tested past performances

DISCLAIMER: This is a technical analysis study, not an advice or recommendation to invest money on.

Golden Cross In Domino's PizzaWhile scanning we came across this as a potential long entry, and to add to our analysis we also just had a delivery to our office which we ordered & tracked on line, delivered promptly and tasted amazing, why not be bullish on Dominos.

Entry level potentially above $292

The golden cross of the 50 & 200ma's is usually a good sign of things to come.

Company profile

Domino's Pizza, Inc. is a pizza company, which operates a network of company-owned and franchise-owned stores in the U.S. and international markets. It operates though the following three segments: U.S. Stores, International Franchise and Supply Chain. The U.S. Stores segment consists primarily of franchise operations. The International Franchise segment comprises of a network of franchised stores. The Supply Chain segment operates regional dough manufacturing and food supply chain centers. The company was founded by James Monaghan and Thomas Stephen Monaghan in 1960 and is headquartered in Ann Arbor, MI.

Domino's Pizza (DPZ) potential post-breakout selloff specialDomino's Pizza (DPZ) pushed up through the downtrend that started in June and is perhaps ready to bounce off the top of the trend for the holiday and game season.

Reasoning: The overall market was having a tough time yesterday, creating a lot of opportunities. As prices recover (or not), many stocks could follow. Of course, this is just an idea. I could be jumping in too soon. I am also betting patterns, trends, and fractals against my own, custom indicator that says it's going down in a higher time frame. The indicator follows past price action. It doesn't predict the future. Either I'm right, or my indicator is right and the whole market is going south. We'll see in a couple of days...

Disclaimer: For entertainment or educational purposes only. If this were actual investment advice, it might state something about past performance not being a guarantee of future results, and incorporating risk management into the investment strategy. If you have any questions, you should seek out competent council, or seek study on your own.

DPZ - Trade setupEarnings out and they reduced guidance for the next few years. I like this pulling back into the 100MA on the monthly chart. I like taking the break of the low and not getting in today with the gap down. I think there is too much chance for a bounce or some pull back before we finally break this support and go down. Set your alert and wait for it.

Dominos in bearish controlStill hard to tell if Dominos will continue this downtrend, but it looks like the bears are taking control here. In large it looks like we are still in a bull flag like we had in sep-dec 2018. But key diffrence is that RSI is below transition zone. Takeaway from this is that we will likely go down instead of going up. Best place to short will be the S/R flip or at the EMA's if price gets there.

Domino's pizza updateDomino's pizza stock approached the support buy zone, near a big daily trend line. Major banks like JP Morgan have a $270 price target at the moment, labelling the stock as 'overweight'. Investment funds like Maxim Group targets at $300 back to the highs of this stock. Overall banks and investment funds believe the stock is considered under priced.

Technically, stock almost hit support at oversold on indicators. Would be best to see if the stock hits the support zone first before buying in. Good Luck!

DPZ Downtrend ContinuationDPZ had an over-reaction in its sell off due to skiddish market behavior which is shown in the prices of precious metals rising, as safe havens instruments continue to rise its possible that this could prevail for the remaining of the earnings season. We'll see when market leaders have their earnings.

9.45 Debit spread. 30 point wide possible max profit is $2055.

I want to take a gain of at least half the debit and same for the loss.

This is a medium risk high reward play.

Although its more likely that it will rise and close the gap as this trend looks very different from netflix which had a similar reaction.

I will exit the trade if it rises back to 270 and take a loss.

No need for panic, Dominos just taking a breather. Shares of Domino's Pizza, the world's largest pizza chain based on sales, fell on Tuesday as it reported that second-quarter net income exceeded estimates but revenue missed expectations.Net income rose 19% to $92.4 million, or $2.19 a share, from $77.4 million, or $1.78, in the year-earlier period, versus analyst estimates for EPS of $2.02, according to FactSet. Global revenue at the Ann Arbor, Mich., company rose 4.1% to $811.6 million from $779.4 million, however, compared to analyst estimates of $836.6 million. Source Thestreet.

CEO Richard Allison is quoted as saying

"We gained a significant amount of market share in the pizza category in Q2, Our unit growth was quite positive. It's a tougher operating environment than in years past and we have new competitors.There are labor pressures currently.Our franchisees are really healthy and we are focused on their profitability.We are positioned quite well relative to the restaurant industry.We still have a very healthy business model.We are gaining share at a significant pace in the International markets."

AVERAGE ANALYSTS PRICE TARGET $305

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 29

SHORT INTEREST 6.2%

COMPANY PROFILE

Domino's Pizza, Inc. is a pizza company, which operates a network of company-owned and franchise-owned stores in the U.S. and international markets. It operates though the following three segments: U.S. Stores, International Franchise and Supply Chain. The U.S. Stores segment consists primarily of franchise operations. The International Franchise segment comprises of a network of franchised stores. The Supply Chain segment operates regional dough manufacturing and food supply chain centers. The company was founded by James Monaghan and Thomas Stephen Monaghan in 1960 and is headquartered in Ann Arbor, MI.

DPZ Earnings Play Day Trade Revenue Miss DPZ got an earnings miss getting below expectations revenue. If you look at the daily chart above and the trendlines, pivots and moving averages you will see its all weakness. Its currently trading at 249 premarket. It has sank a lot by around 20 points which in itself is a concern, because when a stock sinks too much premarket bulls would come in and buy it as a bargain price which sometimes drives the stock back up after a gap fade. Right now, if the bulls don't come in too heavy when the market opens, it looks bearish (weak) so I would be more inclined to short it as it got room to fade down to around 241 which is about 9 points of room. If the bulls come in heavy and fill the market, then it can move up to 257 and then to the daily pivot 262. Having said that I still prefer it for a short rather than a long, as it has bad news, and its below all major moving averages and got room to move.

Dominos fails to close above resistanceWeekly resistance failed to break on positive earning call.

-Bulls managed to break resistance but bears had just enough to close well below resistance/ top of range

-Believe we will test the bottom of that range again, AT LEAST 240

- - If we break that we had down around the ~205 area, but I dont believe that will happen

Daily RSI well oversold

- Not being able to close above resistance after positive earning even more obvious