EL trade ideas

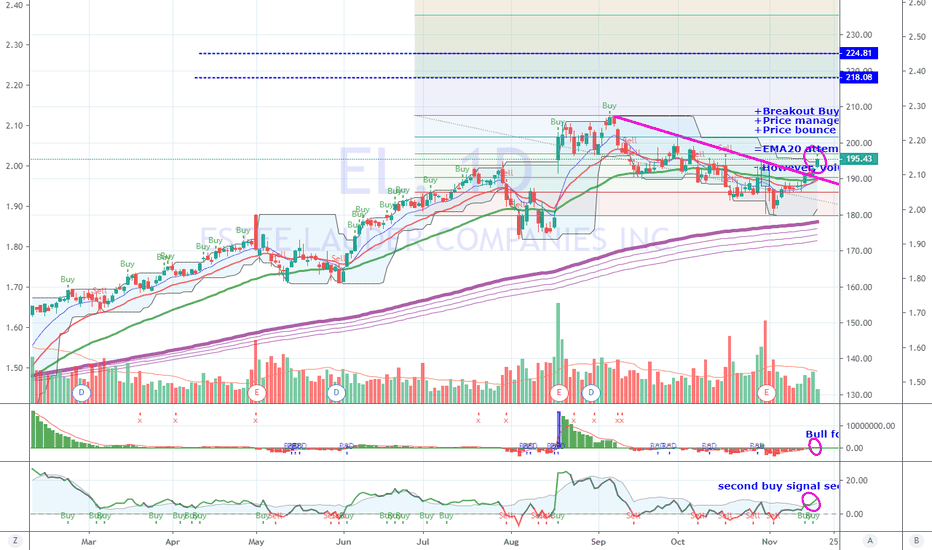

EL - Swing trade If you like Swing trades EL is setting up for something. I like the trapping of red candles here and I like the gap today. I just want you to be leery of the wick of the ATH candle. Let it break that wick then get in for the swing. You don't wait to let the shorts come in again and beat this down at the ATH and trap swing and long traders. Even if it doesn't break today this is one to watch for tomorrow or Wen.. When it breaks it could run for some nice gains.

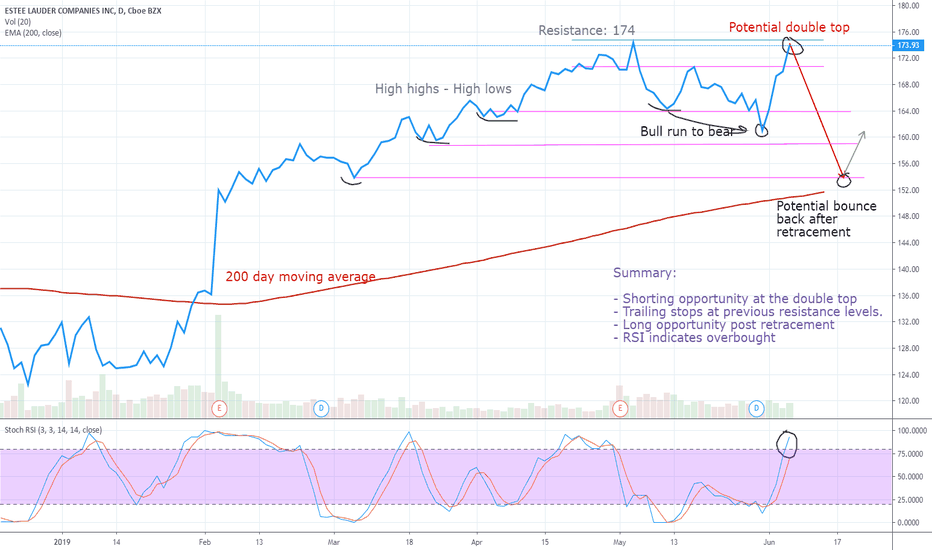

Estee Lauder Shorting OpportunityAfter a 5-month bull run, EL seems to have the symptoms of a tired bull.

The sequences of high high high lows have recently turned into low high low lows. Although news about strong Q3 books, robust travel retail, buyouts might have caused the bull some confidence and momentarily shows signs of strength and stamina. The bear is likely to overcome this with a strong swipe at the 174 mark in the coming months and bend the bull to the markets will.

See chart for details

$EL Estee Lauder is a beauty, but look for lower entry level.Estee reports tomorrow morning and is likely to beat easily, but it is also likely that some profit taking will ensue, which could provide a very good entry level for a stock we previously missed out on.

Company Description

The Estée Lauder Companies, Inc. engages in the manufacture of skin care, makeup, fragrance and hair care products. It sells products under numerous brand names. Its channels consist primarily of department stores, specialty multi-brand retailers, upscale perfumeries and pharmacies, and prestige salons and spas

EL BuyEL has been in an overall uptrend with today's price breaking above resistance @ 145.86. Retest around the resistance turned support was the plan, and placed a buy limit order that got triggered. I have been observing this stock for a long - time and the analysis still supports the long - term buy. Been taking profits( partly due to indiscipline); From the chart, I think that market may continue its uptrend since fundamentals are supporting the company and the markets overall.

EL BuyPrice seems to be trading just above the 9ema, with the 142.63 level broken twice but did not close above suggesting that buyers are probing the area above. Possibility of a higher low sequence developing before strong move up to test T/P level (potential breakout). Keeping S/L wide, considering developments on the trade front.

EL BUY WEEKLY 8.73% 11.86 pip TP 147.75 SL 128.76Analyzing the last 5 quarterly reports, we concluded that a possible gap of 8.73% - 11.86 pip on 08/20/2018 after release of the report.

In the last 4 reports they had positive results in the stock of 6.31% average only the one of May / 2018 that fell 8.53%, we hope that this gap has exactly the opposite effect.

EL BUY WEEKLY 8.73% 11.86 pip TP 147.75 SL 128.76