FHN trade ideas

FHN: Bearish retest after channel break – more downside ahead?First Horizon Corporation is a regional U.S. banking company offering commercial, mortgage, and investment services. It operates mainly across the southern United States and is among the largest regional banks in its sector.

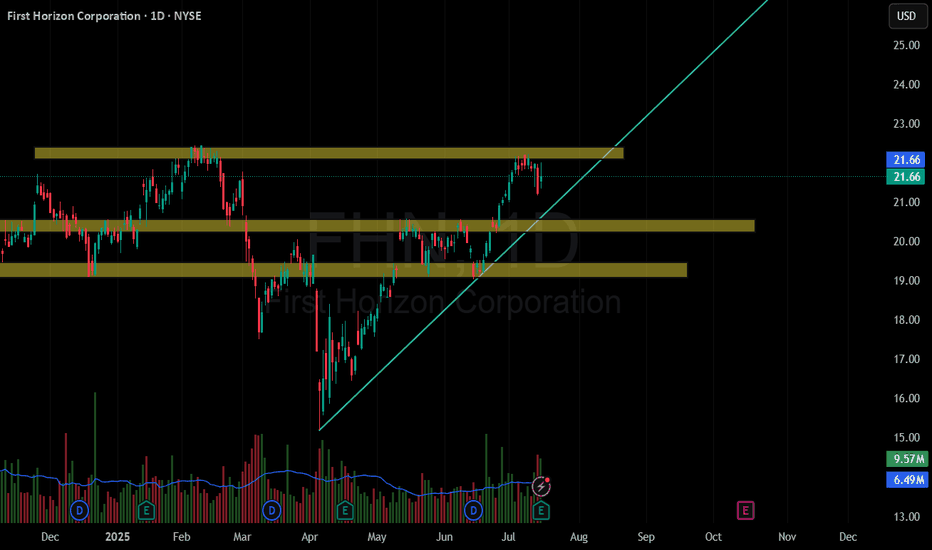

Technical Analysis:

FHN recently broke down from a long-term ascending channel and is now retesting the lower boundary as resistance. Price stalled near 18.65 with weakening bullish momentum. RSI is trending lower and volume on retest is soft. Key downside levels: 15.00, 13.50, and possibly 10.24 if weakness continues.

Fundamentals:

FHN faces headwinds from tightening monetary policy, rising credit costs, and profitability pressures. Regional banks are under investor scrutiny following sector instability. Latest earnings report showed declining margins and weaker guidance.

Scenarios:

Bearish bias – rejection at 18.65 → drop toward 15.00 → 13.50 → 10.24

Bullish reversal – break back above 18.65 → re-entry into channel toward 21.00+

FHN First Horizon Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FHN First Horizon Corporation prior to the earnings report this week,

I would consider purchasing the 14usd strike price at the money Calls with

an expiration date of 2024-2-16,

for a premium of approximately $0.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Bullish Technical TradePure technical trade. $FHN alerted bullish on the Transparent Traders Blackbox on Friday. I'm looking to enter with shares when it breaks 16.10, my stop loss will be 15.25, my price targets will be resistance at 17.89 or 19.41.

The indicators I'm using are the Transparent Traders Breakout indicator (red, yellow, and green lines) and the Transparent Traders Entry & Exit indicators, and 9/200 EMA.