Home Depot May Have BottomedHome Depot has yet to recover from a first-quarter slide, but some traders may think the home-improvement chain has bottomed.

The first pattern on today’s chart is the series of lower highs between January and mid-July. HD has fought above that falling trendline in the last two weeks. Has resistance been broken?

Second, the stock has challenged a peak from around May 20 and yesterday had its highest closing price since March 5. It’s also back above the 200-day simple moving average.

Third, the 8-day exponential moving average (EMA) is above the 21-day EMA. MACD has also been rising. Those signals may reflect increased bullishness in the short term.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

HD trade ideas

$HD - Cookie long hold this is bread and butterNYSE:HD hold a bullish position could see over $505 long term... <3

NYSE:HD breaking out with conviction! Up 5.2% this week on increasing volume. 12 analysts maintain BUY ratings with targets up to $455 (23% upside). Technical pattern shows higher lows since April. Strong revenue growth despite housing headwinds. This home improvement giant looks ready to build higher! #Bullish #HomeDepot"

Check 350.47 support (HA-MS indicator interpretation method)

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(HD 1D chart)

Can the HA-MS indicator be applied to stock charts?!!!

The conclusion is that it can be applied to all charts.

However, since the stock market is traded one week at a time, you cannot collect stocks corresponding to the profit of the coin market.

Since the coin market can be traded in decimals, you can create a medium- to long-term trading strategy by selling the purchase amount when realizing profit and collecting the number of coins (tokens) corresponding to profit.

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, when conducting short-term trading, you need to be careful to check whether the price is above or below the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, you need to respond quickly and quickly in the form of day trading.

Therefore, it is important to find stocks that maintain their price above the M-Signal indicator on the 1M chart if possible.

If you are familiar with day trading, you can conduct trading according to the basic trading strategy regardless of the location of the M-Signal indicator on the 1M chart.

However, since the HA-Low or HA-High indicators are intermediate values, they may proceed in the opposite direction to the basic trading strategy depending on whether there is support.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downtrend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise uptrend.

To confirm this, you need to check the movement of the auxiliary indicator PVT-MACD oscillator indicator and the OBV indicator consisting of the Low Line ~ High Line channel.

One thing to keep in mind here is that there are differences depending on the situation, whether it is a decline or an increase.

In other words, if the HA-Low indicator declines, there is a possibility of a stepwise decline, but the end is an increase.

This means that if the HA-Low indicator shows a stepwise decline, you should focus on finding the right time to buy.

On the other hand, if the HA-High indicator rises, there is a possibility of a stepwise rise, but the end is a decline.

Therefore, if the HA-HIgh indicator shows a stepwise rise, you should focus on finding the right time to sell.

----------------------------------------------

Looking at the current price position based on the above, the price is located near the HA-Low indicator.

However, since the price is located below the M-Signal indicator on the 1M chart, it is recommended to approach the transaction in a short and fast short-term trading (day trading) manner.

The PVT-MACD oscillator indicator is showing a downward trend below the 0 point.

In other words, it should be interpreted that the selling force is dominant.

The OBV indicator is showing signs of breaking through the Low Line upward.

However, since the Low LIne ~ High Line channel is not showing an upward trend, caution is required when trading even if the price is rising until it turns into an upward trend.

Therefore, the key is whether there is support near 350.47, which is the HA-Low indicator point.

If it receives support and rises above the M-Signal indicator of the 1M chart and maintains the price, it is highly likely to turn into an upward trend.

At this time, since the HA-High indicator of the 1M chart is formed at the 363.37 point, there is a high possibility that it will act as resistance near this point.

Therefore, if you are going to make a mid- to long-term investment in this stock, it is recommended to check for support near 363.37 or near the M-Signal indicator on the 1M chart.

Otherwise, if you are thinking of buying in installments, you can buy whenever it shows support on the HA-Low indicator regardless of the M-Signal indicator on the 1M chart.

This is because the end of the stepwise downtrend on the HA-Low indicator is ultimately an uptrend.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Home Depot Wave Analysis – 18 June 2025

- Home Depot broke support zone

- Likely to fall to support level at 340.00

Home Depot recently broke the support zone located between the support level 352.00 (low of wave A from April) and the 61.8% Fibonacci correction of the ABC correction (2) from April.

The breakout of this support zone accelerated the active impulse wave 3 of the intermediate impulse wave (3) from May.

Home Depot can be expected to fall to the next support level at 340.00 (former support from the middle of April).

Long Setup: Home Depot ($HD) | Bullish Continuation Above Cloud 📈 Technical Setup:

Home Depot ( NYSE:HD ) is setting up for a potential bullish continuation after retesting the top of the Ichimoku Cloud and holding key support.

Ichimoku Cloud: Price is consolidating above the Kumo, with the Conversion Line (Tenkan) and Base Line (Kijun) flatlining — signaling potential momentum build.

Fractals: Recent higher low confirmed above cloud support.

Quarterly Pivots:

Support: Held above S1 (331.28)

Current level: Testing pivot (P) zone at 376.08

Target: R1 at 409.03 aligns with the 10% upside move.

CM_Ult_MacD_MTF: Bearish histogram easing, potential shift incoming.

Williams %R: Rebounding from oversold territory (~ -70), signaling bullish potential.

🎯 Trade Parameters:

Entry: ~$367.33

Target: $405.15 (+10.3%)

Stop Loss: $361.15 (-1.68%)

Risk/Reward: 6.12R — excellent setup for swing or trend continuation

🔍 Thesis:

HD has formed a solid base above the cloud and is showing signs of reaccumulation. With macroeconomic resilience in home improvement spending and technical confluence lining up (cloud support + pivot + fractal structure), this setup offers a high R/R swing opportunity into Q3.

Home Depot – Pattern Suggests C Wave Toward $315 from $367 LevelHome Depot appears to be inside a pattern that fits either an Ending Diagonal or Skewed Triangle structure. From the $367 area, a potential C wave may begin targeting the $315 zone.

Investors should be cautious, as diagonal or skewed triangle formations often involve significant uncertainty. The white channel may bring choppy or indecisive price action.

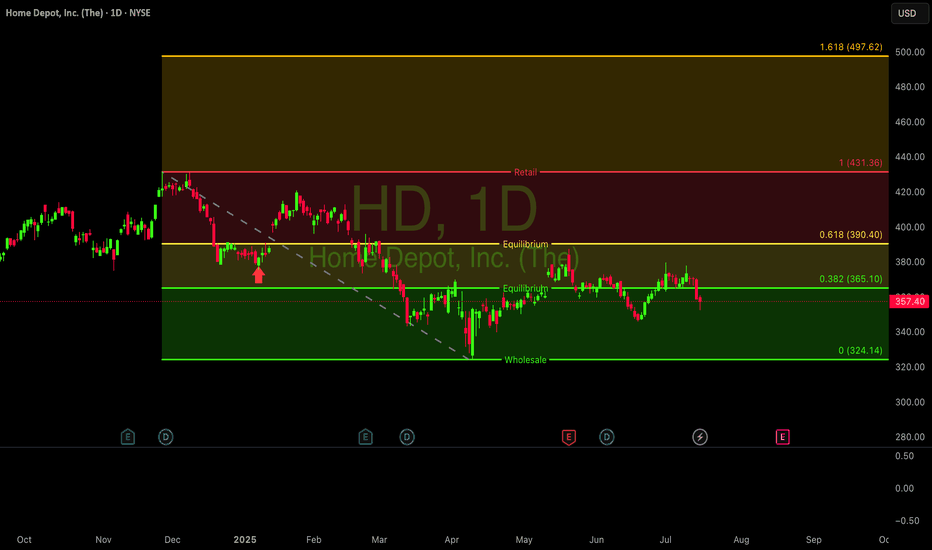

Home Depot Stock Chart Fibonacci Analysis 060325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 372/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

HD BULLISH POTENTIALHere's a professional and engaging English version of your summary, ideal for a social media or blog post:

---

🔨 Home Depot (HD) — Is the Bottom In?

Home Depot, often considered the U.S. equivalent of IKEA in the home improvement sector, just posted **strong Q4 2024 earnings**, signaling potential reversal in a previously sluggish market.

📈 Q4 2024 Highlights

Revenue**: $39.7B — *beat expectations

EPS**: $2.82 — above consensus

FY2025 Outlook: +1% same-store sales, -2% EPS (conservative guidance)

Despite the cautious outlook, markets responded*positively, driven by signs of resilient consumer demand and stabilizing macroeconomic conditions.

📰 Supporting Headlines

Barron’s: “Home Depot's strong results hint at home improvement sector bottoming out.”

Reuters : “Solid Q4 shows resilient consumer demand.”

CNBC : “HD stock upgraded as housing data stabilizes.”

🌍 Global Sentiment :

Improving U.S.–China relations and a more favorable global risk outlook are also key tailwinds to watch.

---

💡 With a technical breakout on the chart and strong macro support, HD could be positioning for a bullish leg. Keep this stock on your radar.

Breakout from the descending channelHome Depot's chart shows it just broke out of a descending channel! After a steady downtrend, it's pushing past resistance around $370. Is this the start of a sustained rally, or a temporary blip before it heads back down? Keep an eye on the next resistance level near $383 – a break above that would strengthen the bullish case. Are you betting on HD's strength, or seeing a potential pullback?

Home Depot (HD) Scalping Strategy🔥 Market Overview:

Trend: Short-term bounce, but overall bearish structure.

Key Levels:

Resistance: $395.00, $400.00

Support: $387.00, $382.00

Indicators:

EMA9 below EMA200 → Bearish trend still in play.

MACD negative → Weak momentum, bears still in control.

RSI at 43.57 → Slightly oversold, but no strong divergence.

Risk of Short Squeeze? Low—needs a breakout above $395.00.

Market Maker Activity: Price consolidating but still under pressure.

🔥 Scalping Strategy:

🩸 1. Momentum Scalping (If Breakout Above $395.00)

Buy near: $395.10

Target: $400.00

Stop-loss: $392.50

Risk-to-Reward: 1:2

🩸 2. Range Scalping (If Price Holds $387 - $395)

Buy near: $387.00

Sell near: $395.00

Stop-loss: $385.00

Profit Potential: ~2.1%

🩸 3. Breakout Scalping (If Below $387.00)

Short below: $387.00

Target: $382.00

Stop-loss: $389.50

Risk-to-Reward: 1:3

🔥 Mid-Term Trend Forecast (1-3 Weeks):

If $395.00 holds, Home Depot could push towards $400.00 - $405.00.

If $387.00 fails, expect a drop to $382.00.

🔥 News & Market Context:

Analysts updated price targets ($430 - $455), but stock is weak → Mixed sentiment.

Stock down 0.71% today → Weak bullish recovery, bears still dominant.

Earnings in 83 days → No immediate catalyst for a big move.

👑 Trade Rating (1-10):

Range Scalping: 6/10 (Still weak, needs confirmation).

Momentum Long Above $395.00: 7/10 (Breakout setup, but risk remains).

Short Below $387.00: 9/10 (Best risk-reward setup).

🔥 Decision:

🩸 Short-term Play: Range scalping $387 - $395 until a breakout.

🩸 Mid-term Play: Break above $395.00 = long; below $387.00 = short.

🩸 Ideal Play: Better shorting opportunities below $387.00.

👑 Final Verdict: Weak bounce—short setup looks stronger.

🔥 LucanInvestor's Quote:

"A weak bounce is just fuel for the next drop."

HD putsI got into some HD puts at 3NINETY-NINE I got an alert from my scanner to get in so I have six contracts for April 17th 2025 for 350 strikes I mean at 150 I'm a trust my scanner and believe that it's finding stuff that you can't see with the naked eye and I'm trusting it so you see that we run it into resistance on both charts so that's what I'm going by this is strictly a technical analysis play and that's why I put my money on if you read this in the future and you see a lot of grammar mistakes it's because I'm actually talking real fast and I'm doing voice to text recognition so if you see a lot of mistakes just know I didn't go back and correct them lol follow me for more

HOME DEPOT ($HD) Q4—HOME FIXES SPARK A SURGEHOME DEPOT ( NYSE:HD ) Q4—HOME FIXES SPARK A SURGE

(1/9)

Good afternoon, TradingView! Home Depot ( NYSE:HD ) is buzzing—$ 39.7B Q4 sales, up 14.1% 📈🔥. Extra week and SRS deal fuel zing—let’s unpack this retail giant! 🚀

(2/9) – REVENUE RUSH

• Q4 Sales: $ 39.7B—14.1% up from $ 34.8B 💥

• Full ‘24: $ 159.5B—4.5% rise from $ 152.7B 📊

• Boost: $ 4.9B from 14th week

NYSE:HD ’s humming—fixer-uppers unite!

(3/9) – EARNINGS GLOW

• Q4 EPS: $ 3.13—beats $ 3.03 est. 🌍

• Net: $ 3.0B—up from $ 2.8B 🚗

• Dividend: $ 2.30—up 2.2%, juicy 🌟

NYSE:HD ’s profit shines—steady cash!

(4/9) – BIG PLAYS

• SRS Buy: Pro segment zaps growth 📈

• Comp Sales: +0.8%—first up in 2 yrs 🌍

• Stores: 12 newbies—expansion zip 🚗

NYSE:HD ’s flexing—home king reigns!

(5/9) – RISKS IN VIEW

• Housing: Rates, $ 396.9K homes—yikes ⚠️

• Inflation: Wallets tighten—sting 🏛️

• Comp: Lowe’s nips—tight race 📉

Hot run—can it dodge the bumps?

(6/9) – SWOT: STRENGTHS

• Lead: $ 159.5B—top dog 🌟

• Comp: +0.8%, 7.6% trans. jump 🔍

• SRS: Pro cash flows—steady juice 🚦

NYSE:HD ’s a retail beast—rock solid!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Housing drag—boo 💸

• Opportunities: Rate cuts, SRS lift—zing 🌍

Can NYSE:HD zap past the risks?

(8/9) – NYSE:HD ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—Growth shines bright.

2️⃣ Neutral—Solid, risks hover.

3️⃣ Bearish—Housing stalls it out.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NYSE:HD ’s $ 39.7B Q4 and SRS spark zing—$ 159.5B year hums 🌍🪙. Premium P/E, but grit rules—gem or pause?

Price will hit $425 in a heartbeat, IMOBullish Order Block (bottom gray box) created by big players, supply created and then absorbed by the 8 million above average shares traded in the last 3 days, that's over $3.1 billion absorbing the shares so there is a lot of energy that has to go somewhere, and the price will shoot up quickly to at least $425. If it blows past that area, then $490 is the next target price which I think will occur before next earnings date if May 20, 2025.

Home Depot Faces Uncertain 2025: Dips 2.20% in Premarket Home Depot (NYSE: NYSE:HD ) has set a cautious tone for 2025, forecasting a decline in annual profit and lower-than-expected same-store sales growth. The home improvement giant is grappling with weakened demand for big-ticket renovations as high borrowing costs and economic uncertainty weigh on consumer spending. Despite a strong holiday quarter, the company’s outlook has spooked investors, leading to a 2.20% drop in premarket trading on Tuesday.

Headwinds for Home Depot

Home Depot’s recent earnings report highlights shifting consumer behavior. While discount-driven promotions boosted holiday sales, the broader trend reflects a pullback in large-scale remodeling projects. Customers are opting for smaller repair and maintenance activities instead of major renovations due to persistent inflation and high financing costs.

The company expects fiscal 2025 adjusted earnings-per-share to decline by about 2%, starkly contrasting analysts' projection of a 4.6% growth. Annual comparable sales growth is forecasted at 1%, below the 1.7% analyst estimate. This weak outlook is further compounded by ongoing inflationary pressures and a volatile macroeconomic environment, with tariffs and federal spending cuts adding to consumer hesitancy.

Despite these concerns, Home Depot reported a surprise rise in same-store sales of 0.8% in Q4, breaking an eight-quarter losing streak. Customer transactions jumped 7.6%, suggesting continued engagement, albeit at a lower spending level. However, customer visits declined by 3% during the quarter, signaling potential weakness ahead.

Technical Analysis

From a technical standpoint, NYSE:HD is struggling to hold support levels. The stock was already oversold at Monday’s close, with a Relative Strength Index (RSI) of 32, indicating selling pressure. Tuesday’s 2.20% premarket dip has pushed the stock below its one-month low support level, raising concerns about further downside.

If bearish momentum persists, the next significant support level could be around $370. A break below this range may trigger additional selling pressure, leading to deeper corrections. On the upside, any recovery would need to push past resistance levels formed at the recent highs to signal a potential reversal.

Conclusion

Home Depot’s weaker-than-expected 2025 forecast underscores the broader economic slowdown and shifts in consumer spending habits. While the company saw a holiday sales boost, macroeconomic headwinds, inflation, and high borrowing costs continue to dampen demand for major home improvement projects.

From a technical perspective, the stock is at a critical juncture. With oversold conditions and broken support levels, investors should monitor the $370 range closely. Any further weakness could lead to a prolonged downtrend, while a recovery above key resistance levels would indicate renewed bullish sentiment.

As Home Depot navigates an uncertain economic landscape, the coming months will be crucial in determining whether it can stabilize and reclaim investor confidence.

Home Depot - time to build - 5% upside anyone?This one came in as a 60% probability of trade success and i see why.

Nothing is certain but here is the TA

Overview (HD 3H Chart)

Trend & Momentum:

Price is consolidating near 385, with recent lower highs suggesting a cautious bias. The 50/200 MAs hover above current levels (around 400–405), creating overhead resistance. Stoch RSI is in a lower region, hinting at a possible short-term bounce.

Key Levels:

• Immediate Support: 380–385

• First Resistance: 400–405

• Secondary Resistance: 417

Short-Term Trade (1–2 weeks)

• Bullish Setup: Buy on a break above 390, target 405. Stop ~385.

Success Probability: ~60% (assuming a bounce from current oversold conditions)

• Bearish Setup: Short on a close below 380, target 370. Stop ~385.

Success Probability: ~40%

Near-Term Outlook (2–4 weeks)

If price holds above 400, a push to 417 is plausible. Failure to reclaim 390 or a breakdown under 380 would likely extend downside pressure.

As always. This is not financial advice.

$HD - Will the right shoulder form?NYSE:HD Home Depot is going into the Earnings with a potential head and shoulder formation. It is still early as the right shoulder has yet to form.

The validation is a close below $378 or 200 DMA.

As always, I share my opinions and trades. I'm not suggesting anyone follow my trades. You do you.