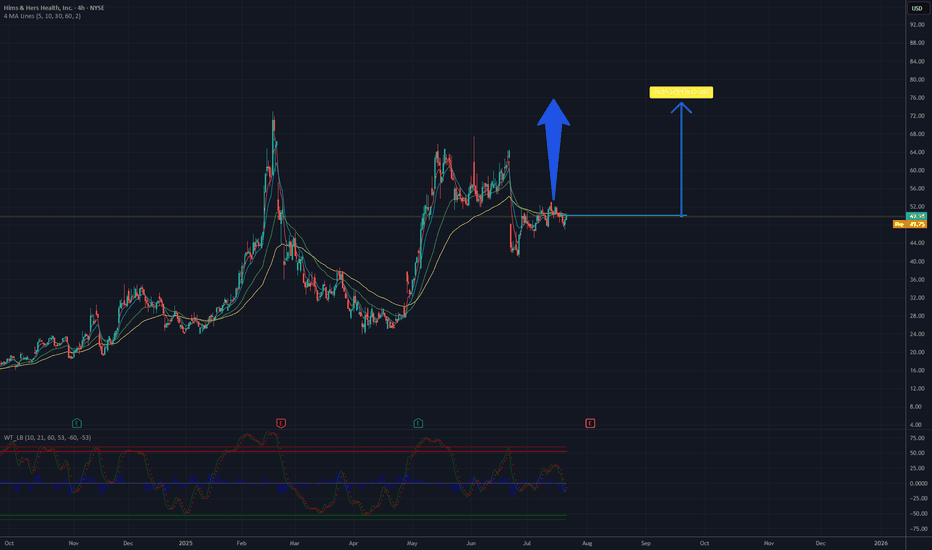

Is it a time for HIMS? Potential 50%,target 75USD.The company has announced plans to introduce comprehensive at-home lab tests, leveraging the acquisition of Trybe Labs, which could enhance service personalization and attract new customers. Additionally, expansion into markets such as Canada and Europe (through the acquisition of Zava) opens new re

Key facts today

On June 23, 2025, Hims & Hers Health shares fell over 34% after Novo Nordisk ended their partnership due to claims of misleading marketing and unapproved semaglutide sales.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.75 USD

126.04 M USD

1.48 B USD

190.44 M

About Hims & Hers Health, Inc.

Sector

Industry

CEO

Andrew Dudum

Website

Headquarters

San Francisco

Founded

2017

FIGI

BBG00Q53VYM7

Hims & Hers Health, Inc. operates a telehealth consultation platform. It connects consumers to healthcare professionals, enabling them to access medical care for mental health, sexual health, dermatology and primary care. The company was founded in 2017 and is headquartered in San Francisco, CA.

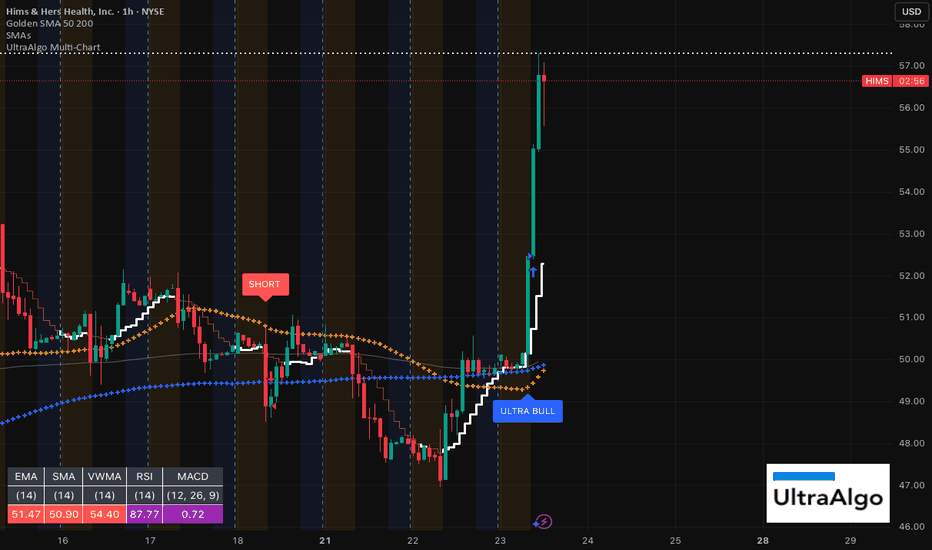

Related stocks

$HIMS - Needs to kiss a lot more frogsAfter drifting sideways for days, NYSE:HIMS exploded off the ultra bull trigger with a near-vertical surge from $49 to $57. The breakout cleared all key averages in one move, flipping sentiment hard. With volume and velocity both peaking, eyes now shift to whether it can hold this breakout or fade

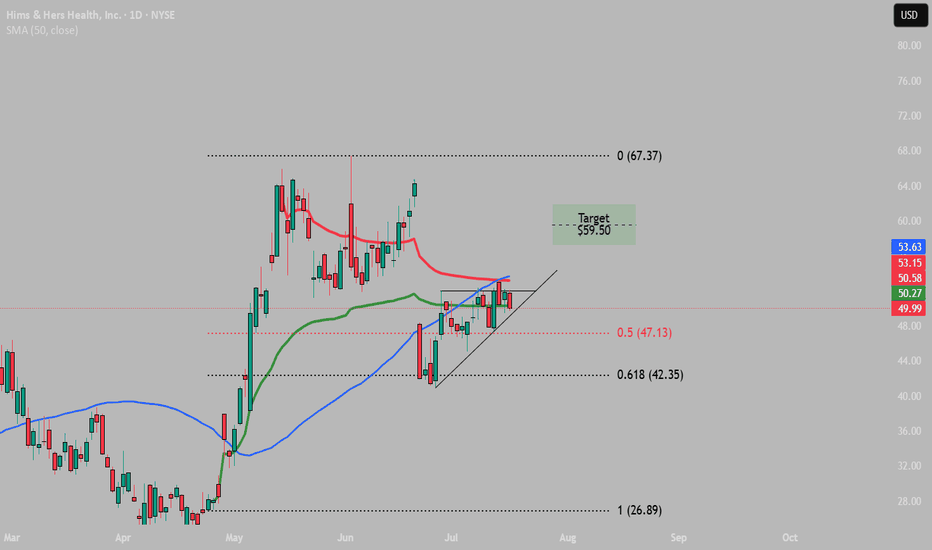

My buy view for Hims & Hers stock. My buy view for Hims & Hers stock.

Overall, I believe this asset is still in a bullish direction. I remember hoping into accummulating this stock when it dropped from $64 to $41 at the open of market on 23/6/2025 which I sold off when it hit $50.

However, I still hold a strong buy bias with my e

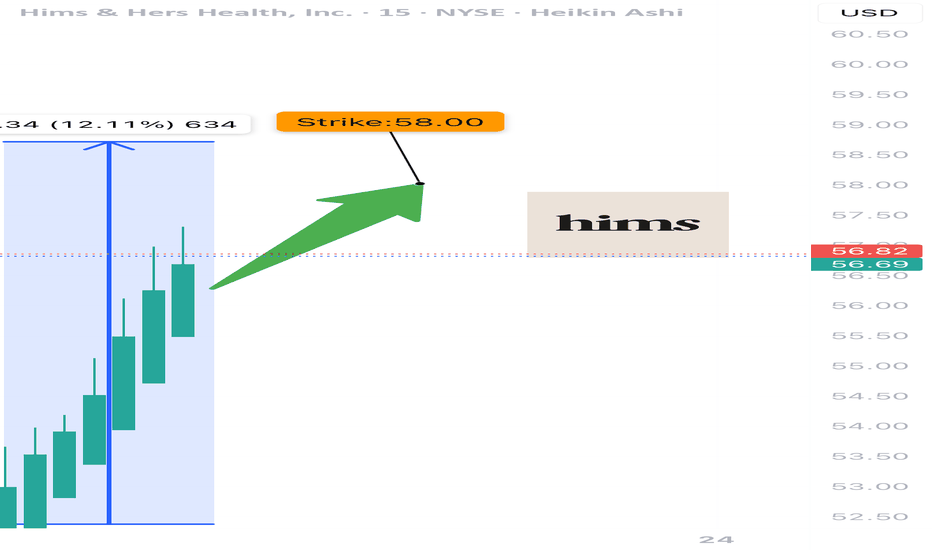

HIMS WEEKLY BULLISH PLAY — 07/23/2025

🩺 HIMS WEEKLY BULLISH PLAY — 07/23/2025

📈 Momentum Up, Flow Bullish, Time Tight — Let’s Ride It

⸻

🔍 MARKET SNAPSHOT

5-model AI consensus = ✅ BULLISH

Why?

• 📈 Weekly RSI = 58.2 (Rising) — Clear momentum

• ⚖️ Call/Put Ratio = 1.63 — Big call volume (45K+)

• 📉 Volume = 0.9x — ⚠️ Slight instituti

Neowave Structural Outlook – Complex Correction: W–X–Y–X–ZThis analysis interprets the ongoing structure as a Complex Correction in the form of a W–X–Y–X–Z pattern. Here's a breakdown of the logic behind the wave labeling and key observations:

Overall Structural Summary:

W wave (M1–M5): Though M1 is labeled as ":5", a closer examination of its internal st

HIMS · 4H — Symmetrical Triangle Breakout Targeting $55 → $60Setup Breakdown

HIMS is forming a symmetrical triangle consolidation, with price tightening between rising support and descending resistance.

The structure follows a previous impulsive move, suggesting this is likely a bullish continuation pattern.

Volume is contracting — typical for pre-breakout

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of HIMS is 57.32 USD — it has decreased by −1.21% in the past 24 hours. Watch Hims & Hers Health, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Hims & Hers Health, Inc. stocks are traded under the ticker HIMS.

HIMS stock has risen by 10.83% compared to the previous week, the month change is a 35.08% rise, over the last year Hims & Hers Health, Inc. has showed a 157.62% increase.

We've gathered analysts' opinions on Hims & Hers Health, Inc. future price: according to them, HIMS price has a max estimate of 85.00 USD and a min estimate of 28.00 USD. Watch HIMS chart and read a more detailed Hims & Hers Health, Inc. stock forecast: see what analysts think of Hims & Hers Health, Inc. and suggest that you do with its stocks.

HIMS reached its all-time high on Feb 19, 2025 with the price of 72.98 USD, and its all-time low was 2.72 USD and was reached on May 12, 2022. View more price dynamics on HIMS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HIMS stock is 4.35% volatile and has beta coefficient of 2.83. Track Hims & Hers Health, Inc. stock price on the chart and check out the list of the most volatile stocks — is Hims & Hers Health, Inc. there?

Today Hims & Hers Health, Inc. has the market capitalization of 12.99 B, it has increased by 4.39% over the last week.

Yes, you can track Hims & Hers Health, Inc. financials in yearly and quarterly reports right on TradingView.

Hims & Hers Health, Inc. is going to release the next earnings report on Aug 4, 2025. Keep track of upcoming events with our Earnings Calendar.

HIMS earnings for the last quarter are 0.20 USD per share, whereas the estimation was 0.12 USD resulting in a 65.41% surprise. The estimated earnings for the next quarter are 0.15 USD per share. See more details about Hims & Hers Health, Inc. earnings.

Hims & Hers Health, Inc. revenue for the last quarter amounts to 586.01 M USD, despite the estimated figure of 538.59 M USD. In the next quarter, revenue is expected to reach 550.99 M USD.

HIMS net income for the last quarter is 49.48 M USD, while the quarter before that showed 26.02 M USD of net income which accounts for 90.14% change. Track more Hims & Hers Health, Inc. financial stats to get the full picture.

No, HIMS doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 25, 2025, the company has 1.64 K employees. See our rating of the largest employees — is Hims & Hers Health, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Hims & Hers Health, Inc. EBITDA is 137.93 M USD, and current EBITDA margin is 5.76%. See more stats in Hims & Hers Health, Inc. financial statements.

Like other stocks, HIMS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Hims & Hers Health, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Hims & Hers Health, Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Hims & Hers Health, Inc. stock shows the strong buy signal. See more of Hims & Hers Health, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.