IGT trade ideas

Bullish options activity in IGT ahead of earningsIGT, International Game Technology, has been getting some unusually bullish call options activity today. IGT blew away analyst estimates on its last earnings report, and options traders may be betting on a repeat performance. IGT has been seeing particularly strong growth in its global lottery division. Even if IGT misses on earnings, it could soon start to gain as it rolls out its new "CrystalBetting" sports betting terminal. In addition to its growth potential, IGT has an $.80 annual dividend.

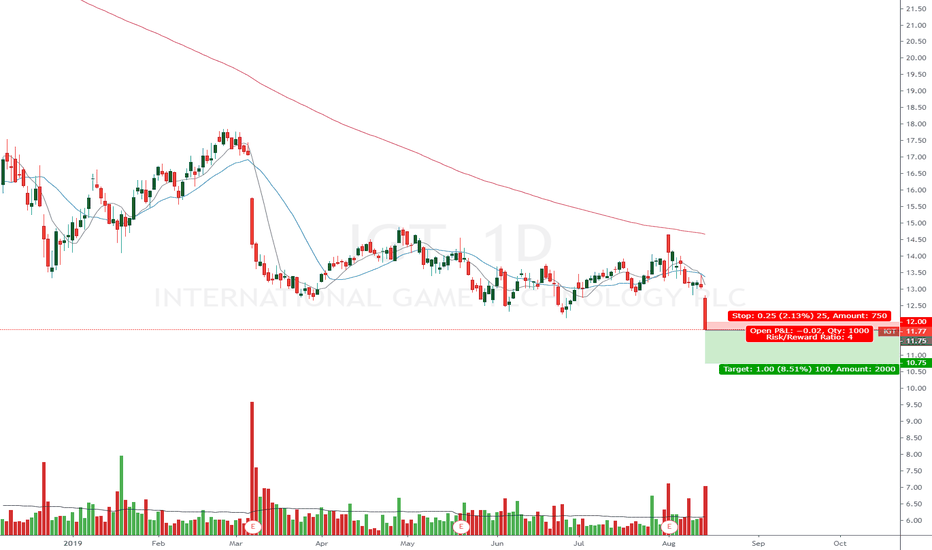

IGT simple playLevels to watch MA200 at 14.14, the blue line at 14.73. The first struggling level should be Fibonacci 78.6 level. In a case of breaking the same one, fibo 61.8 can be reached in the near time. Note that this is D chart.

My play is to buy 500 shr, with $13.30 and $16.92 as Stop and Take levels

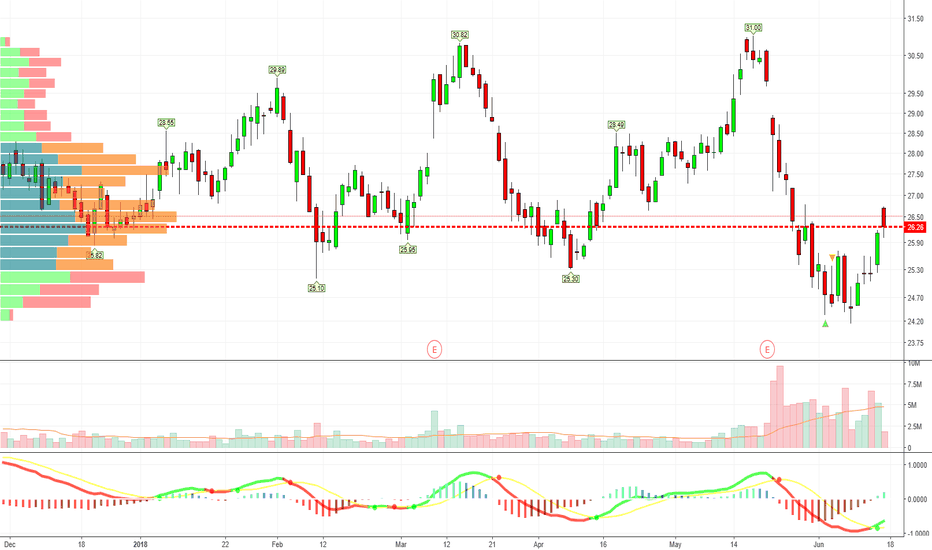

IGT Bullish SwingGap and go today. Since this ended up retesting (due to opening right near a resistance level), I want the stock to break through today's high before getting in. I would prefer a close above my buy price and then a retest of the support level. There has been lots of volume on this one too.

If the stock does not break through within a day or two, I will re-evaluate an entry and stop. I wouldn't mind if IGT trades sideways for about a week to let the short term EMA's catch up.

IGT - Bear flag formation Short from $23 to $20.13 IGT seems forming a bearish flag formation. A break of $23 will be flag pattern breakdown confirmation. And we think it can go down to $20 area at the breakdown.

* Trade Criteria *

Date first found- March 13, 2017

Pattern/Why- Bear Flag formation

Entry Target Criteria- Break of $23

Exit Target Criteria- $20.13

Stop Loss Criteria- $24.13

Please check back for Trade updates. (Note: Trade update is little delayed here.)

Trader take Bullish Activity in IGTInternational Game Technology is in one of many favorite spaces, the gambling space. They designs, develops, manufactures, and markets casino-style gaming equipment, systems technology, and game content for land-based and online markets worldwide. We have seen a slew of Bullish Call activity and even though the stock is trading under the Ichimoku Cloud it might be finding a rounding bottom and test the gap level. A great possible trading idea would to buy Upside Calls in IGT in July. However if I am not an options trader, but a stock trader I could buy IGT at $15.31 with a Stop at $13.81 with Target #1 at $16.01, Target #2 at $16.96 and Target #3 at $19.22. For full disclosure, I currently do not have a position on.