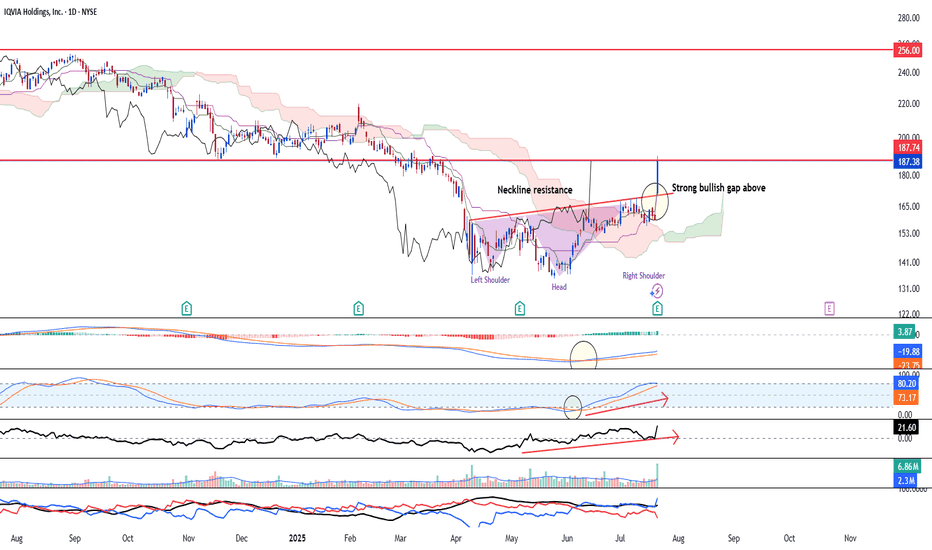

Bottoming out confirmed after inverted HnS confirmedNYSE:IQV bottoming out bullish reversal is confirmed after all indicators see strong bullish momentum.

Ichimoku shows a three bullish golden cross and the strong bullish gap up above the neckline resistance of the inverted head and shoulder speaks of strong reversal.

MACD has come back as MACD/

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.97 USD

1.37 B USD

15.40 B USD

168.53 M

About IQVIA Holdings, Inc.

Sector

Industry

CEO

Ari Bousbib

Website

Headquarters

Durham

Founded

1950

FIGI

BBG00333FYS2

IQVIA Holdings, Inc. engages in the provision of analytics, technology solutions, and clinical research services to the life sciences industry. It operates through the following segments: Technology and Analytics Solutions, Research and Development Solutions, and Contract Sales and Medical Solutions. The Technology and Analytics Solutions segment supplies mission critical information, technology solutions, and real-world solutions and services to the firm's life science clients. The Research and Development Solutions segment provides outsourced clinical research and clinical trial related services. The Contract Sales and Medical Solutions segment offers health care provider and patient engagement services to both biopharmaceutical customers and the healthcare market. The company was founded by Dennis B. Gillings and Gary Koch in 1982 and is headquartered in Durham, NC.

Related stocks

IQV - BullishIQV is now trying to find its momentum and move up to the 249 area. You have to be mindful of the resistance above and if you are trading options, make sure to give yourself some time. Its a game of probabilities and the probabilities for this ticker are lining up for a bullish outlook.

Good luck.

IQVIA bearishIQVIA, formerly Quintiles and IMS Health, Inc., is an American multinational company serving the combined industries of health information technology and clinical research. IQVIA is the largest Healthcare Data Science Company and leader in Human Data Science Technology

set sl above the curve

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

IQV5590191

IQVIA Inc. 6.5% 15-MAY-2030Yield to maturity

6.23%

Maturity date

May 15, 2030

IQV6091480

IQVIA Inc. 6.25% 01-JUN-2032Yield to maturity

5.72%

Maturity date

Jun 1, 2032

IQV5590192

IQVIA Inc. 6.5% 15-MAY-2030Yield to maturity

5.54%

Maturity date

May 15, 2030

IQV4831576

IQVIA Inc. 5.0% 15-MAY-2027Yield to maturity

5.28%

Maturity date

May 15, 2027

QTRN4404230

IQVIA Inc. 5.0% 15-OCT-2026Yield to maturity

5.22%

Maturity date

Oct 15, 2026

IQV5590165

IQVIA Inc. 5.7% 15-MAY-2028Yield to maturity

5.08%

Maturity date

May 15, 2028

IQV5763047

IQVIA Inc. 6.25% 01-FEB-2029Yield to maturity

4.61%

Maturity date

Feb 1, 2029

IQV5590167

IQVIA Inc. 5.7% 15-MAY-2028Yield to maturity

4.49%

Maturity date

May 15, 2028

XS168438745

IQVIA 17/25 REGSYield to maturity

3.85%

Maturity date

Sep 15, 2025

XS218994750

IQVIA 20/28 REGSYield to maturity

3.34%

Maturity date

Jun 15, 2028

XS203679815

IQVIA 19/28 REGSYield to maturity

3.34%

Maturity date

Jan 15, 2028

See all IQV bonds

Frequently Asked Questions

The current price of IQV is 182.45 USD — it has decreased by −1.83% in the past 24 hours. Watch IQVIA Holdings, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange IQVIA Holdings, Inc. stocks are traded under the ticker IQV.

IQV stock has fallen by −9.25% compared to the previous week, the month change is a 11.83% rise, over the last year IQVIA Holdings, Inc. has showed a −26.04% decrease.

We've gathered analysts' opinions on IQVIA Holdings, Inc. future price: according to them, IQV price has a max estimate of 235.00 USD and a min estimate of 177.00 USD. Watch IQV chart and read a more detailed IQVIA Holdings, Inc. stock forecast: see what analysts think of IQVIA Holdings, Inc. and suggest that you do with its stocks.

IQV stock is 3.88% volatile and has beta coefficient of 0.80. Track IQVIA Holdings, Inc. stock price on the chart and check out the list of the most volatile stocks — is IQVIA Holdings, Inc. there?

Today IQVIA Holdings, Inc. has the market capitalization of 31.02 B, it has decreased by −2.47% over the last week.

Yes, you can track IQVIA Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

IQVIA Holdings, Inc. is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

IQV earnings for the last quarter are 2.81 USD per share, whereas the estimation was 2.77 USD resulting in a 1.42% surprise. The estimated earnings for the next quarter are 2.98 USD per share. See more details about IQVIA Holdings, Inc. earnings.

IQVIA Holdings, Inc. revenue for the last quarter amounts to 4.02 B USD, despite the estimated figure of 3.97 B USD. In the next quarter, revenue is expected to reach 4.07 B USD.

IQV net income for the last quarter is 266.00 M USD, while the quarter before that showed 249.00 M USD of net income which accounts for 6.83% change. Track more IQVIA Holdings, Inc. financial stats to get the full picture.

No, IQV doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 3, 2025, the company has 88 K employees. See our rating of the largest employees — is IQVIA Holdings, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. IQVIA Holdings, Inc. EBITDA is 3.38 B USD, and current EBITDA margin is 21.96%. See more stats in IQVIA Holdings, Inc. financial statements.

Like other stocks, IQV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade IQVIA Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So IQVIA Holdings, Inc. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating IQVIA Holdings, Inc. stock shows the neutral signal. See more of IQVIA Holdings, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.